Monthly business surveys like the #PMI are increasingly appearing disconnected from reality. Here’s why these numbers are a mirage.

THREAD 1/8 https://www.barrons.com/articles/why-pmis-keep-predicting-a-v-shaped-recovery-despite-the-coronavirus-recession-51596110776">https://www.barrons.com/articles/...

THREAD 1/8 https://www.barrons.com/articles/why-pmis-keep-predicting-a-v-shaped-recovery-despite-the-coronavirus-recession-51596110776">https://www.barrons.com/articles/...

2/8: Biz surveys suffer many metho problems investors have ignored in their thirst for one data point that captures an entire economy. *KEY* issue: they only measure m/m change & cannot explain Q/Q or Y/Y changes—what official economic data measure—bc they don’t poll on that.

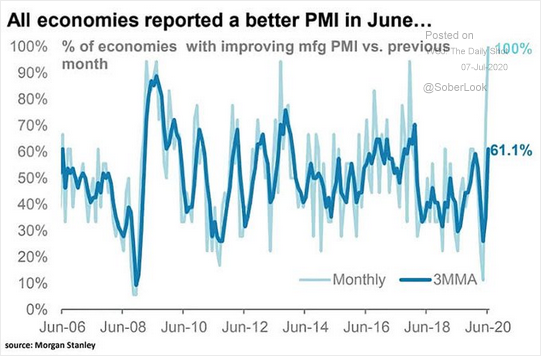

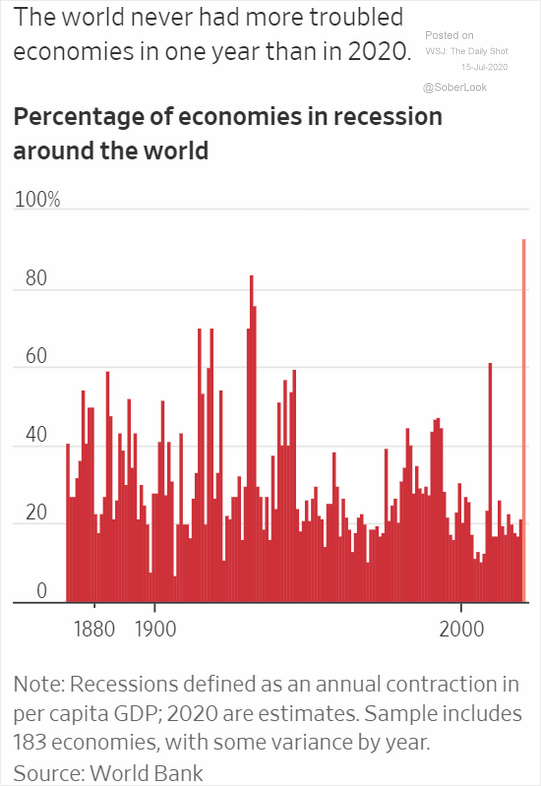

100% of PMIs improved in Jun + the @jpmorgan Global PMI showed recovery YET *93%* of the world’s economies were in a *RECESSION*. So are economies recovering or weakening? PMIs can& #39;t reliably answer that. @ChinaBeigeBook (TY @SoberLook for the charts.)

https://www.barrons.com/articles/why-pmis-keep-predicting-a-v-shaped-recovery-despite-the-coronavirus-recession-51596110776">https://www.barrons.com/articles/...

https://www.barrons.com/articles/why-pmis-keep-predicting-a-v-shaped-recovery-despite-the-coronavirus-recession-51596110776">https://www.barrons.com/articles/...

3/8: E.g. #China’s official #PMI shows sustained recovery, but latest @ChinaBeigeBook data signaled an uneven rebound by surveying firms on Q/Q and Y/Y changes in business performance. For example, industrial output was up over Q1 but down by *double-digits* over 2Q19.

4/8: These polls also only provide directional data—if conditions are better, the same, or worse—& offer no insight on the magnitude of expansion or contraction. As a result, these monthly numbers can exaggerate the strength or weakness of an economy.

5/8: Many PMIs don& #39;t report underlying data, suppressing crucial trends. E.g. CBB showed sales up at 30% of firms v. down at 33%. >1/4 of latter saw a 10%+ decline. These granular + quantifiable measures cut against the bullish outlook catalyzed by single-digit PMIs. @TheStalwart

7/8: Enterprise polls repeatedly survey a few hundred firms in a panel, rather than either randomly selecting respondents or at least drawing in fresh respondents each cycle. This magnifies the issue of nonresponse bias in the results.

8/8: PMs should carefully evaluate different polls and weight their role in models and investments accordingly. The business survey industry is in dire need of standard-setting, including guidelines on transparency and best practices.

6/8: Biz surveys also suffer from lack of transparency on methods. E.g. @ism does not publicly release the sample sizes. China& #39;s NBS offers no data on sample composition. (NBS PMIs bias toward large SOEs and @IHSMarkitPMI bias toward private SMEs is documented.)

Read on Twitter

Read on Twitter