Financials are Dead. Long Live Financials.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Domestic facing sectors doing well & large private lenders suffering are probably inconsistent outcomes. Recovery in domestic economy will lead to better repayment ability of borrowers coupled with increased market share consolidation in both assets & deposits.

2/

2/

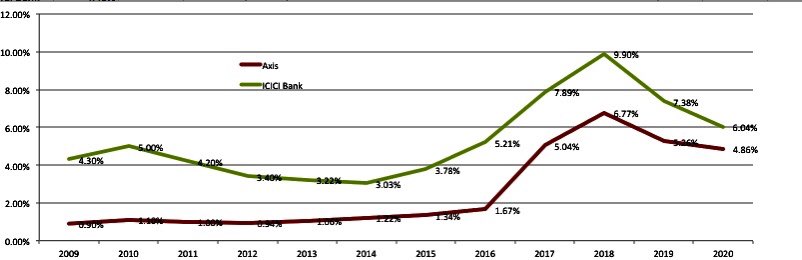

How bad can things get? Here are the gross NPAs of ICICI/AXIS since 2009. Note that all of these NPAs are provided for as of today. HDFC/Kotak figures are much lower.

3/

3/

The peaks here are years of cumulative stress culminating after multiple rounds of restructuring and not precipitated by a single event.

4/

4/

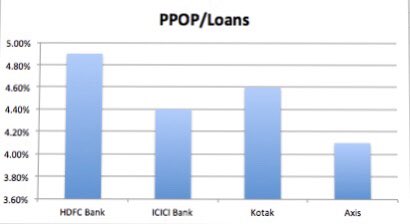

The banks make about 4% to 5% ppop (which flows to book value post taxes in case of no provision).

5/

5/

Even if we:

1. Ignore the current Covid provisioning

2. Assume 50% cut in PPOP

3. LGDs of 50% & Tax of 25%

Then this PPOP takes care of 10.6% to 13.3% of the book slipping over two years. (4% - 5% / 50% / 75%)

10% to 12% is lower than the total Morat book for many banks.

6/

1. Ignore the current Covid provisioning

2. Assume 50% cut in PPOP

3. LGDs of 50% & Tax of 25%

Then this PPOP takes care of 10.6% to 13.3% of the book slipping over two years. (4% - 5% / 50% / 75%)

10% to 12% is lower than the total Morat book for many banks.

6/

Here is how I calculate the Adjusted Book Value.

7/ https://twitter.com/abhishec_s/status/1265665354186977280">https://twitter.com/abhishec_...

7/ https://twitter.com/abhishec_s/status/1265665354186977280">https://twitter.com/abhishec_...

Banks in India are proxies for both consumption and capex and the tailwinds of lower credit penetration and market share gains from PSUs are now further aided by market share gains from small banks and NBFCs as well.

8/

8/

So being bearish on this segment means being very bearish on the overall economy — hence the inconsistency of underperformance.

9/

9/

What about PSUs trading at below book? Promoter/Management quality for one. And reflexivity of price for another. If you can raise money above book that itself calls for a higher multiple. The opposite for when you are raising below book.

There are other issues as well.

10/

There are other issues as well.

10/

A large part of the analysis boils down to confidence in the book. Historical underwriting performance and the quality of the book before they entered the crisis is relevant.

11/

11/

What about smaller better managed banks? Look at the strength of the liability franchise and cost of funds and then multiples. If you have to ever resort to higher growth argument for buying in BFSI you should double check yourself.

Plus what if the stress is much bigger.

12/

Plus what if the stress is much bigger.

12/

Banks that have raised money and have large subsidiaries might not raise money for another decade now. ICICI raised last in 2007. Kotak is over capitalised and over paranoid.

13/

13/

With levered entities lot of things can go wrong and very quickly. But I like this space.

(All views are biased. Don’t be a moron and take investment advice from twitter).

14/14

(All views are biased. Don’t be a moron and take investment advice from twitter).

14/14

Read on Twitter

Read on Twitter