Liverpool& #39;s significant progress in recent years has seen its revenue experience sizeable growth. The club is closing the financial gap with fierce rival Man United at a stellar pace- but there is one area where a sizeable gulf still exists, and that& #39;s on the commercial front.

In the two other key income streams, Liverpool is doing well. Over the last six seasons, the Anfield outfit has generated more broadcast revenue than United. From matchday revenue, what had been a gap of over £65m only seven years ago had reduced to £23m by 2019.

This gap will further reduce when the Anfield Road End stand is expanded by summer 2023 to 61,000. This additional capacity should increase matchday revenue by a further £12m-£14m, reducing the gap with United& #39;s matchday revenue to only £10m or so.

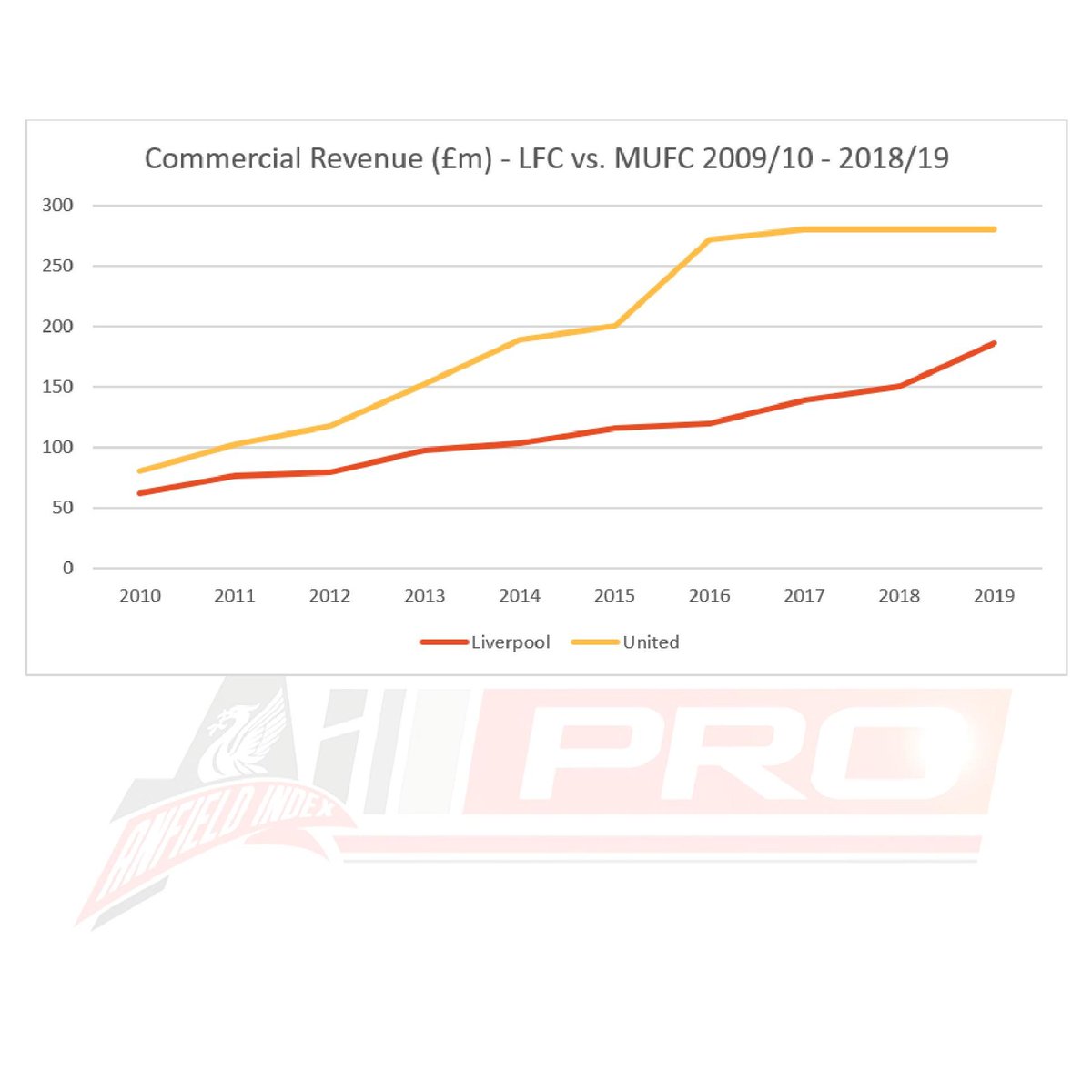

That will leave only commercial where Liverpool will still need to make headway before they can overtake United on the revenue front. This graph below shows the commercial revenue of both clubs over the ten seasons between 2009/10-2018/19 (figures from company accounts):

Contrary to misleading reports, Liverpool were a strong performer on the commercial front even before FSG took over the club in October 2010; during the 2009/10 season, Liverpool& #39;s commercial revenue was second only to United& #39;s in the PL with the gap between the two clubs of £19m

Between 2009/10 - 2015/16, United& #39;s commercial revenue saw massive growth, increasing by 236% in six years as the club moved to lucrative deals with adidas (kit manufacturer) and Chevrolet (shirt sponsor) as well as striking a host of other high value sponsorship deals.

Liverpool& #39;s commercial revenue, meanwhile, grew by a still respectable 94% over the same period, but by 2016, United were ahead of Liverpool on this front by a whopping £152m. In more recent years, however, Liverpool has seen strong growth on this front.

Unlike United& #39;s growth in commercial revenue, though, this was primarily fan-driven with a huge increase in kit sales seeing the New Balance deal go from generating £28m to £64m between 2015/16 to 2018/19 (an increase of £36m).

The shirt sponsor, Standard Chartered, delivered a sizeable increase from £25m to £40m per season after it inked a four year extension in 2018 that ends in 2022. However, the club has struggled with securing lucrative sponsorship deals- something United have excelled at.

In 2018/19, United generated £275m. This was broken down as follows (from company accounts):

adidas £79m

Chevrolet £59m

Aon £17m

Other sponsors £86m

Other retail, merchandising, apparel and licensing £23m

Overseas tours/exhibition matches £11m

adidas £79m

Chevrolet £59m

Aon £17m

Other sponsors £86m

Other retail, merchandising, apparel and licensing £23m

Overseas tours/exhibition matches £11m

For 2018/19, Liverpool generated £188m. This is approximately broken down as follows:

New Balance £64m

Standard Chartered £45m

Bet Victor £7m

Western Union £5m

Other sponsors £31m

Other retail, merchandising, apparel and licensing £25m

Overseas tours/exhibition matches £11m

New Balance £64m

Standard Chartered £45m

Bet Victor £7m

Western Union £5m

Other sponsors £31m

Other retail, merchandising, apparel and licensing £25m

Overseas tours/exhibition matches £11m

I stress the word approximate for Liverpool& #39;s figures because their company accounts provide far less detail than those of United. However, the above figures are based on the best available information.

This does highlight that there is a big gap between both clubs when it comes to income from sponsors (£162m vs. £88m- a difference of £74m). United& #39;s two biggest sponsorship deals - with Chevrolet and Aon - both end next summer and are likely to increase.

That said, United has seen a sharp decrease in official partners recently. The club had 65 in 2017 and that number is now down to 51. That& #39;s still well ahead of Liverpool which has 24 partners- only one more than the 23 it had in the forgettable 2014/15 season, though.

The appointment of Matt Scammell (Man United& #39;s former Head of Global Sponsorship Sales) as its new Commercial Director a couple of weeks ago indicates that Liverpool have realised they need to perform better at securing more sponsors. This is a smart move.

Granted, United have had a had start with securing more lucrative sponsorships due to its era of dominance between 1992/93 - 2012/13, but in recent years it has been Liverpool that has been arguably the hottest commodity in world football.

For global weekly TV viewership and social media engagement, Liverpool has been the strongest performing club over the last couple of years and that is very powerful when deals are there to be made with potential sponsors. Brands are always keen to be associated with success.

In addition, Mo Salah is the biggest sports star in the Arab/Muslim world yet the club has only secured two smaller Egyptian sponsors since his arrival in 2017. Sadio Mane is hugely popular across Africa but the club has struggled to capitalise on this to secure more sponsors.

The arrival of Scammell should see the club make positive moves to increase commercial revenue and close this gap. The sleeve sponsorship deal with Western Union recently ended (two years early) and the Standard Chartered deal ends in 2022.

These key deals, the new agreement with Nike plus securing more high-value sponsors, should see Liverpool close in on the other European superpowers over the next several years, all of whom have commercial revenue of close to or exceeding £300m.

Read on Twitter

Read on Twitter