July Portfolio Update!

$SPY YTD: +0.51%

My portfolio YTD: +48.73%

Beating the market by 48.22%!

Biggest holdings:

$AMZN - 11%

$CMG - 8%

$MELI - 8%

$NVDA - 7%

$AAPL - 7%

$TTD - 6%

$FB - 5%

$SQ - 4%

$SHOP - 3%

$SE - 3%

$DOCU - 3%

$LVGO - 3%

(Thread)

$SPY YTD: +0.51%

My portfolio YTD: +48.73%

Beating the market by 48.22%!

Biggest holdings:

$AMZN - 11%

$CMG - 8%

$MELI - 8%

$NVDA - 7%

$AAPL - 7%

$TTD - 6%

$FB - 5%

$SQ - 4%

$SHOP - 3%

$SE - 3%

$DOCU - 3%

$LVGO - 3%

(Thread)

Significant Changes:

Started a New Position: $RDFN, $FSLY, $ZM, $API

Added to: $SE, $CRWD, $DDOG, $LVGO, $DOCU, $SPCE, $JMIA, $RDFN, $WORK

Reduced: $CMG

Some investors here on Fintwit have posted gains of 100%+ this year. Here is why I am content with 48%:

Started a New Position: $RDFN, $FSLY, $ZM, $API

Added to: $SE, $CRWD, $DDOG, $LVGO, $DOCU, $SPCE, $JMIA, $RDFN, $WORK

Reduced: $CMG

Some investors here on Fintwit have posted gains of 100%+ this year. Here is why I am content with 48%:

(1a) Time Horizon:

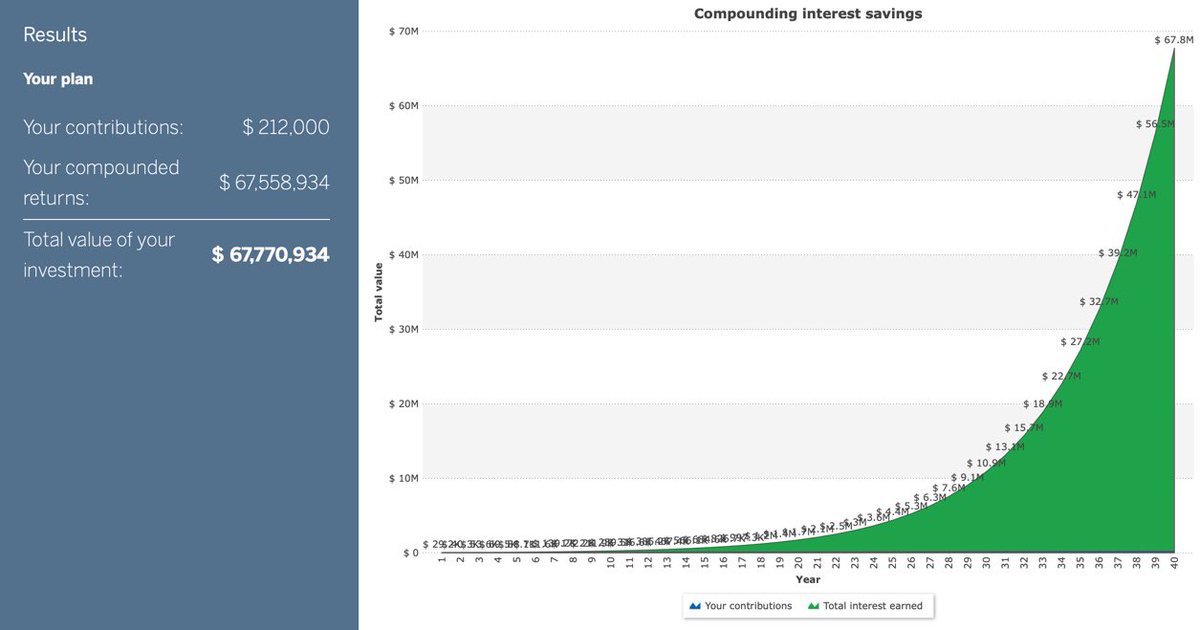

Since I am young, I have a significant amount of time to keep my money invested. Let’s say, for example, that I started with $20k and intended to add $400 per month for the next 40 years. By the end of that time period, I would have invested ~$212k.

Since I am young, I have a significant amount of time to keep my money invested. Let’s say, for example, that I started with $20k and intended to add $400 per month for the next 40 years. By the end of that time period, I would have invested ~$212k.

(1b) Now, if I were able to have my portfolio return 20% annually, something that would be remarkable in most years, my portfolio would be worth ~$67.5M 40 years from now.

(1c) If, somehow, I were able to return 25% per year, my portfolio would be worth $310M. Yet, if I kept returning 20%, it would only take 9 more years to go from $67.5M to $310M.

(1d) I don’t expect to return 20% per year every single year for 40 years, nor do I anticipate never withdrawing money. That being said, this shows the power of time horizon in investing, and I use that to my advantage.

(1e) Sure, I could have a portfolio that is weighted 65% $LVGO and $FSLY, and I have all the respect in the world for people who do. But I prefer to invest in companies that I believe can maintain consistent 20%+ rates of growth for 5/10 years, which leads me to point 2.

(2a) Time Commitment:

The COVID-19 pandemic has given me an unprecedented opportunity to learn about and spend time on the stock market. But, when I return to classes in the fall, I will not have the ability to spend 2/3 hours per day on stocks.

The COVID-19 pandemic has given me an unprecedented opportunity to learn about and spend time on the stock market. But, when I return to classes in the fall, I will not have the ability to spend 2/3 hours per day on stocks.

(2b) Thus, my portfolio is heavily weighted towards stocks that I am confident will outperform the market and in which I am familiar with the company: $AMZN, $NVDA, $TTD etc.

(2c) I also have a large number of 2-3% positions in companies that I think can one day carry my whole portfolio: $SE, $LVGO, $RDFN, $SQ, $CRWD etc. Because I don’t have the time to keep up with all of these stocks consistently, however, I’d rather have them as smaller positions.

(2d) Even at 3%, if $SE is a ten-bagger, I will have massive returns. If an unexpected issue arises, though, and I am not paying attention, it won’t sink my whole portfolio.

(3a) Companies I Love:

Finally, part of the reason I started investing in the first place was the draw of owning a piece of companies I love. Sure, I think $DDOG, $LVGO etc. are great companies, but I don’t have any personal connection to them. And yes, I want stocks that...

Finally, part of the reason I started investing in the first place was the draw of owning a piece of companies I love. Sure, I think $DDOG, $LVGO etc. are great companies, but I don’t have any personal connection to them. And yes, I want stocks that...

(3b) are beating the market, but I don’t want to constrain myself by looking for the maximum return. I love being invested in companies like $DIS, $COST, and $CMG. It’s fun to go to Disney World and think “I own part of this,” even if my money could do better in $FSLY.

By all means, a 48% return is better than I could have ever dreamed of. But one huge thing that I have learned on Fintwit is this: No matter how well your portfolio performs, others will always perform better...

Learn lessons from them; understand how they are gaining 167% in one year. But do not change your investing strategy and copy someone else because you think it’ll make you more money. Stick to what you know, and do your research.

For what I look for in a company, see here: https://twitter.com/ztinvesting/status/1271624860616265728">https://twitter.com/ztinvesti...

For why I sell, see here: https://twitter.com/ztinvesting/status/1280577684670734338">https://twitter.com/ztinvesti...

& I absolutely cannot tweet about my returns without thanking the people I have learned so much from: @themotleyfool @DavidGFool @BrianFeroldi @TMFStoffel @dannyvena @saxena_puru @richard_chu97 @MadMraket @hhhypergrowth @FromValue @RedCoatChicago @KermitCapital @cperruna & more!

Thank you for reading, and thank you Fintwit for all the valuable lessons you have taught me!

Read on Twitter

Read on Twitter