The Cash App seems to be widely misunderstood. So I thought I’d try to clear some things up before earnings tomorrow.

Quick mini-thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">

$SQ

Quick mini-thread

$SQ

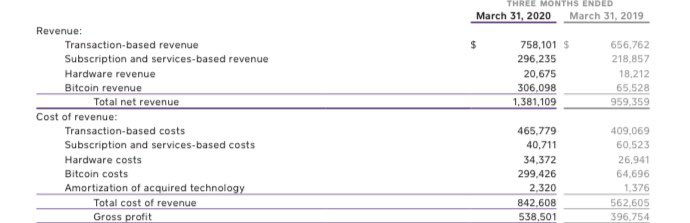

Revenue:

First things first. Don’t just pay attention to the top line, as net revenue can be misleading.

$BTC inflates the top line as it’s essentially zero margin.

It serves more as a customer acquisition cost.

First things first. Don’t just pay attention to the top line, as net revenue can be misleading.

$BTC inflates the top line as it’s essentially zero margin.

It serves more as a customer acquisition cost.

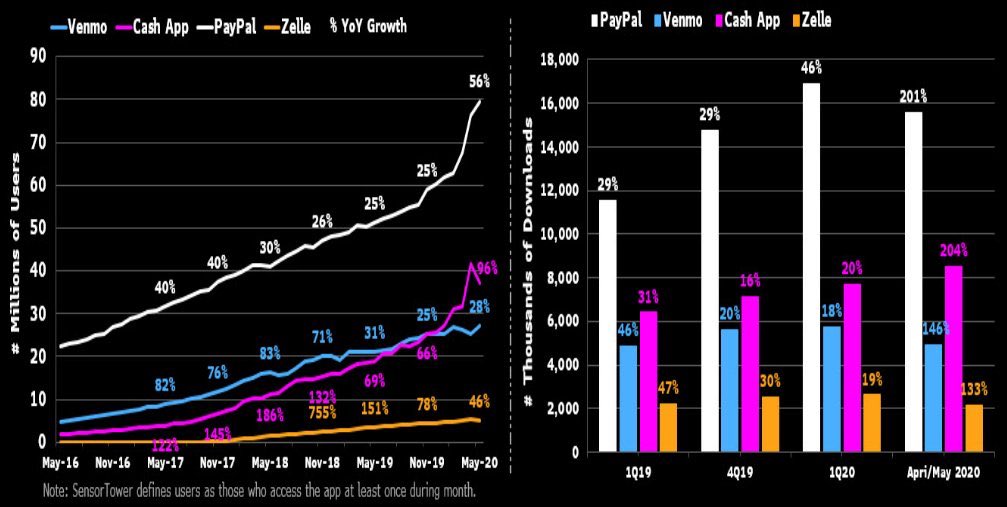

Downloads:

Yes, app downloads are high but that doesn’t necessarily equate to a higher bottom line.

Anecdotally it feels as though Venmo is still winning the pure P2P battle. P2P is traditionally seen as though it will translate to bank transfers.

But that’s not the end game

Yes, app downloads are high but that doesn’t necessarily equate to a higher bottom line.

Anecdotally it feels as though Venmo is still winning the pure P2P battle. P2P is traditionally seen as though it will translate to bank transfers.

But that’s not the end game

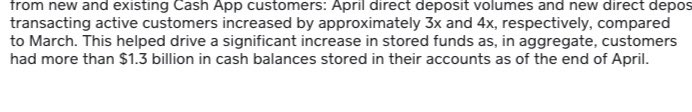

In fact, the end game is to never transfer the money at all.

The robust functionality for the Cash App was actually designed more as a funnel to create float.

Stock trading, bitcoin, cash card, boosts, P2P. It’s all designed to aggregate cash on the platform.

The robust functionality for the Cash App was actually designed more as a funnel to create float.

Stock trading, bitcoin, cash card, boosts, P2P. It’s all designed to aggregate cash on the platform.

Last quarter, we got our first obvious glimpse that management cares about total cash on the platform when they added this little tidbit.

This is where $SQ really becomes a bank.

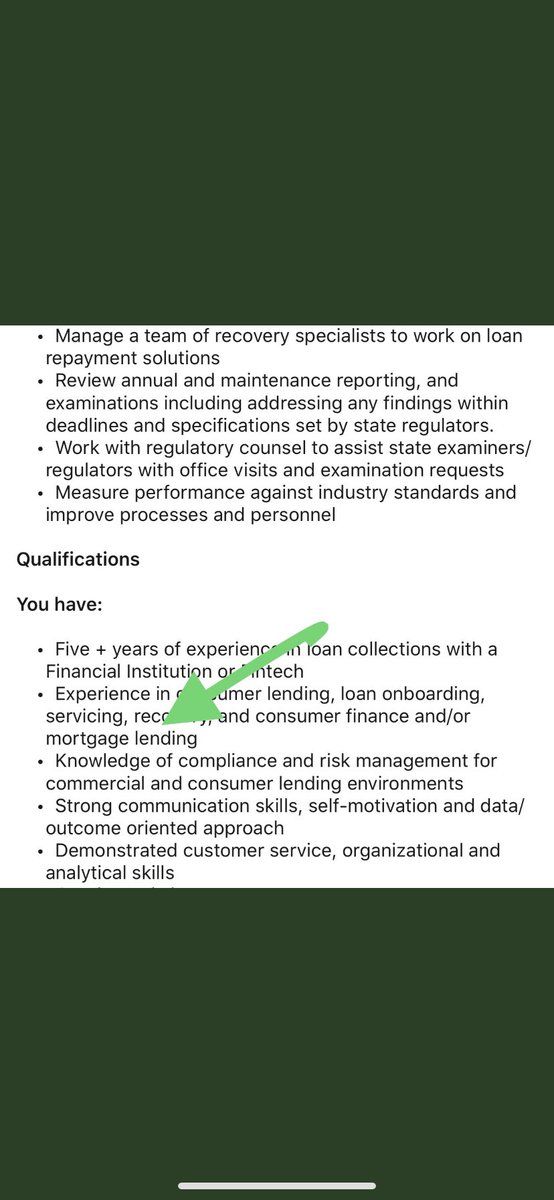

Now that Square’s bank charter has been approved by the FDIC, $SQ will be able to start lending money and accumulating interest.

Their intentions were made clear after they posted this job opening.

Now that Square’s bank charter has been approved by the FDIC, $SQ will be able to start lending money and accumulating interest.

Their intentions were made clear after they posted this job opening.

If you weren’t sure why the market seems to be optimistic about the Cash App ecosystem, I hope this provided some clarity.

Credit to @_SeanDavid for most of these photos.

Read on Twitter

Read on Twitter