There& #39;s a creation myth about modern Ireland that needs debunking. It& #39;s the one of an inward protectionist state until 1958 when Whitaker/Lemass saved us with tax breaks & FDI. It& #39;s popped up in my current research on the Apple case & its presence is highly frustrating 1/

This is the article here. It places the origin of Irish political corruption with protectionism, adding that & #39;...the economy in the first half of the 20th c. was heavily protected, largely subsidised and principally controlled by the state& #39;. 2/

The conceptual framework they& #39;re using to explain corruption in Ireland is thus: state intervention in the economy is an evil. It also framed by the idea of history as & #39;progress& #39; - that Ireland & #39;matured& #39; when it dropped protectionism and embraced tax breaks and FDI. 3/

I& #39;ve got problems with these assumptions - not least because they are not true. The real purpose such an analysis serves (in my opinion) I& #39;ll get to later. But for now let& #39;s look at the reality of Ireland and its so called protectionist past. 4/

First of all Ireland was a founder member of the Organisation for European Economic Cooperation (OEEC) in 1948. Its purpose was to allocate Marshall aid and coordinate the dismantling of tariffs between European states in order to facilitate the rebuilding of post-war Europe. 5/

Its other remit was to halt the spread of communism through full employment, housing & social protections - but that& #39;s for another day. For now, though, it& #39;s important to note that from 1948 Ireland was committed to lowering tariffs as part of a European-wide endeavour. 6/

And far from being a closed, inward-looking, protectionist obsessed state, Ireland was one of the more open economies in Europe at that time - as was noted by the International Bank for Reconstruction & Development (precursor to the World Bank) in 1955. 7/

The key line is this one in the image here - in 1952 Ireland was in the top five of European states in terms of trade openness. This was six years BEFORE the so-called Lemass/Whitaker revolution 8/

The less-highly export-orientated countries included France, Germany, the UK, Italy, Sweden and Austria. Ireland - in 1952 - trumped these states in terms of exports relative to the size of its economy.

Does that sound like an inward-protectionist state? 9/

Does that sound like an inward-protectionist state? 9/

At the same time there were huge issues with the Irish economy - not least massive emigration and frustratingly stagnant job growth. There was little state investment and the welfare state that was emerging was a pale shadow of what was happening in other European states. 10/

Ireland was one of the most open economies in Europe at the time - years before Whitaker/Lemass - but there was a structural imbalance as its foreign trade was dominated by Britain. Between 80-85% of all exports and imports were with Britain alone. 11/

Furthermore, Ireland imported more than it exported so its balance of payments were almost constantly in the red. On top of this it was a part of the Sterling area with only a nominally-independent currency, which meant it couldn& #39;t devalue its currency to make exports cheaper 12/

Nor would the state borrow to invest to increase productivity which was desperately needed in agriculture, the state& #39;s largest (and largely undeveloped) export sector. Ireland& #39;s private banks refused to issue loans at affordable rates, preferring to invest in Britain instead 13/

This left it with the option of internal devaluation - in other words austerity - to address the balances of payments issue by effectively cutting wages and employment to lower demand for imports, along with use of selected tariffs under OEEC rules. 14/

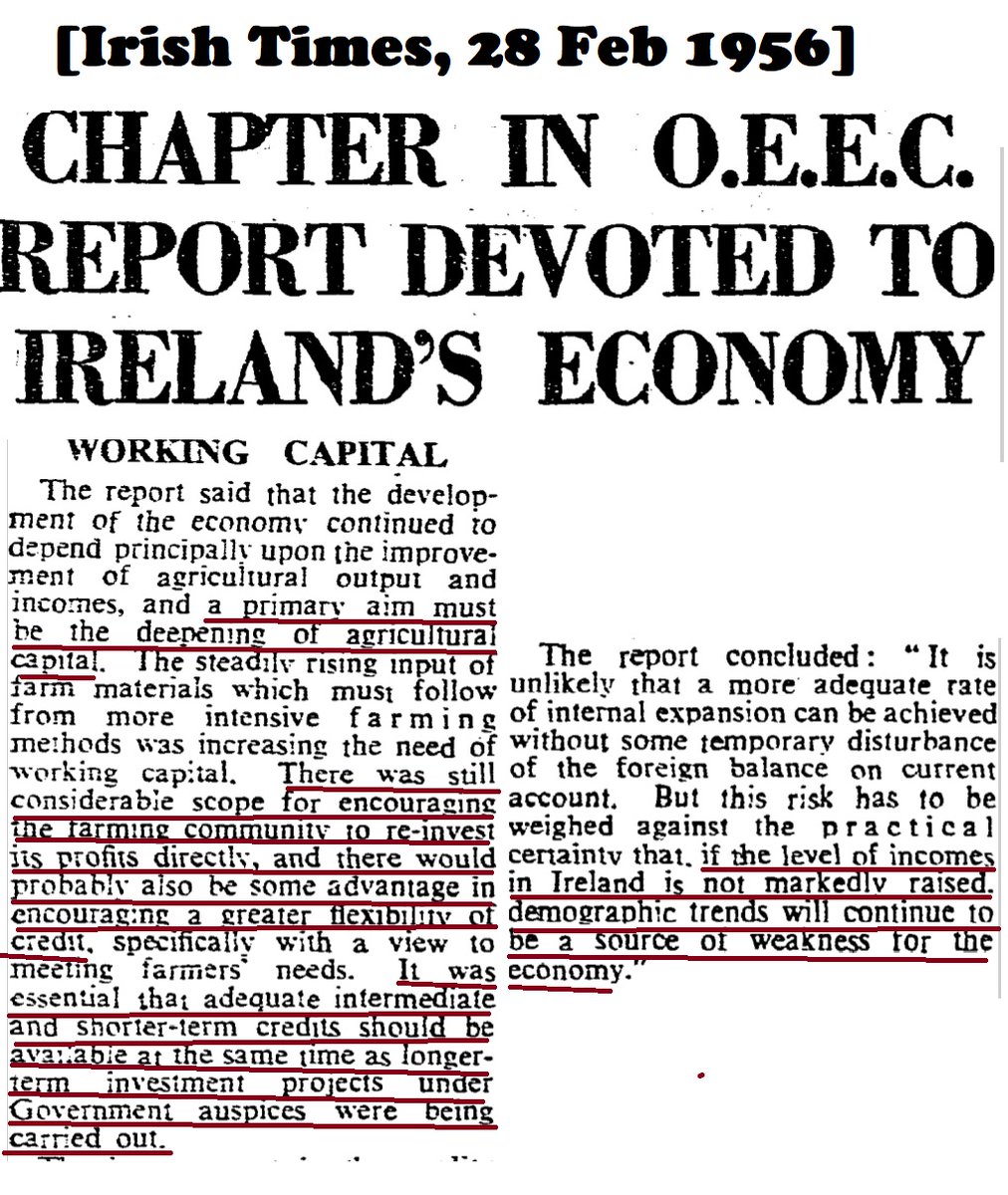

Both the OEEC and the World Bank were clear as to what Ireland should do to address its balance of payments issue - borrow to invest and build up indigenous companies as exporters. As an example, some quotes from the OEEC from 1956. 15/

However, the Irish state was not ready nor willing to take on the banks, or consider a more flexible currency relationship with Sterling, or confront the conservative, risk-adverse cattle ranchers who were wedded to the Dual-Purpose Shorthorn for milk and beef production 15/

The moves to & #39;import& #39; exporters through tax breaks and grants was seen as a way of squaring this circle. I go more into this in my books Sins of the Father and Money if you& #39;re interested -but for now the above is to highlight that the foundation myth of 1958 & Whitaker/Lemass 16/

is there to mask the economic class dynamics at play in Ireland in the 1950s, ones that bear a relationship to comprador capitalist dynamics - and ones that are still at play today with Apple and Ireland as a tax haven. [end]

Read on Twitter

Read on Twitter