I just spent three hours calculating NCAA football player revenue shares on google sheets, so now you have to hear about it, too.

My data is from https://sports.usatoday.com/ncaa/finances/ ">https://sports.usatoday.com/ncaa/fina... here and my numbers are calculated based on total athletic department revenues/expenses and 100 players per team because I am lazy and finding the football-only info and player numbers would take many more hours.

Also, this is based on public schools because private schools don’t have to report. There are 55 P5 schools who reported.

If players get 50% revenue share (lol), the average P5 football player will earn $650K a year. The minimum salary for NFL rookies is $480K a year.

Of all conferences, the average player would get $250K a year.

Zero athletic departments would operate with positive net income.

Of all conferences, the average player would get $250K a year.

Zero athletic departments would operate with positive net income.

If players get 10% revenue share, the average P5 player gets $130K a year.

Six P5 athletic departments would operate with positive net income.

Of all conferences, the average player would get $50K a year. Four non-P5 schools would operate with a net positive.

Six P5 athletic departments would operate with positive net income.

Of all conferences, the average player would get $50K a year. Four non-P5 schools would operate with a net positive.

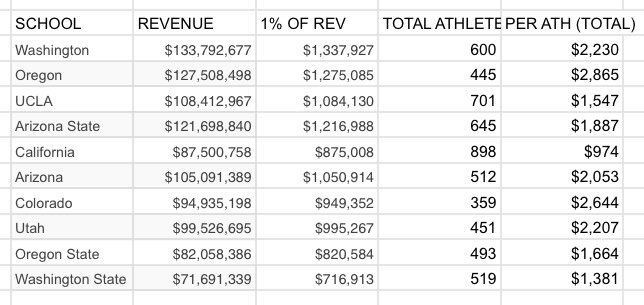

If players get 1% revenue share, the average P5 player gets $13K a year.

31 of the 55 public P5 athletic departments would operate at net positive.

Of all conferences, players would average $5K a year, and 89 of the 227 schools listed would operate at a net positive.

31 of the 55 public P5 athletic departments would operate at net positive.

Of all conferences, players would average $5K a year, and 89 of the 227 schools listed would operate at a net positive.

There are 31 schools who currently operate at a net positive who would fall into the negative if players received 1% revenue share. Six of those are P5 schools.

So 37 of 55 P5 schools and 120 of 227 schools operate at a net positive. That means 18 P5 schools and 107 total schools operate at a deficit.

In FY19, the University of Utah football program spent $4,198,583 on 92.5 students. That averages to $45,390 per student. https://utahutes.com/documents/2020/1/21//FY19_NCAA_Revenue_Expense_Report.pdf?id=23039">https://utahutes.com/documents...

That would be the equivalent of 4.22% of the athletic department’s total revenue.

In FY19, the department spent $12,344,714 on tuition/room/board for 282 total student-athletes, which is 12.4% of total revenues.

The $44K/45K numbers are pretty much on par with cost of attendance for out-of-state students.

https://financialaid.utah.edu/tuition-and-fees/cost-of-attendance.php">https://financialaid.utah.edu/tuition-a...

https://financialaid.utah.edu/tuition-and-fees/cost-of-attendance.php">https://financialaid.utah.edu/tuition-a...

BTW, only four of ten Pac-12 schools currently operate at a net positive.

All Big 12 schools are positive.

The other three P5s are about 2/3 positive.

Ohio State, who had $210.6M in revenues (which is behind only Texas and Texas A&M in total rev), operated at a $10M deficit.

All Big 12 schools are positive.

The other three P5s are about 2/3 positive.

Ohio State, who had $210.6M in revenues (which is behind only Texas and Texas A&M in total rev), operated at a $10M deficit.

Number 1 Texas brought in $223,879,781 in revenues. If players got a 50% revenue share, each Texas football player would get $1.2 million per year. That puts them in the top 1% of wage earners in the US.

Additional Utah-specific fun fact: Utah’s gymnastics team does not operate at a net positive, which surprised me a bit since they sell out every meet and all scholarships are funded by donors.

TV money + external ads make a big difference (which is why men’s bb is positive).

TV money + external ads make a big difference (which is why men’s bb is positive).

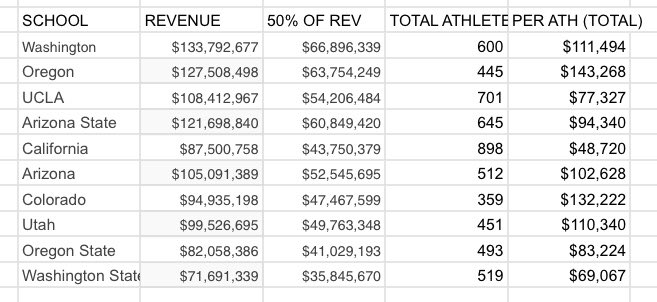

Some Pac-12 specific data. This is the amount of money student-athletes receive at each school if we divide proportion of total revenue by the total number of athletes at the school in all sports. I calculated 50% and 1%.

Although if student-athletes get 50% of total revenue, we can go back to the 100 athlete number and call it a “Football Team” instead of an “Athletic Department” because that is the only sport that will still be able to exist.

Except for schools with successful men’s basketball programs, I guess. I tend to forget about them as a Utah fan.

BTW, Larry K’s salary is $3.75 million and the total operating revenue for the men’s basketball program is $10.75 million.

BTW, Larry K’s salary is $3.75 million and the total operating revenue for the men’s basketball program is $10.75 million.

Read on Twitter

Read on Twitter