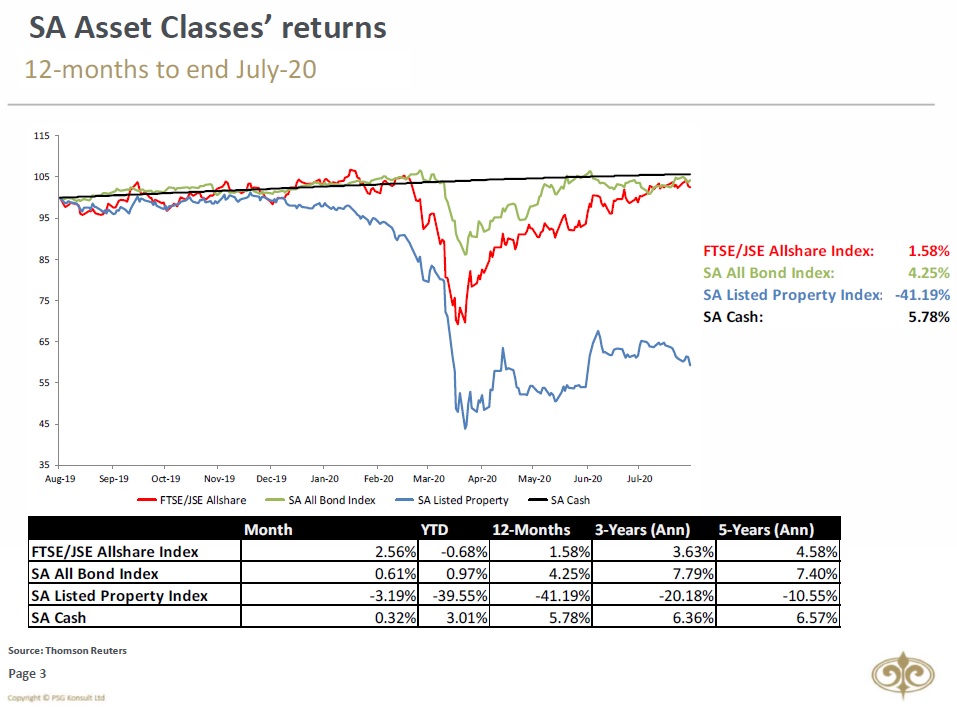

UPDATE ON MARKETS: Following recovery in May & June, FTSE/JSE All Share (JSE) enjoyed another SOLID (+2.56%) month in July. Local Property stocks lost 3.19% of its value. Although foreigners were net sellers of local bonds, SA All Bond Index was still positive over same period.

2/11

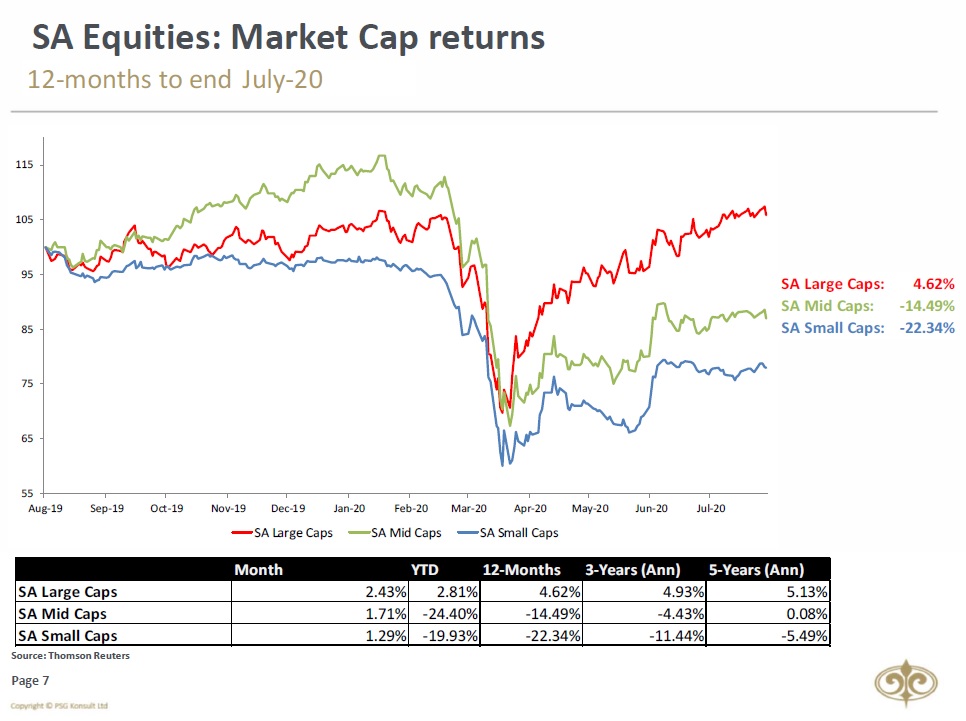

The market was predominantly driven by Large-Caps (+2.43%), while both Mid-Caps & Small-Caps lagged somewhat behind over the same period.

The market was predominantly driven by Large-Caps (+2.43%), while both Mid-Caps & Small-Caps lagged somewhat behind over the same period.

3/11

After seriously outperforming in June, the JSE took a bit of a breather in July, underperforming both MSCI All Country World Index (+5.29%) & MSCI Emerging Market Index (+8.94%), with a performance of 4.44% over the same period.

After seriously outperforming in June, the JSE took a bit of a breather in July, underperforming both MSCI All Country World Index (+5.29%) & MSCI Emerging Market Index (+8.94%), with a performance of 4.44% over the same period.

5/11

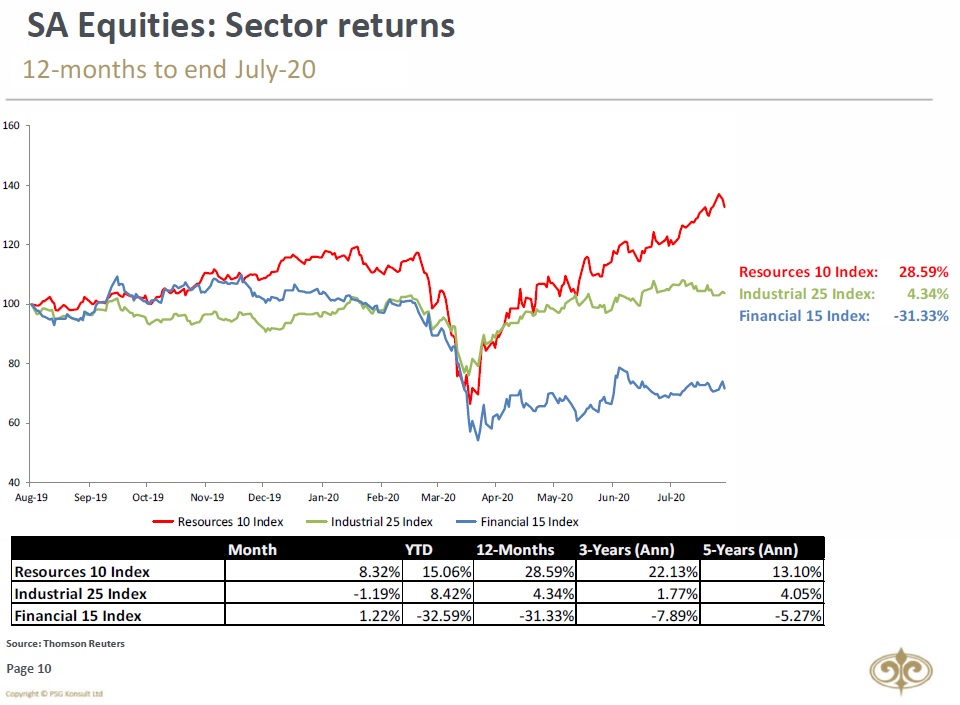

From a sectoral point of view, Resources kept the JSE positive in July, with a performance of +8.32%. Although Financials show some recovery in July, it again lagged behind the JSE. Industrials were outright negative over the same period.

From a sectoral point of view, Resources kept the JSE positive in July, with a performance of +8.32%. Although Financials show some recovery in July, it again lagged behind the JSE. Industrials were outright negative over the same period.

7/11

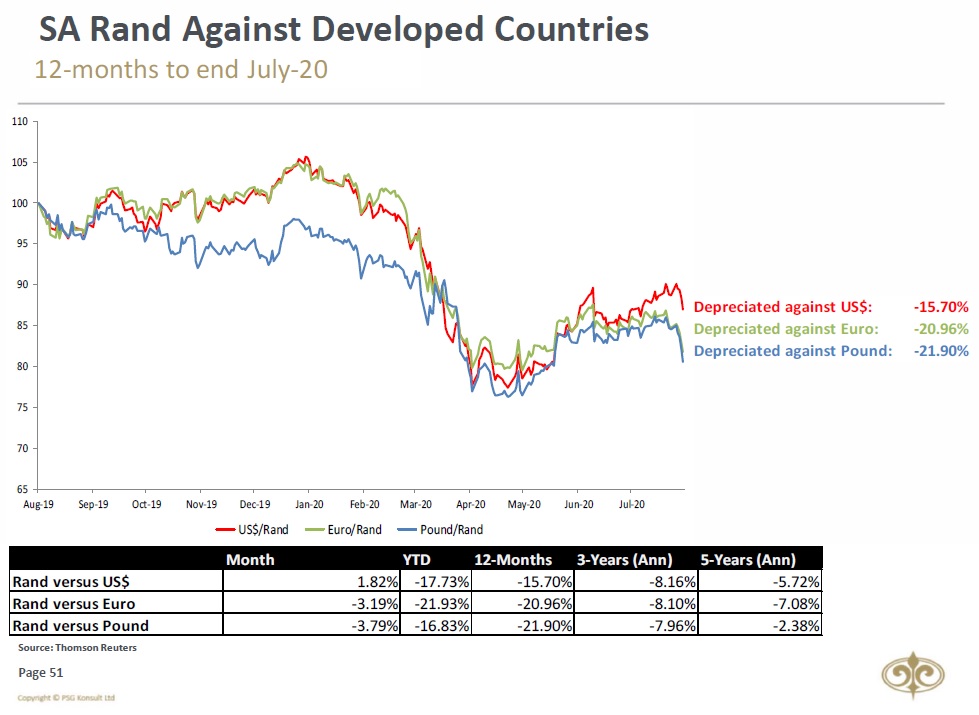

Although the Rand improved against the USD, this was mostly driven by USD weakness. It lost more than 3% in July against both the Euro and GB Pound.

Although the Rand improved against the USD, this was mostly driven by USD weakness. It lost more than 3% in July against both the Euro and GB Pound.

8/11

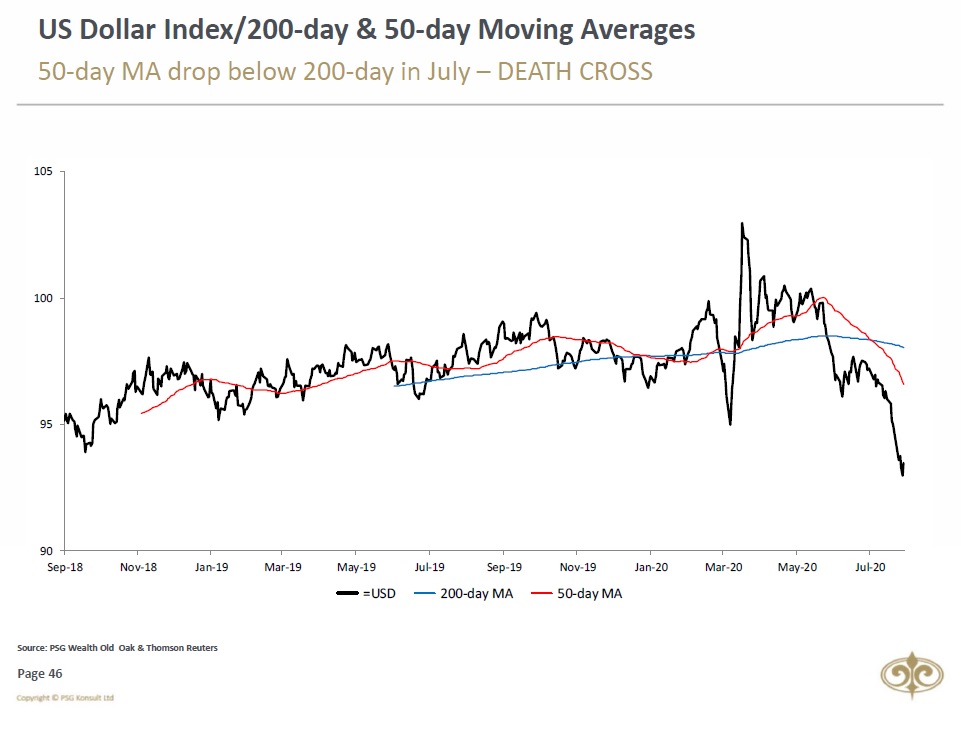

The US Dollar Index dropped, with its 50-day moving average dropping below the 200-day moving average during July. Could this be a permanent trend reversal?

The US Dollar Index dropped, with its 50-day moving average dropping below the 200-day moving average during July. Could this be a permanent trend reversal?

9/11

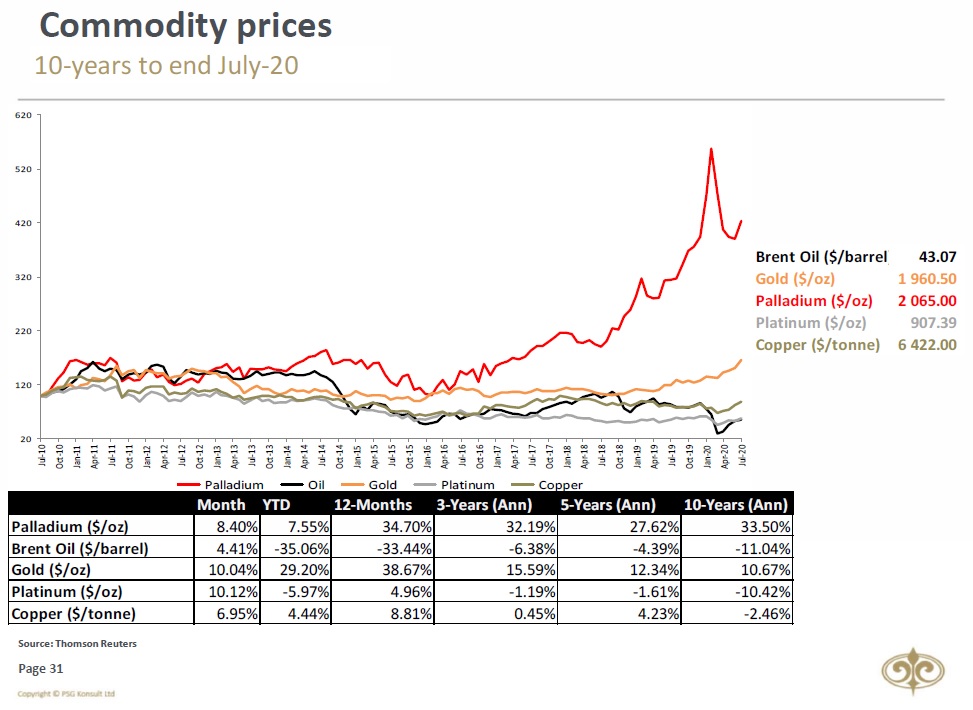

Commodities were SUPER strong in July. Platinum (+10.1%) & Gold (+10%) lead the July race, while Palladium (+8.4%) and Copper (+7%) weren’t too far behind.

Commodities were SUPER strong in July. Platinum (+10.1%) & Gold (+10%) lead the July race, while Palladium (+8.4%) and Copper (+7%) weren’t too far behind.

10/11

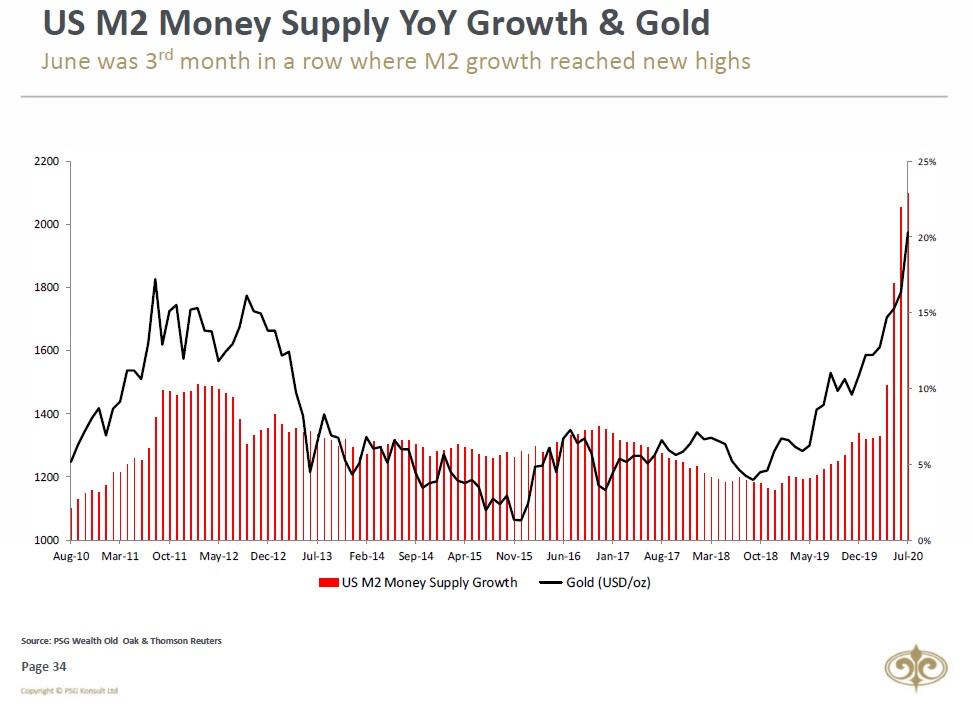

The US M2 Money Supply YoY growth rate reach a new all-time high for the third month in a row during June. As previously mentioned...USD hated the news & Gold loved it!

The US M2 Money Supply YoY growth rate reach a new all-time high for the third month in a row during June. As previously mentioned...USD hated the news & Gold loved it!

Read on Twitter

Read on Twitter