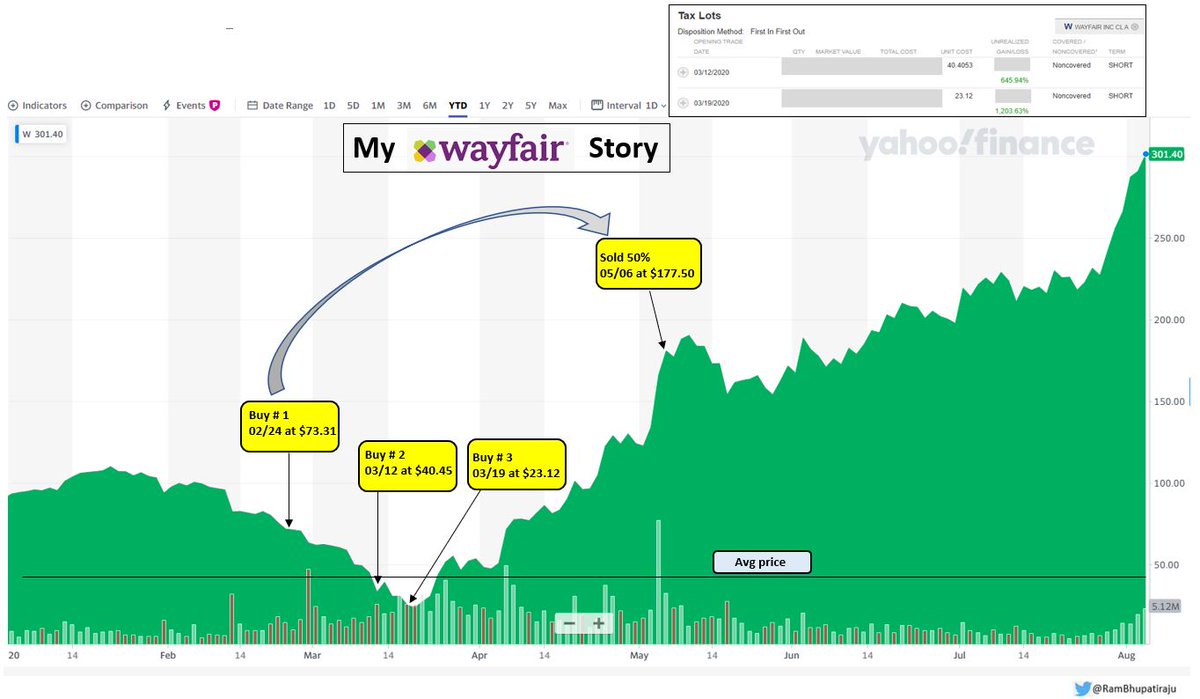

I owe Wayfair $W another thread for the incredible 1200% and the 600% gains it has given me in the remaining two positions bought in March.

A story about some preparation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📄" title="Seite mit der Schriftseite oben" aria-label="Emoji: Seite mit der Schriftseite oben"> , some courage

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📄" title="Seite mit der Schriftseite oben" aria-label="Emoji: Seite mit der Schriftseite oben"> , some courage https://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luck

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luck https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligence

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligence https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">.

A story about some preparation

The original thesis, backstory and the initial follow-up from May. So not going to repeat the same again https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://twitter.com/RamBhupatiraju/status/1258161309738246146?s=20">https://twitter.com/RamBhupat...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://twitter.com/RamBhupatiraju/status/1258161309738246146?s=20">https://twitter.com/RamBhupat...

Simple thesis from March.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://twitter.com/RamBhupatiraju/status/1244758900534063104?s=20">https://twitter.com/RamBhupat...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> https://twitter.com/RamBhupatiraju/status/1244758900534063104?s=20">https://twitter.com/RamBhupat...

When you have a company researched and in Watchlist, the occasional Market volatility could present some great opportunities rewarding your patience (on buying).

It& #39;s never fun to see your initial position quickly lose 40-50% in a matter of few wks, but when it& #39;s more due to Market than the individual company, you can double check your thesis, Balance sheet strength, and buy more if the Risk Reward is even better given the lower price.

Jumping into the Q2 presentation.

Some general tips on maintenance due-diligence (some relevant to this co, and others in general).

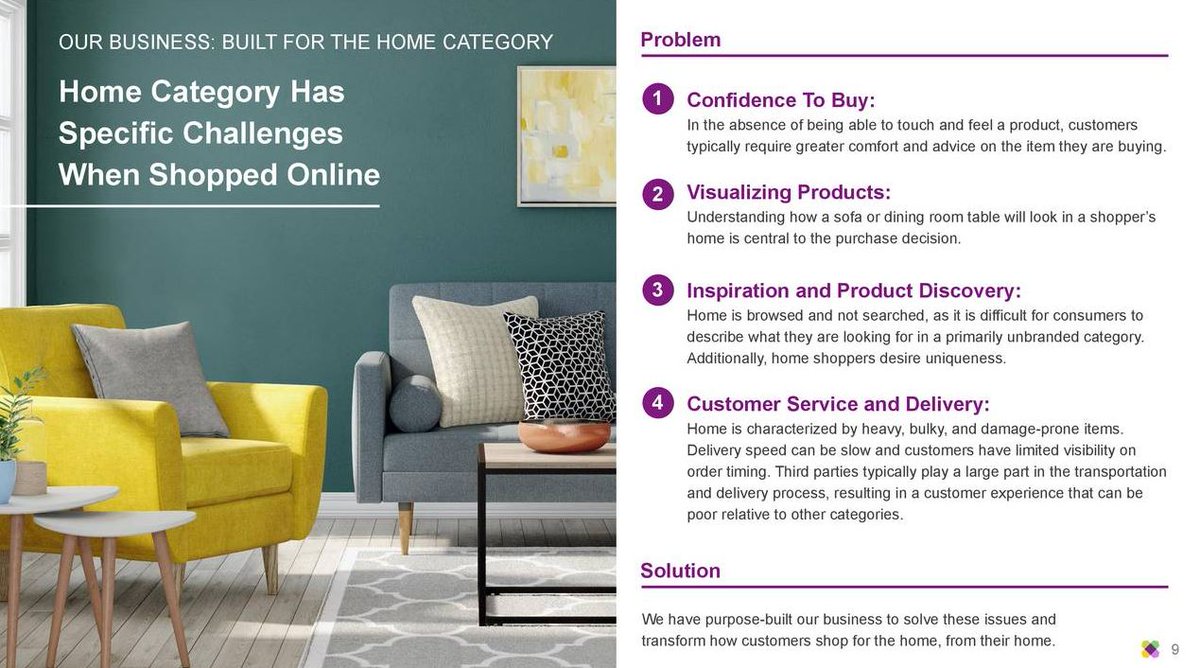

Understanding what Problem this Company trying to solve? How will it make it& #39;s Customer life better?

Some general tips on maintenance due-diligence (some relevant to this co, and others in general).

Understanding what Problem this Company trying to solve? How will it make it& #39;s Customer life better?

Understanding why this Co is better equipped to deliver that value to the Customer.

We don& #39;t need to take Mgmt& #39;s word for everything listed, but thinking about if it all makes sense given the ongoing trends and Co& #39;s unique strength.

We don& #39;t need to take Mgmt& #39;s word for everything listed, but thinking about if it all makes sense given the ongoing trends and Co& #39;s unique strength.

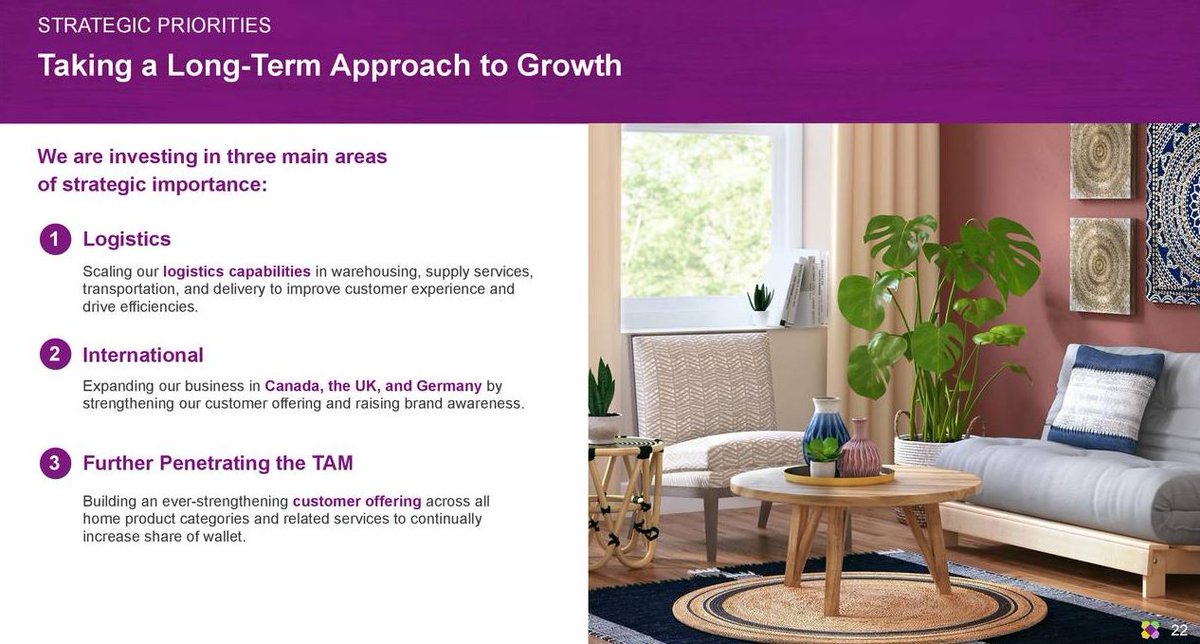

Where is the growth primarily going to come from?

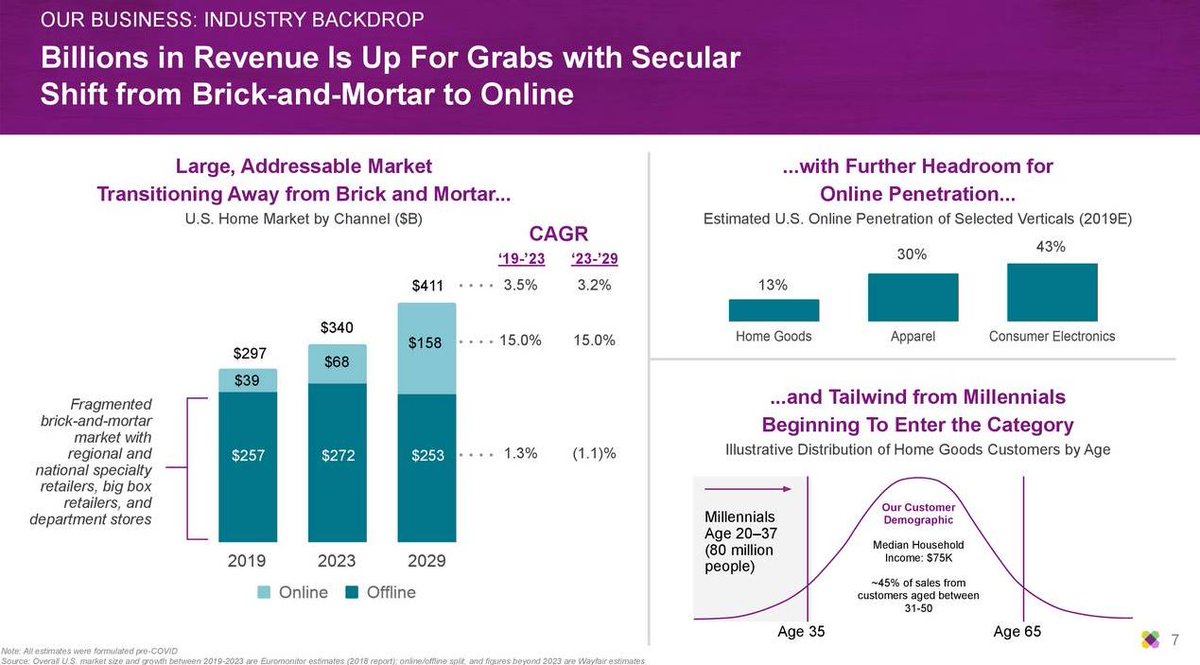

In this case, more and more Millennials entering the home-buying age, and more of Home furnishing purchases moving online.

In this case, more and more Millennials entering the home-buying age, and more of Home furnishing purchases moving online.

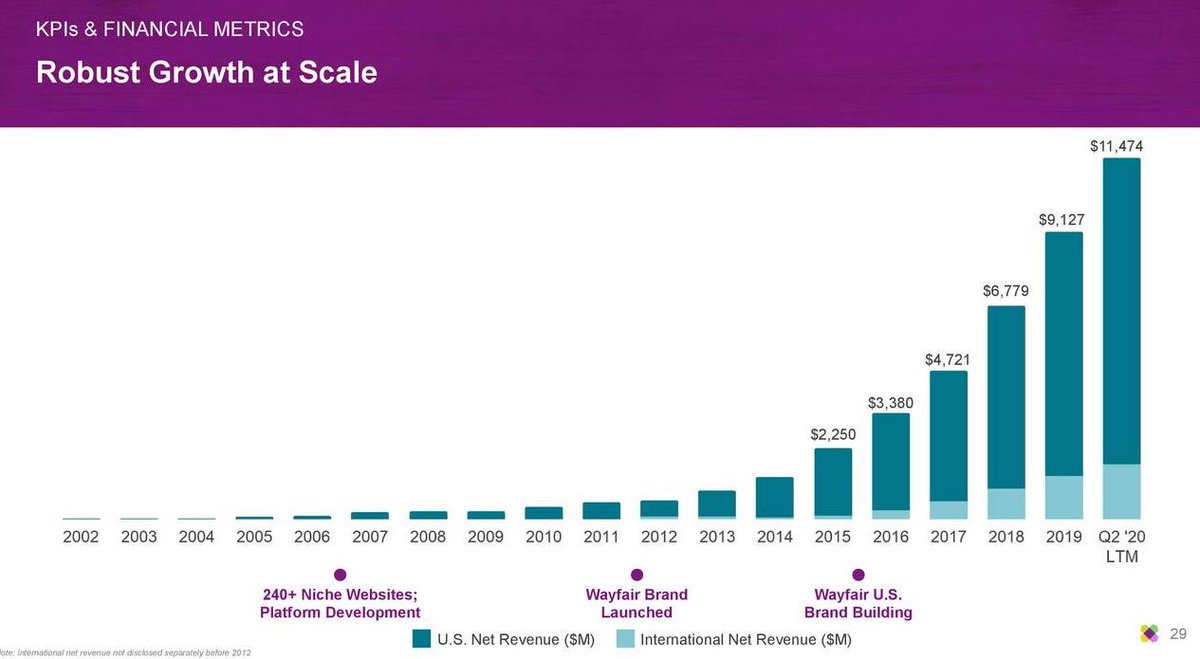

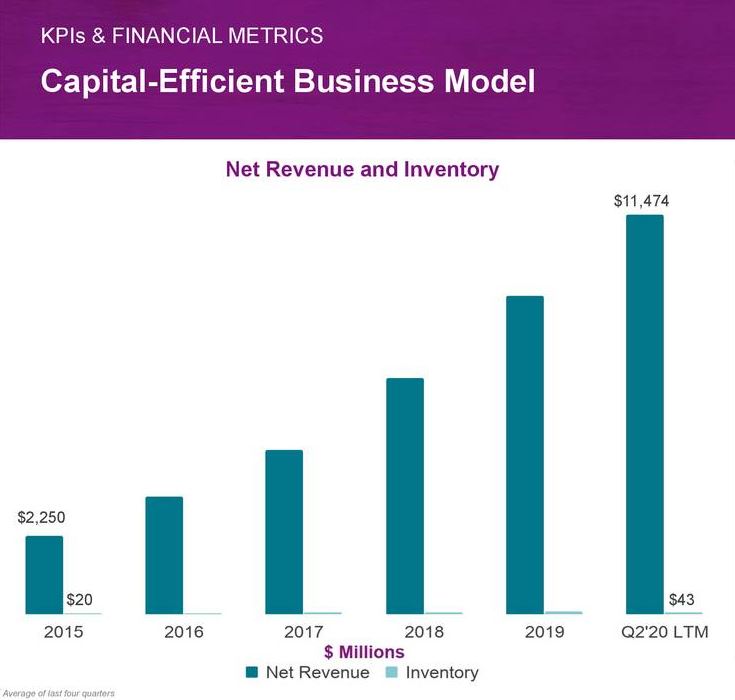

That Revenue growth (in a relatively slow growth sector) and business strategy of not taking Inventory risk is just commendable.

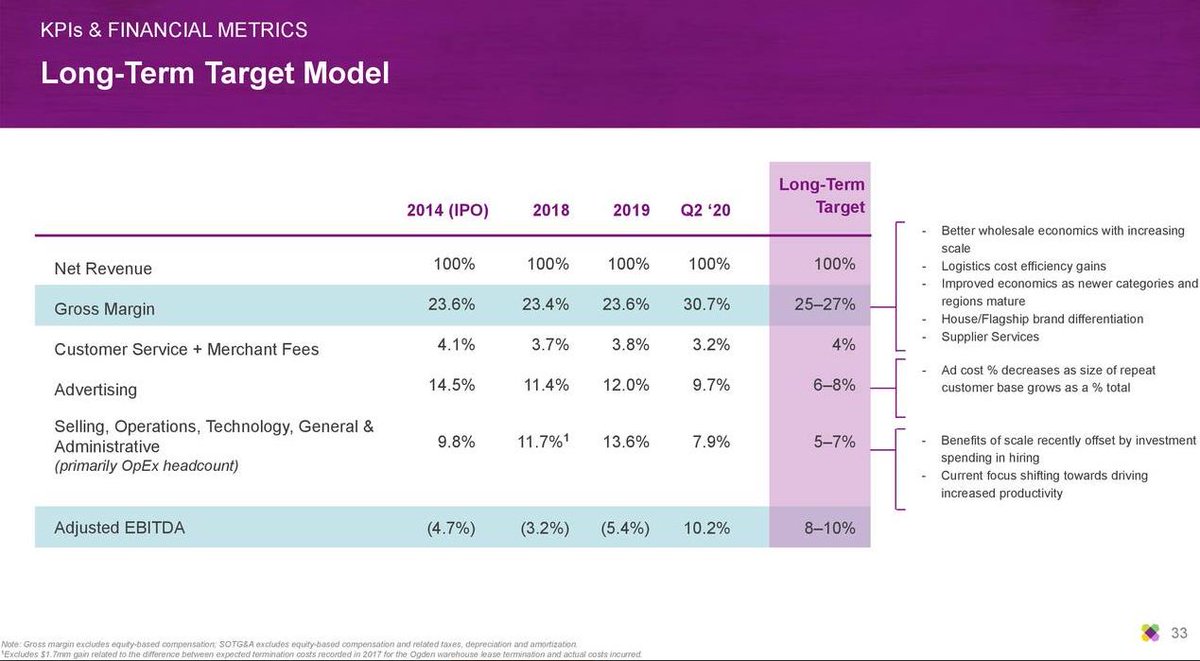

Understanding it& #39;s Cost structure and how the Company is tackling them while balancing growth vs eventual profitability, and how it& #39;s delivering on them.

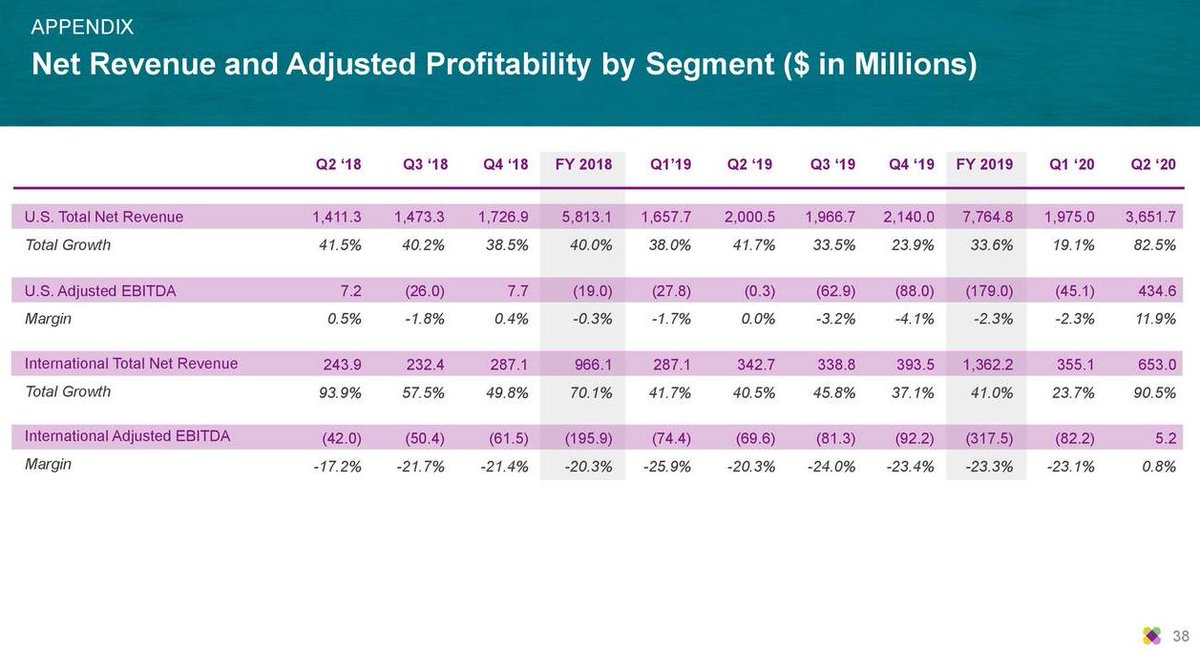

The Revenue growth, with a big increase in member growth, and Cash Flow growth are all commendable given the circumstances. This is the time to capture the mindshare of your core demographic while (offline) competitors are struggling.

Ideally I prefer recurring Revenue & high Gross Margin models in a high growth categories, but not all (succesful) investments need to meet that criteria if they have a differentiated Business model, aligned to the trends and bought at a low price.

I wouldn& #39;t necessarily add more today, but will continue to hold the current position while monitoring the operational results and general trends. (personal opinion, not an advice).

I wish them good luck in leveraging technology in continuing to provide value to their Customers, and Suppliers, while making the Logistics network even stronger thereby creating the flywheel.

Thank you for the brilliant execution and big gains in the last few months. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

/END.

Thank you for the brilliant execution and big gains in the last few months.

/END.

Read on Twitter

Read on Twitter , some couragehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luckhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligencehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">." title="I owe Wayfair $W another thread for the incredible 1200% and the 600% gains it has given me in the remaining two positions bought in March.A story about some preparation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📄" title="Seite mit der Schriftseite oben" aria-label="Emoji: Seite mit der Schriftseite oben"> , some couragehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luckhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligencehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">." class="img-responsive" style="max-width:100%;"/>

, some couragehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luckhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligencehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">." title="I owe Wayfair $W another thread for the incredible 1200% and the 600% gains it has given me in the remaining two positions bought in March.A story about some preparation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📄" title="Seite mit der Schriftseite oben" aria-label="Emoji: Seite mit der Schriftseite oben"> , some couragehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👊" title="Fisted hand" aria-label="Emoji: Fisted hand">and then a lot of luckhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers">. Plus some ongoing due-diligencehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✅" title="Fettes weißes Häkchen" aria-label="Emoji: Fettes weißes Häkchen">." class="img-responsive" style="max-width:100%;"/>