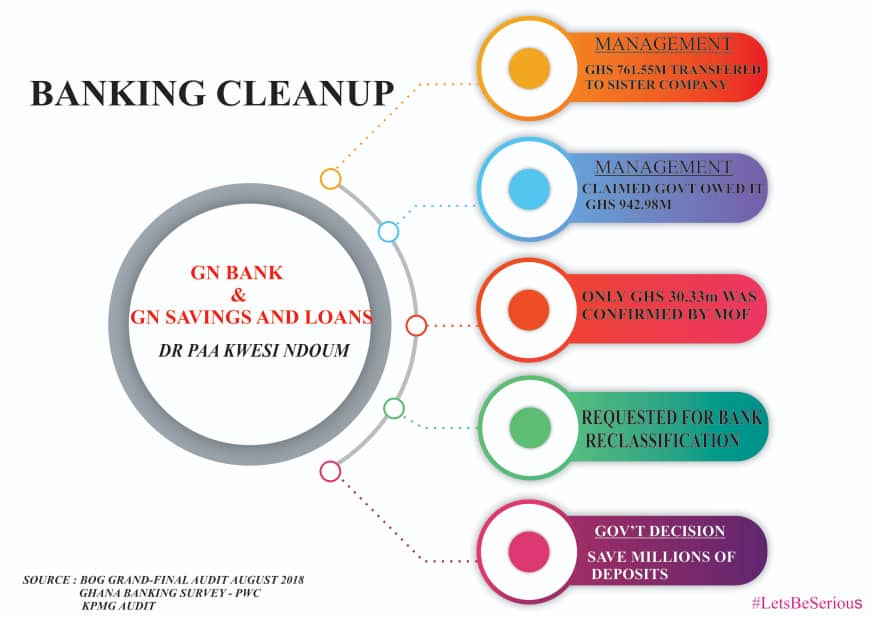

Happenings that led to the collapse of some 9 local banks in Ghana by the BoG. These infographics show how the central bank gave liquidity support to them. They diverted the funds into their holdings. Government stepped in to save millions of depositor funds. Thread;

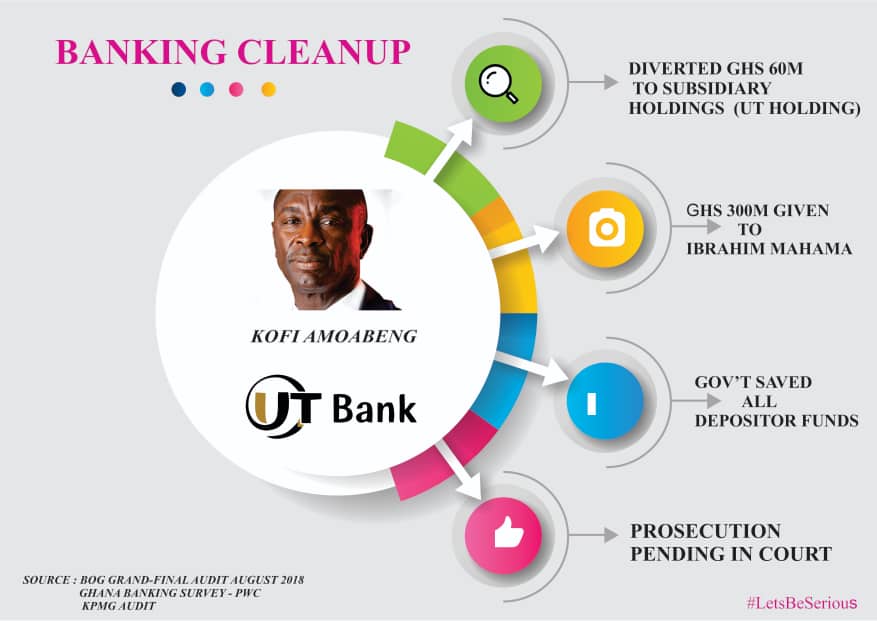

1. UT Bank

1. UT Bank

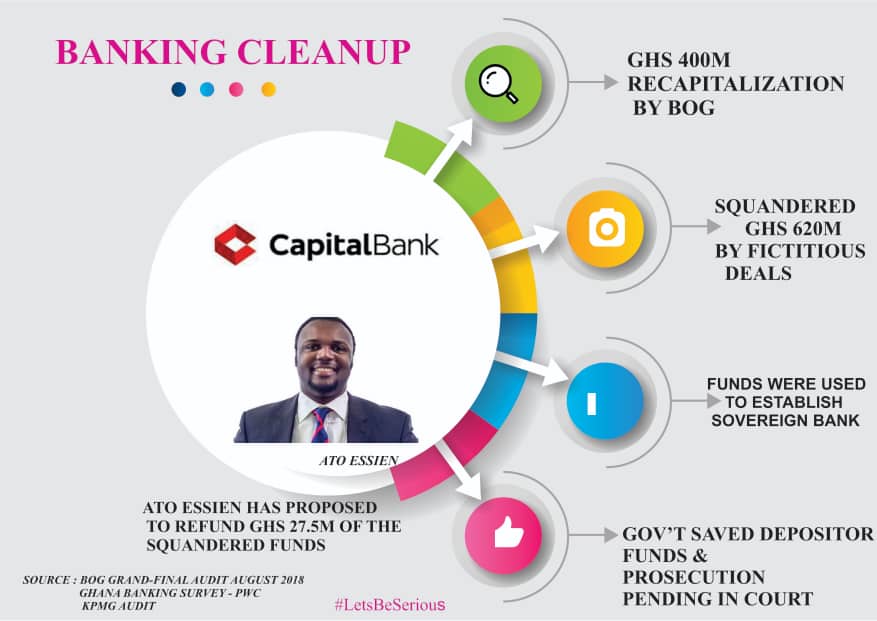

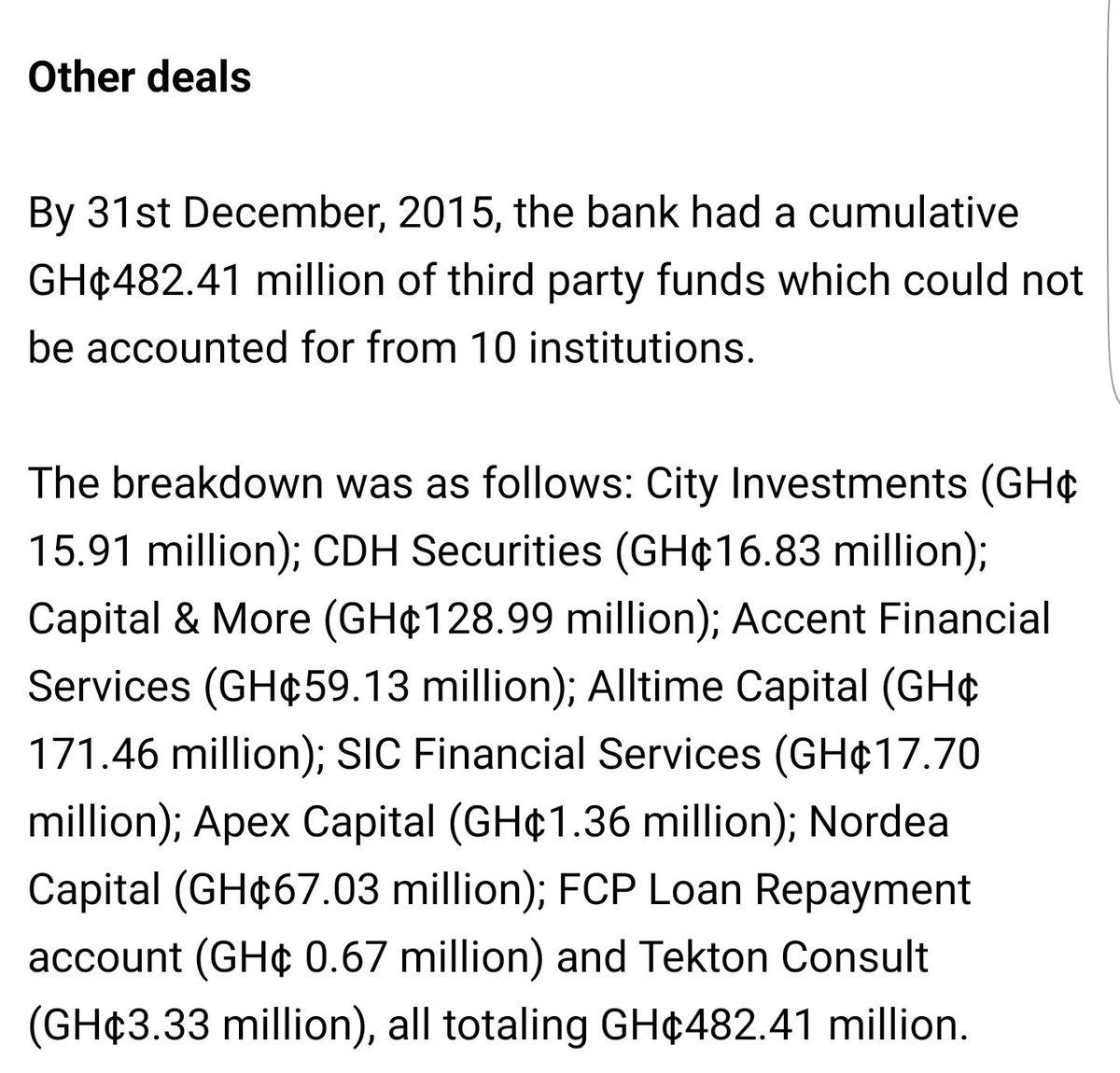

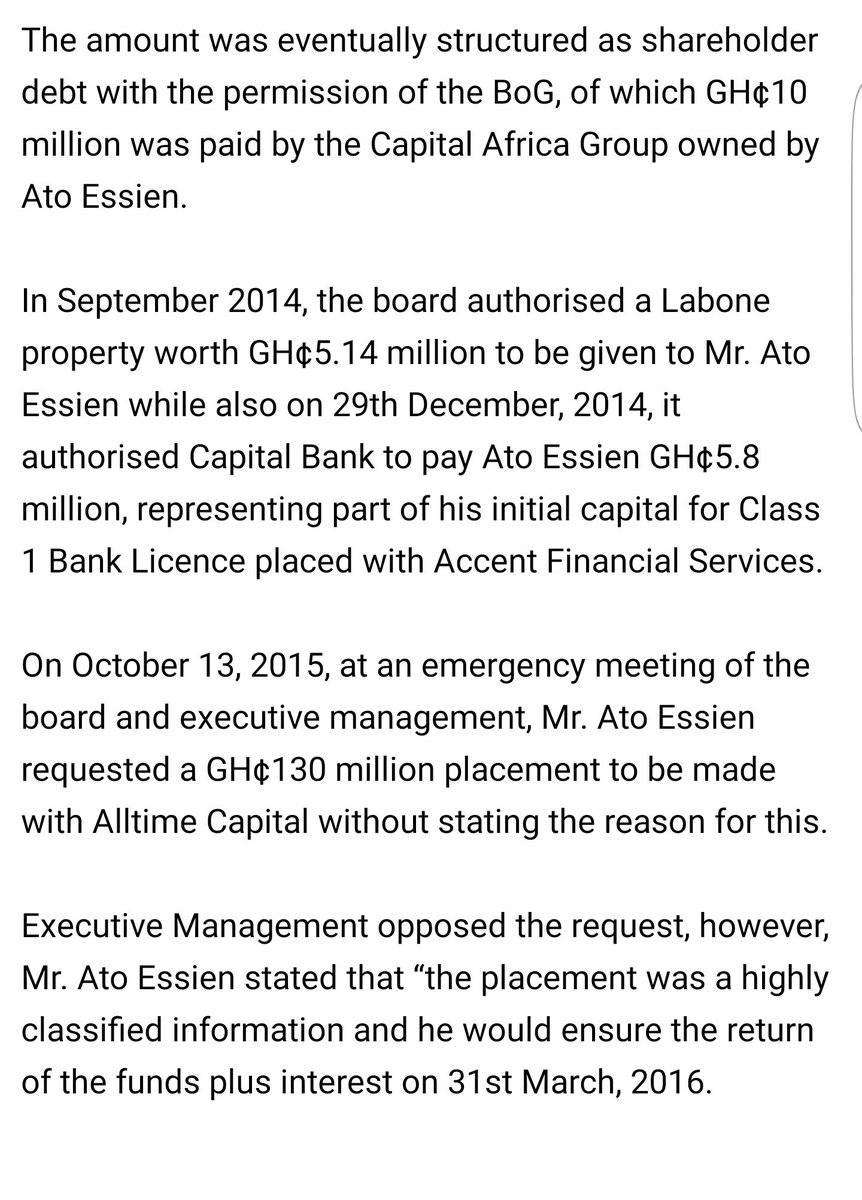

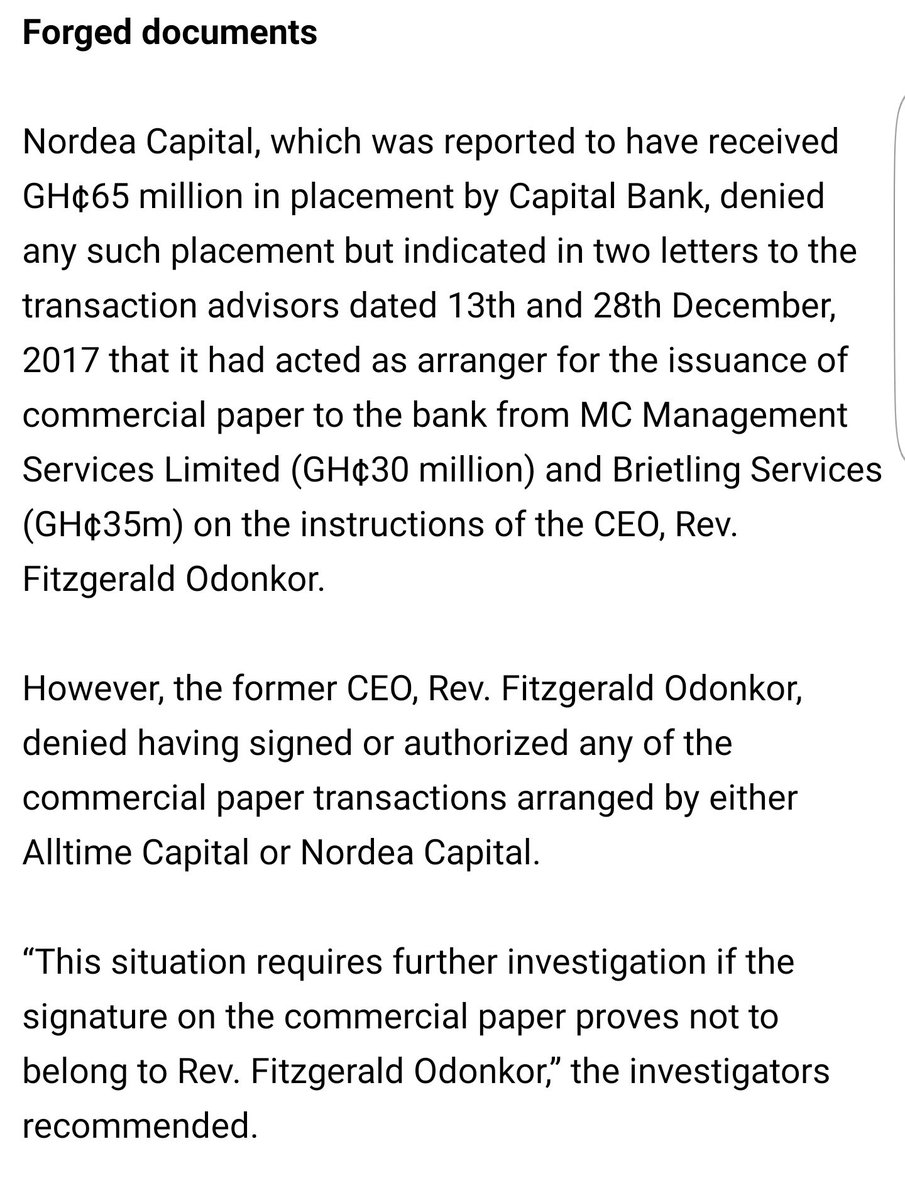

2. Capital Bank. After government gave Capital Bank ¢620 million, they used it to establish Sovereign bank.

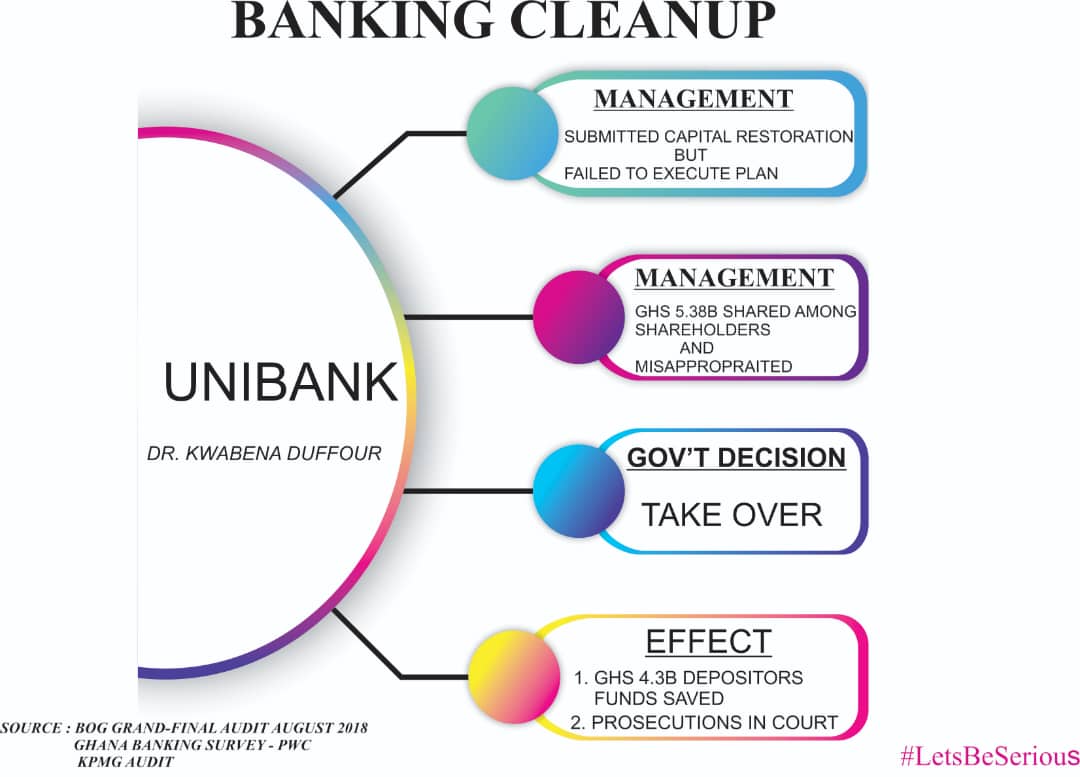

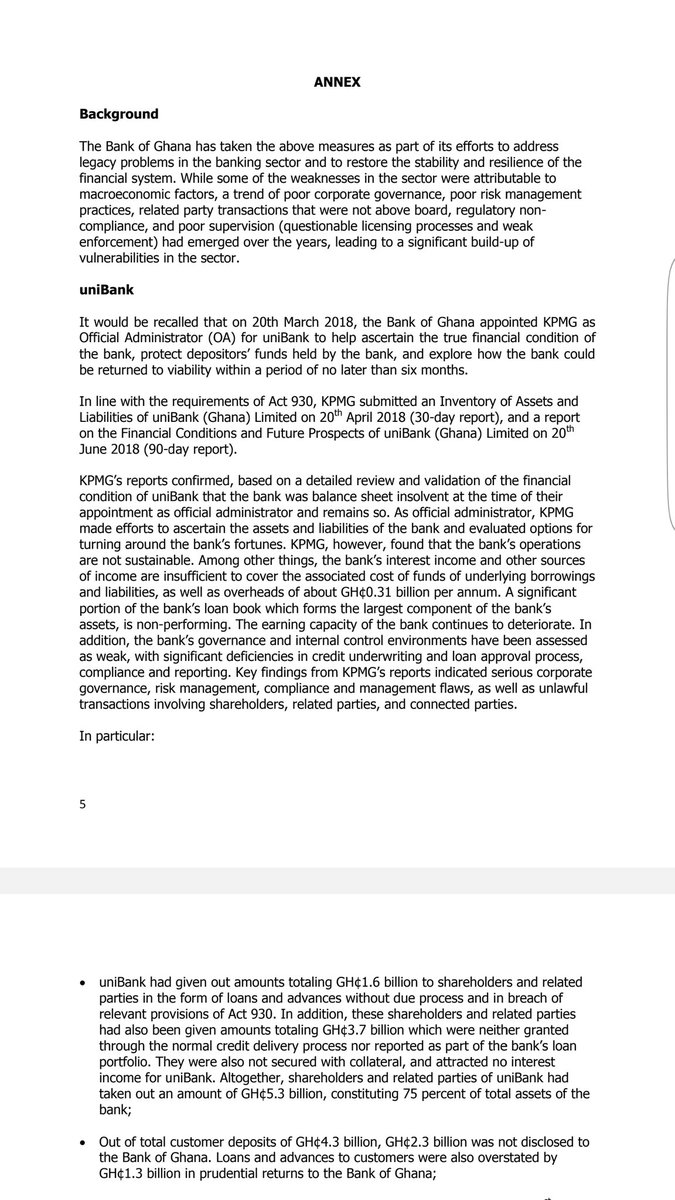

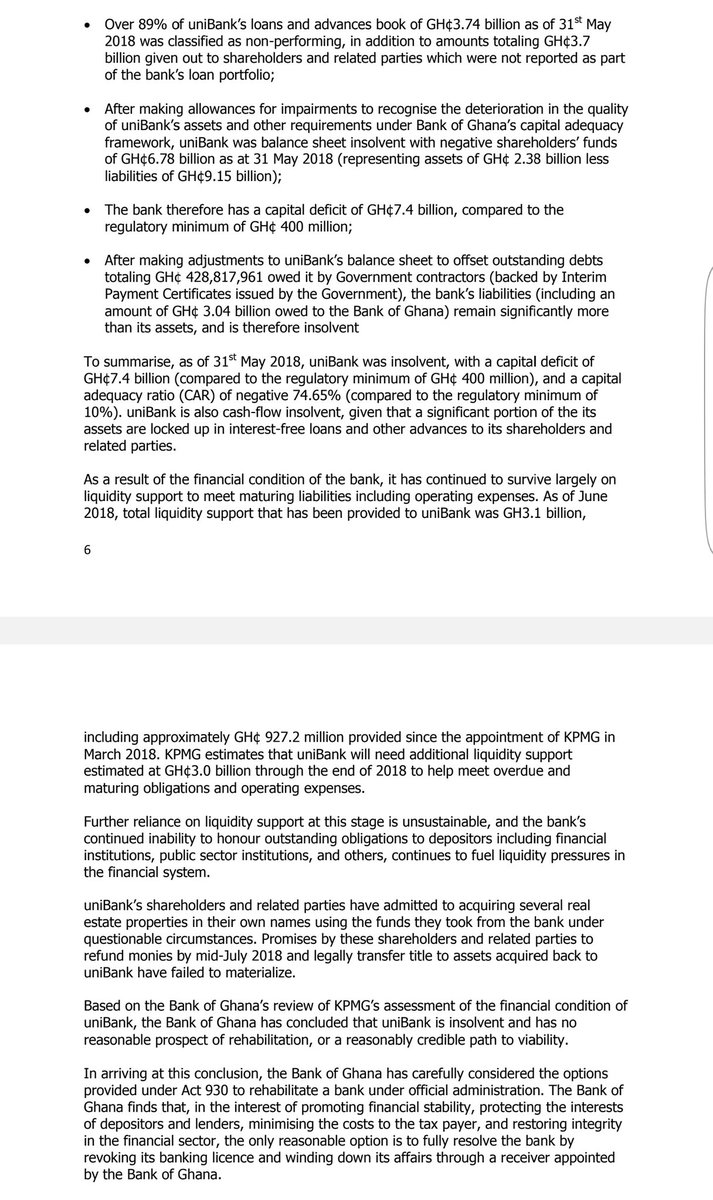

3. Unibank. After KPMG audit, out of total customer deposits of GH¢4.3 billion, GH¢2.3 billion was not disclosed to the Bank of Ghana. Loans and advances to customers were also overstated by GH¢1.3 billion in prudential returns to the Bank of Ghana.

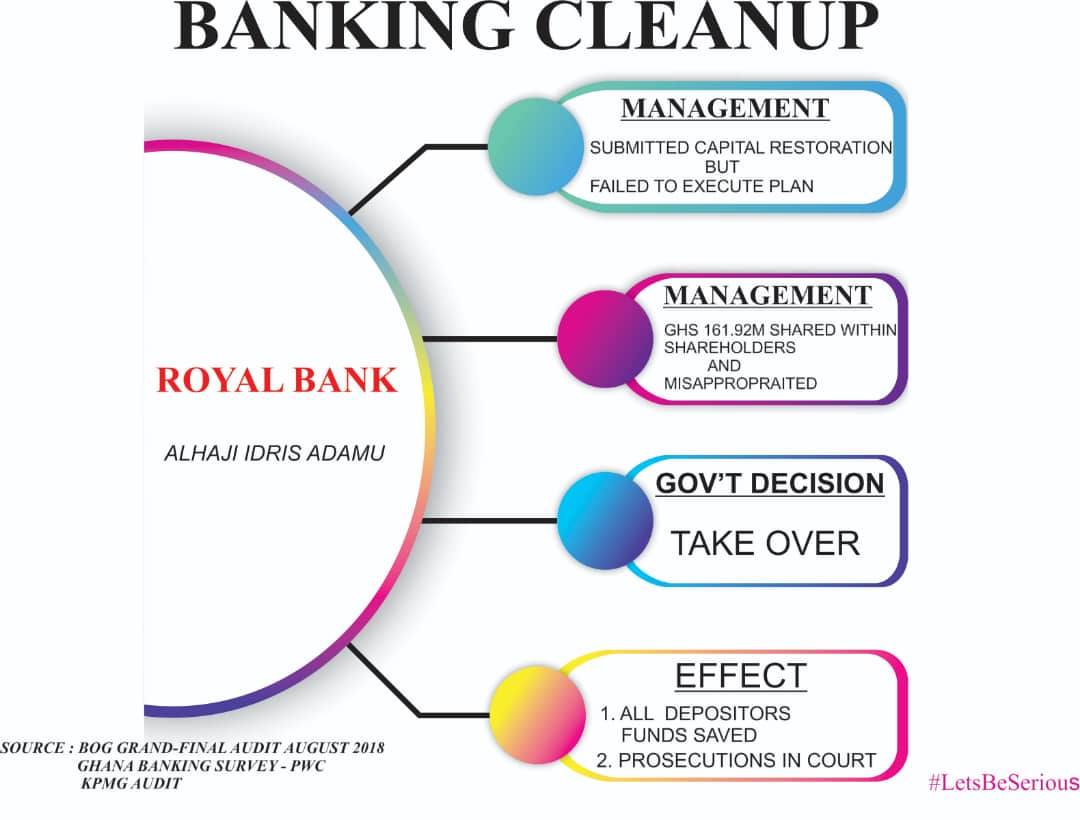

4. Royal Bank. They had an adjusted capital of negative GH¢484 million, yielding a CAR of negative 80.53%. A capital deficiency of GH¢567.78 million and a net-worth of negative GH¢498.63 million.

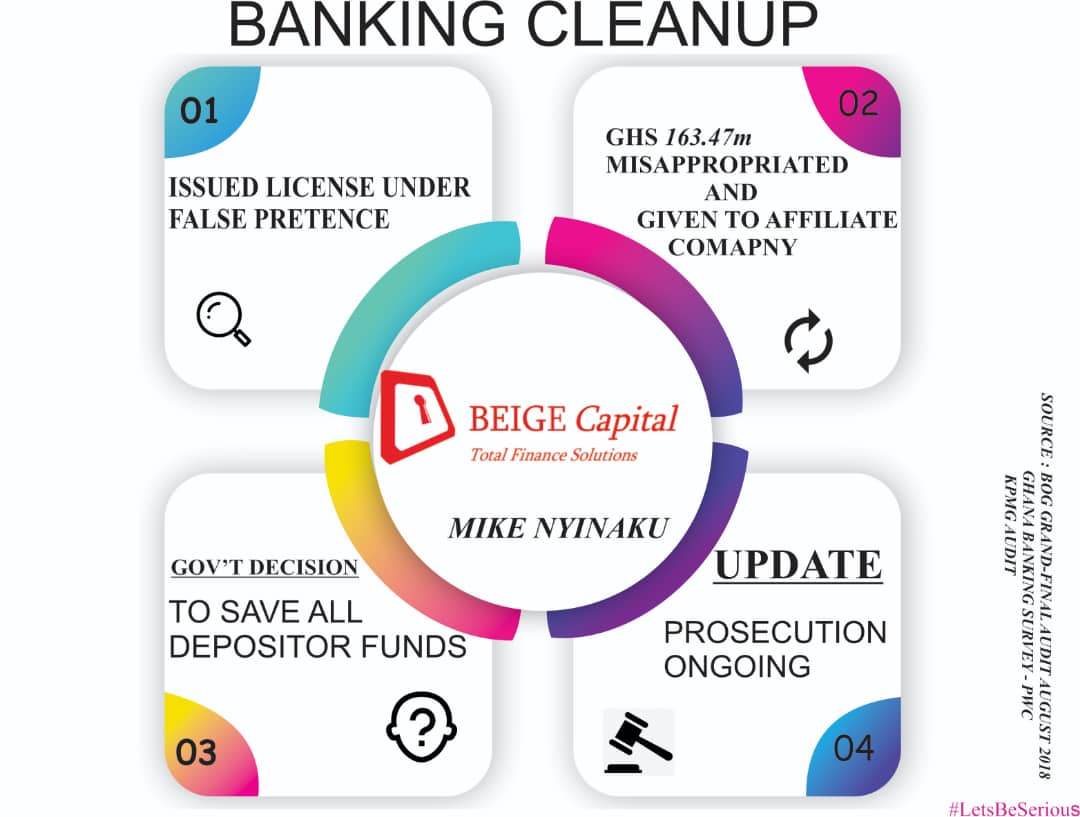

5. Beige Bank. GH¢163.47 million

belonging to depositors of the bank was laundered into one of its affiliate companies. The bank’s Capital Adequacy Ratio was a -17.18% as

against the regulatory minimum of 10%, thus, recording a capital deficit of

GH¢159,162,557.64

belonging to depositors of the bank was laundered into one of its affiliate companies. The bank’s Capital Adequacy Ratio was a -17.18% as

against the regulatory minimum of 10%, thus, recording a capital deficit of

GH¢159,162,557.64

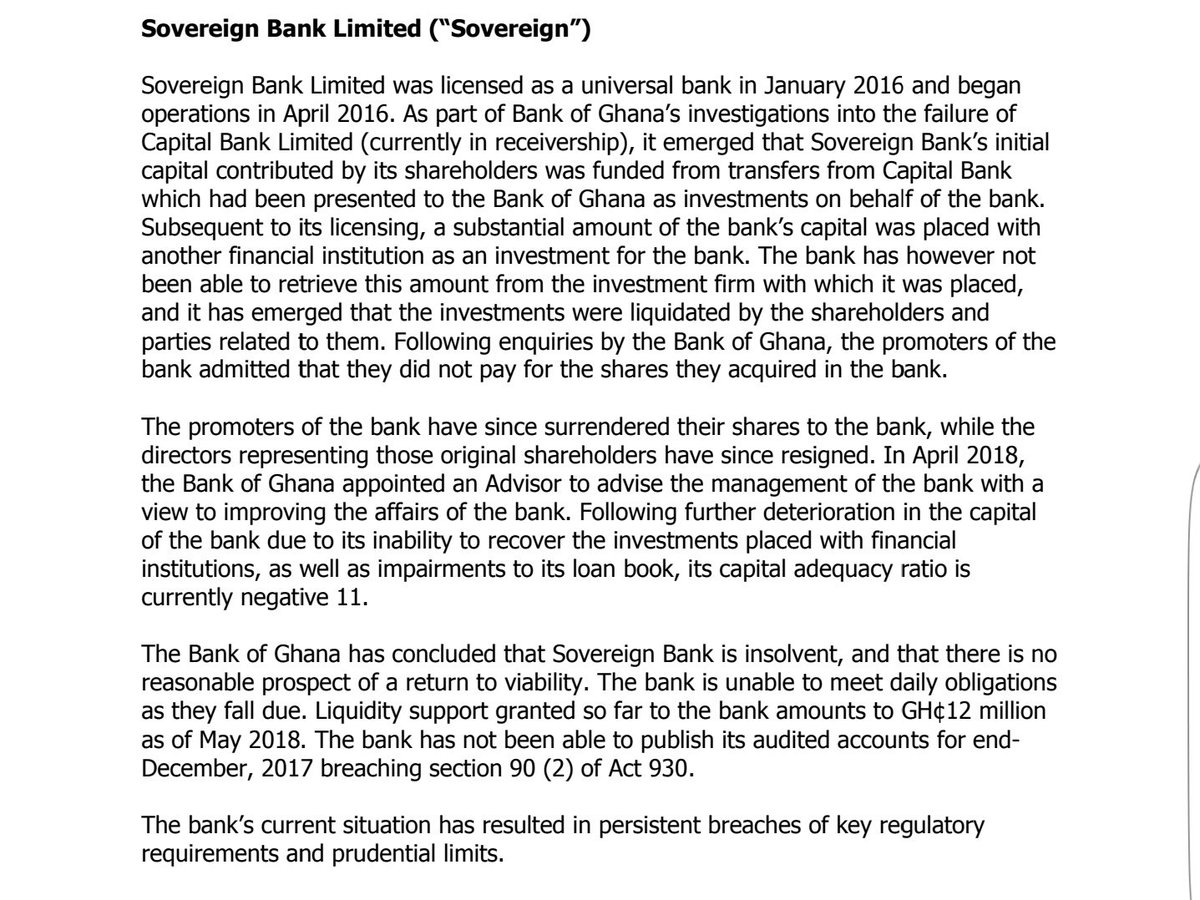

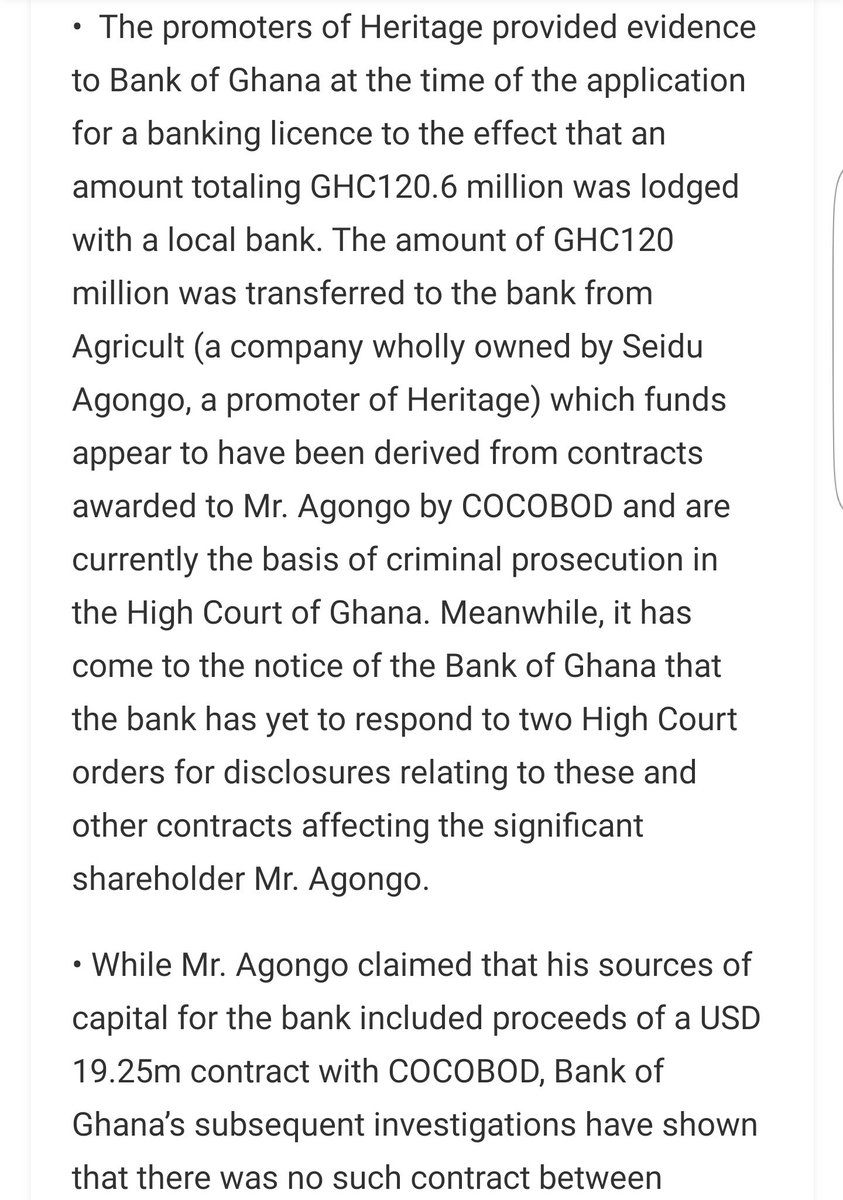

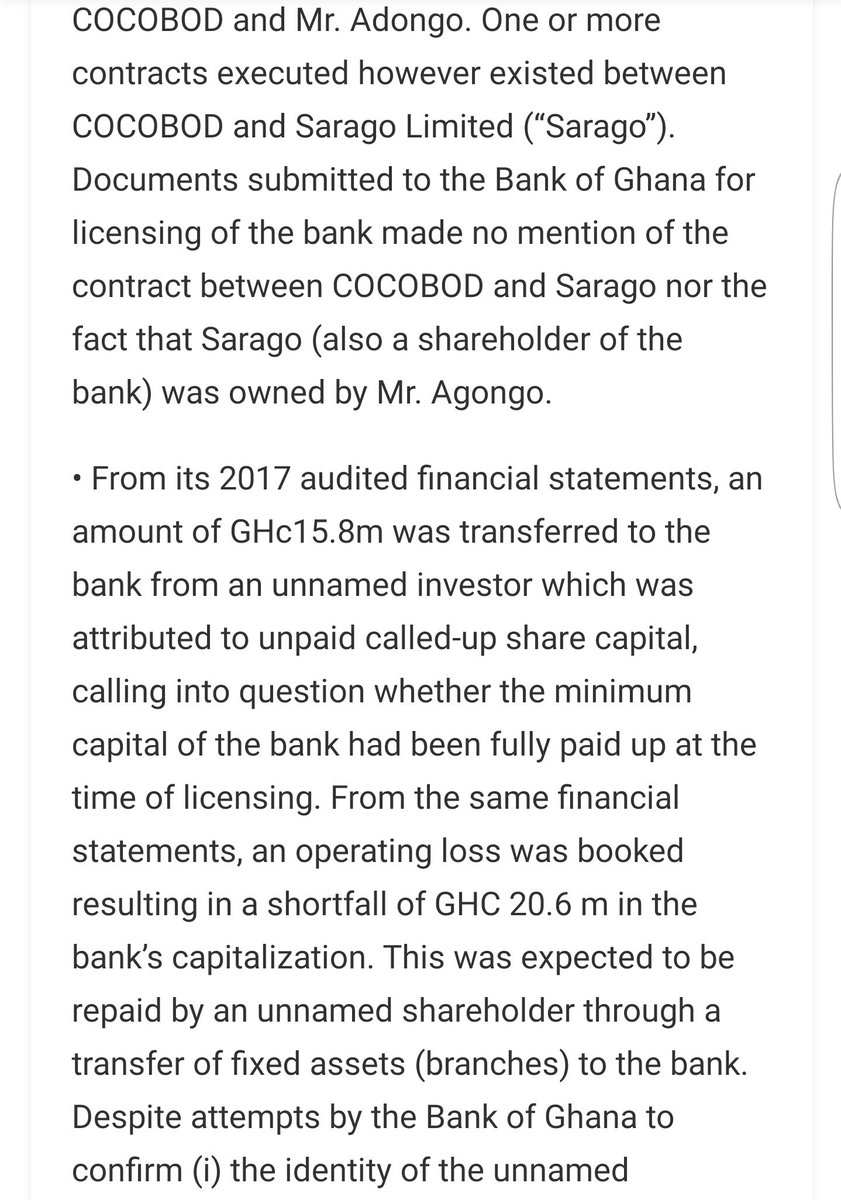

6. Sovereign Bank. This bank was set up under false pretenses. They used the funds BoG gave to Capital Bank to set up. Liquidity support granted by BoG to the bank amounted to GH¢12 million.

Read on Twitter

Read on Twitter