Started an incredible new series ‘Gradually, Then Suddenly’ by @ParkerALewis, about the global financial system and its future.

The essay discusses our current risks, why the market hasn’t priced them in & his best recommendation for protecting wealth.

Here’s a summary.

The essay discusses our current risks, why the market hasn’t priced them in & his best recommendation for protecting wealth.

Here’s a summary.

2/ & #39;Enders Game& #39;

This is the prequel to the series, a 36 pager written in 2017, highlighting the coming dollar crisis, a history of our monetary policy and how it brought us to today.

Nothing has been changed, yet it remains very relevant. It& #39;s impressive how spot on he is.

This is the prequel to the series, a 36 pager written in 2017, highlighting the coming dollar crisis, a history of our monetary policy and how it brought us to today.

Nothing has been changed, yet it remains very relevant. It& #39;s impressive how spot on he is.

3/ Interest Rates

Since the 1980’s during each recession the Fed lowered interest rates to spur demand.

With each passing cycle interest rates never reached the levels prior to the previous one.

Because the credit system was larger, a higher burden couldn’t be sustained.

Since the 1980’s during each recession the Fed lowered interest rates to spur demand.

With each passing cycle interest rates never reached the levels prior to the previous one.

Because the credit system was larger, a higher burden couldn’t be sustained.

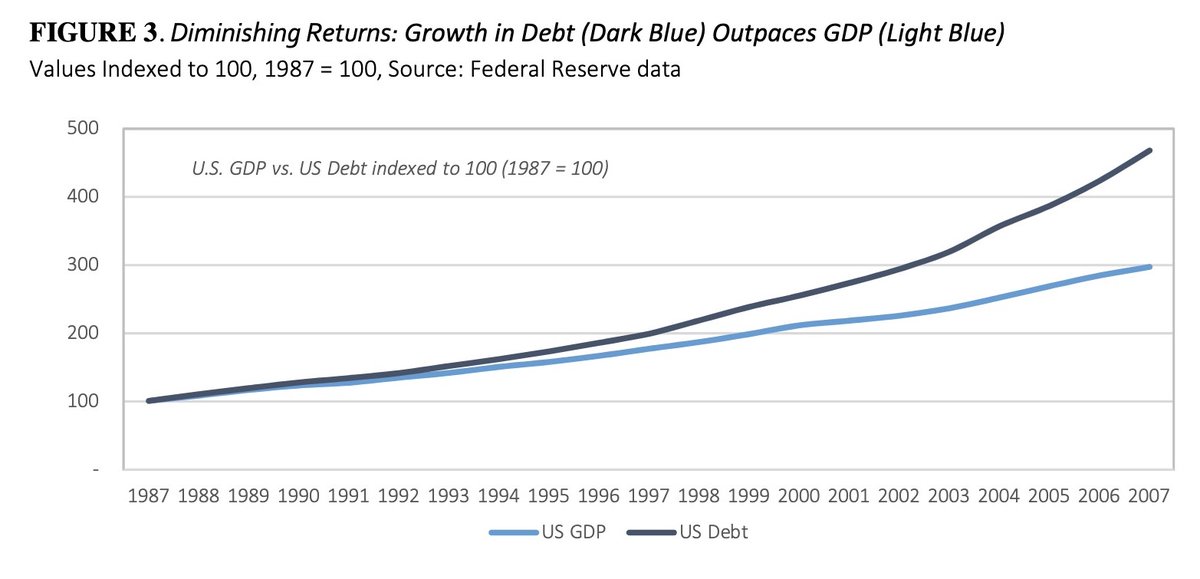

4/ Bonds

The Fed’s policy is to increase cash through buying US treasuries. They call this quantitative easing or QE.

This led to lower yields.

Cheaper credit led to a continued expansion of debt, which grew faster than GDP.

The Fed’s policy is to increase cash through buying US treasuries. They call this quantitative easing or QE.

This led to lower yields.

Cheaper credit led to a continued expansion of debt, which grew faster than GDP.

5/ Bonds vs. Treasuries

These two are easy to confuse, so here& #39;s a quick summary of the difference between them: https://www.differencebetween.com/difference-between-treasury-bills-and-vs-bonds/

(Not">https://www.differencebetween.com/differenc... part of Parker& #39;s essay)

These two are easy to confuse, so here& #39;s a quick summary of the difference between them: https://www.differencebetween.com/difference-between-treasury-bills-and-vs-bonds/

(Not">https://www.differencebetween.com/differenc... part of Parker& #39;s essay)

6/ US Debt

From the 40’s-80’s, US Debt to GDP remained at 150%.

During the 80’s, largely due to Fed policy, this increased to 350%. This led to an artificial housing boom.

The only way to sustain inflated credit levels was artificially suppress rates, which = asset bubbles.

From the 40’s-80’s, US Debt to GDP remained at 150%.

During the 80’s, largely due to Fed policy, this increased to 350%. This led to an artificial housing boom.

The only way to sustain inflated credit levels was artificially suppress rates, which = asset bubbles.

7/ Hot Take

Fed policy to suppress immediate volatility led to future vol, causing Great Financial Crisis.

Artificial demand came from areas sensitive to rates (housing) leading future demand to be pulled forward = excess supply/consumption that otherwise couldnt be afforded.

Fed policy to suppress immediate volatility led to future vol, causing Great Financial Crisis.

Artificial demand came from areas sensitive to rates (housing) leading future demand to be pulled forward = excess supply/consumption that otherwise couldnt be afforded.

8/ Central Bankers disagree.

Humorously, Ben Bernanke, Chairman of the Fed during the Great Recession, said in Jan of 08, ‘The Fed isn’t currently forecasting a recession.’

The ongoing debate is whether the GFC was the end or just the beginning…

Which side are you on?

Humorously, Ben Bernanke, Chairman of the Fed during the Great Recession, said in Jan of 08, ‘The Fed isn’t currently forecasting a recession.’

The ongoing debate is whether the GFC was the end or just the beginning…

Which side are you on?

9/ Debt Based Monetary System

Our system relies on debt. During the debt peak pre financial crisis, each dollar was levered 150x.

When credit contracts, there’s a rush for dollars. People save and cut costs. Velocity of money slows.

Our system relies on debt. During the debt peak pre financial crisis, each dollar was levered 150x.

When credit contracts, there’s a rush for dollars. People save and cut costs. Velocity of money slows.

10/ With too few enough dollars to repay debt, people/ businesses default leading to job loss, credit contraction & more defaults. It happens fast.

& #39;It& #39;s a massive game of musical chairs and when the music stopped, everyone realized the system was far more than one chair short.’

& #39;It& #39;s a massive game of musical chairs and when the music stopped, everyone realized the system was far more than one chair short.’

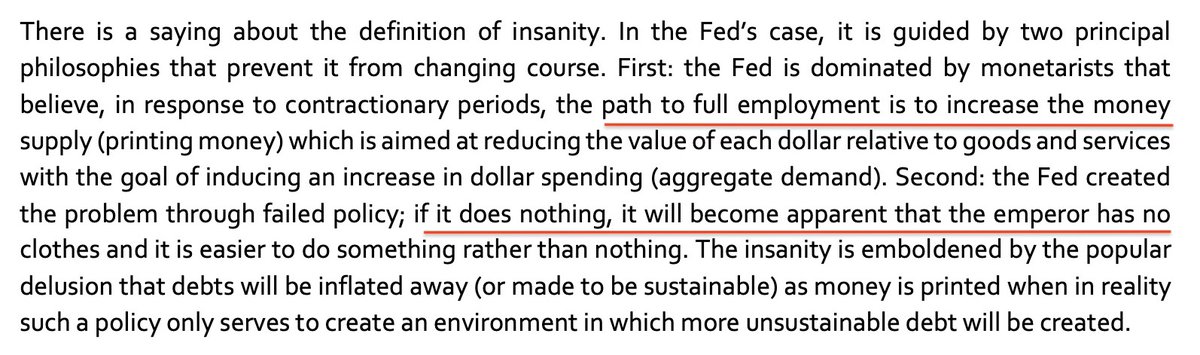

11/ Money Printing

If Fed‘s QE policy isn’t effective, why do it?

Expanding the money supply is the only tool they have. History shows repeatedly in times of crisis, the Fed prints.

This is crucial to understanding where things are headed, & the consequences of their policy.

If Fed‘s QE policy isn’t effective, why do it?

Expanding the money supply is the only tool they have. History shows repeatedly in times of crisis, the Fed prints.

This is crucial to understanding where things are headed, & the consequences of their policy.

12/ Dollar Shortages

Because of a global shortage of dollars, everything was sold to fund dollar denominated liabilities.

The Dollar Index appreciated 20% during this time.

With unprecedented money printing and debt, it’s only a matter of time before this happens again.

Because of a global shortage of dollars, everything was sold to fund dollar denominated liabilities.

The Dollar Index appreciated 20% during this time.

With unprecedented money printing and debt, it’s only a matter of time before this happens again.

13/ Dollar Milkshake

For more on this subject, check out one of my favorite minds on this subject @SantiagoAuFund and his famous & #39;Dollar Milkshake Theory& #39;

Thread: https://twitter.com/SantiagoAuFund/status/1237509972587474945

Video:">https://twitter.com/SantiagoA... https://www.youtube.com/watch?v=2qTOWuL7Zco">https://www.youtube.com/watch...

For more on this subject, check out one of my favorite minds on this subject @SantiagoAuFund and his famous & #39;Dollar Milkshake Theory& #39;

Thread: https://twitter.com/SantiagoAuFund/status/1237509972587474945

Video:">https://twitter.com/SantiagoA... https://www.youtube.com/watch?v=2qTOWuL7Zco">https://www.youtube.com/watch...

14/ The & #39;Insanity& #39; of Fed Policy

This part is so important and too good to summarize so I’ll screenshot it here.

This part is so important and too good to summarize so I’ll screenshot it here.

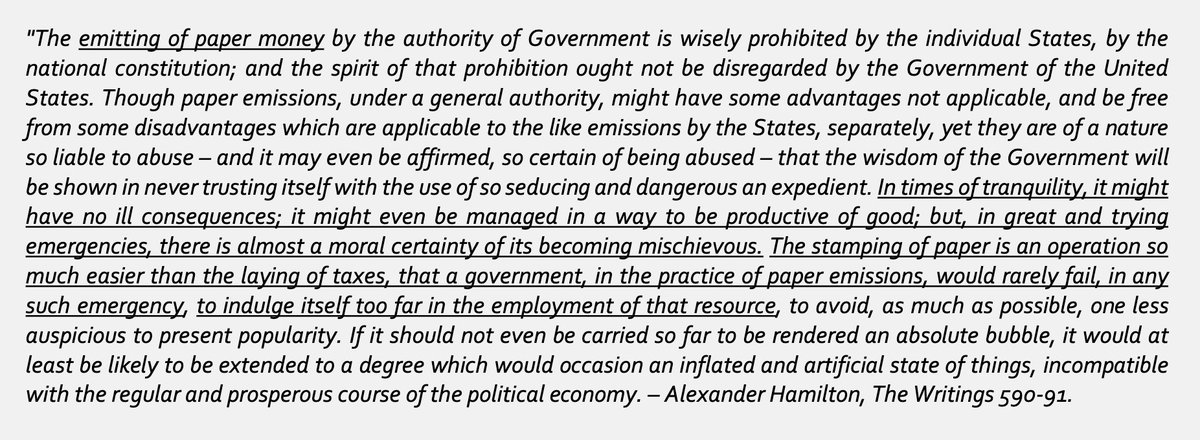

15/ Our Founding Fathers Warned of This

Here’s Alexander Hamilton speaking to the House in Congress on why currency must never be printed.

It feels like he’s writing this today.

Here’s Alexander Hamilton speaking to the House in Congress on why currency must never be printed.

It feels like he’s writing this today.

16/ Why The Policy Won’t Change

Parker writes, & #39;Even when the Fed is introspective and honest concerning its limitations, it finds itself trapped between two bad options: do something or do nothing.& #39;

What happens when an unstoppable force meets an immovable object?

Parker writes, & #39;Even when the Fed is introspective and honest concerning its limitations, it finds itself trapped between two bad options: do something or do nothing.& #39;

What happens when an unstoppable force meets an immovable object?

17/ Stay the course: pursue more and not less. It is partly a function of human nature (survival instinct) & partly of an unchecked and unelected central bank rationalizing irrational decisions.

The consequence is short-term stability at the expense of long-term sustainability.& #39;

The consequence is short-term stability at the expense of long-term sustainability.& #39;

18/ Wealth Increase

Since household wealth is significantly tied to home values, The Fed manipulated the housing market to prop up home prices, causing perception of wealth to go up.

This leads to consumer confidence, which stimulates borrowing and spending and the economy.

Since household wealth is significantly tied to home values, The Fed manipulated the housing market to prop up home prices, causing perception of wealth to go up.

This leads to consumer confidence, which stimulates borrowing and spending and the economy.

19/ Income Inequality

The Feds policies lead to an increase in home prices and stock market prices, both of which are ~50% higher than in 2007.

Naturally this increases the net worth of those who own these assets, thereby further increasing the wealth gap.

The Feds policies lead to an increase in home prices and stock market prices, both of which are ~50% higher than in 2007.

Naturally this increases the net worth of those who own these assets, thereby further increasing the wealth gap.

20/ Put Simply

Parker: ‘When dollars were created through QE, the dollar value of financial assets increased because there were more dollars; when dollars are removed through reverse QE, the dollar value of financial assets will go down because there will be fewer dollars.‘

Parker: ‘When dollars were created through QE, the dollar value of financial assets increased because there were more dollars; when dollars are removed through reverse QE, the dollar value of financial assets will go down because there will be fewer dollars.‘

21/ Counter Take

Interestingly, recent work from an awesome global macro strategist @LynAldenContact shows there’s more to the story:

https://twitter.com/LynAldenContact/status/1289622923846721536

Which">https://twitter.com/LynAldenC... side are you on?

Interestingly, recent work from an awesome global macro strategist @LynAldenContact shows there’s more to the story:

https://twitter.com/LynAldenContact/status/1289622923846721536

Which">https://twitter.com/LynAldenC... side are you on?

22/ What’s Coming

Parker: ‘While it is unclear at what point critical mass will set in as the Fed shrinks its balance sheet, the force pulling risk assets down in aggregate will be like gravity, no matter how gradual at first.& #39;

Parker: ‘While it is unclear at what point critical mass will set in as the Fed shrinks its balance sheet, the force pulling risk assets down in aggregate will be like gravity, no matter how gradual at first.& #39;

23/ Why Risk is Priced Incorrectly

Parker: & #39;Because the market is focused on fiscal reform rather than monetary policy and because the markets misunderstand the impact of balance sheet reduction on liquidity and the real economy, risk is broadly mispriced.‘

Parker: & #39;Because the market is focused on fiscal reform rather than monetary policy and because the markets misunderstand the impact of balance sheet reduction on liquidity and the real economy, risk is broadly mispriced.‘

24/ What Can You Do?

I& #39;ll be summarizing all of ‘Gradually, then Suddenly’ which explores where things are headed and what you can do.

As always, my goal is to seek the truth. I’d love your thoughts so we can discuss this together.

If you like this thread please like/share.

I& #39;ll be summarizing all of ‘Gradually, then Suddenly’ which explores where things are headed and what you can do.

As always, my goal is to seek the truth. I’d love your thoughts so we can discuss this together.

If you like this thread please like/share.

Read on Twitter

Read on Twitter