One private equity firm plans to dominate sports investing through the resurgence of an old investment vehicle.

Time for a thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Time for a thread

1) Last week, private equity firm RedBird Capital Partners announced they are teaming up with Oakland Athletics executive Billy Beane to launch a $500M special purpose acquisition company (SPAC) to fund the potential purchase of a sports related entity.

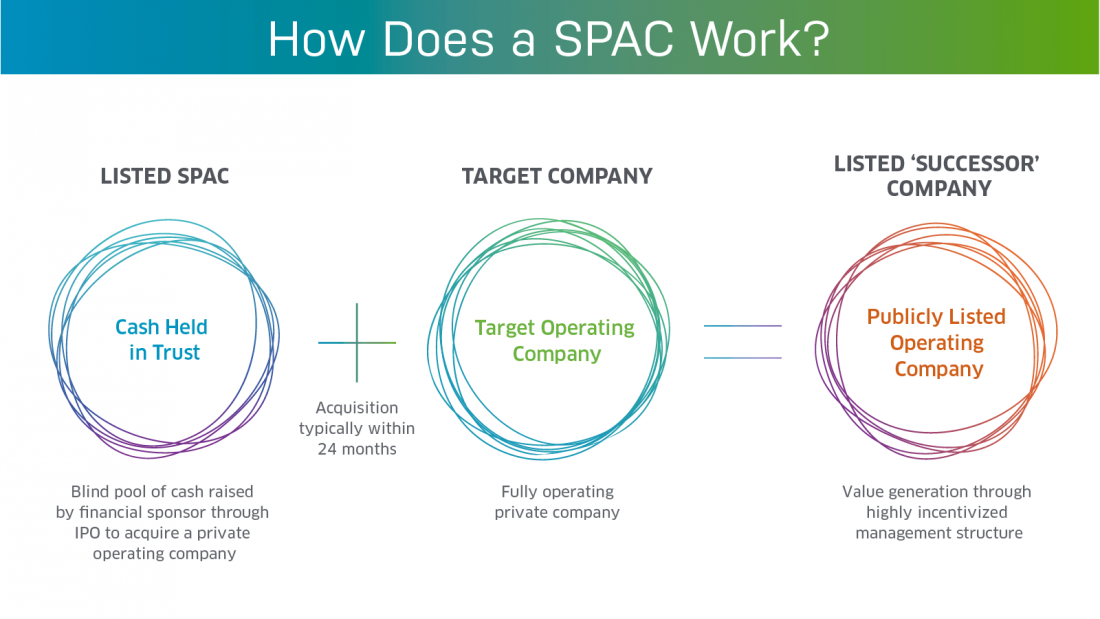

2) SPACs are commonly referred to as blank check companies because they raise a blind pool of capital through an equity offering.

Investors commit a specified amount of capital for up to two years, during which the SPAC sponsor will identify, vet, and finalize a transaction.

Investors commit a specified amount of capital for up to two years, during which the SPAC sponsor will identify, vet, and finalize a transaction.

3) If the deal is finalized and approved by all shareholders, the acquired company is now a publicly traded firm without having to pursue the traditional IPO process.

What& #39;s the catch?

If investors don& #39;t like the deal, they have the right to veto it and take back their money.

What& #39;s the catch?

If investors don& #39;t like the deal, they have the right to veto it and take back their money.

4) RedBird Capital intends to take their SPAC public on the NYSE and wants to target sports media properties.

Potential acquisition targets include data analytics companies, but the investment firm hasn& #39;t ruled out attempting to purchase a sports franchise.

Potential acquisition targets include data analytics companies, but the investment firm hasn& #39;t ruled out attempting to purchase a sports franchise.

5) In December 2019, daily fantasy sports company and bookmaker DraftKings merged with Diamond Eagle Acquisition Corp, a SPAC with a market cap of ~$500M.

With the stock rising over 200% since the merger, it& #39;s considered one of the most successful sports related SPACs ever.

With the stock rising over 200% since the merger, it& #39;s considered one of the most successful sports related SPACs ever.

6) Although DraftKings was successful, using SPACs for team purchases hasn’t always worked in the past.

In 2008, we saw Sports Properties Acquisition Corp. raise $200M via IPO in an unsuccessful attempt to purchase the Chicago Cubs and Florida Panthers.

In 2008, we saw Sports Properties Acquisition Corp. raise $200M via IPO in an unsuccessful attempt to purchase the Chicago Cubs and Florida Panthers.

7) Typically, the execution of a SPAC can run into two main issues:

- Difficulty executing a transaction within the 2-year window required for SPACs.

- Companies often need 18-24 months to prepare for the transition from a private firm to a public one.

- Difficulty executing a transaction within the 2-year window required for SPACs.

- Companies often need 18-24 months to prepare for the transition from a private firm to a public one.

8) RedBird should be able to execute a transaction with a company in the media & analytics sector. I think they’ll run into challenges when it comes to major sports franchises.

There isn’t a consistent supply of teams available & transactions tend to exceed the 2yr SPAC window.

There isn’t a consistent supply of teams available & transactions tend to exceed the 2yr SPAC window.

9) If I was RedBird, I would target the interactive home fitness space which includes companies like Peloton, Tonal, and Hydrow.

I’m bullish on the sector as we continue to see significant growth due to the increasing number of consumers actively moving towards home workouts.

I’m bullish on the sector as we continue to see significant growth due to the increasing number of consumers actively moving towards home workouts.

10) On top of hardware-related revenues from per-unit sales, these businesses are ultimately membership communities & if history has shown us anything, communities can monetize really, really well.

With Lululemon buying home fitness startup Mirror for $500M, they seem to agree.

With Lululemon buying home fitness startup Mirror for $500M, they seem to agree.

If you learned something today and want to receive more updates about the business and money behind sports, subscribe here to receive my free daily newsletter. https://huddleup.substack.com"> https://huddleup.substack.com

Read on Twitter

Read on Twitter