/ A THREAD /

@CJ_Johnson17th courses and Money Twitter have truly revolutionized my life.

But I want y& #39;all to understand the low point that I came from.

I want y& #39;all to understand the cost of a broke mindset.

MY broke mindset!!

I didn& #39;t grow up in a family with a lot of money.

So when I got my first job in my junior year, I was overjoyed to finally be earning.

So overjoyed that I got into vaping.

JUUL& #39;s, SMOKs, you name it.

For the rest of high school, I had piss poor spending habits.

- Vape juice

- A new iPhone

- Clothes

-Shoes

I was spending all my money on nonsense, and little did I know, it was only going to get worse during college.

I& #39;ve been a nerdy kid for most of my life.

I smoked weed a few times before college, but nothing major.

So when I started college, everything was so foreign and inviting to me.

I immersed myself in all of it and disregarded my bank account.

Before college, I was spending less than $40 a month on vape juice.

A month into the first semester, that number jumped to $100.

That $100 was soon paired with $30+ a week on eating out and alcohol for parties.

(Insomnia Cookies had my heart

Not long after the first surge in spending, I spent $200...

On a bong, pipe, and grinder.

I remember the joy of picking up those packages from my RSD like it was yesterday.

From there, I was spending $100 - $150 a month on bud.

In the winter, I received a college refund for over $1,000.

Coupled with a work bonus of around $220.

As you might& #39;ve guessed, the money didn& #39;t last.

Most of it went to:

- Champs

- Nike

- iPhone

- Adidas

None of these expenses were overly large.

But remember:

- I had no job at school

- I barely saved any money during my summer job

I remember being too broke to afford a Spring concert ticket for Lil Uzi.

That was truly one of my lowest points.

I worked like a dog that summer.

I picked up shifts left and right.

I worked doubles regularly.

My last paycheck in August was for nearly 63 hours.

I became as frugal with my money as Mr. Krabs.

I started off the semester well.

- I was eating out once or twice every few weeks

- I had no urge to buy clothes that I didn& #39;t need

But in late October, I crumbled.

My bong& #39;s perc broke, so I bought a new one.

And then, I started buying at least a Q a week.

With that came eating out more frequently.

It became $400+ a month, which was a problem

Because at the time my loan payment was due.

I really had to get my act together.

And I did, at least just enough to get by.

Did I ever get my spending down to an ideal level? Not even close.

Money was so tight that at a Brown debate tournament, I brought a container of snacks because I couldn& #39;t afford to eat out.

My saving grace was a custodial job for my work-study.

Thanks to it, my money situation improved.

It wasn& #39;t where I wanted it to be, but it also wasn& #39;t as bad as it once was.

It took a blow from buying a refurbished iPhone Xs, but nothing major.

In the end, I finished my sophomore year well.

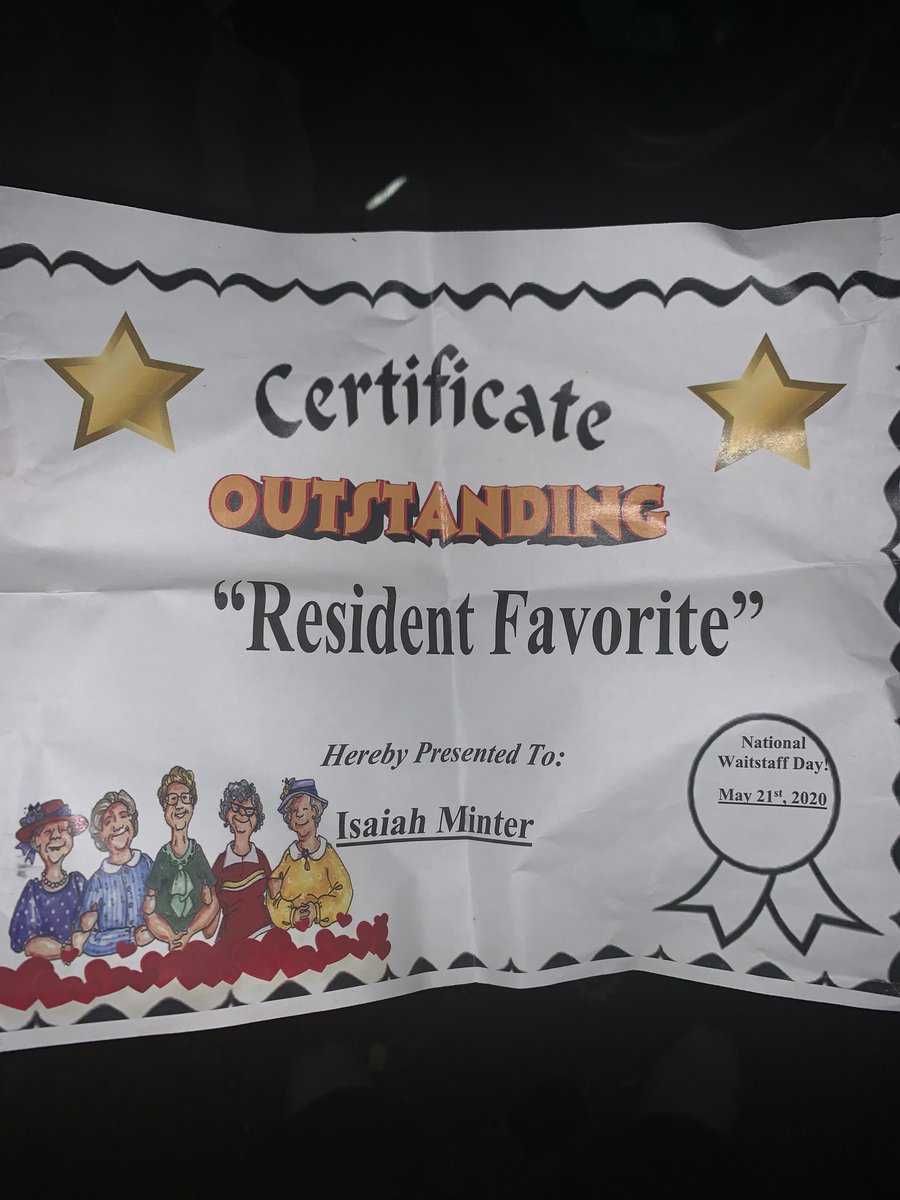

For the last 3 years, I& #39;ve worked as a wait staff server at a retirement home.

The Resident Favorite, people called me :)

So I had job security during the coronavirus.

I also had several college refunds coming in because of the Rona.

Refunds to the tune of nearly $2,500

Around the time of these refunds, I purchased Chris Johnson& #39;s SMG course.

I sat on starting the course, and to this day, I wish I hadn& #39;t.

I broke my refunds down like this:

- $1,000 in my High-Yield Savings

- $300 to get my start in the stock market

- Over $1,000 on Uggs, sneakers, and new gear

Seeing that last expense in my checking was the final blow.

A few days later, I started @CJ_Johnson17th& #39;s SMG course.

And Lord Almighty did it change my life.

His course showed me the cost of my broke mindset.

It showed me where I should park my money:

- Not in my demise (liabilities)

- But in my long-term success (assets)

That course changed my life trajectory.

Chris, I can& #39;t ever thank you enough.

Read on Twitter

Read on Twitter FRESHMAN YEAR (CONT)Before college, I was spending less than $40 a month on vape juice. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💨" title="Staubwolke" aria-label="Emoji: Staubwolke">A month into the first semester, that number jumped to $100. That $100 was soon paired with $30+ a week on eating out and alcohol for parties. (Insomnia Cookies had my heart https://abs.twimg.com/emoji/v2/... draggable="false" alt="💔" title="Gebrochenes Herz" aria-label="Emoji: Gebrochenes Herz">)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> FRESHMAN YEAR (CONT)Before college, I was spending less than $40 a month on vape juice. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💨" title="Staubwolke" aria-label="Emoji: Staubwolke">A month into the first semester, that number jumped to $100. That $100 was soon paired with $30+ a week on eating out and alcohol for parties. (Insomnia Cookies had my heart https://abs.twimg.com/emoji/v2/... draggable="false" alt="💔" title="Gebrochenes Herz" aria-label="Emoji: Gebrochenes Herz">)" class="img-responsive" style="max-width:100%;"/>

FRESHMAN YEAR (CONT)Before college, I was spending less than $40 a month on vape juice. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💨" title="Staubwolke" aria-label="Emoji: Staubwolke">A month into the first semester, that number jumped to $100. That $100 was soon paired with $30+ a week on eating out and alcohol for parties. (Insomnia Cookies had my heart https://abs.twimg.com/emoji/v2/... draggable="false" alt="💔" title="Gebrochenes Herz" aria-label="Emoji: Gebrochenes Herz">)" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> FRESHMAN YEAR (CONT)Before college, I was spending less than $40 a month on vape juice. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💨" title="Staubwolke" aria-label="Emoji: Staubwolke">A month into the first semester, that number jumped to $100. That $100 was soon paired with $30+ a week on eating out and alcohol for parties. (Insomnia Cookies had my heart https://abs.twimg.com/emoji/v2/... draggable="false" alt="💔" title="Gebrochenes Herz" aria-label="Emoji: Gebrochenes Herz">)" class="img-responsive" style="max-width:100%;"/>

FRESHMAN YEAR (CONT) Not long after the first surge in spending, I spent $200... On a bong, pipe, and grinder. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben">I remember the joy of picking up those packages from my RSD like it was yesterday. From there, I was spending $100 - $150 a month on bud. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍃" title="Im Wind flatterndes Blatt" aria-label="Emoji: Im Wind flatterndes Blatt">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> FRESHMAN YEAR (CONT) Not long after the first surge in spending, I spent $200... On a bong, pipe, and grinder. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben">I remember the joy of picking up those packages from my RSD like it was yesterday. From there, I was spending $100 - $150 a month on bud. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍃" title="Im Wind flatterndes Blatt" aria-label="Emoji: Im Wind flatterndes Blatt">" class="img-responsive" style="max-width:100%;"/>

FRESHMAN YEAR (CONT) Not long after the first surge in spending, I spent $200... On a bong, pipe, and grinder. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben">I remember the joy of picking up those packages from my RSD like it was yesterday. From there, I was spending $100 - $150 a month on bud. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍃" title="Im Wind flatterndes Blatt" aria-label="Emoji: Im Wind flatterndes Blatt">" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> FRESHMAN YEAR (CONT) Not long after the first surge in spending, I spent $200... On a bong, pipe, and grinder. https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚗️" title="Destillierkolben" aria-label="Emoji: Destillierkolben">I remember the joy of picking up those packages from my RSD like it was yesterday. From there, I was spending $100 - $150 a month on bud. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍃" title="Im Wind flatterndes Blatt" aria-label="Emoji: Im Wind flatterndes Blatt">" class="img-responsive" style="max-width:100%;"/>

SOPHOMORE YEARI started off the semester well.- I was eating out once or twice every few weeks- I had no urge to buy clothes that I didn& #39;t needBut in late October, I crumbled.My bong& #39;s perc broke, so I bought a new one. And then, I started buying at least a Q a week." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> SOPHOMORE YEARI started off the semester well.- I was eating out once or twice every few weeks- I had no urge to buy clothes that I didn& #39;t needBut in late October, I crumbled.My bong& #39;s perc broke, so I bought a new one. And then, I started buying at least a Q a week." class="img-responsive" style="max-width:100%;"/>

SOPHOMORE YEARI started off the semester well.- I was eating out once or twice every few weeks- I had no urge to buy clothes that I didn& #39;t needBut in late October, I crumbled.My bong& #39;s perc broke, so I bought a new one. And then, I started buying at least a Q a week." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> SOPHOMORE YEARI started off the semester well.- I was eating out once or twice every few weeks- I had no urge to buy clothes that I didn& #39;t needBut in late October, I crumbled.My bong& #39;s perc broke, so I bought a new one. And then, I started buying at least a Q a week." class="img-responsive" style="max-width:100%;"/>

THE PANDEMIC For the last 3 years, I& #39;ve worked as a wait staff server at a retirement home.The Resident Favorite, people called me :) So I had job security during the coronavirus. I also had several college refunds coming in because of the Rona." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> THE PANDEMIC For the last 3 years, I& #39;ve worked as a wait staff server at a retirement home.The Resident Favorite, people called me :) So I had job security during the coronavirus. I also had several college refunds coming in because of the Rona." class="img-responsive" style="max-width:100%;"/>

THE PANDEMIC For the last 3 years, I& #39;ve worked as a wait staff server at a retirement home.The Resident Favorite, people called me :) So I had job security during the coronavirus. I also had several college refunds coming in because of the Rona." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧠" title="Gehirn" aria-label="Emoji: Gehirn"> THE PANDEMIC For the last 3 years, I& #39;ve worked as a wait staff server at a retirement home.The Resident Favorite, people called me :) So I had job security during the coronavirus. I also had several college refunds coming in because of the Rona." class="img-responsive" style="max-width:100%;"/>