Stanford released an updated Search Fund Study yesterday. Highly recommend giving it a read (or just read my takeaways here). https://www.gsb.stanford.edu/faculty-research/centers-initiatives/ces/research/search-funds">https://www.gsb.stanford.edu/faculty-r...

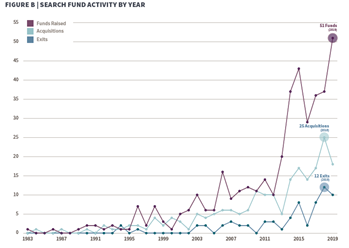

A record 51 searches were launched in 2019. While this a record for the search fund world, searchers remain a small portion of small business buyers. Note: the Stanford study only includes funded searchers using the traditional model.

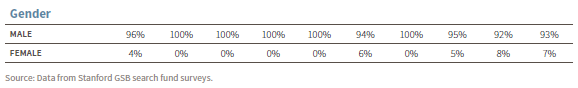

Diversity remains a point where the search industry could improve. Only 7% of search funds raised in the last two years have been from women

Capital is flowing into search funds at an increasing rate. To date $1.4Bn of equity has been invested, $475MM of which has been invested in the last two years. Once again, this is a big increase, but small relative to the overall market.

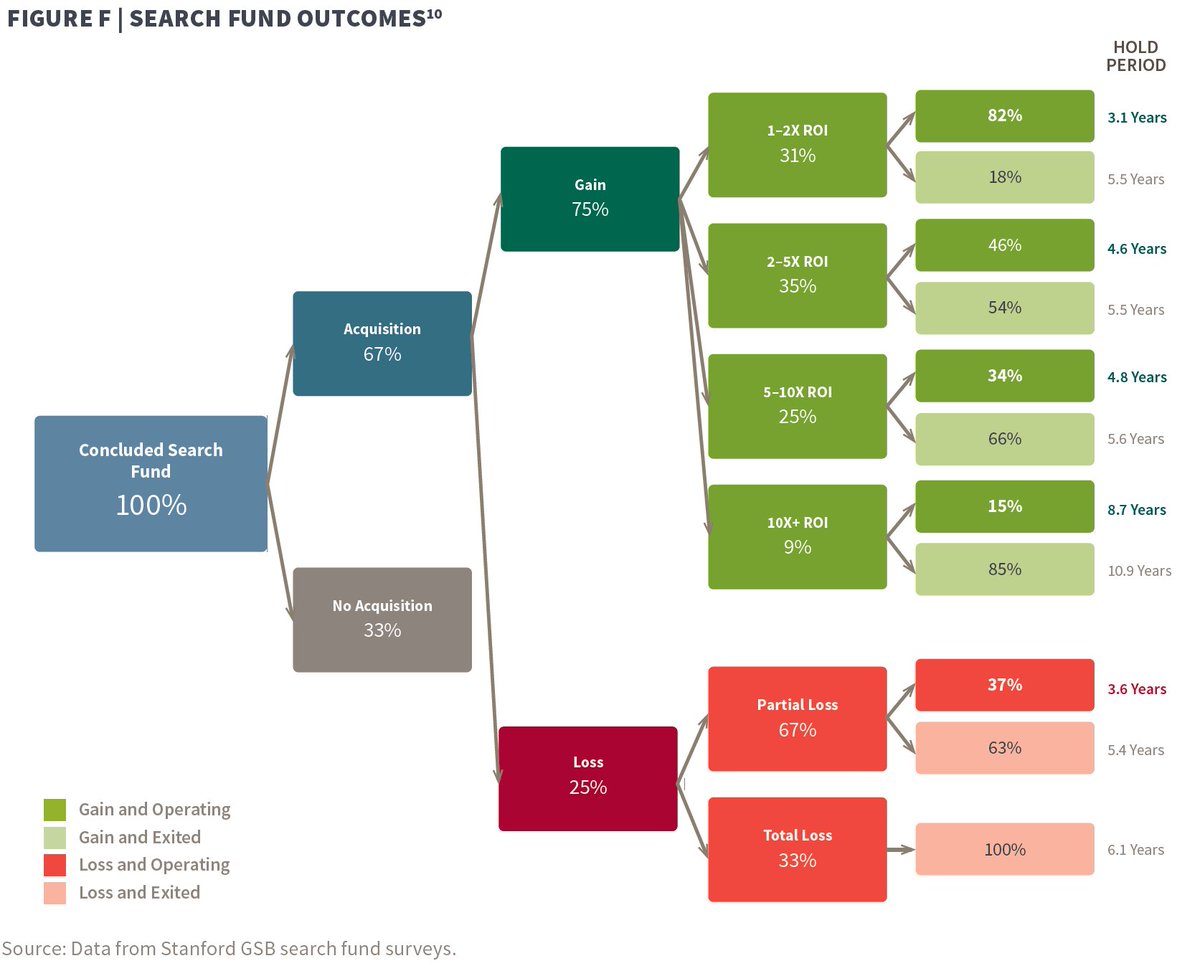

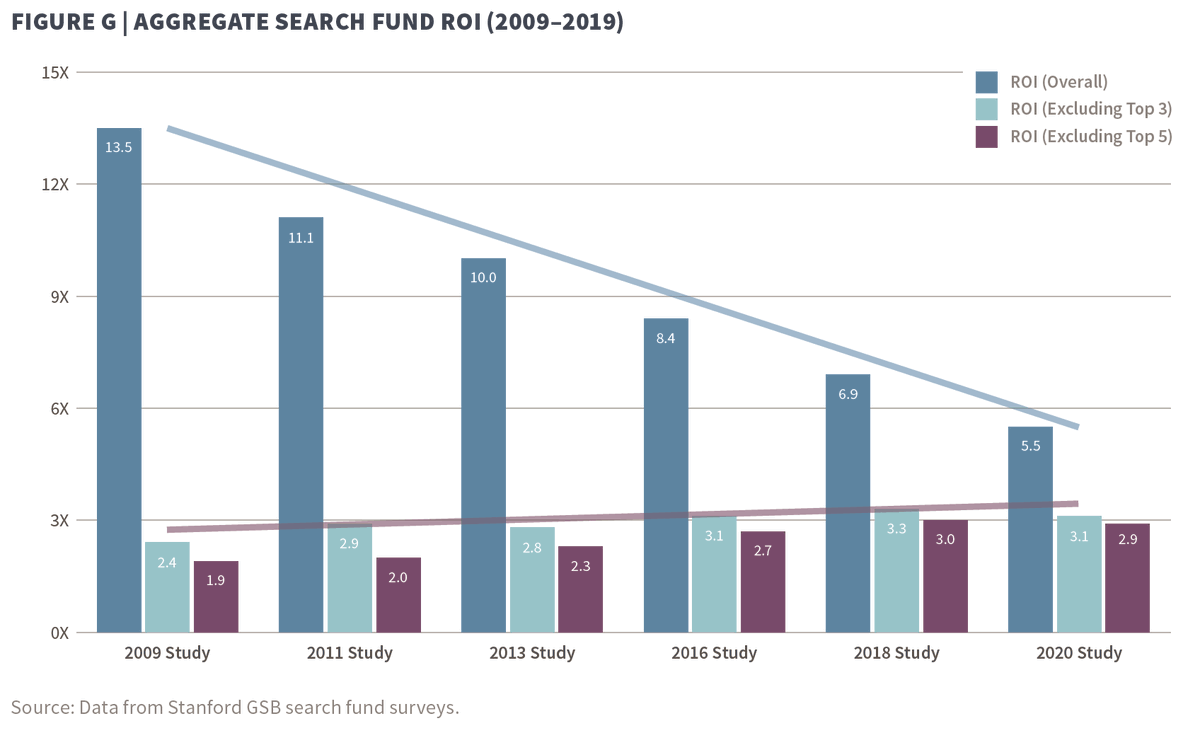

Acquisition rates appear to be going down. Historically 67% of searchers acquire a business, but this appears to be closer to ~60% in the last several years. Returns for those that do buy a business though remain very good.

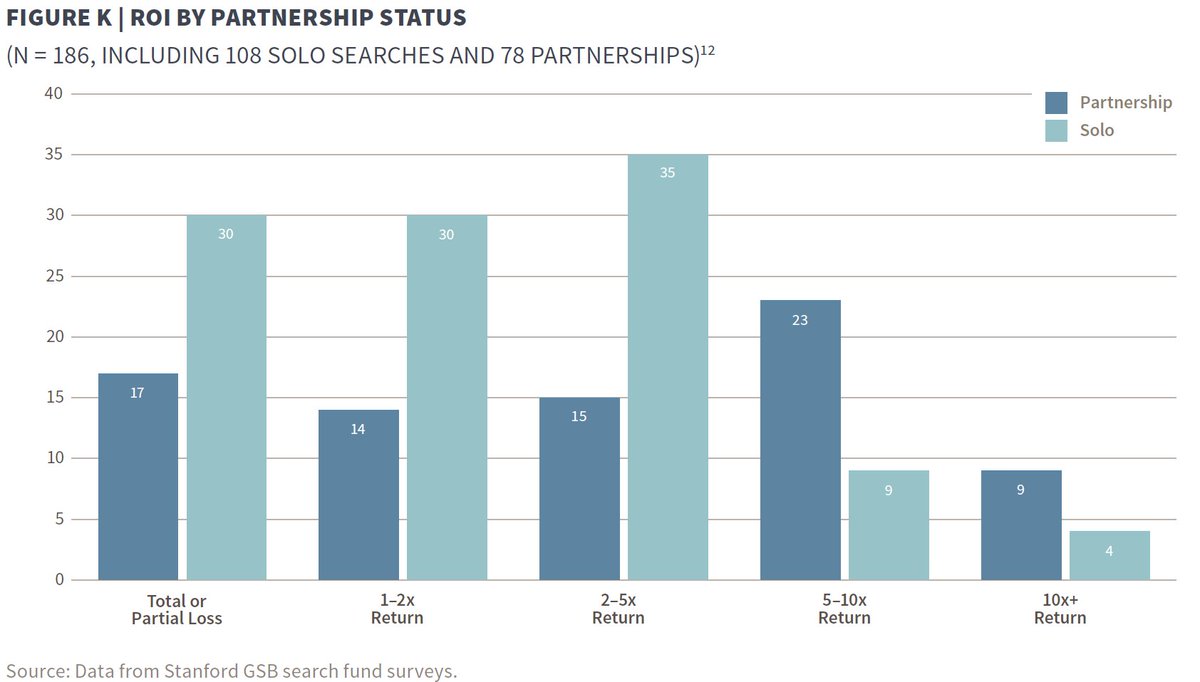

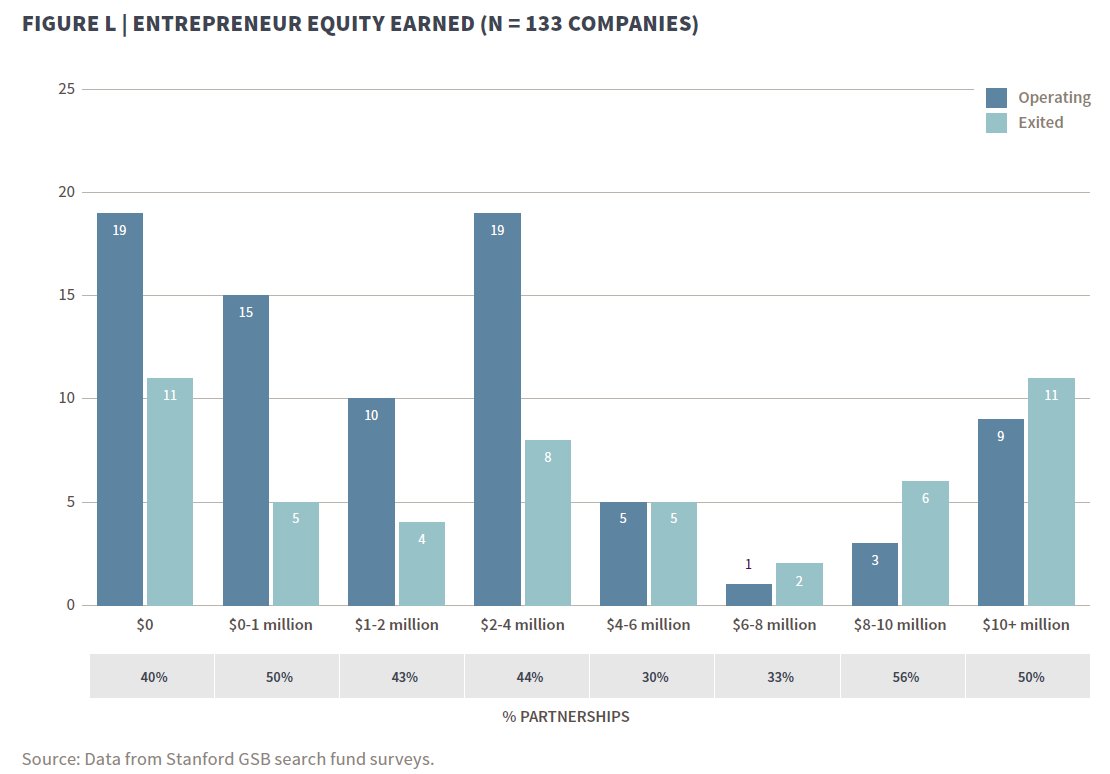

While the majority of search funds are raised by one person, partnerships have accounted for most of the best outcomes.

Acquisition stats: 55% of acquisitions have greater than 65% recurring revenue. Median acquisition price of $10MM (down from $13.1 in the 2018 study) and multiple of 6.0x (down from 6.3x)

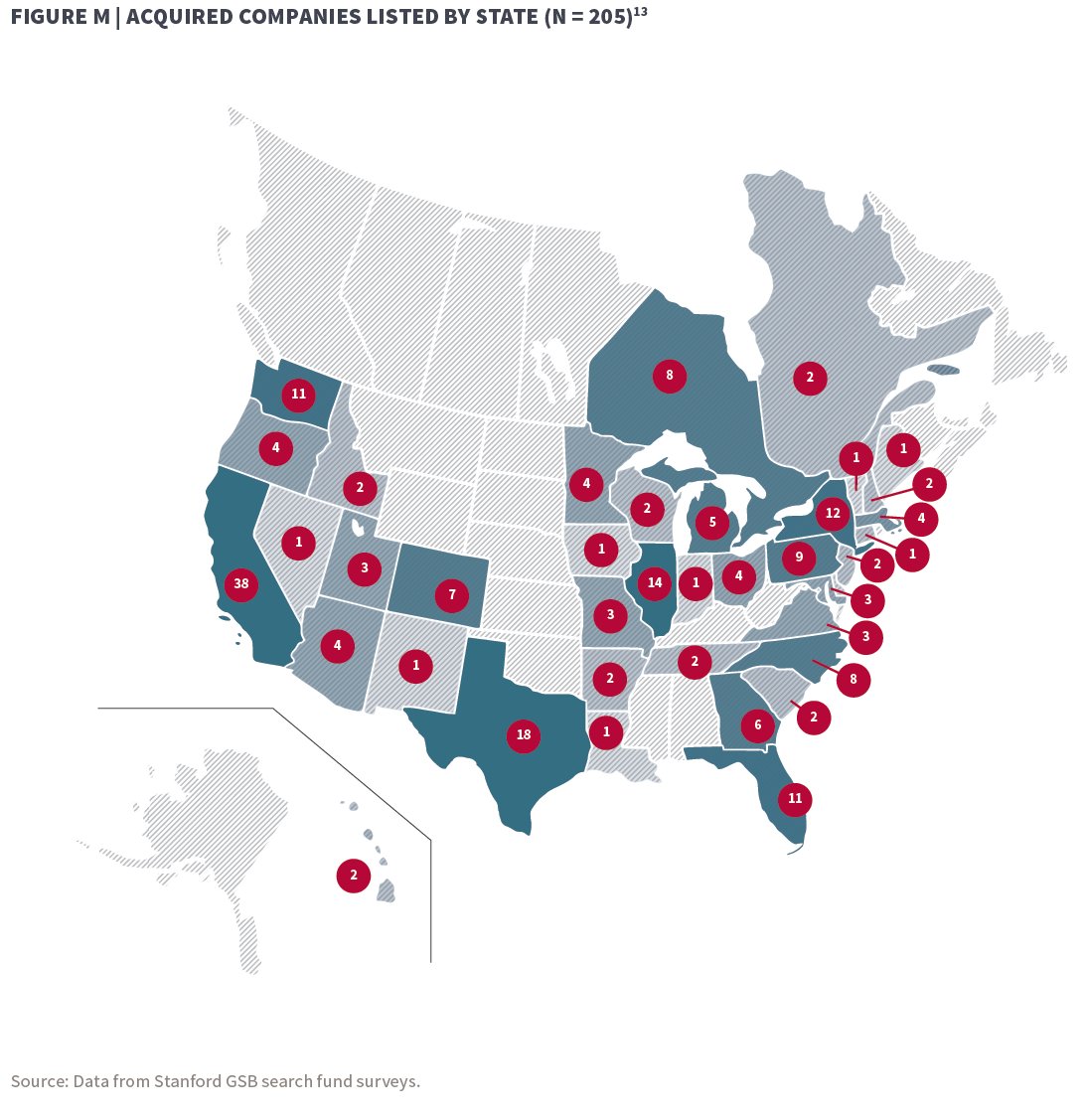

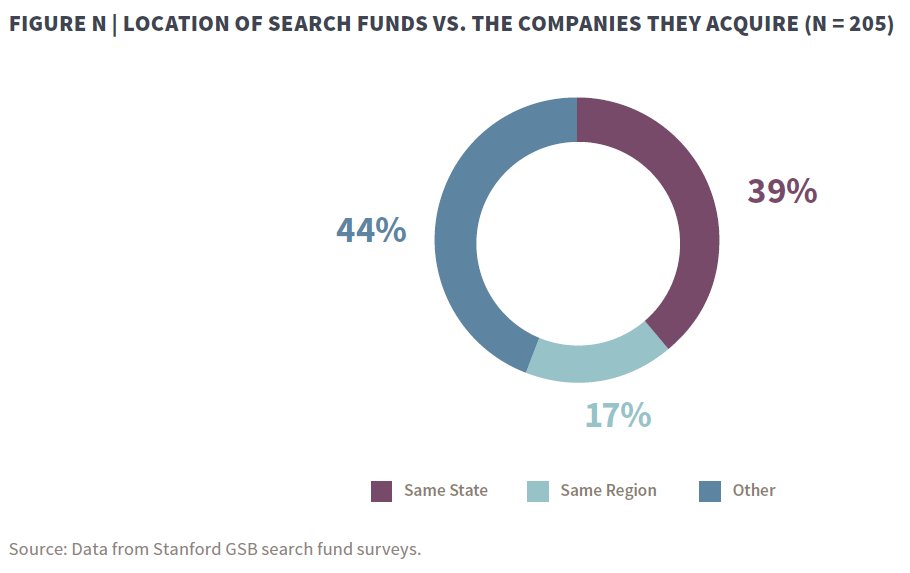

Search acquisitions are concentrated on the coasts and big cities (where most recent MBA graduates want to live) and in the area near where the searcher spent their time searching.

Read on Twitter

Read on Twitter