Pitch deck thread:

You know what? I& #39;m going on staycation tomorrow and feeling good. Let& #39;s break down pitch deck construction with Data.

(info from the Docsend report)

You know what? I& #39;m going on staycation tomorrow and feeling good. Let& #39;s break down pitch deck construction with Data.

(info from the Docsend report)

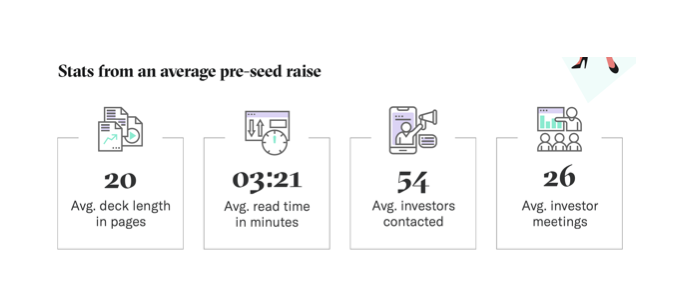

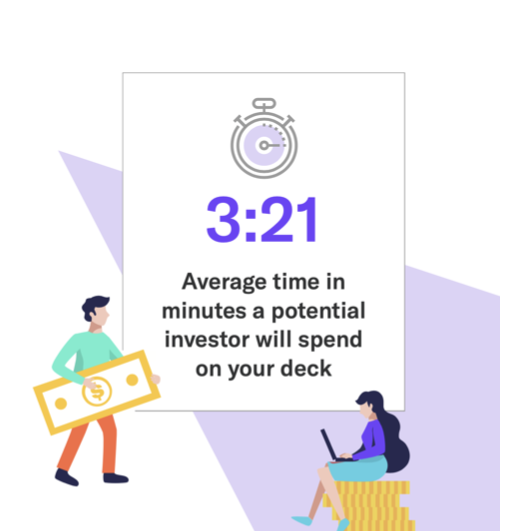

These are stats from the average pre-seed raise. This is interesting data because it shows the actual amount of time investors spend on each slide.

But keep in mind these numbers may be skewed because founders who use Docsend may not be representative of all founders...

But keep in mind these numbers may be skewed because founders who use Docsend may not be representative of all founders...

So as you can see, you have less than 4 minutes to catch an investors attention. This probably means that fewer slides are better than more. I happen to think that 20 slides is on the high end. Ok so which slides should you include?

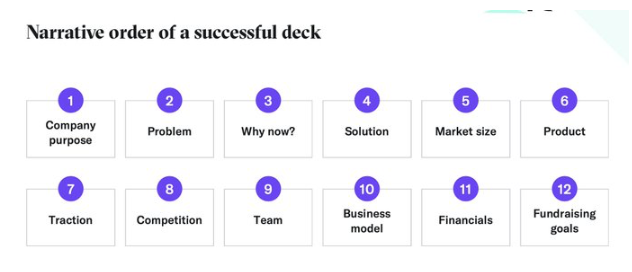

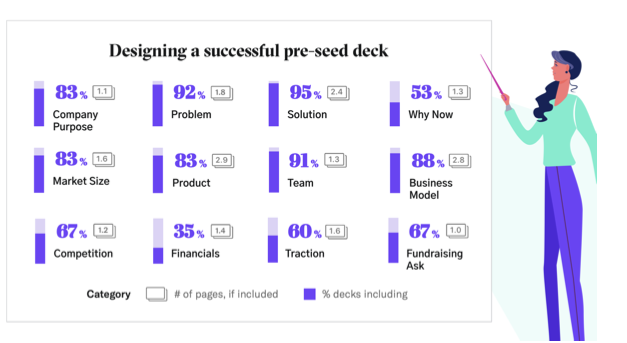

These are the slides that other founders are including in their decks with matching percentages. Good information to know what you are being compared against, but do we have data on what investors are actually looking at? We do!

On successful decks, investors spend more time on the product slide problem and solution slides. On unsuccessful decks, they are looking at the financials and business model. That probably means you need to nail your early slides - company purpose, problem and solution.

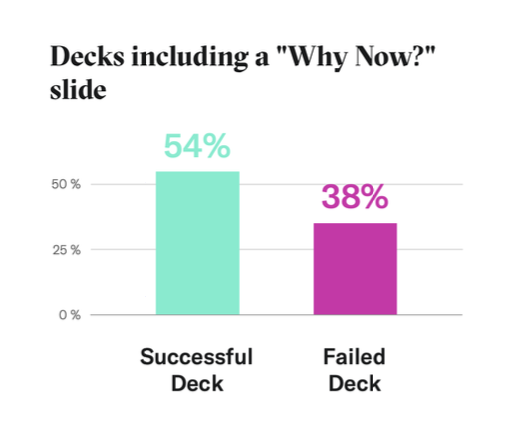

54% of successful decks have a "why now" slide. That was surprising to me, but why now slides can really show that you know your market and have conviction. Plus, most ideas are not too original, you need to differentiate from similar solutions.

Investors are clever, if you don& #39;t have a purpose slide and haven& #39;t explained your product well, or if they don& #39;t like or understand your product, they are going to flip to financials to see if they can disconfirm their belief that you don& #39;t know what you& #39;re talking about.

If your "traction" is strong, you might still get a meeting.

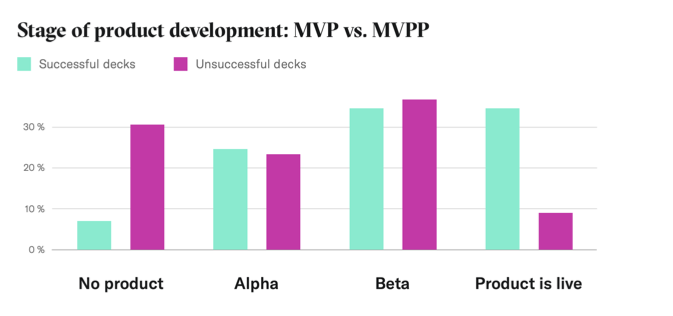

Ok so let& #39;s take a look at what stage of company investors prefer. Pretty straightforward, right, investors prefer better developed products, but wait a second, that& #39;s definitely not linear... what& #39;s going on?

Ok so let& #39;s take a look at what stage of company investors prefer. Pretty straightforward, right, investors prefer better developed products, but wait a second, that& #39;s definitely not linear... what& #39;s going on?

I think @ceonyc nailed an explanation for why alphas are more successful than betas. Founders often think the only company risk is product risk, so they build a solution but can& #39;t sell it. Once your product is ready for market, investors will expect you to have sold something!

When you build the product, some investors will stop using pre-product metrics to evaluate you, and will start comparing you with live products. They& #39;ll want to see traction, and honestly, the logic is not necessarily faulty for most products.

81% of views are on a desktop as opposed to a mobile device, and given work from home, I bet that number has risen, so a deck formatted for a computer or laptop screen is probably best. I would also generally caution against experimenting too much with pitch format.

Ok, so what was Docsend& #39;s takeaway? The bar has risen for pre-seed. Yes, some folks still raise off of a pitch deck, but investors want to see product progress from everyone (but not too much unless your gtm is fleshed out).

Want to chat more contact me? https://deljohnson.typeform.com/to/DQ7zBY ">https://deljohnson.typeform.com/to/DQ7zBY...

Want to chat more contact me? https://deljohnson.typeform.com/to/DQ7zBY ">https://deljohnson.typeform.com/to/DQ7zBY...

I do a presentation on the data of pitching, combining this data with academic data and proprietary info. If your org is interested in a remote speaking engagement, you can find me here: https://deljohnson.typeform.com/to/DQ7zBY ">https://deljohnson.typeform.com/to/DQ7zBY...

Read on Twitter

Read on Twitter