0. How much does it cost to buy $LINK on a Decentralized Exchange (DEX)?

A thread comparing price slippage on @Bancor and @UniswapProtocol.

A thread comparing price slippage on @Bancor and @UniswapProtocol.

1. Bancor V2 launched a few days ago with its first trial pool, a capped pool with $LINK and $BNT. Many observers, such as @timoharings, were quick to notice the comparatively low slippage. https://twitter.com/timoharings/status/1289248918199361537">https://twitter.com/timoharin...

2. But as @ChainLinkGod pointed out, comparing the $BNT - $LINK slippage on Uniswap vs. Bancor V2 isn& #39;t really fair.

Why not? Because $BNT is Bancor& #39;s native network token, but not Uniswap& #39;s. Uniswap& #39;s native pool token is $ETH. https://twitter.com/ChainLinkGod/status/1289278815353495552?s=20">https://twitter.com/ChainLink...

Why not? Because $BNT is Bancor& #39;s native network token, but not Uniswap& #39;s. Uniswap& #39;s native pool token is $ETH. https://twitter.com/ChainLinkGod/status/1289278815353495552?s=20">https://twitter.com/ChainLink...

3. So instead of tracking slippage on the $BNT - $LINK pairing, let& #39;s compare slippage for $BNT - $LINK on Bancor to slippage for $ETH - $LINK on Uniswap.

Note: when I was composing this thread, the approximate prices of $BNT and $ETH were as follows:

BNT = $1.98

ETH = $390

Note: when I was composing this thread, the approximate prices of $BNT and $ETH were as follows:

BNT = $1.98

ETH = $390

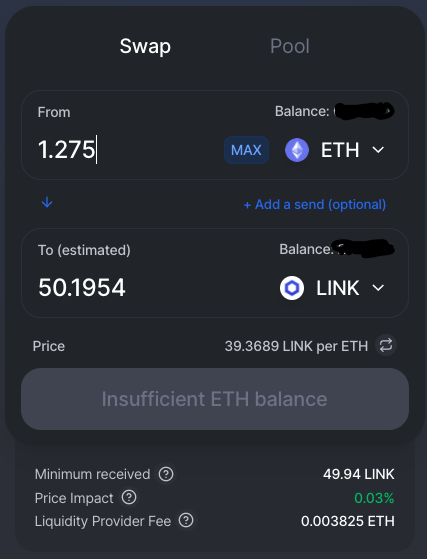

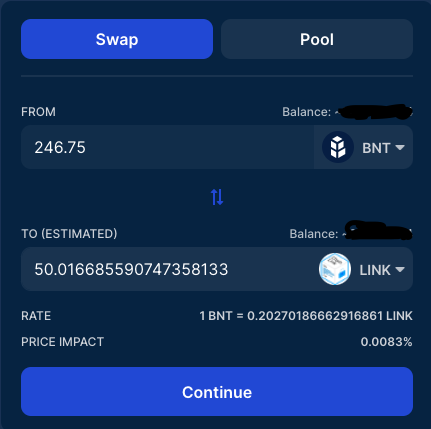

4. First, let& #39;s see how much it costs to buy 50 $LINK on both DEXs.

1.275 ETH = ~$497

246.75 BNT = ~$489

Not such a meaningful difference for an order of this size.

1.275 ETH = ~$497

246.75 BNT = ~$489

Not such a meaningful difference for an order of this size.

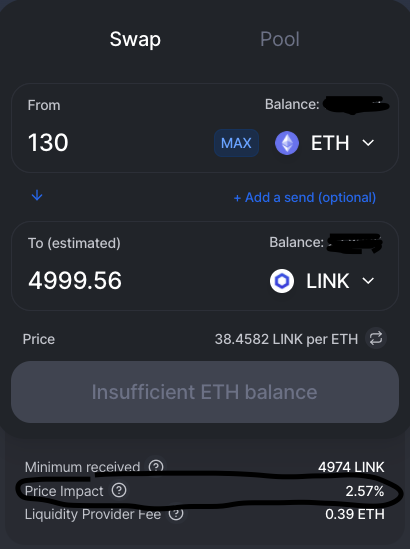

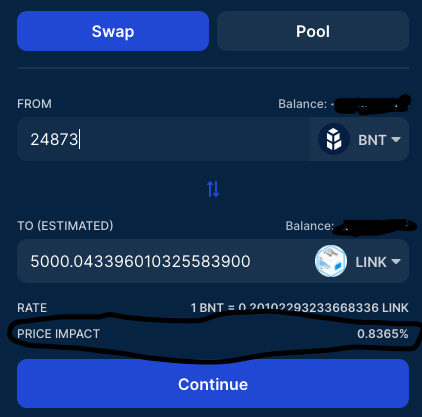

5. But let& #39;s say we wanted to purchase a bigger bag: 5000 $LINK. What are the prices like now?

130 $ETH = $50,700

24873 $BNT = $49,350

That& #39;s a $1,350 difference for purchasing your 5000 LINK on Bancor V2 with BNT, instead of on Uniswap with ETH!

130 $ETH = $50,700

24873 $BNT = $49,350

That& #39;s a $1,350 difference for purchasing your 5000 LINK on Bancor V2 with BNT, instead of on Uniswap with ETH!

6. Now, I would be remiss if I didn& #39;t note that the relative discount of purchasing LINK through Bancor may be amplified by the fact that the BNT/LINK pool is currently unbalanced (see: https://etherscan.io/address/0x222b06e3392998911a79c51ee64b4aabe1653537)">https://etherscan.io/address/0...

7. Because of the LINK "surplus," the pool automatically prices LINK at an attractive price to encourage arbitragers to rebalance the pool. This may be part of the reason why the price of LINK is comparatively low.

(For more on pool rebalancing, see https://docs.bancor.network/v2-liquidity-pools/balancing-mechanics).">https://docs.bancor.network/v2-liquid...

(For more on pool rebalancing, see https://docs.bancor.network/v2-liquidity-pools/balancing-mechanics).">https://docs.bancor.network/v2-liquid...

8. Still, the "discounted" LINK price on Bancor only accounts for some, not all, of the difference in slippage. The primary reason for the difference is Bancor V2& #39;s liquidity amplification, which inflates the value of reserves when pricing a trade. #moderating-slippage">https://docs.bancor.network/getting-started/the-v2-difference #moderating-slippage">https://docs.bancor.network/getting-s...

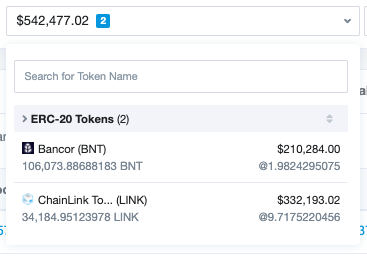

10. And here& #39;s the kicker.

The $BNT - $LINK pool on Bancor V2 was capped at $500k of liquidity when the pool launched. Due to price increases, that figure is now $542k.

Uniswap& #39;s $ETH - $LINK pool, by contrast, has $3.7 million in liquidty. That& #39;s almost 7X as much liquidity!

The $BNT - $LINK pool on Bancor V2 was capped at $500k of liquidity when the pool launched. Due to price increases, that figure is now $542k.

Uniswap& #39;s $ETH - $LINK pool, by contrast, has $3.7 million in liquidty. That& #39;s almost 7X as much liquidity!

11. So to recap: Bancor& #39;s pool is already providing traders with less slippage than Uniswap& #39;s *even though it has 1/7th of the liquidity depth.*

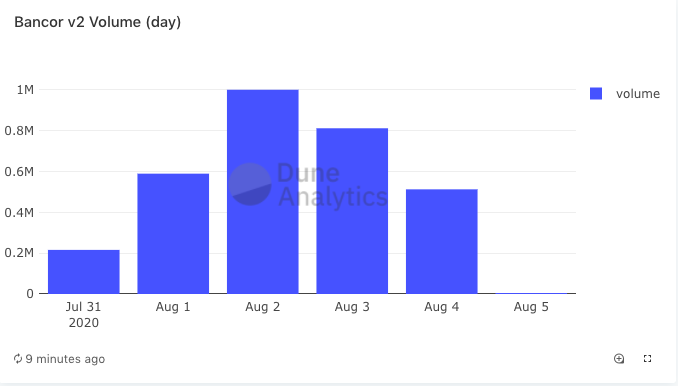

This might help explain why Bancor reached over $1mil of trading volume on half as much liquidity.

This might help explain why Bancor reached over $1mil of trading volume on half as much liquidity.

12. Now, what happens when the liquidity cap is lifted? My guess is as good as yours, but if I had to bet, I& #39;d go with this: https://twitter.com/Rewkang/status/1272631205263900672">https://twitter.com/Rewkang/s...

Read on Twitter

Read on Twitter