The @brecordernews wrote a good piece about our recent paper on & #39;slow rockets and fast feathers - #export responses to RER depreciations in #Pakistan. https://www.brecorder.com/news/40011521 ">https://www.brecorder.com/news/4001... A #thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Since I started working in #Pakistan and talking to #exporters, I hear depreciations are not that helpful. I wondered if that could be falsified w #data, and what were the reasons for it. So we wrote a paper with @martinbrun and @jpgambetta1 2/n

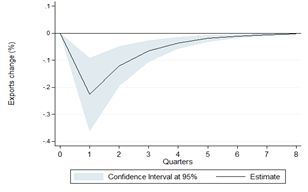

Looking at macro data for 1996-2019, we found that to be the case. Look at the average export response to a 1% appreciation and to a 1% depreciation:

Exports fall after appreciations, but struggle to grow after depreciations (growth is not significant). Why? 3/n

Exports fall after appreciations, but struggle to grow after depreciations (growth is not significant). Why? 3/n

Perhaps fear of reversal of the depreciation? If investment needed to ramp up production is irreversible, it& #39;d make sense. But no evidence that high volatility of the ER (proxy for reversal uncertainty) plays a role. Only thing - very large ER depreciations do affect exports. 4/n

Then we tested 3 hypotheses. [1] Finding new clients is costly & takes time, losing them it& #39;s easier. [2] usual culprit - supply constraints. [3] global buyers reduce dollar prices after depreciations of the PKR (akin to pricing to market). What& #39;s the evidence?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> (5/n)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> (5/n)

Hyp [1] implies that for differentiated products, export response to RER dep is weaker than for homogenous because exporting diff takes more effort in finding clients etc. Some truth to that. The asymmetry is marked for diff, but not for homogeneous. #InformationCosts (6/n)

Hyp [2] Supply constraints mean less & #39;exportable surplus& #39;. Access to finance may play a role. Some truth to that. Sectors with more access to finance, or less financial dependence react more to RER depreciations. (7/n)

Hyp [3] Pricing to (sourcing) market. If global buyers w/ market power could renegotiate prices downward after depreciations [this was brought up by apparel exporters]. Some truth to that. US$ prices fetched by #Pak exporters fall (rel/ to competitors) after (large) dep. (8/n)

In sum - #Pakistan exports respond #asymmetrically to #RER changes. Information costs, supply constraints and pricing to market seem to play a role. For more info - see our working paper! @martinbrun @jpgambetta1 https://documents.worldbank.org/en/publication/documents-reports/documentdetail/561931597063569779/slow-rockets-and-fast-feathers-or-the-link-between-exchange-rates-and-exports-a-case-study-for-pakistan">https://documents.worldbank.org/en/public... (9/9)

Read on Twitter

Read on Twitter

![Hyp [2] Supply constraints mean less & #39;exportable surplus& #39;. Access to finance may play a role. Some truth to that. Sectors with more access to finance, or less financial dependence react more to RER depreciations. (7/n) Hyp [2] Supply constraints mean less & #39;exportable surplus& #39;. Access to finance may play a role. Some truth to that. Sectors with more access to finance, or less financial dependence react more to RER depreciations. (7/n)](https://pbs.twimg.com/media/EfUoPY0XoAAelG1.png)