It took GFC& #39;08 for the idea of endogenous money to enter the mainstream. 12yrs later,after finally ‘everybody’ has become comfortable that the majority of our money is created by the banks,that ‘loans create deposits’,we are discovering that,actually,that& #39;s not the case after & #39;08

QE changed everything.

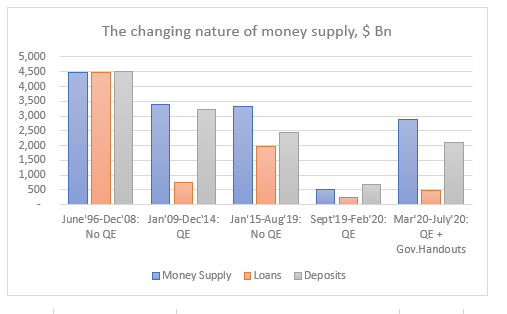

Before 2008, Loans=Deposits=Money Supply,more or less. During QE, loans created only about 20% of the money supply. After the Covid-19 crisis,when the government started sending cash directly to households,loans have created only about 15% of money supply.

Before 2008, Loans=Deposits=Money Supply,more or less. During QE, loans created only about 20% of the money supply. After the Covid-19 crisis,when the government started sending cash directly to households,loans have created only about 15% of money supply.

That latter change is infinitely more important in the monetary transmission mechanism than the process of QE. The main difference is that government handouts cause a net increase in the stock of private financial assets, the way QE couldn’t do.

That happens by default because they are a substitute of employment income and that is what the latter does as well. Up to now, the private sector could get a hold of money in only two ways: income from employment which leads to an increase in net financial assets, and thus...

...is more likely to be inflationary, and through borrowing, which has no effect on the private sector financial balance sheet, and thus is likely to be more disinflationary. There were many issues with that set-up, one of the most important ones was the fact that...

...income from employment has been stagnant in real terms for the last three decades or so. Another issue was that the debt the private sector incurred in the process was mostly ‘unproductive’, thus further reinforcing the disinflationary process.

For example, before 2008 only about 20-25% of the private sector loans were commercial and industrial; the majority were real estate. A third issue was that the inevitable process of compounding with positive interest rates ensured that the private sector debt stock would...

...grow indefinitely over and above the productive capacity of the economy (i.e. as long as private sector interest rates were higher than the growth rate of the economy). Until the point in 2008, when the private sector ‘couldn’t’ take on any more debt. Rather ‘didn’t want to’.

Indeed the private sector has deleveraged since then with private sector debt to GDP lower now than in 2008. It is no wonder then that we’ve been experiencing disinflation for the last three decades or so, and declining productivity especially after 2008.

But now we are observing a drastic change in the way money is created and income is obtained. Not through employment and not through debt. This is huge. If it becomes permanent, it will change our economy for ever… and for the better.

Read on Twitter

Read on Twitter