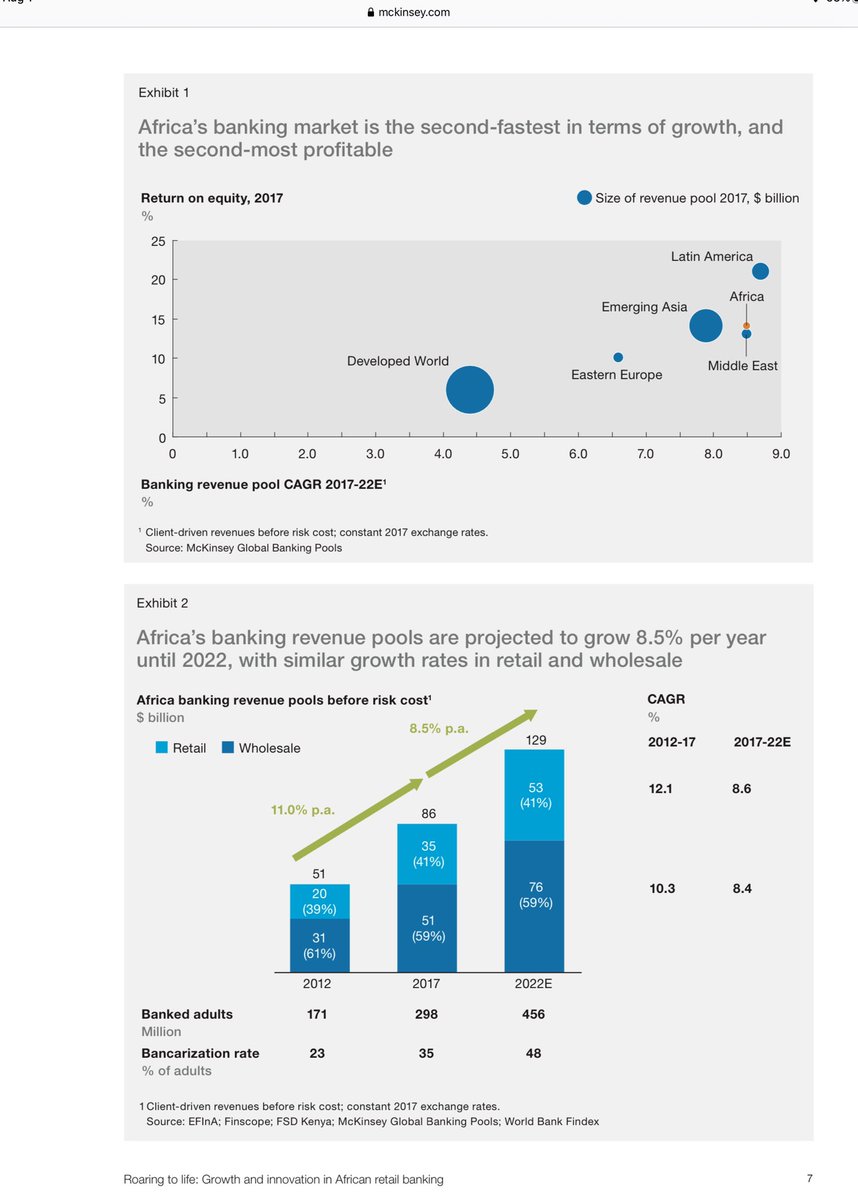

To understand the brilliance of @brassbanking, you look at where the current profit pools are in Nigerian banking and where is going to be next. This report below is from my good friends at @McKinsey

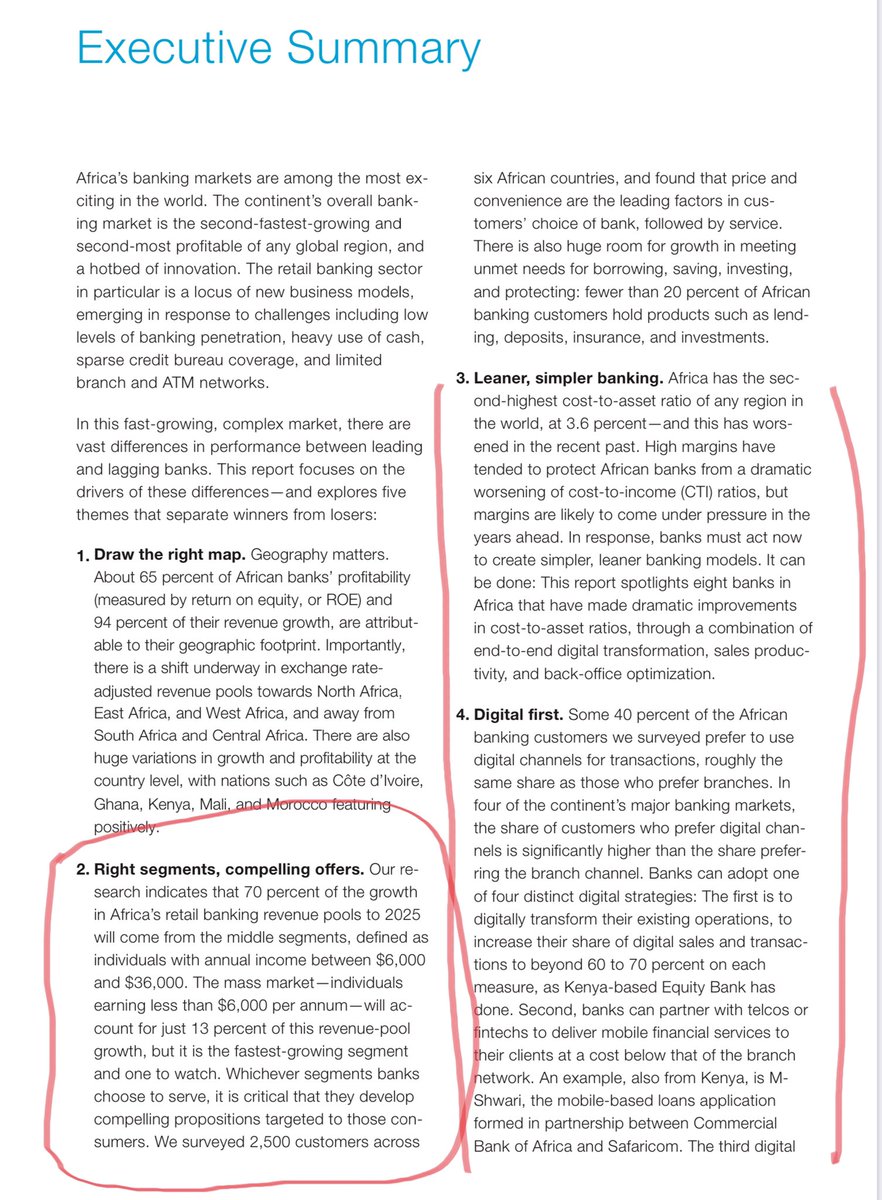

The middle market is there the meat is going to be.

https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/african%20retail%20bankings%20next%20growth%20frontier/roaring-to-life-growth-and-innovation-in-african-retail-banking-web-final.ashx">https://www.mckinsey.com/~/media/m...

The middle market is there the meat is going to be.

https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/african%20retail%20bankings%20next%20growth%20frontier/roaring-to-life-growth-and-innovation-in-african-retail-banking-web-final.ashx">https://www.mckinsey.com/~/media/m...

I don& #39;t know if they are exclusive to FCMB but it will be great if they can become a bank agnostic layer or as @opeadeoye calls it ”a bank on top of a bank”. Maybe more of a bank on top of banks. An OTT layer to do away with the inefficiencies of current banking. A WhatsApp model

The singular focus on growing businesses is brilliant and it is one of the things I have been harping about. I have been discouraging banks from building useless ”Swiss Army Knife” products that end up incorporating every useless feature but with little tangible net benefit.

You can dominate a niche with excellent service only and understand the niche so well with data that it becomes a moat. I am looking forward to the same thing for other niches. Personal banking has been over flogged, how about smaller niches in there? What of women only banking?

It is about unions and not intersections. Old banking was about too many intersections @brassbanking and others will be about the union of one market and excellent service. I trust that they will deliver. With a brilliant mind like @akindolu there, ”I no fear” as we say in UNIBEN

Maybe this is what will end our Indian core banking product dominance in Africa. I am excited!!!

Read on Twitter

Read on Twitter