We @DanielaGabor @M_Nikolaidi @YannisDafermos show there is a significant

We offer 2 alternative strategies that would

1/16

Our report was covered by @Bloomberg @Jess_Shankleman:

@CarolineLucas @labourlewis @OwenJones84 @CommonsTreasury @MelJStride @AnnelieseDodds @RishiSunak @Keir_Starmer @SteveBakerHW @angelaeagle @leicesterliz @FelicityBuchan @ab4scambs

2/16 https://www.bloomberg.com/news/articles/2020-08-03/boe-seen-undermining-johnson-s-green-recovery-pledge-with-qe">https://www.bloomberg.com/news/arti...

@CarolineLucas @labourlewis @OwenJones84 @CommonsTreasury @MelJStride @AnnelieseDodds @RishiSunak @Keir_Starmer @SteveBakerHW @angelaeagle @leicesterliz @FelicityBuchan @ab4scambs

2/16 https://www.bloomberg.com/news/articles/2020-08-03/boe-seen-undermining-johnson-s-green-recovery-pledge-with-qe">https://www.bloomberg.com/news/arti...

Just two weeks before announcing the expansion of Corporate QE, Governor Bailey suggested that excluding fossil fuels and re-aligning the Bank’s corporate bond portfolio with the government’s climate goals is a ‘perfectly sensible thing to do’.

3/16 https://twitter.com/i/status/1235243133719457793">https://twitter.com/i/status/...

3/16 https://twitter.com/i/status/1235243133719457793">https://twitter.com/i/status/...

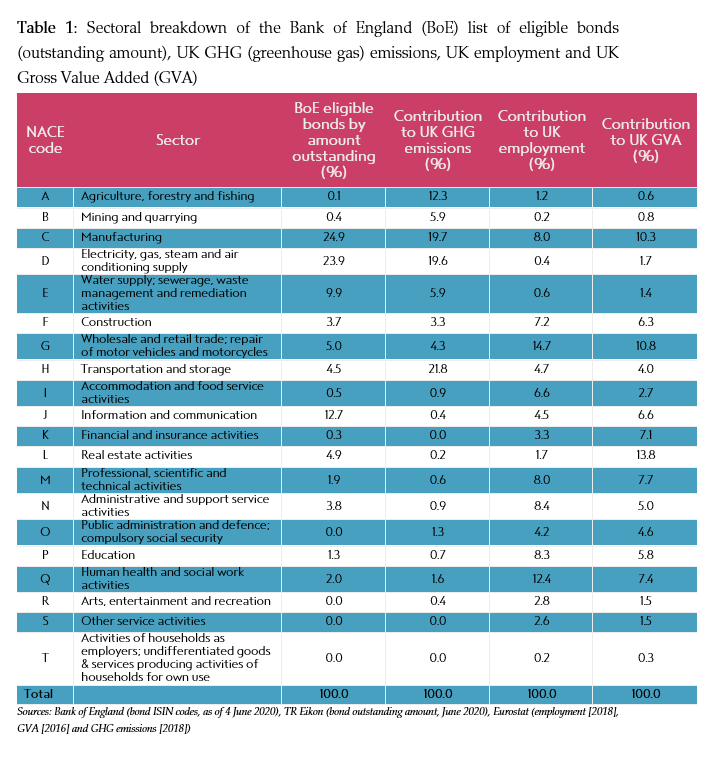

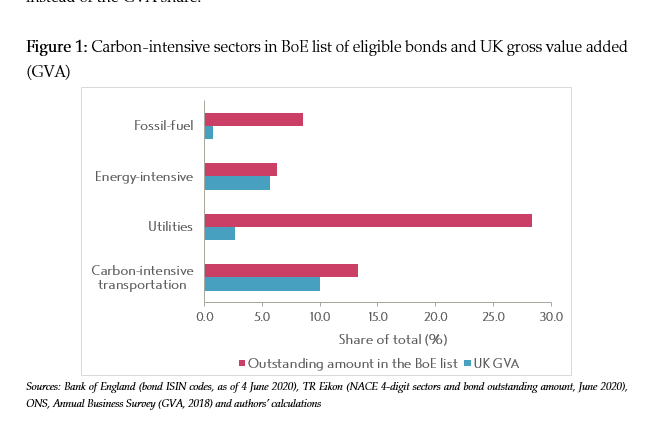

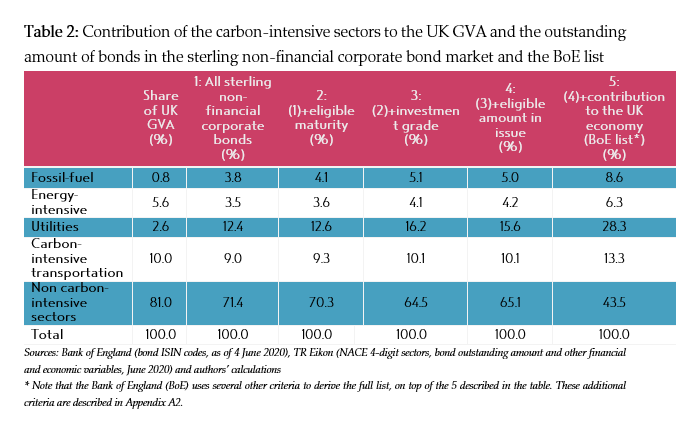

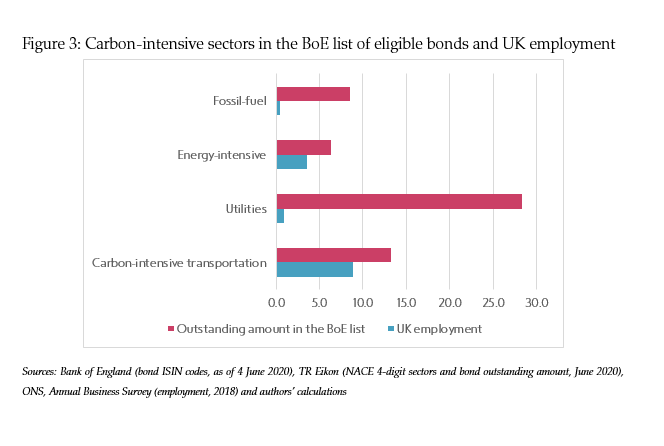

The @bankofengland is pumping £11.4 billion of new money into the dirtiest sectors of the economy. But despite making-up such a large portion of the Corporate QE programme, these dirty sectors actually offer relatively marginal contributions to the UK economy.

4/16

4/16

Approximately 57% of the value of the bonds purchased by the Bank are from the most carbon intensive sectors, but they only represent 13.8% of overall UK employment and contribute 19% to GVA (a metric used to measure the economic contribution of different sectors).

5/16

5/16

While the carbon bias already exists in the universe of bonds, it becomes worse as the eligibility criteria are applied. In particular, the criterion on the contribution to the UK economy (see last column) sharpens the carbon bias significantly.

6/16

6/16

So Corporate QE is heavily skewed towards carbon-intensive sectors. This carbon bias means the program may lower the cost of borrowing (an implicit subsidy) and encourage more debt issuance by the most carbon-intensive firms relative to low carbon firms.

7/16

7/16

So it is perfectly sensible to green QE! Not least b/c:

1) Its actively at odds w/ democratically defined environmental objectives

2) Reinforces climate related financial risks- its inconsistent w/ the own BoE’s policy rehotoric

3) A missed opportunity to #BuildBackBetter

8/16

1) Its actively at odds w/ democratically defined environmental objectives

2) Reinforces climate related financial risks- its inconsistent w/ the own BoE’s policy rehotoric

3) A missed opportunity to #BuildBackBetter

8/16

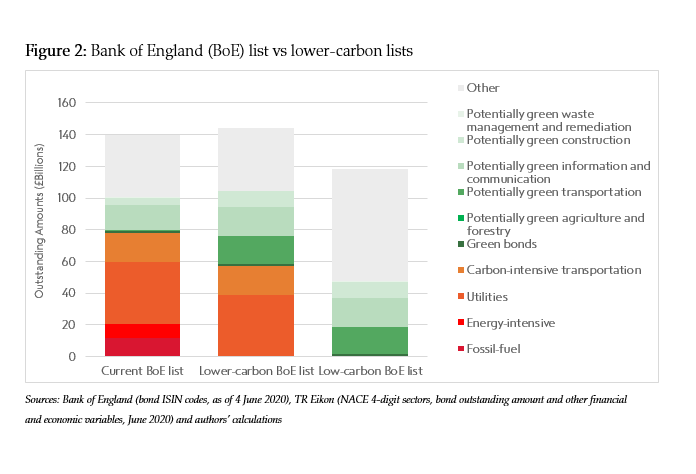

We recognise that the Bank is serious about cleaning up its balance sheet – so we come up with two alternative purchase strategies:

1) Excludes dirtiest - fossil fuel and energy intensive bonds.

2) Excludes the vast majority of bonds issued by all carbon-intensive sectors.

9/16

1) Excludes dirtiest - fossil fuel and energy intensive bonds.

2) Excludes the vast majority of bonds issued by all carbon-intensive sectors.

9/16

(We also add bonds issued by sectors that are not carbon-intensive. All the bonds that we have added meet the Bank’s main criteria: they are all sterling non-financial, investment grade and are eligible according to their maturity and amount in issue.)

10/16

10/16

The common retort - you might ask: What about those dirty companies that are serious and want to support a green transition? In our framework, carbon-intensive sectors could still be included in the @BankofEngland purchases as long as they issue green bonds.

11/16

11/16

Apart from changing the structure of the existing QE programme, the Bank could also run a separate permanent corporate QE programme with an explicit aim of supporting green bonds on a persistent, long-term basis.

12/16

https://www.feps-europe.eu/attachments/publications/feps%20gperc%20policybriefgreenqe.pdf">https://www.feps-europe.eu/attachmen...

12/16

https://www.feps-europe.eu/attachments/publications/feps%20gperc%20policybriefgreenqe.pdf">https://www.feps-europe.eu/attachmen...

Low-carbon and green corporate QE programmes would not in any case be sufficient to ensure the transition to a low-carbon economy. Fiscal policies have a stronger and more substantial role to play in achieving such a transition quickly.

13/16 https://neweconomics.org/2020/07/building-a-green-stimulus-for-covid19">https://neweconomics.org/2020/07/b...

13/16 https://neweconomics.org/2020/07/building-a-green-stimulus-for-covid19">https://neweconomics.org/2020/07/b...

But the urgency of the climate crisis requires that all policy tools are used for the purpose of avoiding a climate breakdown. Decarbonisation of the Bank& #39;s QE would also provide a very clear signal to financial markets that the era of ‘dirty’ finance is coming to an end.

14/16

14/16

The full report is available here: https://neweconomics.org/2020/08/decarbonising-the-bank-of-englands-pandemic-qe

15/16">https://neweconomics.org/2020/08/d...

15/16">https://neweconomics.org/2020/08/d...

And accessible @NEF blog here: https://neweconomics.org/2020/08/road-to-recovery

16/16">https://neweconomics.org/2020/08/r...

16/16">https://neweconomics.org/2020/08/r...

Read on Twitter

Read on Twitter NEW BRIEFhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">: Decarbonsing the @bankofengland& #39;s Pandemic QE: "Perfectly Sensible?"We @DanielaGabor @M_Nikolaidi @YannisDafermos show there is a significant https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund">CARBON BIAShttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund"> to Corporate QE. We offer 2 alternative strategies that would https://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt">GREENhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt"> corporate QE. 1/16" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">NEW BRIEFhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">: Decarbonsing the @bankofengland& #39;s Pandemic QE: "Perfectly Sensible?"We @DanielaGabor @M_Nikolaidi @YannisDafermos show there is a significant https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund">CARBON BIAShttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund"> to Corporate QE. We offer 2 alternative strategies that would https://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt">GREENhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt"> corporate QE. 1/16" class="img-responsive" style="max-width:100%;"/>

NEW BRIEFhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">: Decarbonsing the @bankofengland& #39;s Pandemic QE: "Perfectly Sensible?"We @DanielaGabor @M_Nikolaidi @YannisDafermos show there is a significant https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund">CARBON BIAShttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund"> to Corporate QE. We offer 2 alternative strategies that would https://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt">GREENhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt"> corporate QE. 1/16" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">NEW BRIEFhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔥" title="Feuer" aria-label="Emoji: Feuer">: Decarbonsing the @bankofengland& #39;s Pandemic QE: "Perfectly Sensible?"We @DanielaGabor @M_Nikolaidi @YannisDafermos show there is a significant https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund">CARBON BIAShttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤬" title="Gesicht mit Symbolen über dem Mund" aria-label="Emoji: Gesicht mit Symbolen über dem Mund"> to Corporate QE. We offer 2 alternative strategies that would https://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt">GREENhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="☘️" title="Kleeblatt" aria-label="Emoji: Kleeblatt"> corporate QE. 1/16" class="img-responsive" style="max-width:100%;"/>