UK challenger bank annual reports are all in.

A few highlights https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

A few highlights

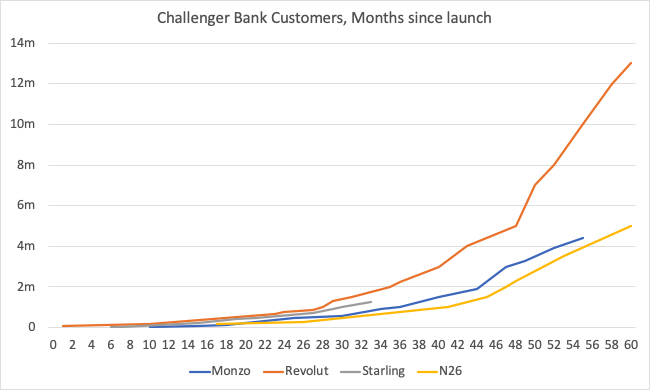

Monzo customer growth is slowing down, but not the others. Revolut is now at 13m customers.

"We’ve seen organic customer growth slow as word-of mouth drops." Monzo founder

"We’ve seen organic customer growth slow as word-of mouth drops." Monzo founder

Lending is hurting.

Both Monzo and Starling provisioned more for bad loans last year than they earned in interest income. They& #39;d have been better off not lending a penny! https://twitter.com/MarcRuby/status/1292091212330151937">https://twitter.com/MarcRuby/...

Both Monzo and Starling provisioned more for bad loans last year than they earned in interest income. They& #39;d have been better off not lending a penny! https://twitter.com/MarcRuby/status/1292091212330151937">https://twitter.com/MarcRuby/...

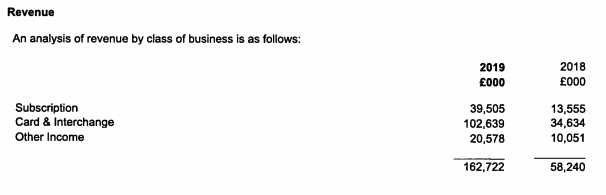

Reliance on interchange is still high.

In spite of its diversification into other areas, cards is still 63% of Revolut& #39;s income. But subscription fees do make up >40% of the admin expenses.

In spite of its diversification into other areas, cards is still 63% of Revolut& #39;s income. But subscription fees do make up >40% of the admin expenses.

Between them they sit on £4.8bn of customer deposits.

• Starling has the highest balances because of its corporate skew.

• Monzo& #39;s deposits per customer are going up as they go after salaries.

• But Revolut& #39;s are going down, as they focus on customer growth.

• Starling has the highest balances because of its corporate skew.

• Monzo& #39;s deposits per customer are going up as they go after salaries.

• But Revolut& #39;s are going down, as they focus on customer growth.

The challengers are all doing £20-25 of revenue per customer. But costs are still going up and combined losses were £276m last year.

Fortunately they all raised capital this year and have enough runway to give it a shot.

Fortunately they all raised capital this year and have enough runway to give it a shot.

More on the current state of online lending here. https://netinterest.substack.com/p/online-lending-the-good-the-bad-and">https://netinterest.substack.com/p/online-...

Read on Twitter

Read on Twitter " title="UK challenger bank annual reports are all in. A few highlights https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>

" title="UK challenger bank annual reports are all in. A few highlights https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">" class="img-responsive" style="max-width:100%;"/>