A thread on my exprience with SIPs...

I started doing SIPs in 2011, a few years after I moved back to India, well before joining the MF world.

After having patchy experiences investing lumsum in 2005 and trying to time markets, SIP was a way to simplify my investing process.

After having patchy experiences investing lumsum in 2005 and trying to time markets, SIP was a way to simplify my investing process.

I still maintain I do SIPs not for the returns only, but for the discipline they bring in my investing. My monthly SIP is like an automatic “investing tax” on my income. It forces me to save and invest, without consuming time and bandwidth.

I started in 2011 by doing SIPs in the standard set of equity funds. Mid cap, small cap, large cap. I also started an SIP in a global equity fund in 2011. SIPs is my only preferred way of investing in volatile asset classes. I was a poor entrepreneur so investments were small!

Once I moved from entrepreneurship to a salaried income, I built a larger portfolio with equity, debt, global funds and gold. I then realised that if there was a standard portfolio and asset allocation I had, then I need to maintain it by replicating it via my SIPs.

So my SIPs now replicate my whole portfolio. BAF accounts for a large part of my portfolio and I’ve found BAF SIPs to be very effective. As I just checked, my Edel BAF SIP CAGR is 8.5 percent in 3 years, 1.5% higher than lumsum returns in the fund.

I have increased and topped up my SIPs with increase in salaries over the years. I keep the number of funds limited, and if I exit a fund (rarely, if I have an issue with the process), I also have stopped the SIPs.

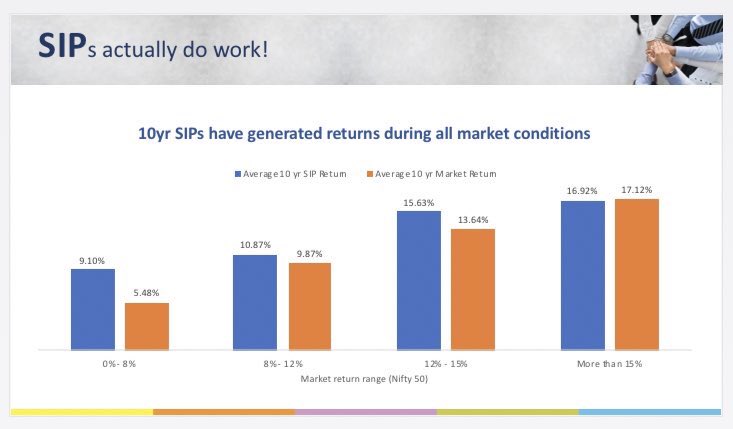

The growth in SIP corpus has positively surprised me. Finally this chart by @avasthiniranjan gives me a lot of positivity. Even in markets that have returned 0-8pc, SIPs have delivered meaningful returns. In fact they have done better relative to lumsum in poor markets.

My experience: do an SIP in a good think, think of it as a good check on your behaviour and discipline, and sit back and give it time.

Happy investing!

Happy investing!

Read on Twitter

Read on Twitter