1/ In the spirit of a remix, I have been meaning to put together a list of the big foundational ideas - the mental tools that have helped me make sense of the investment world.

Which ideas have had the biggest impact on how you invest?

Which ideas have had the biggest impact on how you invest?

2/ 99% of investment information is a “sugar high”.

This piece by @morganhousel does an excellent job differentiating the 1%. https://www.collaborativefund.com/blog/expiring-vs-lt-knowledge">https://www.collaborativefund.com/blog/expi...

This piece by @morganhousel does an excellent job differentiating the 1%. https://www.collaborativefund.com/blog/expiring-vs-lt-knowledge">https://www.collaborativefund.com/blog/expi...

3/ Taleb - Skin in the game. It doesn’t guarantee success, but does ensure the people in charge feel the pain of being wrong. This is the foundation of aligning interests and better decision-making. https://www.amazon.com/Skin-Game-Hidden-Asymmetries-Daily/dp/042528462X">https://www.amazon.com/Skin-Game...

4/ Also Taleb - the opposite of fragile isn’t robust but antifragile, or things that grow stronger with stress. Invest in companies that take advantage of volatility and get stronger as they get bigger. https://www.amazon.com/Antifragile-Things-That-Disorder-Incerto/dp/0812979680">https://www.amazon.com/Antifragi...

5/ Moat trajectory from WCM. Perhaps the most effective tool to avoid value traps. https://www.afr.com/companies/financial-services/wcm-how-laguna-beachs-super-stock-pickers-beat-the-market-and-live-the-dream-20170519-gw96xs">https://www.afr.com/companies...

6/ Diversification - crucial to generating solid returns, but the standard definition is off. One can be diversified with far fewer holdings than conventional wisdom implies. There are a number of studies, all hotly debated. Sweet spot is probably >15 and <50 stocks.

7/ Costs - managing them is far from glamorous yet the single most important thing an investor can control that will improve returns. Classic from Bogle: https://www.cfainstitute.org/en/research/financial-analysts-journal/2014/the-arithmetic-of-all-in-investment-expenses">https://www.cfainstitute.org/en/resear...

8/ @morganhousel again - Even the most spectacular investments follow an excruciating path. If this is not an investors’ baseline expectation they will have no chance of capturing high returns. They will be thrown off the bull. https://www.google.com/amp/s/www.fool.com/amp/investing/general/2016/02/09/the-agony-of-high-returns.aspx">https://www.google.com/amp/s/www...

9/ @mjmauboussin and the “outside view”. Most situations are not as unique as they seem - look for a reference class to help calibrate probabilities. https://fs.blog/2015/05/inside-view-michael-mauboussin/">https://fs.blog/2015/05/i...

10/ @mjmauboussin again. Markets as complex, adaptive systems is the model that best squares with experience and a world awash in information. Look for diversity breakdowns (both ways) for oportunities.

http://www.e-m-h.org/Maub02.pdf ">https://www.e-m-h.org/Maub02.pd...

http://www.e-m-h.org/Maub02.pdf ">https://www.e-m-h.org/Maub02.pd...

11/ Owner-operators. Related to skin in the game. Changes everything about how a company is run, mostly for the better. Not a panacea, but great place to fish. https://horizonkinetics.com/research-reports/research-archive/owner-operators-mar-2014/">https://horizonkinetics.com/research-...

12/ Zeckhauser - seeing him speak in mid-2000s was an incredibly fortunate event. The UU model is very powerful, although I have a slightly different take....nearly all situations an investor encounters are UU. Humbling. https://www.cfainstitute.org/research/foundation/2010/investing-in-the-unknown-and-unknowable">https://www.cfainstitute.org/research/...

13/ Thorndike’s Outsiders. Talent is not linear. Some people can achieve/build 10-100x more than others. They are not too difficult to find, although it may be hard to articulate (even to yourself) what makes them so special. https://www.amazon.com/Outsiders-Unconventional-Radically-Rational-Blueprint/dp/1422162672">https://www.amazon.com/Outsiders...

14/ Change + Ambiguity = Bad. Don’t recall where I saw this one. When the first two conditions are present investors frequently assume and price in the worst case scenario. Can lead to high uncertainty / low risk opportunities.

15/ There are no absolutes. The answer to almost every investment related question should start with “it depends”.

16/ The Halo Effect. The order in which an investor digests information has a huge impact on how it is perceived. Being deliberate pays off.

https://en.m.wikipedia.org/wiki/Halo_effect">https://en.m.wikipedia.org/wiki/Halo...

https://en.m.wikipedia.org/wiki/Halo_effect">https://en.m.wikipedia.org/wiki/Halo...

17/ @aswathdamodoran imagination and stories. Instrumental in understanding why expectations shift over time and how companies with bright futures can be systematically mispriced. https://m.youtube.com/watch?v=uH-ffKIgb38">https://m.youtube.com/watch...

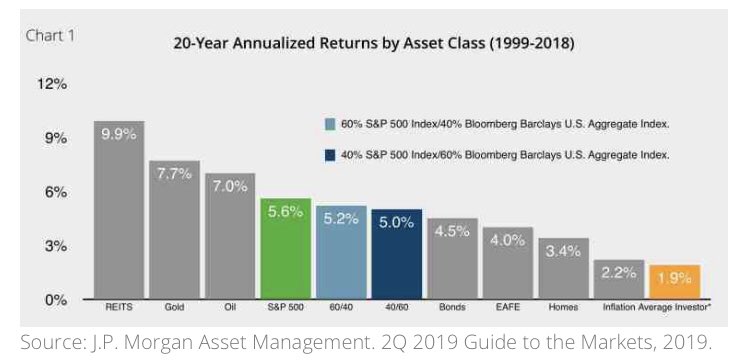

18/ The behavior gap - perhaps most importantly, being a good investor is different than, and a prerequisite to, being a good stock picker.

19/ @gladwell Puzzles vs. Mysteries. Investors frequently think we are analyzing puzzles, which could be solved if we just had more information. But we are really looking at mysteries which require a completely different mindset. https://www.newyorker.com/magazine/2007/01/08/open-secrets-3/amp">https://www.newyorker.com/magazine/...

20/ Like baseball, investing is a game of inches where small advantages compound over time. Over ~20 years Tony Gwynn batted .338, and Alan Trammel (a solid player and HOFer) .285. The difference was about one hit every five games.

21/ end

Read on Twitter

Read on Twitter