Our current Bull vs Bear debate thread on current market conditions below:  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

#ES_F #NQ_F $SPY $QQQ $AAPL $AMZN $FB $MSFT $GOOG $TSLA

#ES_F #NQ_F $SPY $QQQ $AAPL $AMZN $FB $MSFT $GOOG $TSLA

Bull:

1) The Federal Reserve will not go away.

2) Effective tax rates support EPS loss from current economic conditions.

3) The most hedged against the pandemic account for 45% of the Nasdaq. $AAPL, $AMZN, $FB, $GOOG, $MSFT

4) US financial system counter-cyclical by Dodd-Frank.

1) The Federal Reserve will not go away.

2) Effective tax rates support EPS loss from current economic conditions.

3) The most hedged against the pandemic account for 45% of the Nasdaq. $AAPL, $AMZN, $FB, $GOOG, $MSFT

4) US financial system counter-cyclical by Dodd-Frank.

Bear:

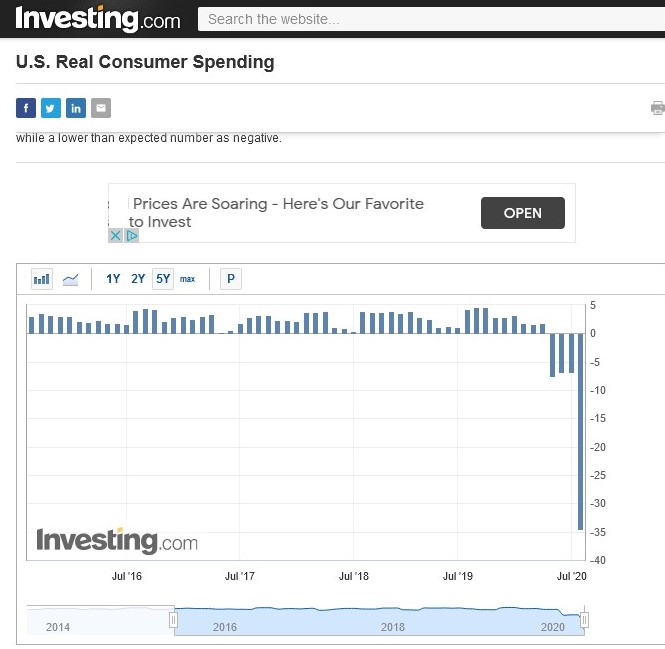

1) The consumer isn& #39;t spending much at all to start Q3.

2) Covid spikes continue & regulations tighten.

3) Possible peak pandemic profits by #BigTech.

4) China & US tensions are very high.

5) Stimulus bill will be harder to pass with markets being more stable.

1) The consumer isn& #39;t spending much at all to start Q3.

2) Covid spikes continue & regulations tighten.

3) Possible peak pandemic profits by #BigTech.

4) China & US tensions are very high.

5) Stimulus bill will be harder to pass with markets being more stable.

Bull sources:

1) https://www.cnbc.com/2020/07/28/the-fed-is-extending-its-lending-programs-until-the-end-of-the-year.html">https://www.cnbc.com/2020/07/2...

1) https://www.cnbc.com/2020/07/28/the-fed-is-extending-its-lending-programs-until-the-end-of-the-year.html">https://www.cnbc.com/2020/07/2...

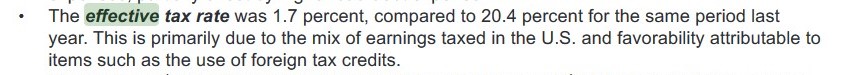

2) $NKE (left); $MU (top right); $AMZN (bottom right); all less than 15%; $NKE was 1.7% & $MU was 6%; $AMZN approx 15% because they swallowed up the world during the pandemic.

3) We don& #39;t really need to explain #BigTech size to anyone.

4) https://www.federalreserve.gov/newsevents/testimony/bernanke20110721a.htm;">https://www.federalreserve.gov/newsevent... This link is testimony of Ben Bernanke and explaining Dodd-Frank and how it should work in this same very situation.

4) https://www.federalreserve.gov/newsevents/testimony/bernanke20110721a.htm;">https://www.federalreserve.gov/newsevent... This link is testimony of Ben Bernanke and explaining Dodd-Frank and how it should work in this same very situation.

Bear sources:

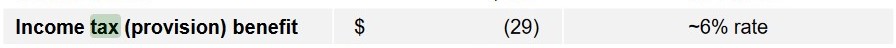

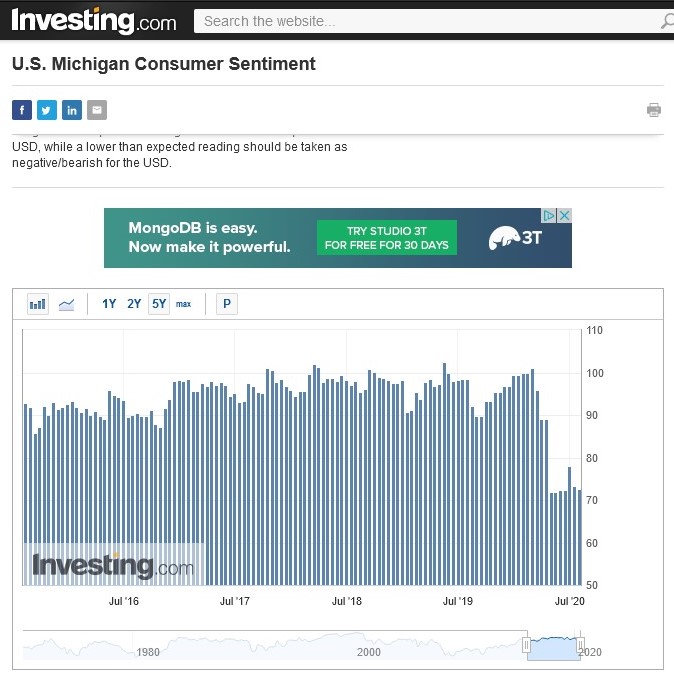

1) Several consumer sentiment data as well as spending for the past month, paired with continuous jobless claims.

1) Several consumer sentiment data as well as spending for the past month, paired with continuous jobless claims.

2) Covid surges keep happening. As they roll out of states like #Texas, #Flordia, etc... They go to places like #Kentucky, #Ohio, etc...

As of July 28th. Kentucky has also closed down bars again and reduced restaurant capacity to 25% https://www.cnbc.com/amp/2020/07/28/fauci-says-there-are-early-signs-coronavirus-outbreaks-are-brewing-in-ohio-indiana-kentucky-and-tennessee.html?fbclid=IwAR1r7fV33odxG62qIBhjCRK0esFo-w7FDjP9PCUcwsqj-hOBfIV-K5uRz34">https://www.cnbc.com/amp/2020/...

As of July 28th. Kentucky has also closed down bars again and reduced restaurant capacity to 25% https://www.cnbc.com/amp/2020/07/28/fauci-says-there-are-early-signs-coronavirus-outbreaks-are-brewing-in-ohio-indiana-kentucky-and-tennessee.html?fbclid=IwAR1r7fV33odxG62qIBhjCRK0esFo-w7FDjP9PCUcwsqj-hOBfIV-K5uRz34">https://www.cnbc.com/amp/2020/...

3) We don& #39;t need to explain to many of you how big $AAPL $FB $AMZN $MSFT beat. But 2 things, $FB had advertisers leave in droves and then still nailed EPS, while $AMZN delivered a beat 5x the amount of anticipated EPS. Those are insanely strong numbers that are huge outliers.

4) The market continues to sidestep Chinese & US tensions. $MSFT just posted a deal to close buying TikTok this evening, after @realDonaldTrump said he opposed the deal. https://www.cnbc.com/2020/08/03/microsoft-confirms-talks-to-buy-tiktok-in-us.html">https://www.cnbc.com/2020/08/0...

5) Pure speculation to politics but now that it& #39;s not the end of the world financially, we only expect Washington to do what it does best and not help out the people.

We hope we presented a bit of insight into the risks of the current market environment for US equity financial markets here through this thread and hope all is well and have a very safe week everyone!

Read on Twitter

Read on Twitter