How to find out actual value of a stock?

Intrinsic valuation calculation as per Warren Buffet.

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">: -

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📜" title="Schriftrolle" aria-label="Emoji: Schriftrolle">: -

Intrinsic valuation calculation as per Warren Buffet.

A thread

Let’s say you live in a small village.

There’s a Pizza shop in your village called ‘Pizza Burst& #39;.

It has been in existence for more than 30 years. It’s located at a good spot near the mall. Good number of customers visits daily and the owner is your good friend.

There’s a Pizza shop in your village called ‘Pizza Burst& #39;.

It has been in existence for more than 30 years. It’s located at a good spot near the mall. Good number of customers visits daily and the owner is your good friend.

One day, this friend gives you a call telling you that he& #39;s planning for retirement. His kids don’t want to run this family business. They are pursuing their education overseas and will probably settle there.

So he want to sell his business completely.

So he want to sell his business completely.

You’re a rich person; you already have several businesses under your belt.

So you tell him “Okay, I’ll get back to you in a few days”.

Along with that, you ask him for financial reports of last 10 years.

So you tell him “Okay, I’ll get back to you in a few days”.

Along with that, you ask him for financial reports of last 10 years.

You’re a smart investor.

So you go home, you start with your research & analysis to give him a price quote.

Obviously, it’s not trading on a stock exchange so you probably need to figure it out all on your own.

So you go home, you start with your research & analysis to give him a price quote.

Obviously, it’s not trading on a stock exchange so you probably need to figure it out all on your own.

You identified that his expenses include variable costs (depending on sales) such as flour, cheese, sauce, etc.

Fixed costs such as rent, utility bills, employee salaries, etc.

Some capital expenses in every few year periods such as microwave, furniture, interior design etc..

Fixed costs such as rent, utility bills, employee salaries, etc.

Some capital expenses in every few year periods such as microwave, furniture, interior design etc..

You know that he’s created a unique taste & a reputed brand in the village.

There are no other similar stores around. Hence, people love re-visiting his store. It’s a kind of a monopoly.

There are no other similar stores around. Hence, people love re-visiting his store. It’s a kind of a monopoly.

After doing the analysis, you identified the profit margin is great.

His earning has been pretty much stable throughout the years during good & bad times.

It doesn’t matter what the market condition is, people prefer visiting his store to relax, spend time, eat, etc.

His earning has been pretty much stable throughout the years during good & bad times.

It doesn’t matter what the market condition is, people prefer visiting his store to relax, spend time, eat, etc.

After considering all the costs, you identified that his business makes about ₹10 lakhs worth of profit annually.

As an investor, you identified his business is not too risky, but nether too safe.

So you want to have atleast 14% returns on your investment.

As an investor, you identified his business is not too risky, but nether too safe.

So you want to have atleast 14% returns on your investment.

Assuming that his business gives us steady cashflow of ₹10 lakhs annually forever,

The calculation to find out the value of his business is this:

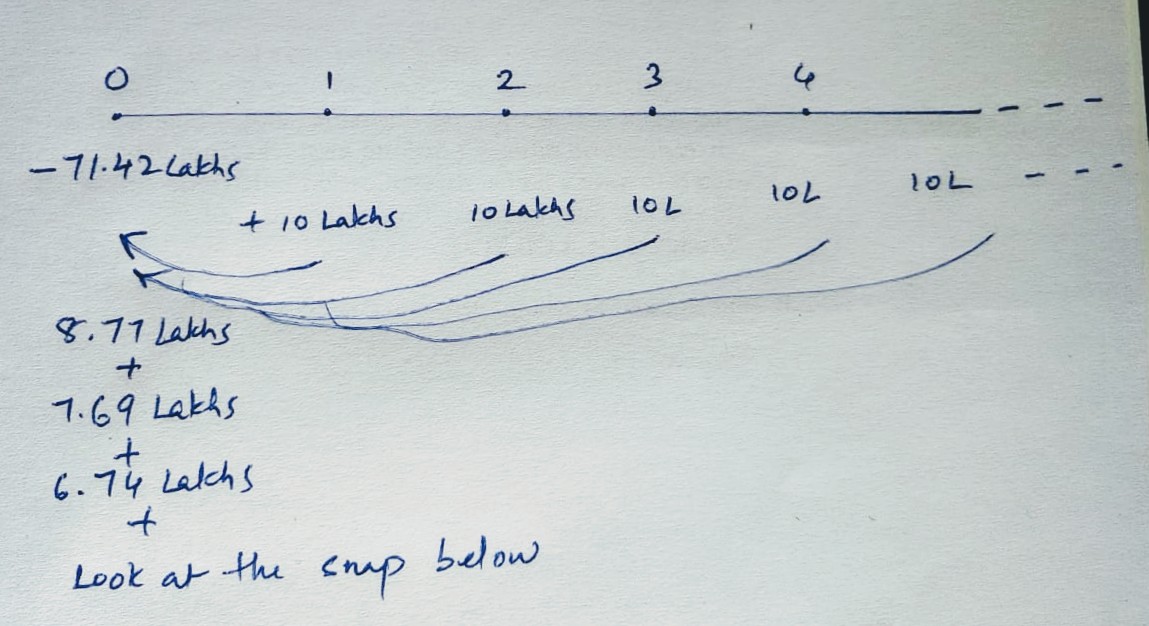

10,00,000 / 0.14 (i.e. yearly cashflow/required rate of return in decimal form) = ₹71,42,857

The calculation to find out the value of his business is this:

10,00,000 / 0.14 (i.e. yearly cashflow/required rate of return in decimal form) = ₹71,42,857

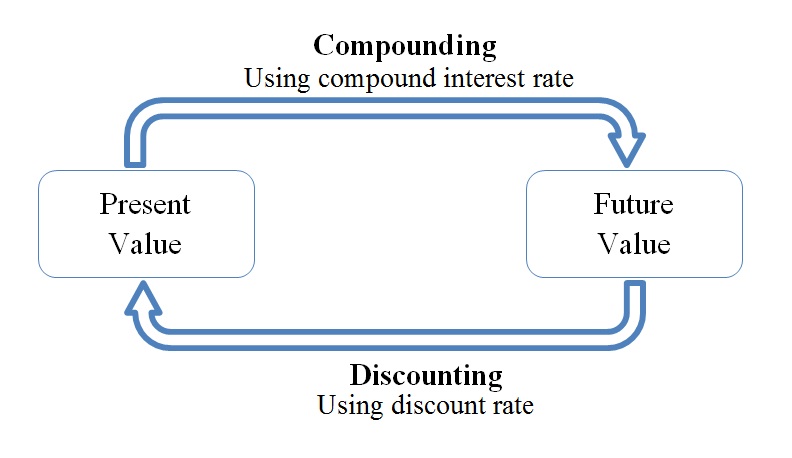

It is called DCF (Discounted Cash Flow) method of valuation. You’re discounting (reducing) the future cashflows to bring it to Present value.

Which is the fundamental principle of valuation: -

“The VALUE of any asset is the present value of all the expected future cash flows."

Which is the fundamental principle of valuation: -

“The VALUE of any asset is the present value of all the expected future cash flows."

In compounding, you increase the value of current cash that goes into future.

Here, you discount.

Because ₹1 today is worth more than ₹1 after 5 years.

So if you want to find out PRESENT value of a ₹1 that you’ll get in 5 years, you need to discount it.

Here, you discount.

Because ₹1 today is worth more than ₹1 after 5 years.

So if you want to find out PRESENT value of a ₹1 that you’ll get in 5 years, you need to discount it.

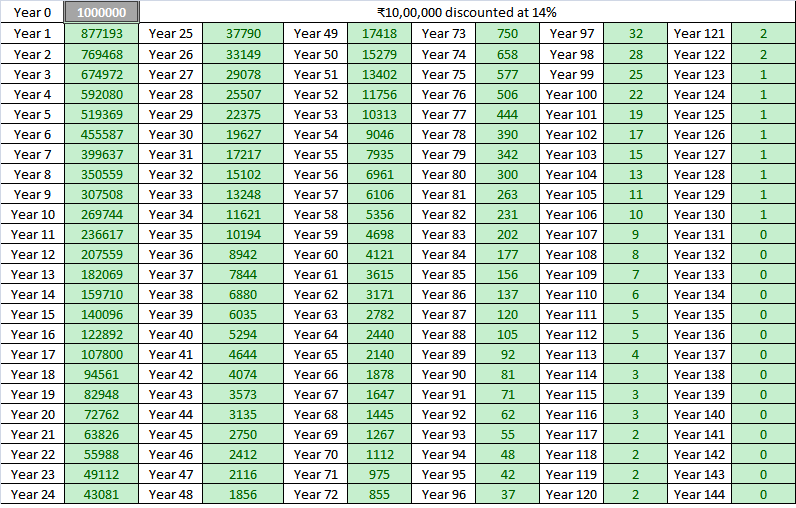

As his business is generating ₹10 lakh yearly. So the PRESENT value of his 10 lakh earnings 1 year from now at (14% discount rate) will be ₹8,77,193.

And, it’ll keep on reducing each year because of the effect of discounting. See https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

And, it’ll keep on reducing each year because of the effect of discounting. See

If you do a total of all these (discounted) cashflows mentioned in green above, your total value will be 71,42,857.

After all, that is what you& #39;re getting from the business, so that is what we pay.

(Which is the present value of the business we estimated earlier with formula)

After all, that is what you& #39;re getting from the business, so that is what we pay.

(Which is the present value of the business we estimated earlier with formula)

Now that we’ve found a value for the business, let’s test it with P/E (price/earning) ratio.

The P/E ratio for this company is ₹71,42,857 / ₹10,00,000 = 7.14.

The P/E ratio for this company is ₹71,42,857 / ₹10,00,000 = 7.14.

This means for every ₹7.14 invested, your business earns ₹1 in a year.

Whether you re-invest it back to grow your business or take it home as dividends.

Your business, your choice.

Whether you re-invest it back to grow your business or take it home as dividends.

Your business, your choice.

This 7.14 is also called “Payback period”.

In other words, "recovery of your investment amount".

You’ll get your investment back in approx 7.14 years.

(Ignoring time value of money and assuming the earnings aren’t growing each year.).

In other words, "recovery of your investment amount".

You’ll get your investment back in approx 7.14 years.

(Ignoring time value of money and assuming the earnings aren’t growing each year.).

Let’s say your friend doesn’t agree to this price and claims that he has built a strong business with good reputation & demands more price.

You agreed (in your mind) & re-value the business again.

You reduce your required rate of return to 12%. That& #39;s 10,00,000/0.12 = 83,33,333

You agreed (in your mind) & re-value the business again.

You reduce your required rate of return to 12%. That& #39;s 10,00,000/0.12 = 83,33,333

The PE now has increased to 8.33.

As an investor, you’d want to have lowest P/E possible. Lesser the investment, more the return.

However, you& #39;re also hoping the earnings will grow. Hence, many investors are happy to pay high price for a company with a “hope” of future growth.

As an investor, you’d want to have lowest P/E possible. Lesser the investment, more the return.

However, you& #39;re also hoping the earnings will grow. Hence, many investors are happy to pay high price for a company with a “hope” of future growth.

“Whether we& #39;re buying all of a business or a little piece of a business, I always think we& #39;re buying the whole business because that& #39;s my approach to it. I look at it and I say, what will come out of this business and when?”

– Warren Buffett

– Warren Buffett

Sometimes, you don’t need all these calculations. Although numbers are important, but non-numerical factors also play important role for sustainability of business.

You don’t want to buy a company that has strong numbers reported recently but only sells DVD player.

You don’t want to buy a company that has strong numbers reported recently but only sells DVD player.

“If high level mathematics and algebra was required to invest in stocks, I& #39;d have to go back to delivering newspaper.”

-- Warren Buffett.

-- Warren Buffett.

Most of the times, a simple P/E ratio can tell (save) you a lot. This can also help you avoid huge losses in the market.

For ex. The P/E ratio of Dmart (a 20 year old company) is currently 133. This means it’ll take 133 years for Dmart to earn the amount you’ve invested.

For ex. The P/E ratio of Dmart (a 20 year old company) is currently 133. This means it’ll take 133 years for Dmart to earn the amount you’ve invested.

This shows that the investors are hoping (or betting) that the earnings will grow or probably explode in the years to come.

On the other hand, the P/E ratio of ITC (a 100 year old FMCG company with several old brands) is 17.

On the other hand, the P/E ratio of ITC (a 100 year old FMCG company with several old brands) is 17.

My 2 cents:

Whenever we think of buying a property for investment, we research a lot of factors. Such as location, growth prospect of area, its rental payment, prices of other houses in same location to compare, etc..

Whenever we think of buying a property for investment, we research a lot of factors. Such as location, growth prospect of area, its rental payment, prices of other houses in same location to compare, etc..

Same things can be done in investing by looking at market share, growth prospects, div yield, peer comparison, P/E, etc..

Sadly, while buying a stock, many investors hardly do any such research.

"The stock price is going up from so many days, let me get in and take some profits"

Sadly, while buying a stock, many investors hardly do any such research.

"The stock price is going up from so many days, let me get in and take some profits"

You do not become a great investor just because the stock went up after your purchase.

A stock price increase after a few days of your purchase only indicates that someone else was willing to pay more for that stock. Nothing more.

A stock price increase after a few days of your purchase only indicates that someone else was willing to pay more for that stock. Nothing more.

Few calculations, a short story of why you think its worth buying can be more than enough.

“We don’t formally have discount rates. Every time we start talking about this, Charlie (Munger) reminds me that I’ve never prepared a spreadsheet, but I do in my mind.”

– Warren Buffett

“We don’t formally have discount rates. Every time we start talking about this, Charlie (Munger) reminds me that I’ve never prepared a spreadsheet, but I do in my mind.”

– Warren Buffett

While buying a stock, tell yourself that I am NOT:

• an investor

• an analyst

• an advisor

• a fund manager

• a speculator

• a speculator

• a speculator

• a speculator

• a speculator...

• an investor

• an analyst

• an advisor

• a fund manager

• a speculator

• a speculator

• a speculator

• a speculator

• a speculator...

I am an owner. A business owner.

"WHAT will I get out of it and WHEN?"

Change your mindset. Then think of buying a company, not a stock.

Let me know what happens.

Enjoy your journey and don& #39;t forget to share. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Lächelndes Gesicht mit geöffnetem Mund" aria-label="Emoji: Lächelndes Gesicht mit geöffnetem Mund">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Lächelndes Gesicht mit geöffnetem Mund" aria-label="Emoji: Lächelndes Gesicht mit geöffnetem Mund">

@invest_mindset

"WHAT will I get out of it and WHEN?"

Change your mindset. Then think of buying a company, not a stock.

Let me know what happens.

Enjoy your journey and don& #39;t forget to share.

@invest_mindset

Read on Twitter

Read on Twitter

" title="As his business is generating ₹10 lakh yearly. So the PRESENT value of his 10 lakh earnings 1 year from now at (14% discount rate) will be ₹8,77,193.And, it’ll keep on reducing each year because of the effect of discounting. Seehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="As his business is generating ₹10 lakh yearly. So the PRESENT value of his 10 lakh earnings 1 year from now at (14% discount rate) will be ₹8,77,193.And, it’ll keep on reducing each year because of the effect of discounting. Seehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>