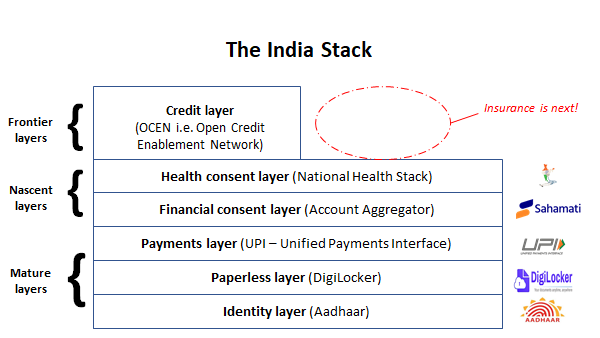

On 25.07, @Product_Nation unveiled OCEN - India& #39;s open credit protocol

I& #39;ve spent ~ 3 weeks delving into the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> Stack and spoken with the good folks at iSPIRIT

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> Stack and spoken with the good folks at iSPIRIT

I& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol

1/5

I& #39;ve spent ~ 3 weeks delving into the

I& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol

1/5

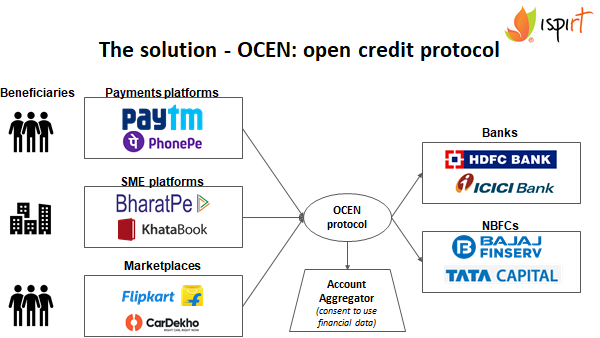

Firstly, a 101 on OCEN

(h/t iSPIRIT for the sessions)

- From a platform lens, a "single API for credit"

- The iSPIRIT team has devised a protocol for loan originators to "source capital" from the *entire* lending network

- Enabled by the India Stack and new regs (e.g. LSP)

2/5

(h/t iSPIRIT for the sessions)

- From a platform lens, a "single API for credit"

- The iSPIRIT team has devised a protocol for loan originators to "source capital" from the *entire* lending network

- Enabled by the India Stack and new regs (e.g. LSP)

2/5

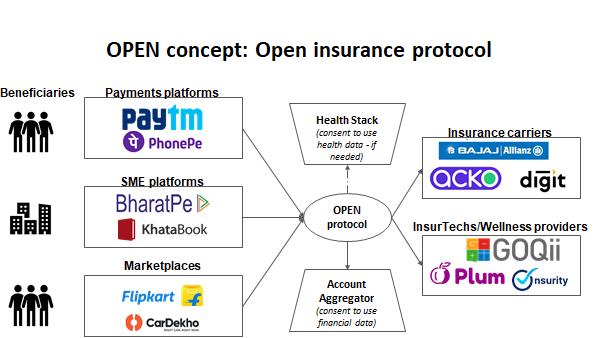

OPEN would operate in a similar manner as a "single API for insurance"

Whether this evolves as private or public infrastructure, it is clear that "insurance is a feature" (just like lending)

~ 40 digital distribution partnerships via FinTechs this year alone

3/5

Whether this evolves as private or public infrastructure, it is clear that "insurance is a feature" (just like lending)

~ 40 digital distribution partnerships via FinTechs this year alone

3/5

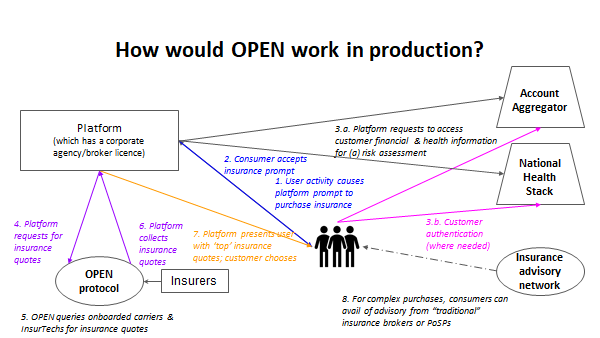

Below, I have highlighted OPENs process flow

(Very similar to OCEN!)

I have accounted for

a. An "insurance quote" (insurance is more complicated than lending)

- Premium & schedule

- Policy benefits & exclusions

- Complimentary benefits

b. The role of insurance brokers

4/5

(Very similar to OCEN!)

I have accounted for

a. An "insurance quote" (insurance is more complicated than lending)

- Premium & schedule

- Policy benefits & exclusions

- Complimentary benefits

b. The role of insurance brokers

4/5

India needs OPEN

- Swiss Re pegs India& #39;s protection gap at 92.8%

- Platforms have (new) locked-in distribution

I invite your comments, feedback & thoughts here, via DM or on the LinkedIn post directly https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.linkedin.com/posts/rahul-jaideep-mathur_open-open-protection-enablement-network-activity-6697054568469065728-UGZu">https://www.linkedin.com/posts/rah...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://www.linkedin.com/posts/rahul-jaideep-mathur_open-open-protection-enablement-network-activity-6697054568469065728-UGZu">https://www.linkedin.com/posts/rah...

- Swiss Re pegs India& #39;s protection gap at 92.8%

- Platforms have (new) locked-in distribution

I invite your comments, feedback & thoughts here, via DM or on the LinkedIn post directly

If you& #39;d like more context on InsurTech in  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> and how recent regulations are enabling E2E digital insurance sales, please feel free to check out my newsletter below: https://insurtechtribe.substack.com/p/update-on-insurtech-in-india-q1-fy">https://insurtechtribe.substack.com/p/update-...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> and how recent regulations are enabling E2E digital insurance sales, please feel free to check out my newsletter below: https://insurtechtribe.substack.com/p/update-on-insurtech-in-india-q1-fy">https://insurtechtribe.substack.com/p/update-...

Read on Twitter

Read on Twitter Stack and spoken with the good folks at iSPIRITI& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol 1/5" title="On 25.07, @Product_Nation unveiled OCEN - India& #39;s open credit protocolI& #39;ve spent ~ 3 weeks delving into the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> Stack and spoken with the good folks at iSPIRITI& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol 1/5" class="img-responsive" style="max-width:100%;"/>

Stack and spoken with the good folks at iSPIRITI& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol 1/5" title="On 25.07, @Product_Nation unveiled OCEN - India& #39;s open credit protocolI& #39;ve spent ~ 3 weeks delving into the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇮🇳" title="Flagge von Indien" aria-label="Emoji: Flagge von Indien"> Stack and spoken with the good folks at iSPIRITI& #39;d like to get a conversation going on a concept - OPEN: India& #39;s open insurance protocol 1/5" class="img-responsive" style="max-width:100%;"/>