How to trade options?

-> Options can be traded via bias only.

Either Bullish, bearish, Neutral or mild bullish/ bearish.

Now its turn how to play that bias.

1. Now let me tell, when you expecting market to go up

How to play that.

-> Options can be traded via bias only.

Either Bullish, bearish, Neutral or mild bullish/ bearish.

Now its turn how to play that bias.

1. Now let me tell, when you expecting market to go up

How to play that.

-> Make a shart strangle such that where Call is far OTM incomparision to Put means you are selling more PE premium v/s CE premium.

If markets goes up, CE would rise slowly & PE would fall at more pace, consequently making profit.

If markets goes up, CE would rise slowly & PE would fall at more pace, consequently making profit.

If bias is bearish, just do opposite of earlier.

Sell more premium CE v/s PE.

-> Strikes selection can be done via support/resistance or Using ATR .

Already shared a thread how to approach markets to understand support/resistance.

Sell more premium CE v/s PE.

-> Strikes selection can be done via support/resistance or Using ATR .

Already shared a thread how to approach markets to understand support/resistance.

-> If you expect range bound or volatility then it’s better to go with short straddle & as markets moves up / down keep rolling up / down the straddle accordingly.

Biggest mistake retailers including me makes is:-

You have bearish bias, but as markets go up, one becomes uncomfortable & out of this , one start selling PE.

Don’t do this. Stick to your bias till you proven wrong by markets.

You have bearish bias, but as markets go up, one becomes uncomfortable & out of this , one start selling PE.

Don’t do this. Stick to your bias till you proven wrong by markets.

I m telling you, once you hv had bias, made positions accordingly, no fire fighting can stop you from getting loss, if markets goes against your bias.

It’s better to change your bias & consequently positions, once you proven wrong instead of continuously fire fighting.

It’s better to change your bias & consequently positions, once you proven wrong instead of continuously fire fighting.

What if moves comes into favour ?

->Never ever allow PE premium more than CE after your bias is proven right by market when you hv bearsish view & selling more CE premium than less PE premium.

It’s time to roll down PE positions as it happens.

->Never ever allow PE premium more than CE after your bias is proven right by market when you hv bearsish view & selling more CE premium than less PE premium.

It’s time to roll down PE positions as it happens.

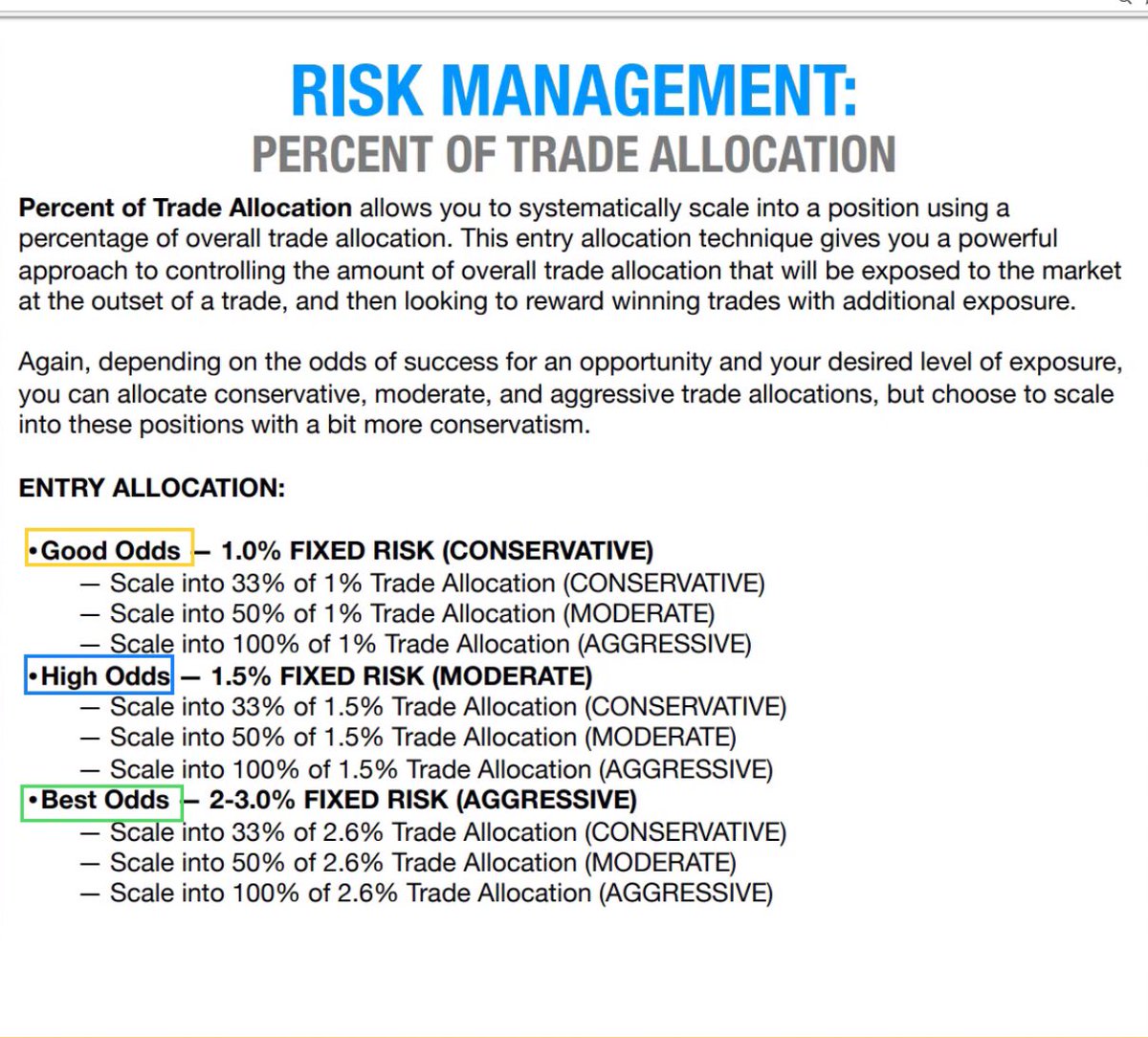

Before Entry any side, don’t forget to analyse the quality of trade & board accordingly. Risk assessment is my core & base for any trading activity as I m highly conservative to moderate risk profile I have.

Short straddle players,they r eyeing on theta decay & expecting market to remain in short range. It’s Okay to do when one has mild bullish to neutral view.

Most of time, not https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">% once market starts slipping in negative territory, Vix starts increasing causing Premium inflated.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💯" title="Hundert Punkte Symbol" aria-label="Emoji: Hundert Punkte Symbol">% once market starts slipping in negative territory, Vix starts increasing causing Premium inflated.

Most of time, not

How to make bias whether market is positive negative or in range.

I took reference from First 5 minutes candle H&L & EMA 20.

If both indicating + or - trend, it trend day.

If contradictory it gonna range bound till it find a trend either side.Dow theory addition for fine tuning.

I took reference from First 5 minutes candle H&L & EMA 20.

If both indicating + or - trend, it trend day.

If contradictory it gonna range bound till it find a trend either side.Dow theory addition for fine tuning.

Once bias made, I chalk out important levels.

Then wait for price to reach these levels. If price rejects that lvl with a pin bar or Doji, I m ready to pull trigger as indecisive bar H/L taken out by next bar with SL @ another end of same candle + 3 to 5 points for buffering.

Then wait for price to reach these levels. If price rejects that lvl with a pin bar or Doji, I m ready to pull trigger as indecisive bar H/L taken out by next bar with SL @ another end of same candle + 3 to 5 points for buffering.

If follow up intense buying or selling didn’t comes or encountered with another Doji in expected direction, immediately i squares of it @ breakeven and wait for another set up to develop. This seems very simple but very effective in live market as you are tend to follow market.

In option selling, one should be damn clear of levels when to exit else no fire fighting can save you once caught in wild move .Blindly selling straddle strangles not gonna help you in long run without edge. So work on that & develop as per yours suitability.

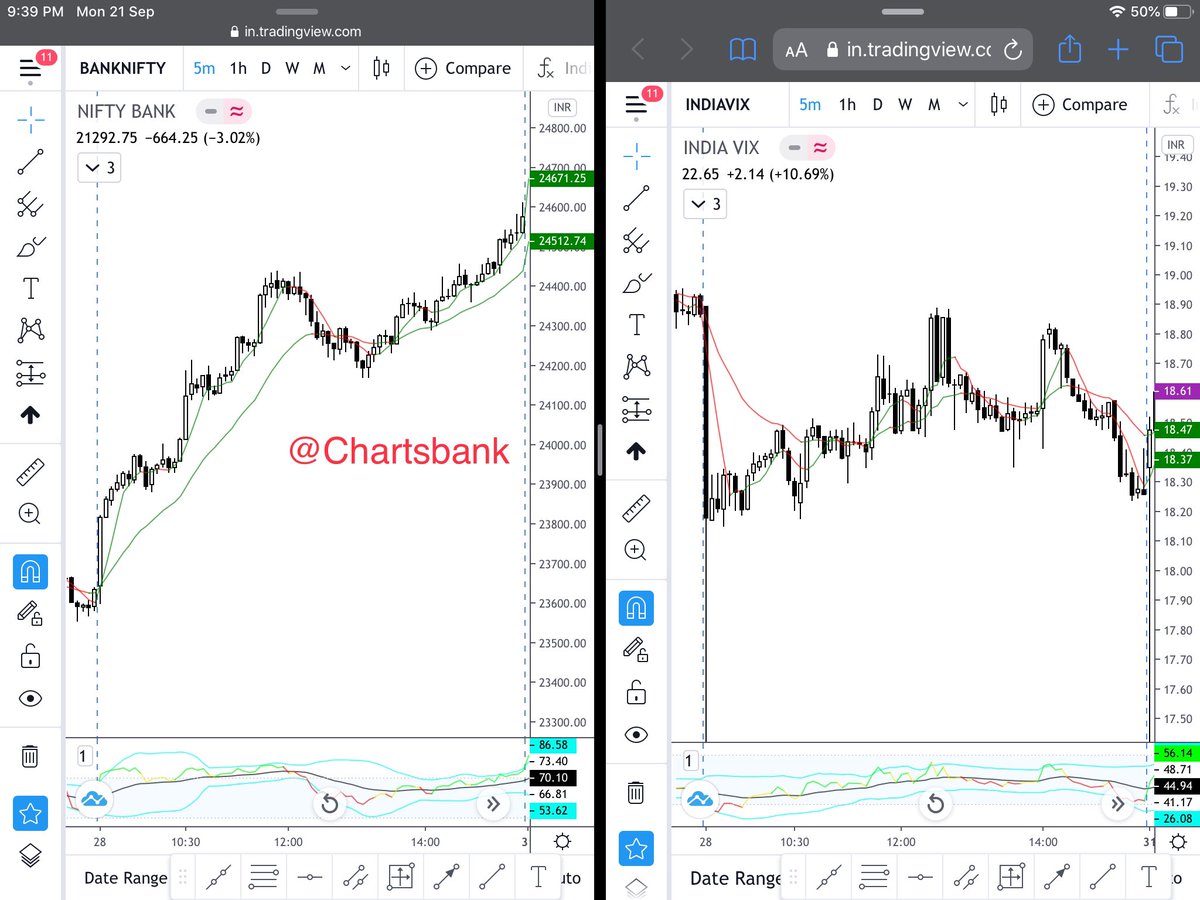

Generally markets goes up, vix comes down.

Market goes down, vix increases considering more fear.

But sometimes opposite happens like 28 Aug 20 as both market & VIX increases. I suffered 3X of normal loss that day so still can’t forget it.

Market goes down, vix increases considering more fear.

But sometimes opposite happens like 28 Aug 20 as both market & VIX increases. I suffered 3X of normal loss that day so still can’t forget it.

Selling directional straddles is best strategy when it goes up.

When expecting mild bear to neutral , sell straddle with SL on PE leg to avoid any wild move works fine.

When completely bearish, buying PE is best way to go.

When expecting mild bear to neutral , sell straddle with SL on PE leg to avoid any wild move works fine.

When completely bearish, buying PE is best way to go.

There is another angle to decide whether to sell or not a particular price is whether it is trading below or above the last close. If below, go & short . If not then stay cool calm.

This one is only for blind sellers.

This one is only for blind sellers.

Read on Twitter

Read on Twitter