1) Been studying DeFi ... just explained it all to a friend, while it& #39;s fresh in my head, here& #39;s the & #39;explained simply& #39; version:

2) There& #39;s a new way to do lending and borrowing -- one that doesn& #39;t require a bank.

And all of us can participate as lenders.

Normally, a bank takes our money, then lends it out and keeps 90% of the profit. No more.

And all of us can participate as lenders.

Normally, a bank takes our money, then lends it out and keeps 90% of the profit. No more.

3) Now, we all can be lenders and make 7% - 10% interest on our money.

This comes at a time when banks are headed towards negative interest rates (i.e. pay us to do cloud storage of your money, peon).

This comes at a time when banks are headed towards negative interest rates (i.e. pay us to do cloud storage of your money, peon).

4) We do this in the Ethereum universe. We get some tokens, we give it to the & #39;bank& #39; -- which is now a smart contract. Examples of these & #39;banks& #39;: Compound and Aave.

5) So that& #39;s level one.

Level two are these new-wave exchanges like Uniswap which have arisen. They are part exchange, part AMM (Automated Market Maker).

Anyone can list any token. No listing fee. Anyone can use it: no KYC, no signup, no login. Just connect with ETH wallet.

Level two are these new-wave exchanges like Uniswap which have arisen. They are part exchange, part AMM (Automated Market Maker).

Anyone can list any token. No listing fee. Anyone can use it: no KYC, no signup, no login. Just connect with ETH wallet.

6) Uniswap is being driven by DeFi lending and borrowing - and transaction fees.

So there is revenue flowing into this world. It& #39;s not just a dead rock token.

So there is revenue flowing into this world. It& #39;s not just a dead rock token.

7) And this revenue is exactly how banks make money.

All of this is about disrupting banks, Uberizing and democratizing banks.

You couldn& #39;t be a mini-bank before. Now you can. You can participate.

All of this is about disrupting banks, Uberizing and democratizing banks.

You couldn& #39;t be a mini-bank before. Now you can. You can participate.

8) Now. There are Automated Market Makers who supply liquidity to the lenders and exchanges.

Because there are rarely a collision of buyer and seller who are perfect matches for a transaction, this is a huge problem on DEX& #39;s in particular.

Because there are rarely a collision of buyer and seller who are perfect matches for a transaction, this is a huge problem on DEX& #39;s in particular.

9) Thus has arisen an army of liquidity providers.

Basically, you participate by putting your crypto in a giant pool with others. You earn (with everyone else) from:

- Transaction fees

- Lending yield (depending on the pool). These pools can lend in Aave and Compound.

Basically, you participate by putting your crypto in a giant pool with others. You earn (with everyone else) from:

- Transaction fees

- Lending yield (depending on the pool). These pools can lend in Aave and Compound.

10) Then there is the Apex Predator (at least so far) $YFi.

This is a collection of pools and tools that automate moving the pool tokens around to the greatest interest yield. Oh you have 12% and that& #39;s the highest? Move everything there! Oh it dropped? Move elsewhere!

This is a collection of pools and tools that automate moving the pool tokens around to the greatest interest yield. Oh you have 12% and that& #39;s the highest? Move everything there! Oh it dropped? Move elsewhere!

11) You stake in YFi-run pools and you earn:

- The highest interest yield

- Transaction fees (this is more as activity in DeFi increases)

- YFi governance token itself, which is currently ~$4K, and described as the & #39;Bitcoin of DeFi& #39; by some

- The highest interest yield

- Transaction fees (this is more as activity in DeFi increases)

- YFi governance token itself, which is currently ~$4K, and described as the & #39;Bitcoin of DeFi& #39; by some

12) Again, this world is & #39;Bank World& #39; but it gets rid of the banks.

You and 10,000 others are collectively a new kind of bank.

You all earn the best interest and transaction fees. YOU keep 90%, not the bank.

You and 10,000 others are collectively a new kind of bank.

You all earn the best interest and transaction fees. YOU keep 90%, not the bank.

13) Anyway :) Yes I skipped over some things, etc. but trying to make this & #39;Explained Simply& #39;.

The key takeaway is that banks make money TODAY doing all this, so it is a model that works. But this is the first time it& #39;s been broken into bits and distributed evenly.

The key takeaway is that banks make money TODAY doing all this, so it is a model that works. But this is the first time it& #39;s been broken into bits and distributed evenly.

14) Providing liquidity is also a very valuable and very real service.

A proportion of tokens (say 50% ETH, 50% BTC) is established -- and maintained electronically by a bot which says: "I& #39;m out of balance this much, I& #39;ll pay premium for token I need to bring balance back".

A proportion of tokens (say 50% ETH, 50% BTC) is established -- and maintained electronically by a bot which says: "I& #39;m out of balance this much, I& #39;ll pay premium for token I need to bring balance back".

15) The more out of balance the pool is, the more the bot will pay.

This create arbitrage opportunities that can be farmed as well.

This create arbitrage opportunities that can be farmed as well.

16) The pool itself allows for an & #39;artificial order book& #39; to be maintained on DEX& #39;s with sufficient depth to satisfy most customers.

17) (I know there is no order book in an AMM -- hence & #39;artificial& #39; -- it is merely virtually the same)

18) One last DefI LEGO brick I forgot: Oracles.

In order for lenders to know whether the value of staked crypto collateral is & #39;enough& #39; to cover a loan (or whether they should issue a & #39;margin call& #39;) they need a source of truth for crypto price info.

In order for lenders to know whether the value of staked crypto collateral is & #39;enough& #39; to cover a loan (or whether they should issue a & #39;margin call& #39;) they need a source of truth for crypto price info.

19) That& #39;s where & #39;oracles& #39; come in (and I hate that name. More goddamn crypto mysticism. But anyway.)

For reasons I don& #39;t fully get yet, blockchain contracts can& #39;t talk to the outside world easily. So you need an & #39;in world& #39; API they can hit to get this info.

For reasons I don& #39;t fully get yet, blockchain contracts can& #39;t talk to the outside world easily. So you need an & #39;in world& #39; API they can hit to get this info.

20) Companies like Chainlink provide these & #39;in-world& #39; API & #39;sources of truth& #39; info.

Get the price of ETH for X amount of $LINK token (yes you have to pay in $LINK for every API query).

On the other end, anyone can become an info-supplier and make $LINK for supplying API& #39;s.

Get the price of ETH for X amount of $LINK token (yes you have to pay in $LINK for every API query).

On the other end, anyone can become an info-supplier and make $LINK for supplying API& #39;s.

21) To run your API Node, however, you must stake $LINK tokens.

If your info does not agree with others providing the same info -- or you are unresponsive -- you lose your staked $LINK. So tell the truth -- or else.

If your info does not agree with others providing the same info -- or you are unresponsive -- you lose your staked $LINK. So tell the truth -- or else.

22) Which brings us back to $YFI.

$YFI is about to open a new vault for $LINK which will be used to provide $LINK liquidity to exchanges, lenders and consumers of $LINK for API services.

Yes. It& #39;s circular, a snake eating its tail, in a way.

But so is Bank World.

$YFI is about to open a new vault for $LINK which will be used to provide $LINK liquidity to exchanges, lenders and consumers of $LINK for API services.

Yes. It& #39;s circular, a snake eating its tail, in a way.

But so is Bank World.

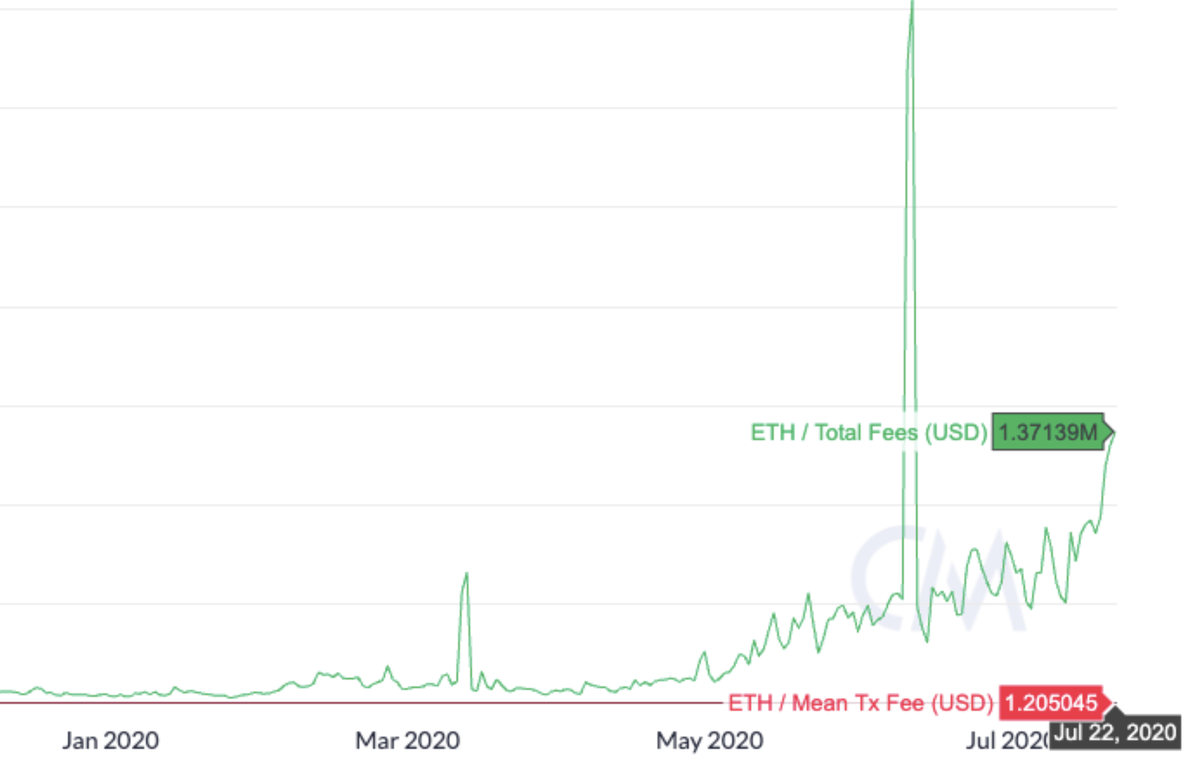

23) This entire castle of DeFi is built on Ethereum.

As of late, because of the DeFi explosion, transaction fees have gone through the roof -- & #39;surge pricing& #39; in the ETH universe.

And congestion has gone up.

As of late, because of the DeFi explosion, transaction fees have gone through the roof -- & #39;surge pricing& #39; in the ETH universe.

And congestion has gone up.

24) If it keeps growing like it is, the ETH blockchain might slow to a crawl and become unusable.

Success could kill it, in other words.

That& #39;s possible. Others have pointed this out recently.

Success could kill it, in other words.

That& #39;s possible. Others have pointed this out recently.

25) Graph in tweet 23 above courtesy of @dahongfei by the way -- credit where it is due.

The NEO universe separated out GAS from the NEO token specifically to avoid the traffic crunch and tx fee surge ETH is feeling right now.

The NEO universe separated out GAS from the NEO token specifically to avoid the traffic crunch and tx fee surge ETH is feeling right now.

26) There& #39;s 4.3 billion locked into DeFi smart contracts as of this writing -- and that number is growing fast.

So -- something is happening here. It does appear that this all has legs of some sort.

So -- something is happening here. It does appear that this all has legs of some sort.

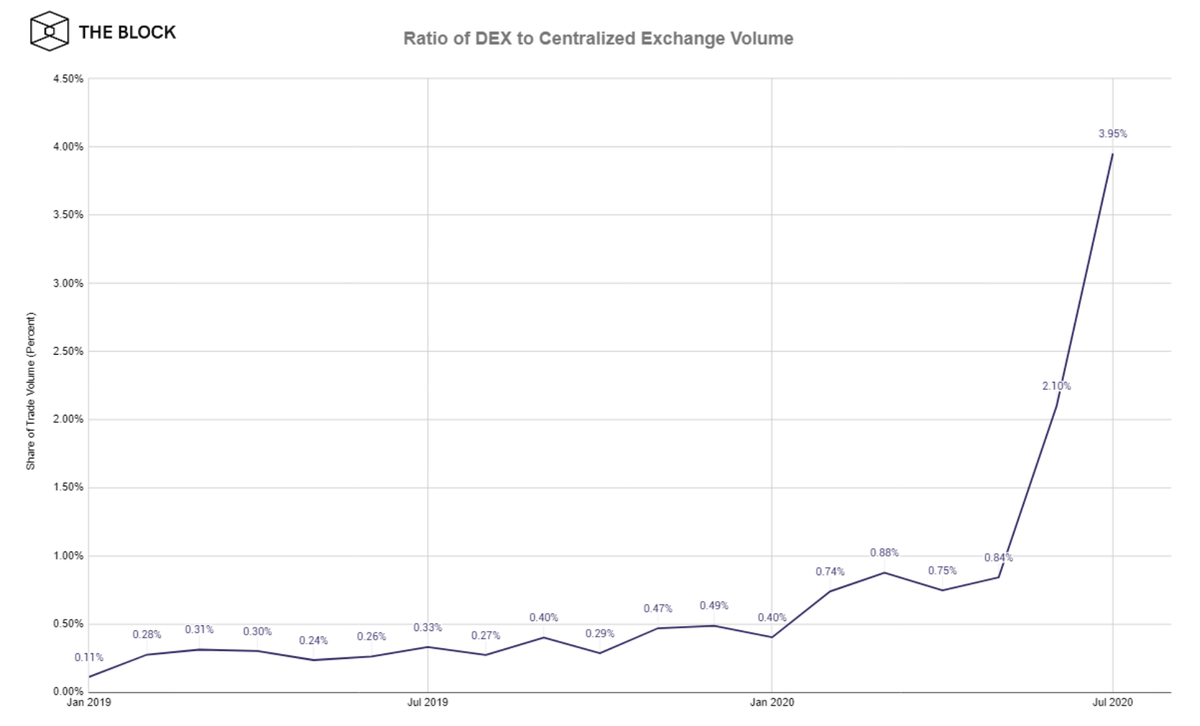

27) DeFI and DEX usage are tied together at the hip -- they are two sides of one coin.

Here& #39;s a new chart from The Block showing a nice giant spike in DEX usage:

Here& #39;s a new chart from The Block showing a nice giant spike in DEX usage:

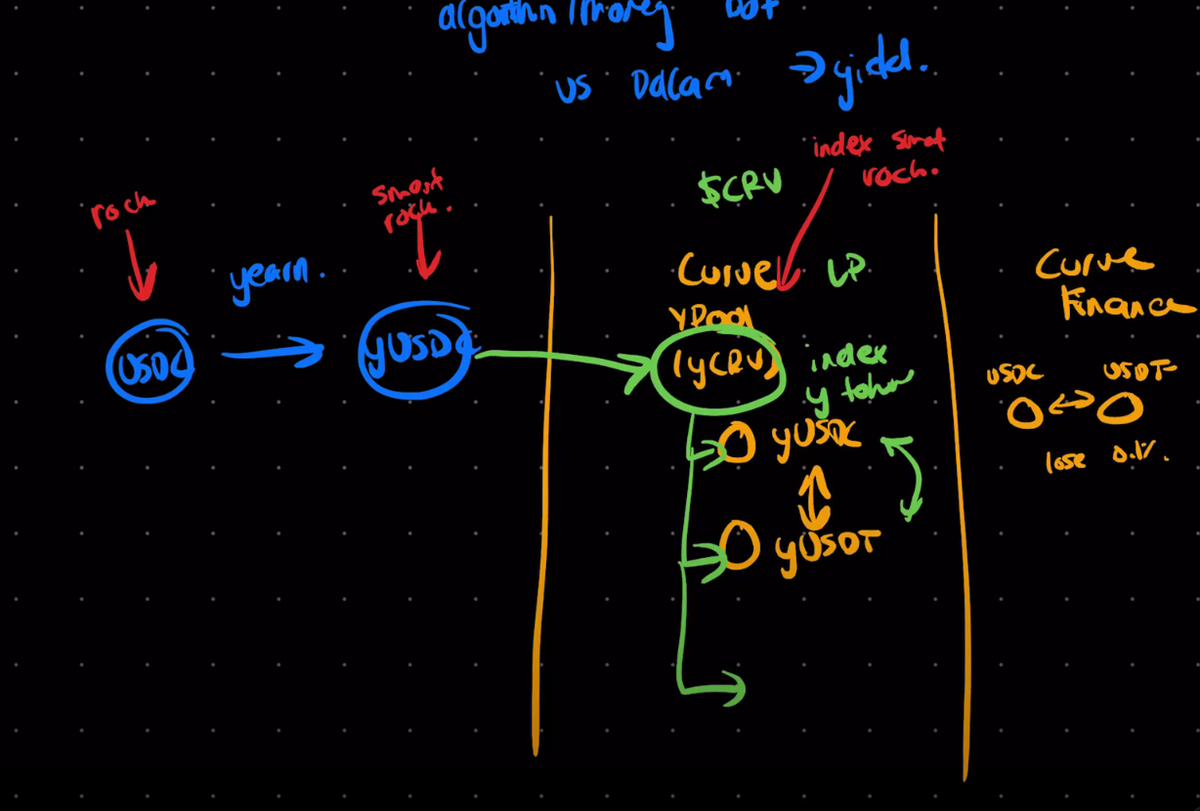

28) Here is a snap from a great video explaining $YFi ... ( https://youtu.be/3IkRHymMWLM )

-">https://youtu.be/3IkRHymMW... $USD is a rock (it does nothing)

- $yUSD (Yearn& #39;s stablecoin) is a & #39;smart rock& #39; always gravitating towards the greatest yield

- $yCRV is an index of smart rocks.

-">https://youtu.be/3IkRHymMW... $USD is a rock (it does nothing)

- $yUSD (Yearn& #39;s stablecoin) is a & #39;smart rock& #39; always gravitating towards the greatest yield

- $yCRV is an index of smart rocks.

And YFi is a governance token for $yCRV.

Yes. It& #39;s a derivative of a derivative of a derivative of a derivative.

Normally, I hate that sort of nonsense.

But YFi is making more sense to me than I would have guessed. It seems logical, not normal banker trickery.

Yes. It& #39;s a derivative of a derivative of a derivative of a derivative.

Normally, I hate that sort of nonsense.

But YFi is making more sense to me than I would have guessed. It seems logical, not normal banker trickery.

29) One more thought:

Because there are only 30,000 YFi tokens total, buying $10,000 worth of YFi right now (2.5 $YFi) is like buying 1,500 Bitcoins for $6.6 each.

(You’d need 1,500 Bitcoins to have the same % of circulating supply.)

Because there are only 30,000 YFi tokens total, buying $10,000 worth of YFi right now (2.5 $YFi) is like buying 1,500 Bitcoins for $6.6 each.

(You’d need 1,500 Bitcoins to have the same % of circulating supply.)

Read on Twitter

Read on Twitter