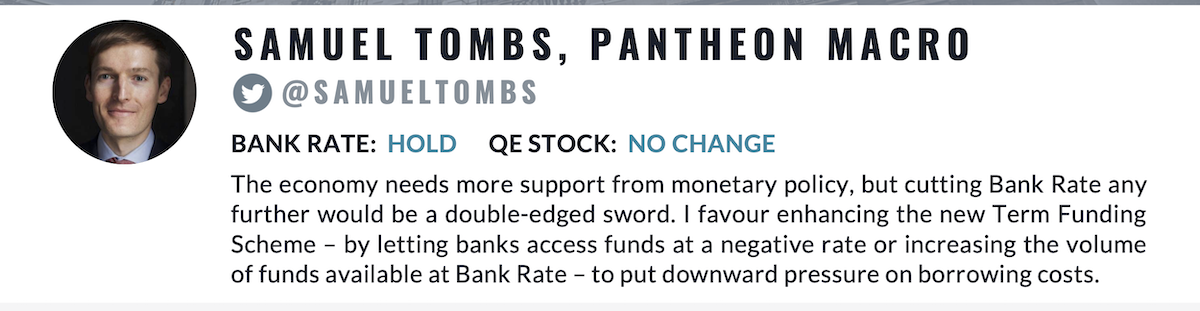

@samueltombs Economy needs more support from monetary policy but cutting Bank Rate further would be a double-edged sword. I favour enhancing the new Term Funding Scheme – by letting banks access funds at a negative rate or increasing the volume of funds available at Bank Rate 2/

@Macrodesiac_ Little that a rate cut can do at this stage. Will hit 0% at some point – but that point is not now. Waiting out to see what kind of Brexit deal we get by year-end. Probably want to save the 10bps & #39;bazooka& #39; cut for then – even if it will be ineffectual 3/

@EqualsFX Subsequent demand pressures may risk an inflation undershoot within forecast period but policy action to stimulate inflation can wait until the balance is clearer. By the end of the year, Brexit risks will again heighten and fiscal impetus is forecast to have waned 4/

@lizzzburden Negative rates may be under active review but now is not the right time for further monetary stimulus. MPC should keep what& #39;s left of its powder dry for later in the year in case of a potential spike in unemployment when the furlough scheme ends 5/

@adamlinton1 Any adjustment below 0.1% is unlikely at this juncture given the symbolism in doing so. Balance sheet remains the tool of choice for now and policymakers should keep their powder dry for later in the year when economic turbulence could return again 6/

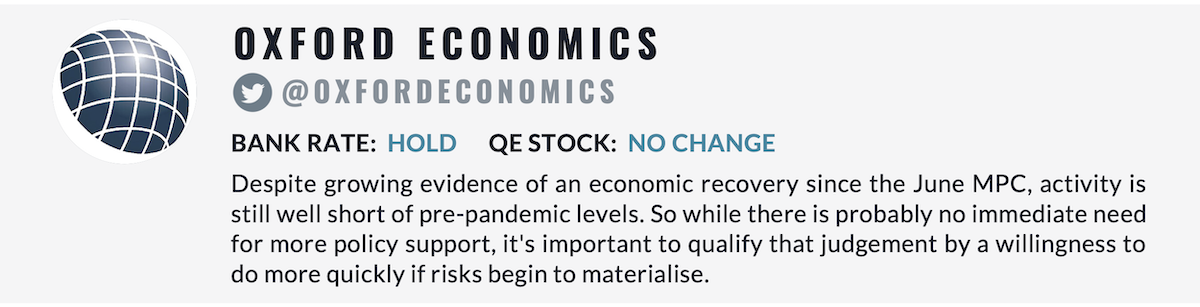

@GauravSaroliya Despite growing evidence of a recovery since June - activity still well short of pre-pandemic levels. While there& #39;s no immediate need for more policy support, important to qualify that judgement by a willingness to do more quickly if downside risks materialise 7/

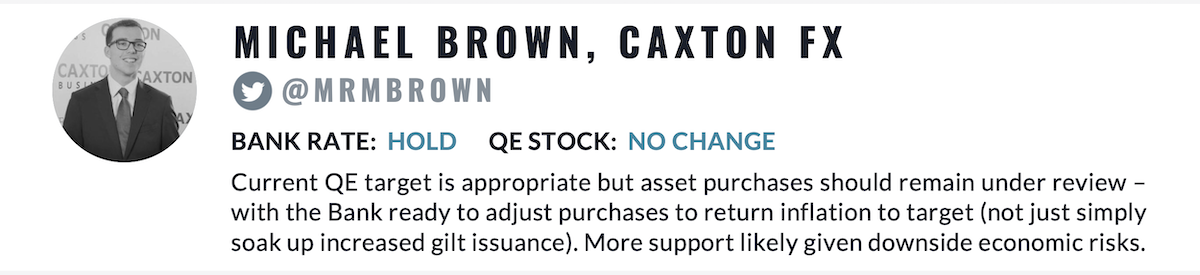

@MrMBrown Current QE target is appropriate but asset purchases should remain under review – with the Bank ready to adjust purchases to return inflation to target (not just simply soak up increased gilt issuance). More support likely given downside economic risks 8/

@VPatelFX Balance of risks is that more (not less) monetary easing will be the next move. As COVID 2nd wave & Brexit economic risks mount, watch gilt markets closely for signs of dysfunction that requires a step-up in the weekly pace of QE purchases which has halved since July 9/

@PriapusIQ Absolutely no reason to cut now and firmly in the & #39;wait and see& #39; camp. Against any action to lower rates into negative territory and YCC. Crucial that tools stay in the box as we assess the virological and economical impacts through autumn/winter 10/

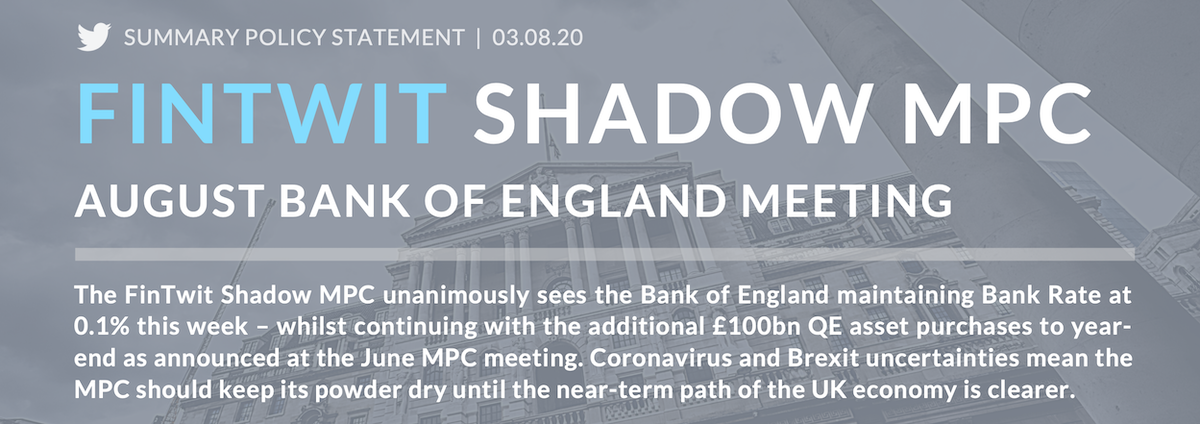

Summary: Coronavirus & Brexit uncertainties mean the MPC should keep its powder dry until the near-term path of the UK economy is clearer - but the Bank should express a willingness to provide additional monetary stimulus should downside risks to the UK economy materialise 11/

Check out the blog for the full range of views and analysis by each individual analyst. Huge thanks to @samueltombs @macrodesiac_ @equalsfx @lizzzburden @Adamlinton1 @GauravSaroliya @MrMBrown @PriapusIQ for participating in the FinTwit Shadow MPC  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands"> [END] https://medium.com/@VPatelFX/fintwit-shadow-mpc-august-bank-of-england-meeting-a9a2c0101c64?source=friends_link&sk=5f048db66029538d7637491af2365ab6">https://medium.com/@VPatelFX...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands"> [END] https://medium.com/@VPatelFX/fintwit-shadow-mpc-august-bank-of-england-meeting-a9a2c0101c64?source=friends_link&sk=5f048db66029538d7637491af2365ab6">https://medium.com/@VPatelFX...

Read on Twitter

Read on Twitter