We’re pleased to announce a podcast on Reviving Growth Keynesianism! We’re starting it off with a double header: an introductory episode followed immediately by an interview with @NicholsUprising.

In our first intro episode, we argue that fighting inequality to boost growth is a tradition as American as apple pie. https://www.buzzsprout.com/1240292/4890311-introduction">https://www.buzzsprout.com/1240292/4...

The tradition goes at least as far back as the 1930s, to a prominent Harvard economist named Alvin Hansen, “the American Keynes.”

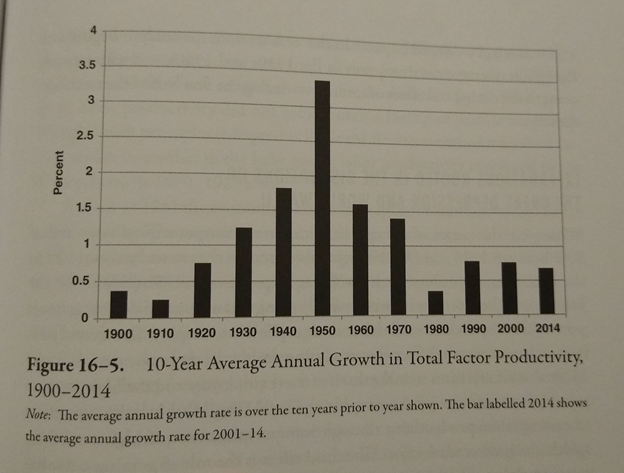

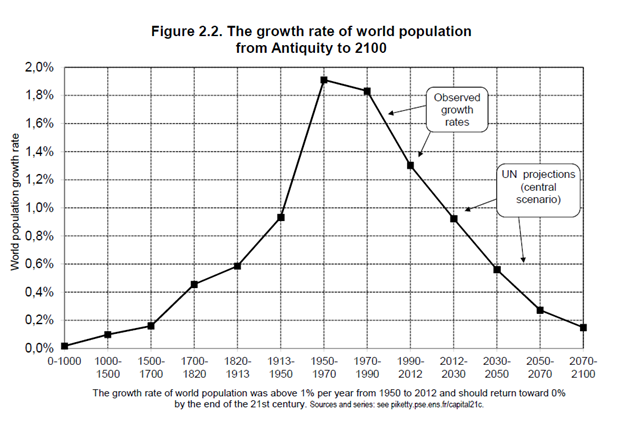

Hansen thought the objective conditions for strong investment were coming to an end: with the closing of the Western Frontier in the 1890s, slowing population growth, and weak technological innovations, there just wasn’t that much more to invest in https://www.jstor.org/stable/1806983?seq=1">https://www.jstor.org/stable/18...

But without strong investment spending by business, there would be unemployment. Hence, he predicted a new period in history, a period of “secular stagnation,” when unemployment would be persistently high, and economic growth would be perennially slow.

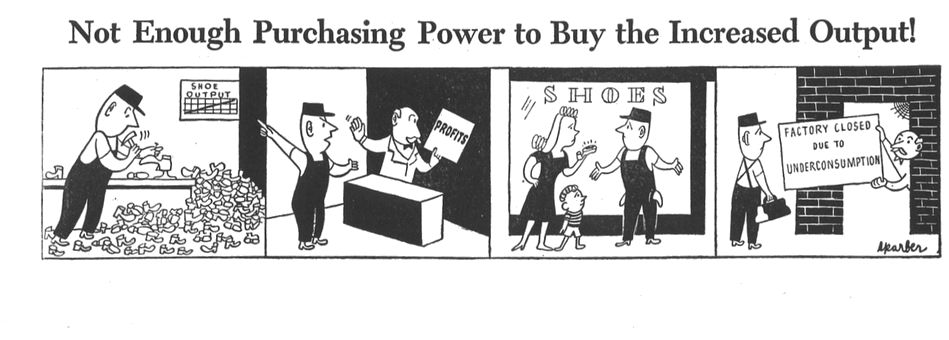

Fortunately, there was an alternative. Because investment is fueled by demand for the final product, increasing wages for workers can create profitable investment opportunities, all by itself.

As Utah banker and future Fed Chair Marriner Eccles told Congress in 1933, “It is for the interests of the well to do... that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit.”

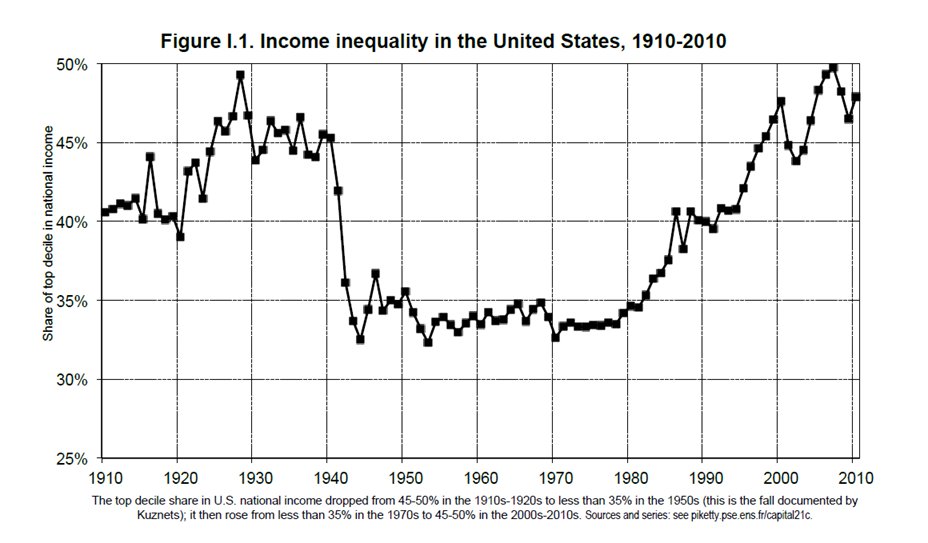

After WWII, the US largely followed what we call the “Growth Keynesian” playbook. Purchasing power was more equitably distributed, which created enormous investment opportunities and massive economic growth.

Businesses knew it, too: here’s a tribute video Fortune Magazine made to the Middle Income Consumer in 1956. As they put it, “He has fed new demands into the production apparatus of industry, accounting for the housing boom, appliance sales…” https://archive.org/details/opportunities_unlimited">https://archive.org/details/o...

Of course, it probably didn’t hurt that population and productivity—the sources of Hansen’s pessimism—grew at all time highs during this era too.

Today, though, reality seems to be catching up to the concept of “secular stagnation.” Tech and population are slowing. https://voxeu.org/article/secular-stagnation-facts-causes-and-cures-new-vox-ebook">https://voxeu.org/article/s...

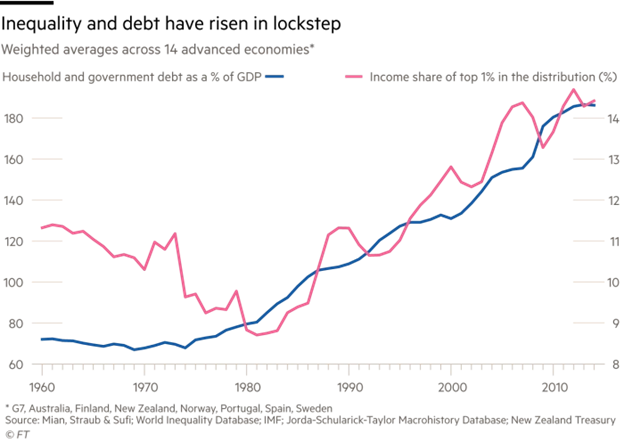

Inequality has been rising for 40 years, and lower-income Americans have only been able to keep up their standards of living through borrowing.

Meanwhile, US economic growth is persistently sluggish. We think these trends are linked, and it’s time to revisit Growth Keynesian ideas, without nostalgia, in the quite different context of the early 21st century.

As Chester Bowles, another Growth Keynesian, put it, “In our modern world, for the first time in history, what makes good morals makes good economics, too.”

The podcast will explore some of these ideas in the coming months through interviews and reading series. We hope you’ll join us!

https://twitter.com/RGK_Project/status/1292958932151996420">https://twitter.com/RGK_Proje...

Read on Twitter

Read on Twitter