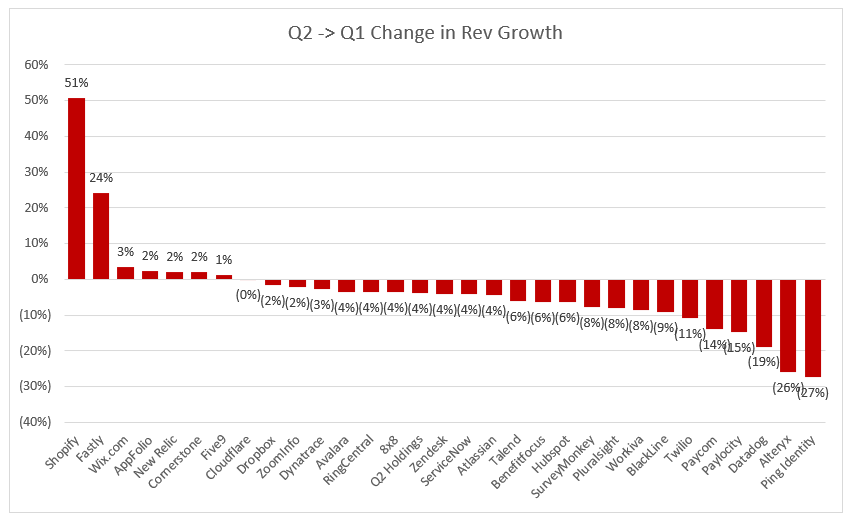

Digital Transformations from Covid are accelerating rev growth in SaaS businesses!! Not so fast...The change in YoY growth rates from Q1 to Q2 tells a different story. Data below shows the absolute change in %. Ex: Fastly grew 38% in Q1 and 62% in Q2 (difference is graphed, +24%)

Why is this happening? Digital transformations are in fact accelerating. However, sales cycles are lengthening. Even products with some elements of usage based pricing (Datadog, Twilio) are being "metered" as businesses looked to tighten up expenses

For larger companies, this effect was emphasized as procurement was put through extra scrutiny. Datadog talked in their earnings call about larger businesses not expanding as much as normal. Alteryx (with longer, enterprise sales motions) was hurt more than most.

Count me in the group who was particularly surprised with these results. I didn& #39;t foresee growth pretty much decelerating across the board. Even a company like Twilio, I expected diff results given their survey around digital communication strategies accelerating by 6 years

The easy answer is "well a company of Twilio& #39;s scale always has decelerating rev growth when historical growth was ~60%. No one maintains that growth at that scale!!"

I hear that argument... but... does that just mean Twilio is on the same pre-covid growth trajectory? No bump?

I hear that argument... but... does that just mean Twilio is on the same pre-covid growth trajectory? No bump?

My point is I would have liked to see more "proof" in the earnings numbers so far behind digital transformations accelerating. Again, I think a big reason for this was buying / procurement generally being put on pause more than we would have anticipated.

Next Q will be EXTREMELY telling. Either my theory is correct and pushed deals will close in Q3 or Covid really isn& #39;t helping SaaS businesses like we thought (but the valuations have increased under this assumption!), and we could be headed for short term volatility in valuations

Don& #39;t get me wrong - I& #39;m extremely bullish long term on SaaS / Cloud. Cloud penetration is accelerating, and still has TONS of room to grow. But I am very closely monitoring the next couple quarters to see if the multiple bump we saw over the last ~4 months is justified

The reality may be that the "benefit" for SaaS was that they weren& #39;t as negatively impacted as most industries. I will continue to build out this graph as more companies report earnings over the coming weeks

Also... Shopify... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Augen" aria-label="Emoji: Augen"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

Also... Shopify...

Read on Twitter

Read on Twitter