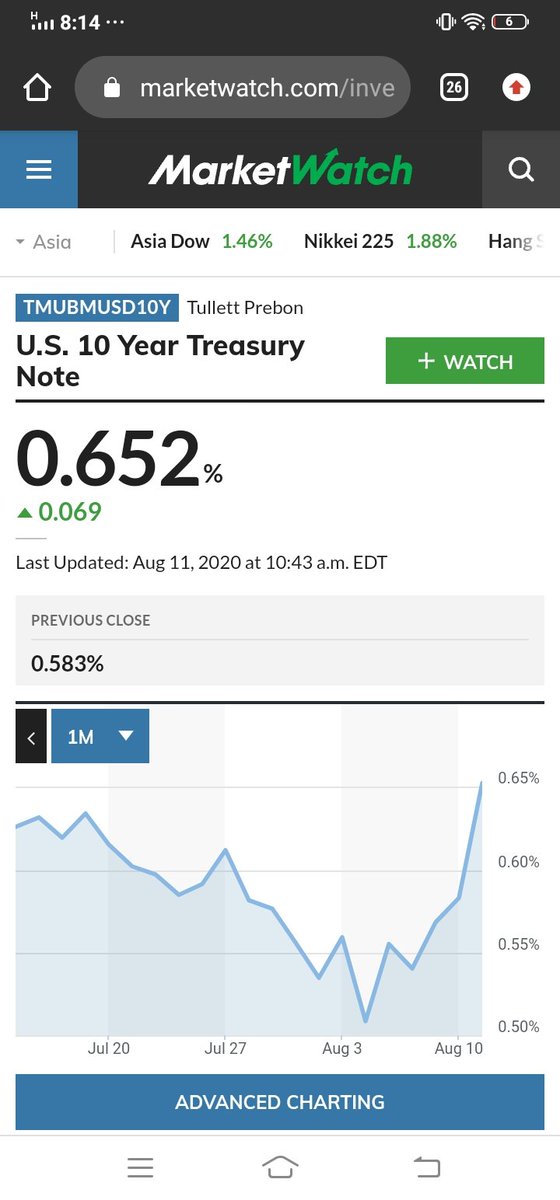

The last leg of this current liquidity driven run may have started as bond yields start rising again in US treasuries

A lot of money went into US via US$ and US treasuries in the last 2 years to capture the yield spreads and currency upmove. These positions actually started hammoraging once the USD started falling last month.

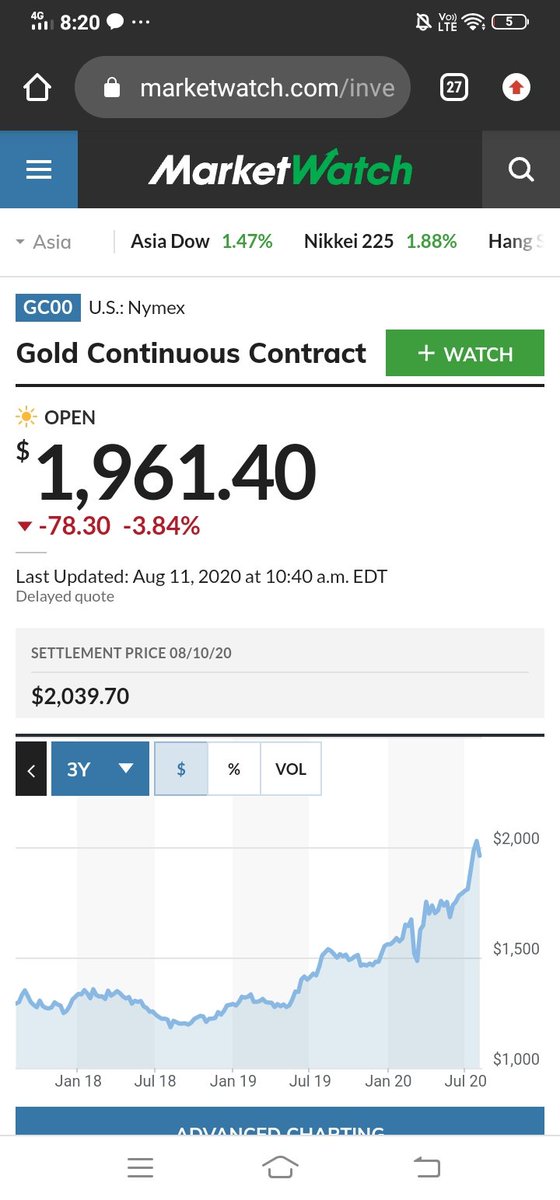

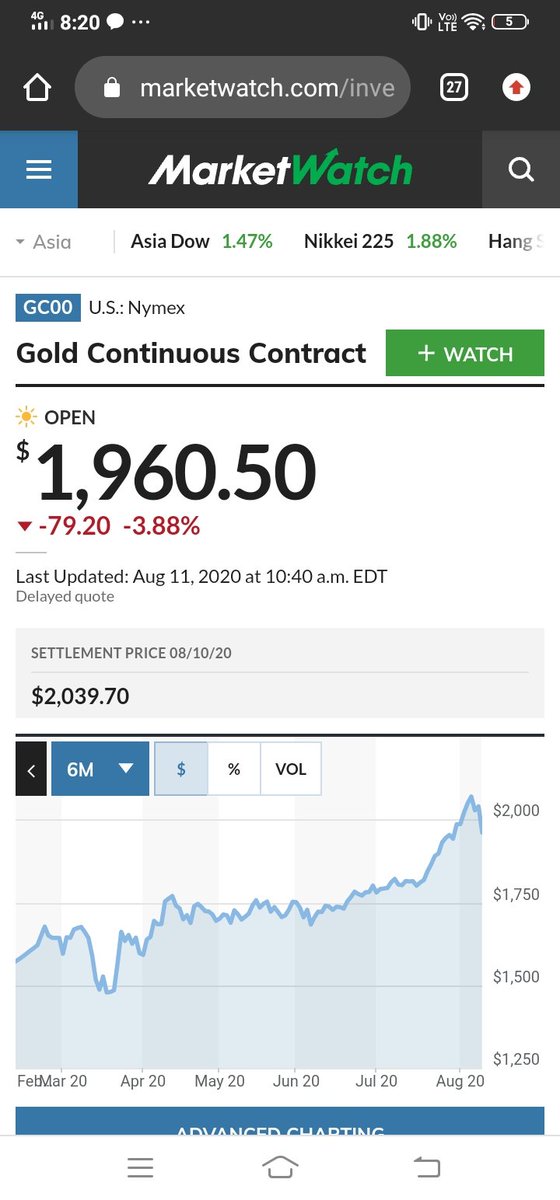

This move down in bond yields coupled with a stronger USD leading to mild inflation has lowered real yields and been the ballast for the Gold rally in the last two years.

As Gold is a very topical - the current correction will likely be bought into given the interest and cause the next upmove. However that up-move coinciding with a further treasury yield spike is potentially problematic.

The combination of US treasury yields and Gold both rising will create the conditions for a narrative about inflation and the FED losing control. Given all of this is a result of the Fed liquidity creation, the case will become stronger for the Fed to change its policy stance

Read on Twitter

Read on Twitter