What& #39;s better than a dividend?

A growing dividend.

More importantly...

A sustainable one.

Let& #39;s go through the steps of analyzing the dividend possibilities of a company.

Learn how the pros do it.

- A THREAD -

A growing dividend.

More importantly...

A sustainable one.

Let& #39;s go through the steps of analyzing the dividend possibilities of a company.

Learn how the pros do it.

- A THREAD -

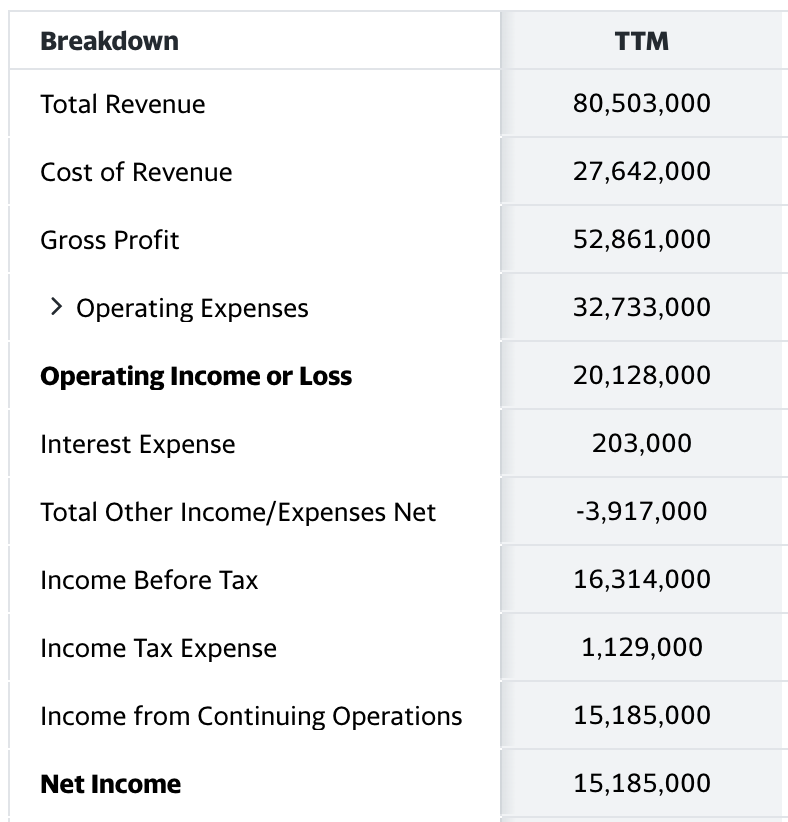

1.

"Current fiscal year profit"

Forget revenue.

We want profit.

Here& #39;s $JNJ for example.

Revenue looks nice but how much is profit?

The "Net income" line will tell you.

$15 billion for the Trailing Twelve Month (TTM) period.

*All numbers are in thousands*

"Current fiscal year profit"

Forget revenue.

We want profit.

Here& #39;s $JNJ for example.

Revenue looks nice but how much is profit?

The "Net income" line will tell you.

$15 billion for the Trailing Twelve Month (TTM) period.

*All numbers are in thousands*

2.

"Stable profits"

Let& #39;s take a look at $MMM this time.

If you focus your attention on the "Net income" line again.

You can see their profits remained fairly stable from the years 2016-2019.

This is a good sign for dividend sustainability.

"Stable profits"

Let& #39;s take a look at $MMM this time.

If you focus your attention on the "Net income" line again.

You can see their profits remained fairly stable from the years 2016-2019.

This is a good sign for dividend sustainability.

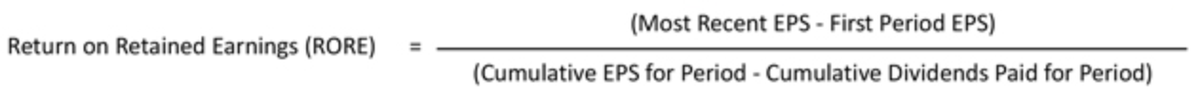

3.

"The Rate of Return on Retained Earnings"

Retained earnings is the amount of income left over after the company has paid out dividends.

Money that can be used for long term growth.

Compare this number with industry averages to see how they match up.

Formula:

"The Rate of Return on Retained Earnings"

Retained earnings is the amount of income left over after the company has paid out dividends.

Money that can be used for long term growth.

Compare this number with industry averages to see how they match up.

Formula:

4.

"Net Working Capital"

This is a measure of a companies liquidity, efficiency of operations and short term financial situation.

A positive net working capital means that the company can fund its operations and have money left over for growth.

Formula:

"Net Working Capital"

This is a measure of a companies liquidity, efficiency of operations and short term financial situation.

A positive net working capital means that the company can fund its operations and have money left over for growth.

Formula:

5.

"Dividend Policies"

Policies are put into place for dividend payouts:

1) Residual

Where dividends are paid out only if capital requirements are met for internal projects.

2) Stability

Where the company sets the dividend at a specific number.

3) Hybrid

A mix of both.

"Dividend Policies"

Policies are put into place for dividend payouts:

1) Residual

Where dividends are paid out only if capital requirements are met for internal projects.

2) Stability

Where the company sets the dividend at a specific number.

3) Hybrid

A mix of both.

6.

"Future plans for expansion"

If the company is looking to expand in the near future.

They may keep more of their earnings to fund expansion.

This means dividend increases will be limited (if any)

Make sure you have a good grasp of the companies expansion plans.

"Future plans for expansion"

If the company is looking to expand in the near future.

They may keep more of their earnings to fund expansion.

This means dividend increases will be limited (if any)

Make sure you have a good grasp of the companies expansion plans.

This is just the tip of the iceberg when measuring dividend possibilities.

If you want to learn more...

I& #39;ve put together a course that will have you earning a growing and sustainable dividend for years to come.

Start creating your own paycheck. https://bit.ly/dividendmoney ">https://bit.ly/dividendm...

If you want to learn more...

I& #39;ve put together a course that will have you earning a growing and sustainable dividend for years to come.

Start creating your own paycheck. https://bit.ly/dividendmoney ">https://bit.ly/dividendm...

Read on Twitter

Read on Twitter