1/ Let& #39;s talk video games, investing, and $NERD, @roundhill& #39;s ETF designed to track esports and video games.

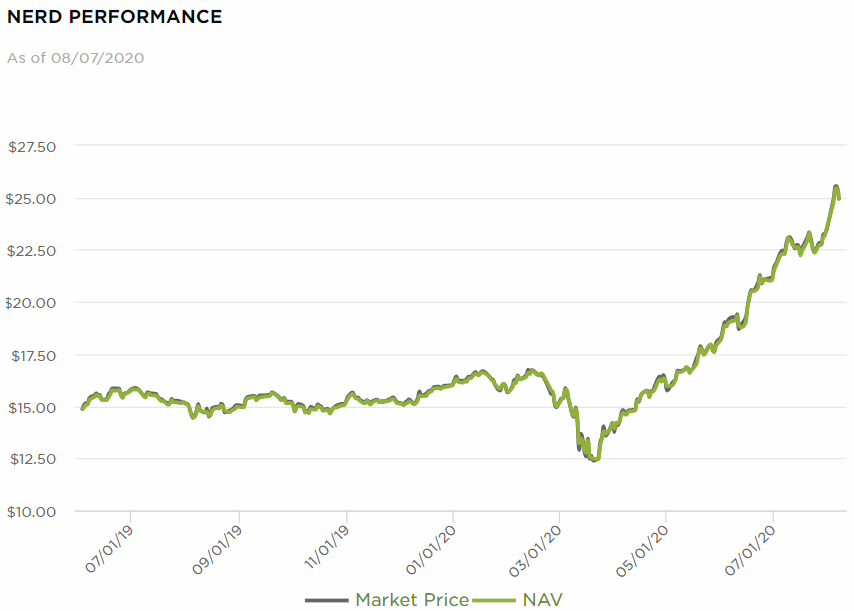

$NERD has now more than doubled from 52-wk low, 13th best-performing ETF this year (top 1%), +36% YOY

https://www.roundhillinvestments.com/assets/pdfs/Roundhill_NERD_100_Off_Lows_PR.pdf">https://www.roundhillinvestments.com/assets/pd...

$NERD has now more than doubled from 52-wk low, 13th best-performing ETF this year (top 1%), +36% YOY

https://www.roundhillinvestments.com/assets/pdfs/Roundhill_NERD_100_Off_Lows_PR.pdf">https://www.roundhillinvestments.com/assets/pd...

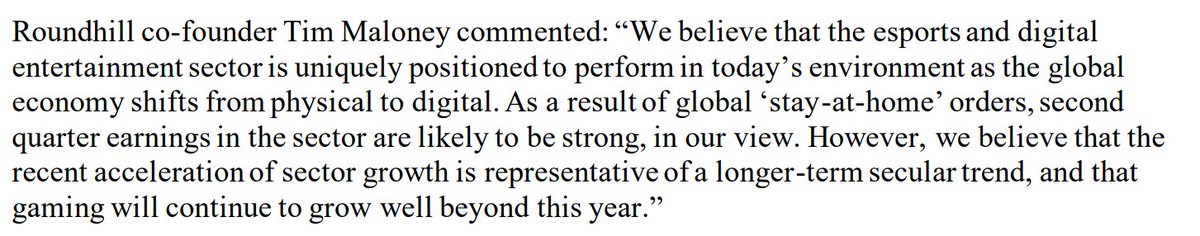

2/ $NERD co-founder @MaloneySandwich stated video games were benefiting from both short-term SAH orders and long-term secular trends. That might be an understatement and truly represents the best of both worlds.

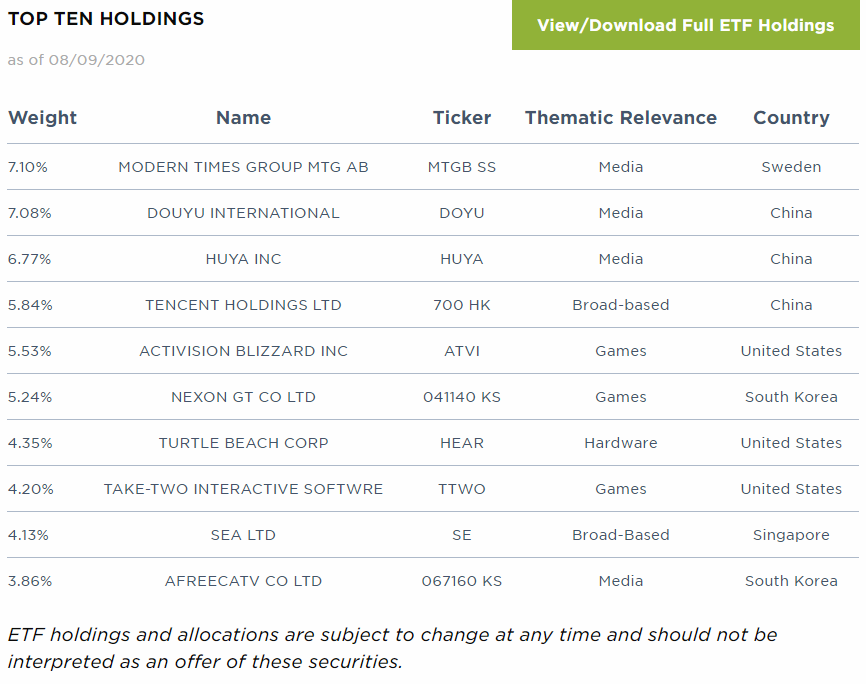

3/ I& #39;m obviously an individual stock-kind-of-guy, but for those w/o the time or interest for that, investing in the right ETFs can be a smart strategy. FWIW, $NERD would be high on my list. Let& #39;s take a quick look at some of its top 10 holdings, representing ~54% of its portfolio

4/ $DOYU is a game-centric, live streaming platform in China.

It now has >165M MAUs, including 58M mobile MAUs which is +15% YOY.

It reported its Q2 earnings today and revenue grew +34% YOY and gross profit jumped +74% YOY.

It now has >165M MAUs, including 58M mobile MAUs which is +15% YOY.

It reported its Q2 earnings today and revenue grew +34% YOY and gross profit jumped +74% YOY.

5/ $HUYA is another live game-streaming platform in China w/ 151M MAUs, about half of which are mobile. It reports Q2 earnings tomorrow. In Q1 revenue spiked +48% YOY, net income rose +170% YOY!

Live game streaming in China is a good industry to be in! http://ir.huya.com/2020-05-20-HUYA-Inc-Reports-First-Quarter-2020-Unaudited-Financial-Results">https://ir.huya.com/2020-05-2...

Live game streaming in China is a good industry to be in! http://ir.huya.com/2020-05-20-HUYA-Inc-Reports-First-Quarter-2020-Unaudited-Financial-Results">https://ir.huya.com/2020-05-2...

6/ $TCEHY is a beast that has its hands in digital payments, fintech, social messaging, and investments sprawled across the video game industry, including owning Riot Games outright and a 40% stake in Epic Games (the maker of Fortnite) https://www.pcgamer.com/every-game-company-that-tencent-has-invested-in/">https://www.pcgamer.com/every-gam...

7/ $HEAR is the industry& #39;s high-quality gaming audio leader, a beloved brand for gaming headsets now expanding into other console/PC gaming accessory markets. In just reported Q2, revenue rose +93%, while net income went from negative $2.4M to positive $8.2M

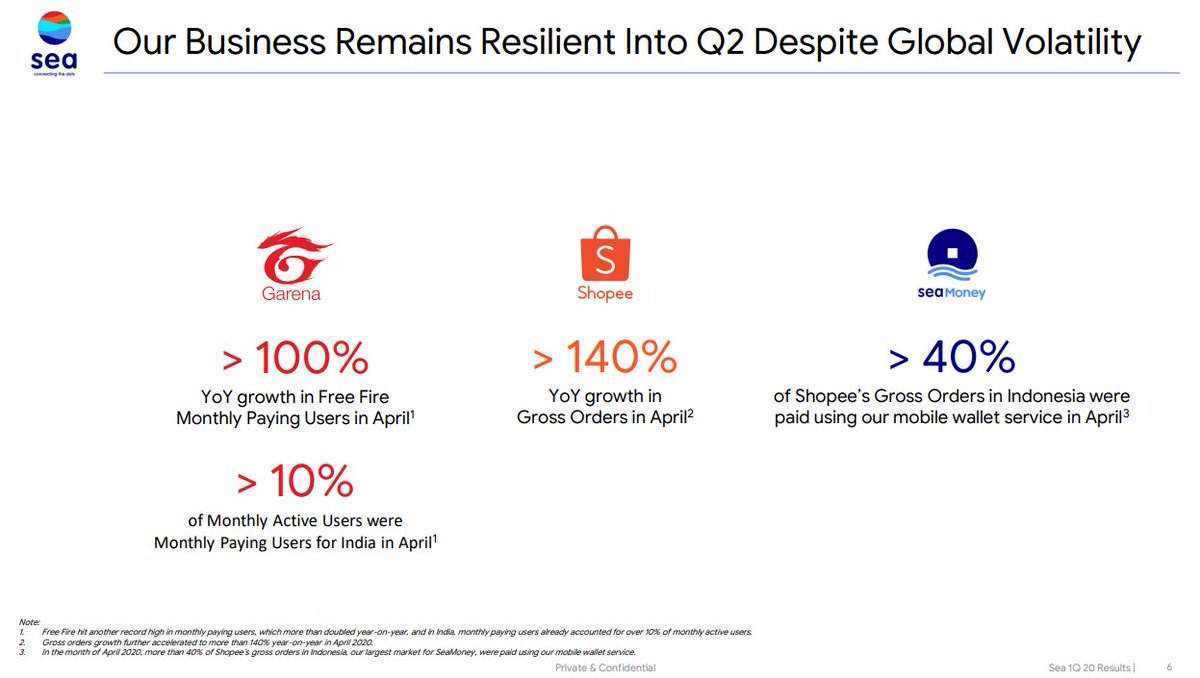

8/ Many of you are already familiar with $SEA, the SE Asia digital wallet, e-commerce platform, and maker of the hit video game Free Fire

9/ I loved how $NERD co-founder @maybebullish described Roundhill& #39;s thinking around identifying companies with the most exposure to digital entertainment, gaming, and eSports in this interview w/ my 7investing teammate @7AustinL https://7investing.com/articles/podcast-9-esports-with-roundhill-investments-ceo-will-hershey/">https://7investing.com/articles/...

10/ $NERD isn& #39;t loaded with companies that offer little exposure to video games, like many themed ETFs seem to do. IOW, you& #39;re NOT going to find a high allocation to $MSFT b/c of its Minecraft and Xbox segments which make up relatively small percentages of the company& #39;s revenue.

11/ As current @7investing members know, we recommended a company from the video game industry this month, I doubt it will be the last. But $NERD seems like another smart way to get exposure to a growing industry. Hard to argue w/ the results thus far.

Read on Twitter

Read on Twitter