1/ $DIS 2020 Q3 earnings are out:

Revenue $11.8B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 42% YOY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 42% YOY

Diluted EPS $0.08, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOY

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOY

FCF $454M (actually up from -$3B YOY)

CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."

Revenue $11.8B,

Diluted EPS $0.08,

FCF $454M (actually up from -$3B YOY)

CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."

2/ $DIS Parks, Experiences, and Products segment:

Revenue $1B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">85%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">85%

Operating income ($2B) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2B

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2B

Impact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B.

Revenue $1B,

Operating income ($2B)

Impact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B.

3/ $DIS Media Networks segment:

Cable networks rev $4.03B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">10%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">10%

Cable op income $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%

Broadcast rev $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%

Broadcast op income $477M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%

The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB

Cable networks rev $4.03B,

Cable op income $2.5B,

Broadcast rev $2.5B,

Broadcast op income $477M,

The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB

4/ $DIS Studio Entertainment segment:

Revenue $1.7B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">55%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">55%

Op income $668M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%

Theaters were shut down and no big releases negatively impacted sales (obviously)

TV/SVOD rev was up from sales of content to Disney+

Revenue $1.7B,

Op income $668M,

Theaters were shut down and no big releases negatively impacted sales (obviously)

TV/SVOD rev was up from sales of content to Disney+

5/ $DIS Direct-to-consumer & Int& #39;l segment

Revenue $4.0B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">2%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">2%

Op income ($706M)

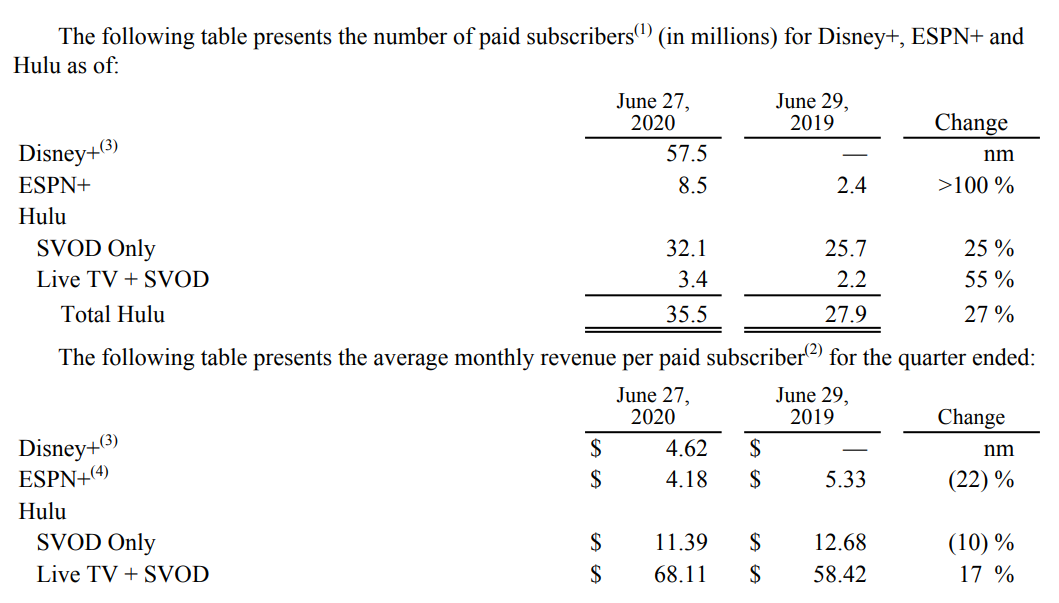

The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs

Revenue $4.0B,

Op income ($706M)

The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs

Read on Twitter

Read on Twitter 42% YOYDiluted EPS $0.08,https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOYFCF $454M (actually up from -$3B YOY)CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."" title="1/ $DIS 2020 Q3 earnings are out:Revenue $11.8B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 42% YOYDiluted EPS $0.08,https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOYFCF $454M (actually up from -$3B YOY)CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."" class="img-responsive" style="max-width:100%;"/>

42% YOYDiluted EPS $0.08,https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOYFCF $454M (actually up from -$3B YOY)CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."" title="1/ $DIS 2020 Q3 earnings are out:Revenue $11.8B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 42% YOYDiluted EPS $0.08,https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten"> 94% YOYFCF $454M (actually up from -$3B YOY)CEO Bob Chapek: "Global reach of our full portfolio of direct-to-consumer services now exceeds an astounding 100 million paid subscriptions..."" class="img-responsive" style="max-width:100%;"/>

85%Operating income ($2B) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2BImpact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B." title="2/ $DIS Parks, Experiences, and Products segment:Revenue $1B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">85%Operating income ($2B) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2BImpact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B." class="img-responsive" style="max-width:100%;"/>

85%Operating income ($2B) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2BImpact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B." title="2/ $DIS Parks, Experiences, and Products segment:Revenue $1B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">85%Operating income ($2B) https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏩" title="Nach rechts zeigendes doppeltes Dreieck" aria-label="Emoji: Nach rechts zeigendes doppeltes Dreieck"> that& #39;s negative $2BImpact of COVID-19 felt most significantly in this segment, estimated hit to segment& #39;s operating income estimated to be $3.5B." class="img-responsive" style="max-width:100%;"/>

10%Cable op income $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%Broadcast rev $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%Broadcast op income $477M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB" title="3/ $DIS Media Networks segment:Cable networks rev $4.03B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">10%Cable op income $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%Broadcast rev $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%Broadcast op income $477M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB" class="img-responsive" style="max-width:100%;"/>

10%Cable op income $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%Broadcast rev $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%Broadcast op income $477M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB" title="3/ $DIS Media Networks segment:Cable networks rev $4.03B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">10%Cable op income $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">50%Broadcast rev $2.5B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">12%Broadcast op income $477M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">55%The increase in op income was due to lower programming costs, namely production shutdowns on ABC, no fees to NBA/MLB" class="img-responsive" style="max-width:100%;"/>

55%Op income $668M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%Theaters were shut down and no big releases negatively impacted sales (obviously)TV/SVOD rev was up from sales of content to Disney+" title="4/ $DIS Studio Entertainment segment:Revenue $1.7B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">55%Op income $668M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%Theaters were shut down and no big releases negatively impacted sales (obviously)TV/SVOD rev was up from sales of content to Disney+" class="img-responsive" style="max-width:100%;"/>

55%Op income $668M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%Theaters were shut down and no big releases negatively impacted sales (obviously)TV/SVOD rev was up from sales of content to Disney+" title="4/ $DIS Studio Entertainment segment:Revenue $1.7B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">55%Op income $668M, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Pfeil nach unten" aria-label="Emoji: Pfeil nach unten">16%Theaters were shut down and no big releases negatively impacted sales (obviously)TV/SVOD rev was up from sales of content to Disney+" class="img-responsive" style="max-width:100%;"/>

2%Op income ($706M)The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs" title="5/ $DIS Direct-to-consumer & Int& #39;l segmentRevenue $4.0B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">2%Op income ($706M)The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs" class="img-responsive" style="max-width:100%;"/>

2%Op income ($706M)The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs" title="5/ $DIS Direct-to-consumer & Int& #39;l segmentRevenue $4.0B, https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬆️" title="Pfeil nach oben" aria-label="Emoji: Pfeil nach oben">2%Op income ($706M)The big news is that Disney+ had 57.5M subs at end of quarter, ESPN+ 8.5M subs, total Hulu 35.5M subs" class="img-responsive" style="max-width:100%;"/>