0/ In early May we wrote about COVID-19 as a societal accelerant and highlighted at home fitness. $PTON was capturing the headlines (up 50% YTD at the time) but microcap $NLS had been up 200% YTD. They reported 2Q earnings today & are now +685% YTD https://medium.com/@John_Street_Capital/covid-19-as-a-societal-accelerant-3aafcde45cf6">https://medium.com/@John_Str...

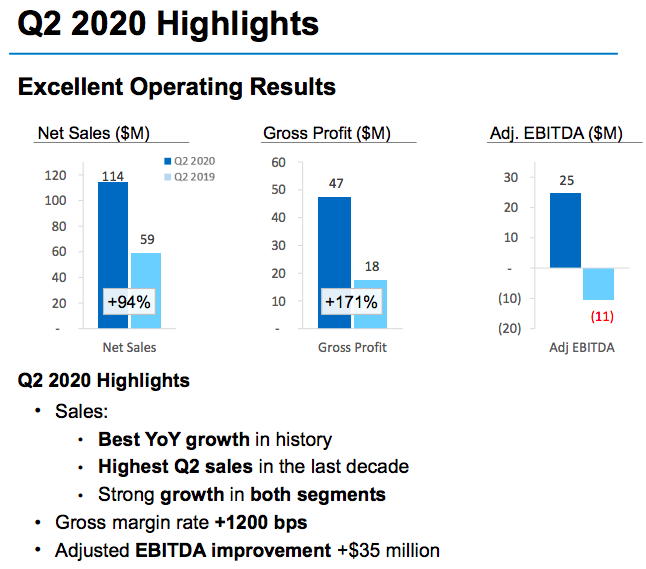

1/ $NLS reported a record 2Q with sales +94% to $114mn / EBITD of $25mn for a ~$400mn market cap company (with ~$33mn of net cash on the B/S). Management highlighted the demand outpaced supply & they enter 3Q w/ a $34mn backlog.

2/ Their direct segment saw $50.4mn of sales +142.1% YoY driven by the cardio products which were +183.4% led by connected-fitness bikes. "[They] believe that, in the near-term, demand for our products will continue to be elevated relative to pre-COVID levels, and that consumers

3/ will react favorably to the new products that we are launching later this year. However, structural production constraints in our asset-light model will likely limit our ability to fulfill all the demand."

Read on Twitter

Read on Twitter

![2/ Their direct segment saw $50.4mn of sales +142.1% YoY driven by the cardio products which were +183.4% led by connected-fitness bikes. "[They] believe that, in the near-term, demand for our products will continue to be elevated relative to pre-COVID levels, and that consumers 2/ Their direct segment saw $50.4mn of sales +142.1% YoY driven by the cardio products which were +183.4% led by connected-fitness bikes. "[They] believe that, in the near-term, demand for our products will continue to be elevated relative to pre-COVID levels, and that consumers](https://pbs.twimg.com/media/EfF5oq8XkAEeSkA.png)