1/ Thread: Looking beyond accounting based earnings

Imagine there& #39;s a genie who comes to you two months before the next quarter ends and tells you whether the stocks you own will meet, beat, or miss consensus estimates.

How much would you pay to have access to this genie?

Imagine there& #39;s a genie who comes to you two months before the next quarter ends and tells you whether the stocks you own will meet, beat, or miss consensus estimates.

How much would you pay to have access to this genie?

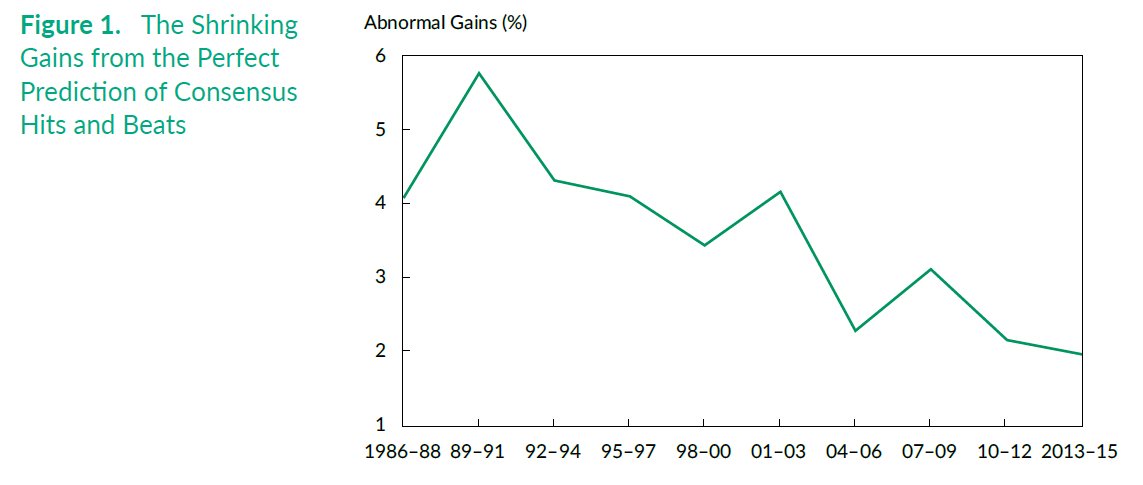

2/ In 2017, Gu and Lev estimated how much you would make if you went long stocks that meet/beat analyst EPS estimates and short stocks that miss estimates. Holding period is 3 months.

With this strategy, you would make ~6% in the early 90s. But in 2013-15, it came down to 2%!

With this strategy, you would make ~6% in the early 90s. But in 2013-15, it came down to 2%!

3/ The trend is clear. You should not want to pay too much to the genie even if the genie had 100% success rate.

The argument made by the authors of this paper was earnings just do not have as much explanatory power of how the business is doing as they used to have!

The argument made by the authors of this paper was earnings just do not have as much explanatory power of how the business is doing as they used to have!

4/ Why?

Because the accounting rules have become super outdated.

How?

The rise of intangibles.

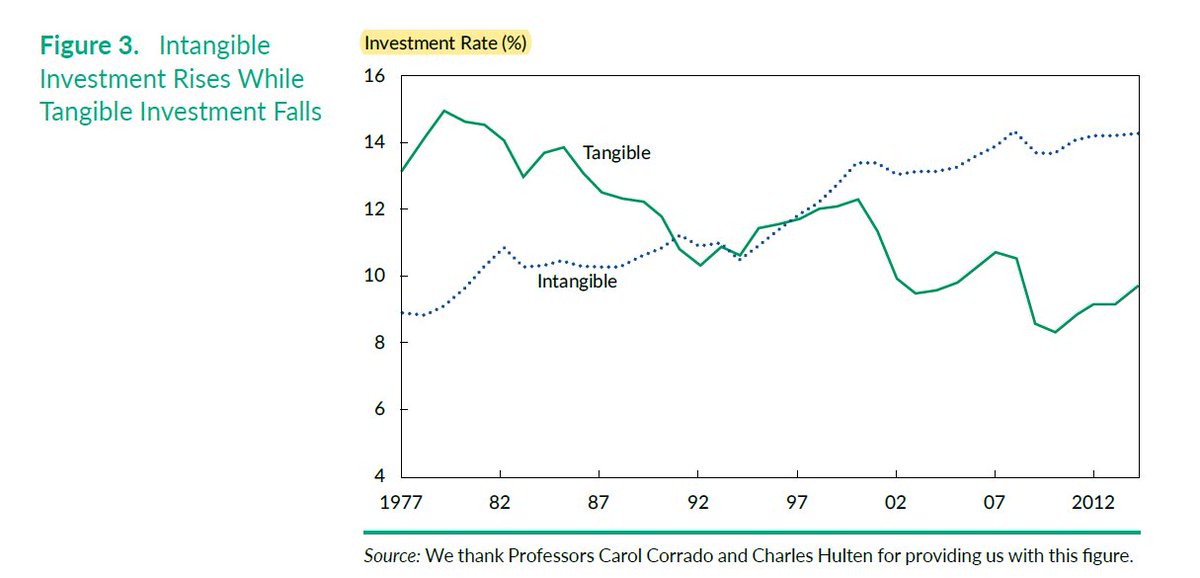

Tangible assets as % of gross added value declined from 15% in 1977 to 9% in 2014. Intangibles increased from 9% to 14% during the same period.

Because the accounting rules have become super outdated.

How?

The rise of intangibles.

Tangible assets as % of gross added value declined from 15% in 1977 to 9% in 2014. Intangibles increased from 9% to 14% during the same period.

5/ You create intangibles through R&D, patents, trademarks, brands, IT, employee training etc. Most or all of these are expensed immediately, and decrease your accounting earnings even though these tend to enhance your "intrinsic" value.

6/ Even worse, when you create intangibles through acquisitions, they can be capitalized.

But when you generate intangibles internally, there is no reflection of that in your balance sheet, and in fact, it depresses your short-term earnings.

But when you generate intangibles internally, there is no reflection of that in your balance sheet, and in fact, it depresses your short-term earnings.

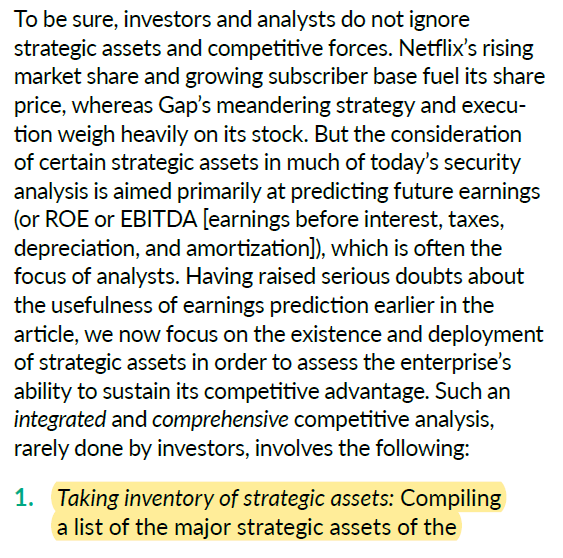

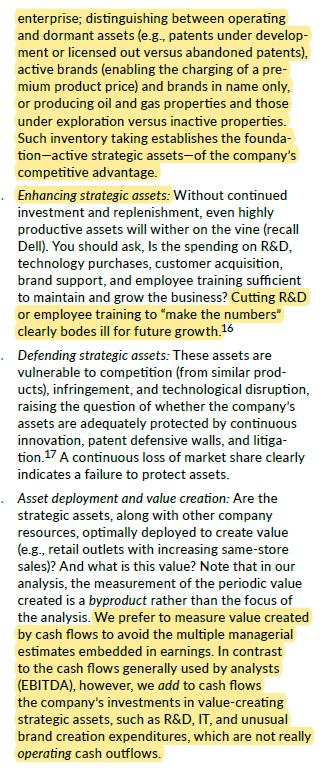

7/ Instead of focusing on accounting based earnings, the authors suggest an alternative model to analysts.

First, figure out what the strategic assets of a company are.

First, figure out what the strategic assets of a company are.

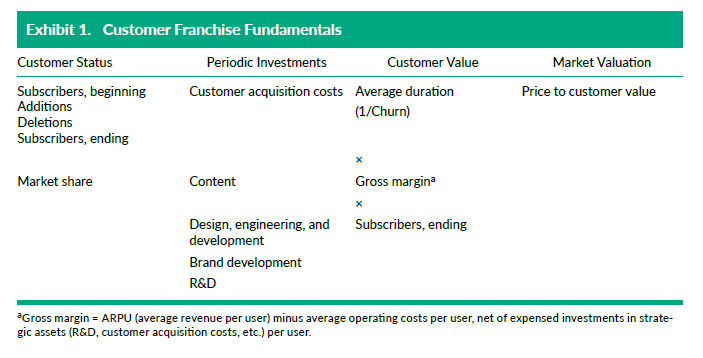

8/ The authors used subscription based business models to illustrate how it can be done although they think it can be implemented in other businesses as well.

Price to customer value is an interesting metric.

Price to customer value is an interesting metric.

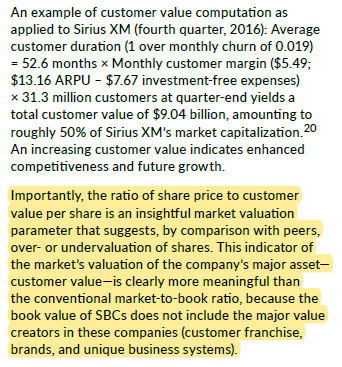

9/ To explain the model using an actual example, the authors used $SIRI.

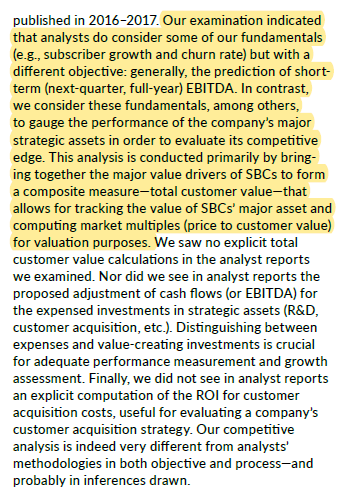

10/ Aren& #39;t analysts already doing this?

Of course, we all look at subscriber growth, churn etc but most analysts still remain fixated on earnings/EBITDA number.

Of course, we all look at subscriber growth, churn etc but most analysts still remain fixated on earnings/EBITDA number.

End/ Obviously, estimating customer value is no easy task, and will be fraught with many assumptions.

But that& #39;s true for every model out there, especially for DCFs.

Link to the paper discussed: https://www.fundresearch.de/fundresearch-wAssets/sites/default/files/Nachrichten/Inside/2017/Time%20to%20Change%20Your%20Investment%20Model.pdf">https://www.fundresearch.de/fundresea...

But that& #39;s true for every model out there, especially for DCFs.

Link to the paper discussed: https://www.fundresearch.de/fundresearch-wAssets/sites/default/files/Nachrichten/Inside/2017/Time%20to%20Change%20Your%20Investment%20Model.pdf">https://www.fundresearch.de/fundresea...

Read on Twitter

Read on Twitter