Many are asking why, even though the CARES Act set an expiration date for UI benefits four months in the future, Congress did not begin negotiating until the week it expired.

Welcome to the wonderful world of waiting for federal UI reform. Our story begins in 1976.

(thread)

1/

Welcome to the wonderful world of waiting for federal UI reform. Our story begins in 1976.

(thread)

1/

The economy was recovering from a devastating recession. The Unemployment Compensation Amendments of 1976 increased UI taxes and expanded UI coverage to workers in SUA, an emergency program set up during the recession to cover workers who were not already covered.

2/

2/

But Congress also recognized that UI, a program that was then 40 years old, needed to be reformed. The 1976 Amendments created the National Commission on Unemployment Compensation (NCUC) with the mandate to design comprehensive reform.

3/

https://www.ssa.gov/policy/docs/ssb/v40n2/v40n2p22.pdf">https://www.ssa.gov/policy/do...

3/

https://www.ssa.gov/policy/docs/ssb/v40n2/v40n2p22.pdf">https://www.ssa.gov/policy/do...

The NCUC released their findings in 1980. A sample of their recommendations:

- increase states& #39; maximum benefit to 2/3 average earnings in a state

- change the status of independent contractors so that they pay into and are covered by the program

4/

- increase states& #39; maximum benefit to 2/3 average earnings in a state

- change the status of independent contractors so that they pay into and are covered by the program

4/

- design the minimum earnings eligibility so that minimum wage workers qualify for benefits

- and more:

https://oui.doleta.gov/dmstree/misc_papers/advisory/ncuc/uc_studies_and_research/ncuc-final.pdf

In">https://oui.doleta.gov/dmstree/m... the end, Congress adopted none of the proposed reforms.

5/

- and more:

https://oui.doleta.gov/dmstree/misc_papers/advisory/ncuc/uc_studies_and_research/ncuc-final.pdf

In">https://oui.doleta.gov/dmstree/m... the end, Congress adopted none of the proposed reforms.

5/

Instead, they started charging interest on loans. When a state& #39;s trust fund runs low, like during a recession, they (typically) get an interest free loan from the feds that the state pays back when the recession is over. Now (after a period), the feds would charge interest.

6/

6/

As a result, many states increased the minimum earnings requirement for eligibility so as to reduce claimants.

The GAO warned that the low-tax, low-benefit policy compromised the program& #39;s effectiveness.

https://www.gao.gov/products/HRD-93-107

7/">https://www.gao.gov/products/...

The GAO warned that the low-tax, low-benefit policy compromised the program& #39;s effectiveness.

https://www.gao.gov/products/HRD-93-107

7/">https://www.gao.gov/products/...

Fast forward to 1991: the US is recovering from a devastating recession. UI, then nearly 60 years old, still needed to be reformed. The transition from an industrial to service economy and the increase in female labor force participation had changed work and workers.

8/

8/

So yes, Congress created another commission on UI reform, this one called the Advisory Council on Unemployment Compensation (ACUC). The commission released recommendations in 1994, 1995, and 1996.

https://oui.doleta.gov/dmstree/misc_papers/advisory/acuc/collected_findings/adv_council_94-96.pdf

9/">https://oui.doleta.gov/dmstree/m...

https://oui.doleta.gov/dmstree/misc_papers/advisory/acuc/collected_findings/adv_council_94-96.pdf

9/">https://oui.doleta.gov/dmstree/m...

It included many of the same reforms of the 1980 report about expanded benefits and how to shore up state trust fund balances.

These reforms were quickly enacted by Congress.

.

.

.

.

.

Obviously I& #39;m kidding! Like the NCUC, none of the ACUC recommendations were enacted.

10/

These reforms were quickly enacted by Congress.

.

.

.

.

.

Obviously I& #39;m kidding! Like the NCUC, none of the ACUC recommendations were enacted.

10/

So the Great Recession---did we get another unemployment commission?!

No. (But, the Organization for Economic Cooperation and Development (OECD) reviewed UI in 2016 and recommended, among other things, that we create a commission to study UI reform.)

11/ #page1">https://read.oecd-ilibrary.org/employment/back-to-work-united-states_9789264266513-en #page1">https://read.oecd-ilibrary.org/employmen...

No. (But, the Organization for Economic Cooperation and Development (OECD) reviewed UI in 2016 and recommended, among other things, that we create a commission to study UI reform.)

11/ #page1">https://read.oecd-ilibrary.org/employment/back-to-work-united-states_9789264266513-en #page1">https://read.oecd-ilibrary.org/employmen...

In 2020, when it became clear that the pandemic would induce something akin to the Great Depression in our labor market, there were 40 years of UI reforms to catch up on. Many CARES Act provisions were “cousins” of the ignored commissions, enacted in the fastest way possible.

12/

12/

For example, had UI formally incorporated independent contractors (rec: 1980) or set earnings eligibility test at the minimum wage (rec: 1994), PUA, the catchall for workers who don& #39;t qualify for regular UI, would be much smaller. As it is, PUA makes up half of UI recipients.

13/

13/

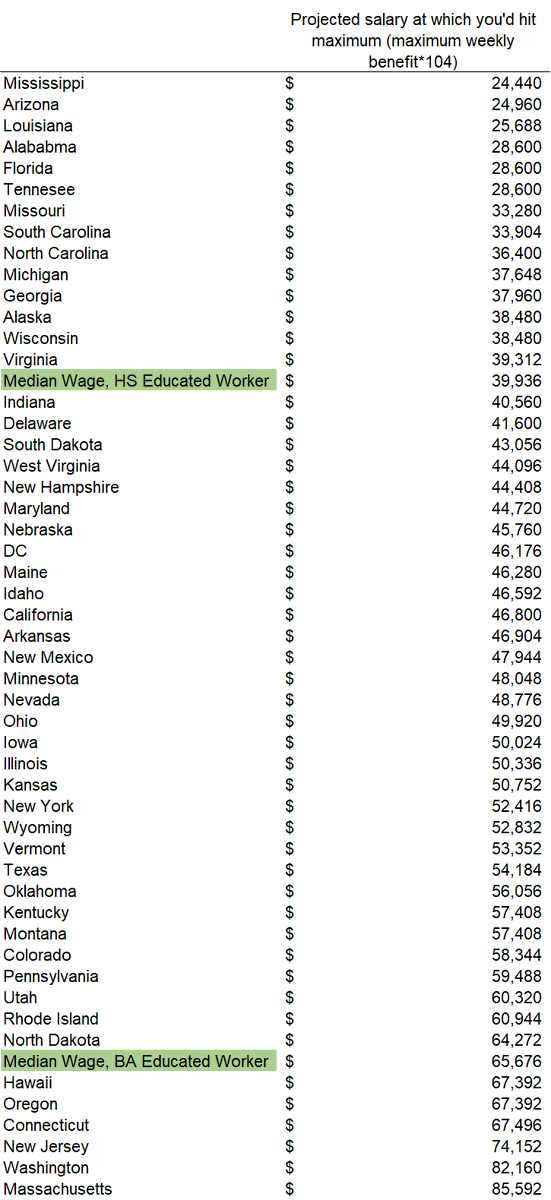

Or, had states been required to set the minimum benefit at 50% of the state& #39;s average wage and maximum benefit at 66% (rec:1994), the need for a flat federal add-on would be (in my opinion) much lower. As it is, 14 states don& #39;t replace half of earnings for the median HS grad.

14/

14/

I& #39;ve noted before 1) the $600 add-on is vital to the economy right now and 2) that there is no evidence that it& #39;s holding back employment yet.

But I think it& #39;s important to note what I present here, 3) the federal add-on is as much a product of neglected but needed reform.

But I think it& #39;s important to note what I present here, 3) the federal add-on is as much a product of neglected but needed reform.

Sources, 1:

@UpjohnInstitute has a great history of federal neglect of UI

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3477213

That">https://papers.ssrn.com/sol3/pape... PUA is half of current beneficiaries can be found in the latest release

https://www.dol.gov/ui/data.pdf ">https://www.dol.gov/ui/data.p...

@UpjohnInstitute has a great history of federal neglect of UI

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3477213

That">https://papers.ssrn.com/sol3/pape... PUA is half of current beneficiaries can be found in the latest release

https://www.dol.gov/ui/data.pdf ">https://www.dol.gov/ui/data.p...

Sources, 2:

The three volumes of the ACUC:

https://research.upjohn.org/cgi/viewcontent.cgi?article=1002&context=externalpapers

https://research.upjohn.org/cgi/viewc... href=" https://research.upjohn.org/cgi/viewcontent.cgi?article=1003&context=externalpapers

https://research.upjohn.org/cgi/viewc... href=" https://research.upjohn.org/cgi/viewcontent.cgi?article=1001&context=externalpapers

The">https://research.upjohn.org/cgi/viewc... final background volume has a historical overview that discusses increasing eligibility due to trust fund shortfalls

https://oui.doleta.gov/dmstree/misc_papers/advisory/acuc/background/acuc0196vol4.pdf">https://oui.doleta.gov/dmstree/m...

The three volumes of the ACUC:

https://research.upjohn.org/cgi/viewcontent.cgi?article=1002&context=externalpapers

The">https://research.upjohn.org/cgi/viewc... final background volume has a historical overview that discusses increasing eligibility due to trust fund shortfalls

https://oui.doleta.gov/dmstree/misc_papers/advisory/acuc/background/acuc0196vol4.pdf">https://oui.doleta.gov/dmstree/m...

Sources, 3:

The increase in women& #39;s labor force participation is summarized here

https://www.bls.gov/spotlight/2017/women-in-the-workforce-before-during-and-after-the-great-recession/pdf/women-in-the-workforce-before-during-and-after-the-great-recession.pdf">https://www.bls.gov/spotlight...

The increase in women& #39;s labor force participation is summarized here

https://www.bls.gov/spotlight/2017/women-in-the-workforce-before-during-and-after-the-great-recession/pdf/women-in-the-workforce-before-during-and-after-the-great-recession.pdf">https://www.bls.gov/spotlight...

Oh, and the UI maximum benefit amounts for 2020 can be found here:

https://oui.doleta.gov/unemploy/content/sigpros/2020-2029/January2020.pdf">https://oui.doleta.gov/unemploy/...

https://oui.doleta.gov/unemploy/content/sigpros/2020-2029/January2020.pdf">https://oui.doleta.gov/unemploy/...

Read on Twitter

Read on Twitter