Welcome to your daily lesson or guide to ’Listing on the Korean Exchange’ by the PWC.

As you all may have heard, Big Hit has passed the preliminary and will be listing this year.

We hope this is thread and the resource below are useful to understand.

@bts_twt #BTSResearch

As you all may have heard, Big Hit has passed the preliminary and will be listing this year.

We hope this is thread and the resource below are useful to understand.

@bts_twt #BTSResearch

Please keep in mind that this thread may be a bit long. We may not always give you the full picture therefore we provide you with links for you to research and read more.

Thank you. https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz">

Thank you.

Let’s take a look first at the & #39;The Korea Exchange & #39;(KRX).

In 1956, the Korean stock market opened with the start of Korea Stock Exchange. In January 2005, through integration of Korea Stock Exchange and two other domestic markets, the Korea Exchange (KRX) was created.

In 1956, the Korean stock market opened with the start of Korea Stock Exchange. In January 2005, through integration of Korea Stock Exchange and two other domestic markets, the Korea Exchange (KRX) was created.

There are 4 markets in the KRX; Main Board (KOSPI Market), KOSDAQ (Korea Securities Dealers Automated Quotation), KONEX (Korea new exchange) and the derivatives market.

**BH has listed on the KOSPI one.**

@bts_twt #BTSResearch

**BH has listed on the KOSPI one.**

@bts_twt #BTSResearch

The Korea Composite Stock Price Index (KOSPI) market is the main board of KRX & many of the larger domestic & international companies such as Samsung Elect., LG Elect., Hyundai Motor, POSCO & KIA Motors are listed on KOSPI.

*BH has listed on this one.*

@bts_twt #BTSResearch

*BH has listed on this one.*

@bts_twt #BTSResearch

KOSDAQ Market

The KOSDAQ mkt. opened in 1996 to support venture & small/medium-sized companies’ smooth financing. The IPO requirement for the KOSDAQ mkt. is less rigorous than the requirements for the KOSPI mkt, enabling middle-sized companies with high potential to be listed.

The KOSDAQ mkt. opened in 1996 to support venture & small/medium-sized companies’ smooth financing. The IPO requirement for the KOSDAQ mkt. is less rigorous than the requirements for the KOSPI mkt, enabling middle-sized companies with high potential to be listed.

KONEX Market

The KRX opened KONEX mkt. in 2013 to support small/middle-sized start-ups to raise capital. IPO requirement for the KONEX mkt. is less rigorous than the requirements for the KOSDAQ mkt, enabling small/middle-sized or start-up companies w/high potential to be listed.

The KRX opened KONEX mkt. in 2013 to support small/middle-sized start-ups to raise capital. IPO requirement for the KONEX mkt. is less rigorous than the requirements for the KOSDAQ mkt, enabling small/middle-sized or start-up companies w/high potential to be listed.

Listing Information

KRX is mainly divided into two types of market, KOSPI market and KOSDAQ market; and based on

the company’s industry group and size, it will select one of the two markets.

KRX is mainly divided into two types of market, KOSPI market and KOSDAQ market; and based on

the company’s industry group and size, it will select one of the two markets.

Listing requirements of KOSPI market and KOSDAQ market include both qualitative and quantitative aspects.

More details about this will be included on the link at the end of the thread as its too much info. to write out.

Here is just a bit of the info.

More details about this will be included on the link at the end of the thread as its too much info. to write out.

Here is just a bit of the info.

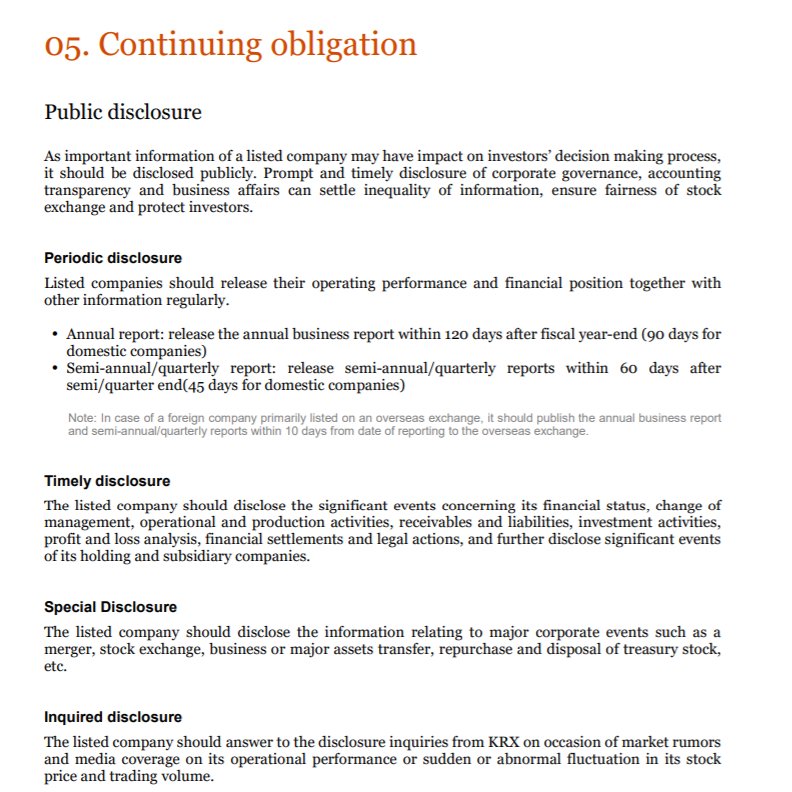

Once the company has been listed, important information from them may have impact on investors’ decision making process therefore they will need to do a public disclosure.

You can read the full report from the PWC which was published in 2019 called, & #39;Listing in Korea, A Guide to Listing on the Korean Exchange.& #39;

https://www.pwc.com/kr/en/publications/samilpwc_k-ipo-2019.pdf">https://www.pwc.com/kr/en/pub...

https://www.pwc.com/kr/en/publications/samilpwc_k-ipo-2019.pdf">https://www.pwc.com/kr/en/pub...

Or more so why did BH chose to list on KOSPI rather than the rest.

The KOSPI is majorly considered the place for publicly traded companies in Korea. The KOSDAQ has about 1,000+ small- & medium-sized businesses & start-ups listed on it.

Therefore,.....

Therefore,.....

The KOSDAQ is considered much riskier than the KOSPI. The KOSDAQ is often compared to the N ASDAQ in the US. The KONEX is a trading place for pre-IPO (pre-initial public offering) stocks.

You can read more about this here:

& #39;The Comparison of Trading Costs between Two Markets: KOSPI & KOSDAQ by Keebong Park& #39; https://www.researchgate.net/publication/331326348_The_comparison_of_T_rading_Costs_between_Two_markets_KOSPI_and_KOSDAQ">https://www.researchgate.net/publicati...

& #39;The Comparison of Trading Costs between Two Markets: KOSPI & KOSDAQ by Keebong Park& #39; https://www.researchgate.net/publication/331326348_The_comparison_of_T_rading_Costs_between_Two_markets_KOSPI_and_KOSDAQ">https://www.researchgate.net/publicati...

If you want to look more into the Korean Stock Exchange (KRX), we recommend reading this link. https://www.investopedia.com/terms/k/koreastockexchange.asp">https://www.investopedia.com/terms/k/k...

Then if you want to read more in depth about the KOSPI. Here is the link:

@bts_twt #BTSResearch https://www.investopedia.com/terms/k/kospi.asp">https://www.investopedia.com/terms/k/k...

@bts_twt #BTSResearch https://www.investopedia.com/terms/k/kospi.asp">https://www.investopedia.com/terms/k/k...

Here is the official link to the Korean Exchange (KRX). Once BH lists publicly you will be able to find them on this website.

http://global.krx.co.kr/main/main.jsp ">https://global.krx.co.kr/main/main...

http://global.krx.co.kr/main/main.jsp ">https://global.krx.co.kr/main/main...

An explanation by @Ramya_BTS as to some pros of listing publicly, for investors, etc.

Thank you for sharing your knowledge with us! https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz"> https://twitter.com/Ramya_BTS/status/1291679372613578752?s=20">https://twitter.com/Ramya_BTS...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💜" title="Violettes Herz" aria-label="Emoji: Violettes Herz"> https://twitter.com/Ramya_BTS/status/1291679372613578752?s=20">https://twitter.com/Ramya_BTS...

Thank you for sharing your knowledge with us!

BH passed the test to sell their  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis">. Therefore, they will be able to open a big

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis">. Therefore, they will be able to open a big  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis"> factory in Korea. But not only will they have the biggest

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis"> factory in Korea. But not only will they have the biggest  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis"> factory in Korea but have also in the past few months expanded in buying the candy store, the grocery store, etc. making them stronger.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🍦" title="Softeis" aria-label="Emoji: Softeis"> factory in Korea but have also in the past few months expanded in buying the candy store, the grocery store, etc. making them stronger.

Read on Twitter

Read on Twitter