Monetary Policy imp points for Banks summarised:

1. Repo rate unchanged at 4%, Reverse repo rate unchanged at 3.35%

2. Accommodative stance maintained(there is a room for lowering of interest rates) 1/15

(Thread)

#RBI #MonetaryPolicy2020

1. Repo rate unchanged at 4%, Reverse repo rate unchanged at 3.35%

2. Accommodative stance maintained(there is a room for lowering of interest rates) 1/15

(Thread)

#RBI #MonetaryPolicy2020

3. Allows one-time restructuring

a. Eligibility: Only accounts not more than 30-days overdue as of March 1 are eligible.

b. Intention: To help borrowers affected by pandemic and lockdown only. Better choice as compared to extension of the moratorium.2/15

a. Eligibility: Only accounts not more than 30-days overdue as of March 1 are eligible.

b. Intention: To help borrowers affected by pandemic and lockdown only. Better choice as compared to extension of the moratorium.2/15

c. Who may need it at most?: Borrowers who opted in for both 1st and 2nd moratorium might consider restructuring their loans

d. Time period: Specific 2-year cap with or without a moratorium (lenders can only extend the repayment period by 2 years) 3/15

d. Time period: Specific 2-year cap with or without a moratorium (lenders can only extend the repayment period by 2 years) 3/15

e. Deadline to apply:

Decision by banks to be completed by Dec 31 2020. Implementation by March 31, 2021(Individual & MSME) & June 30,2021(Corporate).

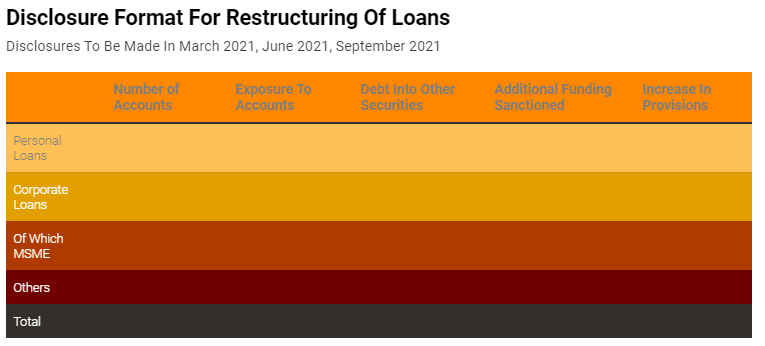

f. RBI mandates quarterly disclosures of accounts which have undergone restructuring from March 2021(good for analysing QoQ)4/15

Decision by banks to be completed by Dec 31 2020. Implementation by March 31, 2021(Individual & MSME) & June 30,2021(Corporate).

f. RBI mandates quarterly disclosures of accounts which have undergone restructuring from March 2021(good for analysing QoQ)4/15

g. Provisions by Banks: At least 10% provisioning for restructured assets. For lenders who do not sign the agreement, the requirement is higher at 20%

(for consortium: 60% of lenders by number and 75% of lenders by value must sign ICA within 30 days of invocation)5/15

(for consortium: 60% of lenders by number and 75% of lenders by value must sign ICA within 30 days of invocation)5/15

h. The R/S asset will remain standard after the implementation of plan.

i. Default post-restructuring

Default with any lender will lead to a 30 day review period. Within these 30days, if atleast 10% repayment is not made, the loan will be classified as NPA across all lenders6/15

i. Default post-restructuring

Default with any lender will lead to a 30 day review period. Within these 30days, if atleast 10% repayment is not made, the loan will be classified as NPA across all lenders6/15

j. Reversal of Provisions: 50% can be reversed after 20% repayment of the residual debt and 50% after another 10% i.e after 30% repayment, 100% provision can be reversed

7/15

7/15

k. Personal loans definition: Consumer credit, education loans, loans for creation or enhancement of the immovable property, including housing, and loans are given for investment in financial assets- RBI 8/15

Negatives:

a. The provisioning seems to be low at 10%.

b. Partial booking of NPA by Dec 31,20. Delay in recognition of NPA by 2Y. Definitely will reduce the NPA amount but borrowers who might not be able to revive in these 2 years will become NPA post 2Y from implementation9/15

a. The provisioning seems to be low at 10%.

b. Partial booking of NPA by Dec 31,20. Delay in recognition of NPA by 2Y. Definitely will reduce the NPA amount but borrowers who might not be able to revive in these 2 years will become NPA post 2Y from implementation9/15

4. LTV ratio for gold loans relaxed to 90% from 75%.

Intention: Will provide better liquidity to cash-strapped borrowers opting for gold loans. Will be available on loans availed of till 31 March 2021

How much of this will be passed on by gold financiers is yet to be seen! 10/15

Intention: Will provide better liquidity to cash-strapped borrowers opting for gold loans. Will be available on loans availed of till 31 March 2021

How much of this will be passed on by gold financiers is yet to be seen! 10/15

5. Banks can’t open a current account for borrowers who have a cash credit account (CC) with any other bank.

Intention: Monitor cash flow of borrowers by Lenders. 11/15

Intention: Monitor cash flow of borrowers by Lenders. 11/15

Banks shouldn& #39;t route any withdrawal transaction from TL availed by borrower through CA & should remit directly to the supplier of goods&services.Expenses incurred by the borrower for day-to-day operations should be routed through the CC, if the borrower has one, else CA. 12/15

6. Additional special liquidity facility of ₹10,000cr will be provided at the policy repo rate consisting of :

a. ₹5,000cr to NHB to shield the housing sector from liquidity disruptions & augment the flow of finance to the sector through HFCs 13/15

a. ₹5,000cr to NHB to shield the housing sector from liquidity disruptions & augment the flow of finance to the sector through HFCs 13/15

b. ₹5,000cr to the NABARD to make an improvement to the stress being faced by smaller NBFCs & MFIs in obtaining access to liquidity.14/15

Overall, a good stand of not extending the moratorium which spoils the credit discipline of borrowers but it needs to be seen when these most affected sectors (hospitality, travel and tourism, etc. ) will revive. 15/15

Read on Twitter

Read on Twitter