For my past 3 years in #crypto VC we experienced a massive frenzy, 50-90% crashes and prolonged winter affected the market dynamics, the way people build and fund their companies.

Now that infrastructure is here, enter the spring!

Thread below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://outlierventures.io/research/web-3-funding-july-2020-in-numbers/">https://outlierventures.io/research/...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://outlierventures.io/research/web-3-funding-july-2020-in-numbers/">https://outlierventures.io/research/...

Now that infrastructure is here, enter the spring!

Thread below

July set almost a record since the pandemic with 29 deals and over $254 million raised. This is more than what we did for the entire Q2 2020.

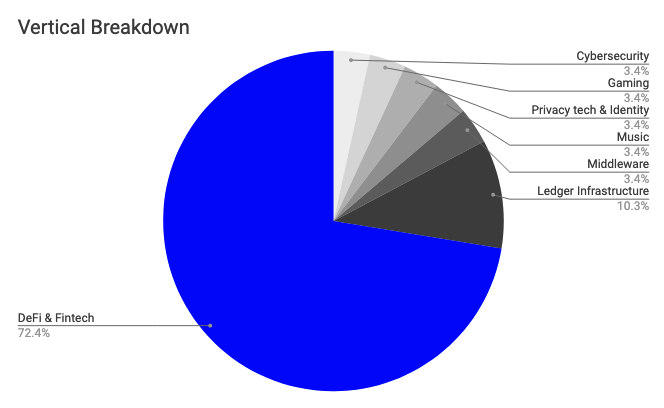

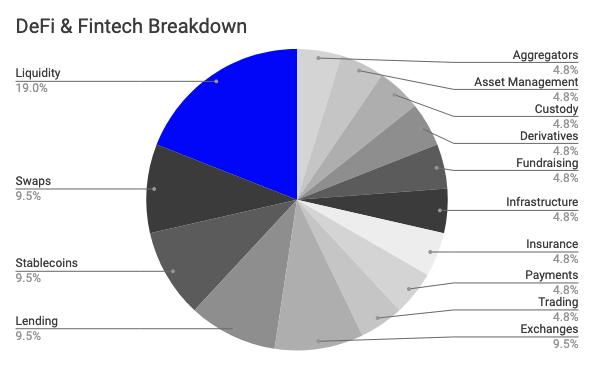

72% of the deals were in DeFi & Fintech. This is almost half of the total funding with $140 million committed!

If you& #39;re founder building in the space, DMs are always open!

If you& #39;re founder building in the space, DMs are always open!

Privacy Tech & Identity, Gaming closed 1 deal in each category.

Despite that I am still bullish on privacy tech and very interested committing more there!

Gaming and NFTs are also wildly underrepresented in July& #39;s funding cohort.

Founder building in the space? DMs open!

Despite that I am still bullish on privacy tech and very interested committing more there!

Gaming and NFTs are also wildly underrepresented in July& #39;s funding cohort.

Founder building in the space? DMs open!

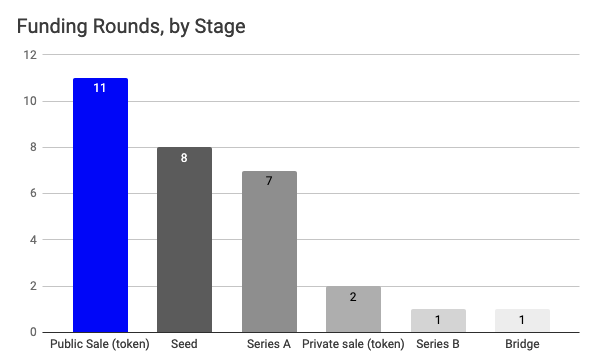

The most common round for July was seed, oops no, it was public token sales.

Equity and tokens received almost equal amount of $$.

Equity and tokens received almost equal amount of $$.

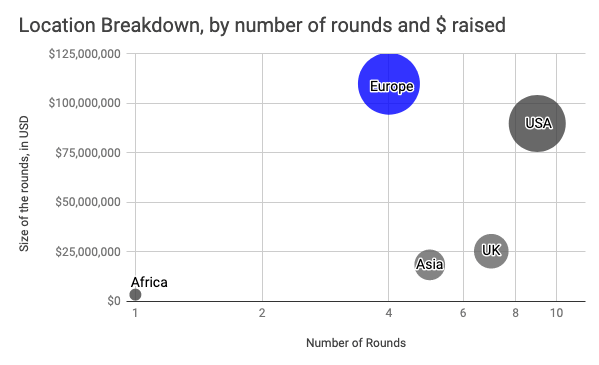

Europe is leading the way forward in $$ committed followed by the US, the UK, Asia and Africa.

We have seen good presence from LatAm and Africa in Q2 but this month is lacking representation.

We have seen good presence from LatAm and Africa in Q2 but this month is lacking representation.

Investors are active again (or perhaps they never stopped?)

Congrats to our friends at @DCGco @Maven11Capital @coinbase @panteracap as well as the hard workers at @hiFramework @paraficapital @lightspeedvp.

Congrats to our friends at @DCGco @Maven11Capital @coinbase @panteracap as well as the hard workers at @hiFramework @paraficapital @lightspeedvp.

Read on Twitter

Read on Twitter