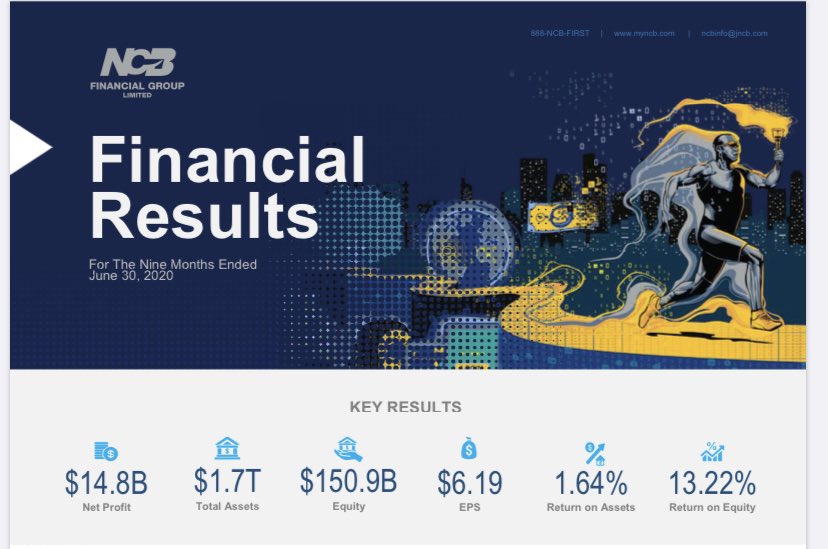

$NCBFG.ja results are out. Here are my quick thoughts.

NCB is a beast. All banks have been under pressure as a result of the pandemic and it shows in these results, but honestly I expected it to be much, much worse.

For starters, they were still profitable.

#FinanceTwitterJA

NCB is a beast. All banks have been under pressure as a result of the pandemic and it shows in these results, but honestly I expected it to be much, much worse.

For starters, they were still profitable.

#FinanceTwitterJA

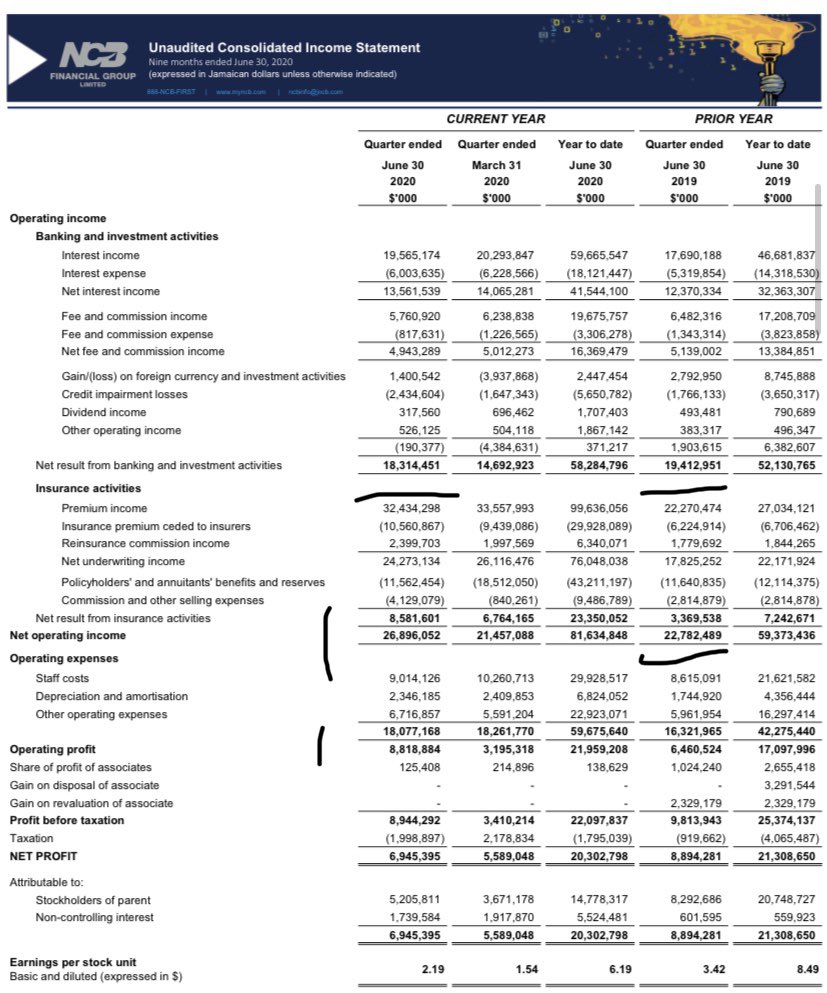

Their drive to diversify the financial group by adding other financial services through inorganic growth (acquisitions) especially Guardian is paying dividends and showing the prudence of that strategy.

This page tells the story.

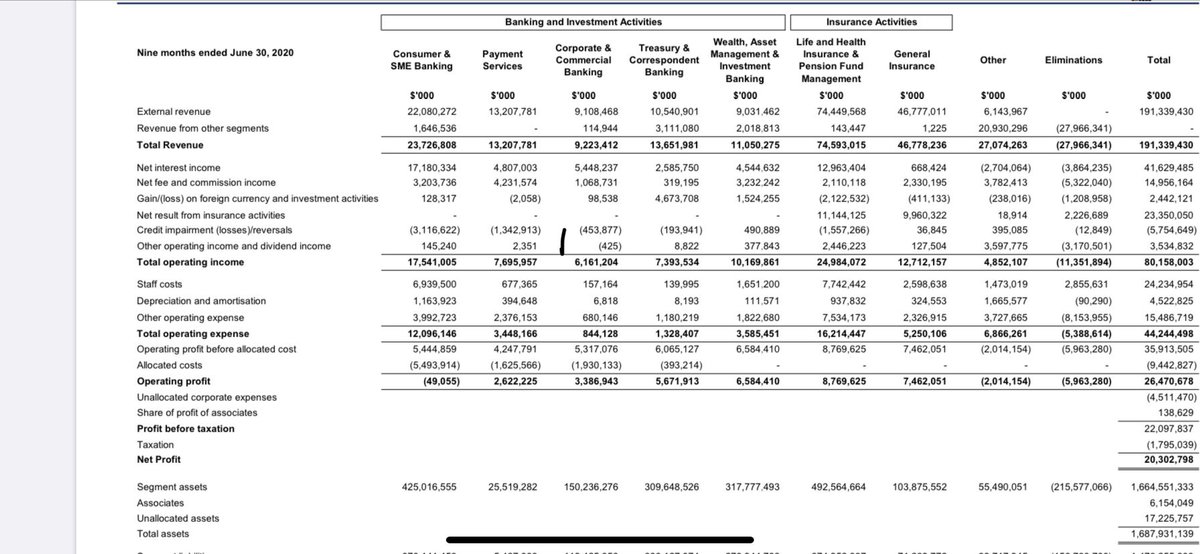

You can see that YoY Banking & Investing Income is down for this quarter, but Insurance Income is up almost 160%.

So even though Operating Expenses are up by almost $2B JMD, Operating Profit is up 37.5% for the quarter YoY.

You can see that YoY Banking & Investing Income is down for this quarter, but Insurance Income is up almost 160%.

So even though Operating Expenses are up by almost $2B JMD, Operating Profit is up 37.5% for the quarter YoY.

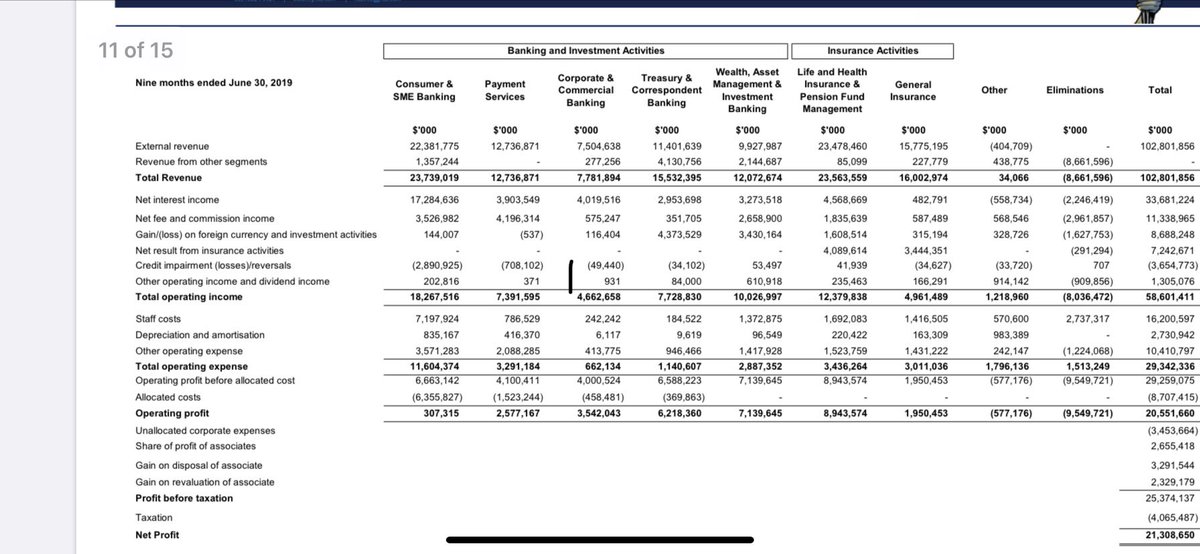

But looking at the bank only, we can see that Credit Impairment Losses are up almost 10X (which is what you expect in the middle of a crisis) from $49M to $453M, but even still the bank was able to post an Operating Profit.

Even though Op. Prof. was down 4.37% YoY I exp. worse.

Even though Op. Prof. was down 4.37% YoY I exp. worse.

I haven’t dug too deep into the rest of the results yet, but those two things were the first things to jump out at me.

Building a relatively pandemic resistant business is very hard, but these guys seem to be doing a great job so far.

See them here - https://www.jamstockex.com/ncb-financial-group-limited-ncbfg-unaudited-financial-results-nine-months-ended-june-30-2020/">https://www.jamstockex.com/ncb-finan...

Building a relatively pandemic resistant business is very hard, but these guys seem to be doing a great job so far.

See them here - https://www.jamstockex.com/ncb-financial-group-limited-ncbfg-unaudited-financial-results-nine-months-ended-june-30-2020/">https://www.jamstockex.com/ncb-finan...

https://www.jamstocketwitter.com/ncb-financial-group-limited-ncbfg-unaudited-financial-results-nine-months-ended-june-30-2020/

Read on Twitter

Read on Twitter