Based on the price action this week vs last month I think it& #39;s important to talk about Portfolio vs Active approach.

There are times when the market is trending and we just keep pushing through levels like nothing, then there are times when the market is not trending cont...

There are times when the market is trending and we just keep pushing through levels like nothing, then there are times when the market is not trending cont...

and your trades turn on you after being profitable for some short time. Your emotional capital starts to deplete and you start to lose your focus on the market and fail to act consistently on your edge. It may not be that your edge has disappeared, it may be that

the edge you have created your system around doesn& #39;t perform well during those conditions AND that& #39;s okay. Many say "you don& #39;t have to trade everyday" and while I agree, I offer a different perspective: You don& #39;t have to trade when market conditions aren& #39;t met.

Do you know what that looks like for your system? Do you know how to identify when to press and when to take it easy or just not trade at all?

I didn’t until I created a Portfolio vs. Active approach.

I didn’t until I created a Portfolio vs. Active approach.

I spent a crazy amount of time backtesting my system through different cycles & different markets over the last 5 years. I realized that when markets were in a trend, my system would have 8/10 winners and when markets weren’t trending it would have 4/10 winners. BIG difference.

I began to write down what it looked like when markets would trend, how price would act, how the price structure prior to the trend would come together (important), and what indicators could tell me that could support my thesis.

After some time, I learned what conditions needed to be met in order for the market to enter an Up/Down trend which would allow my system to perform at it’s best. Once the market started a trend,

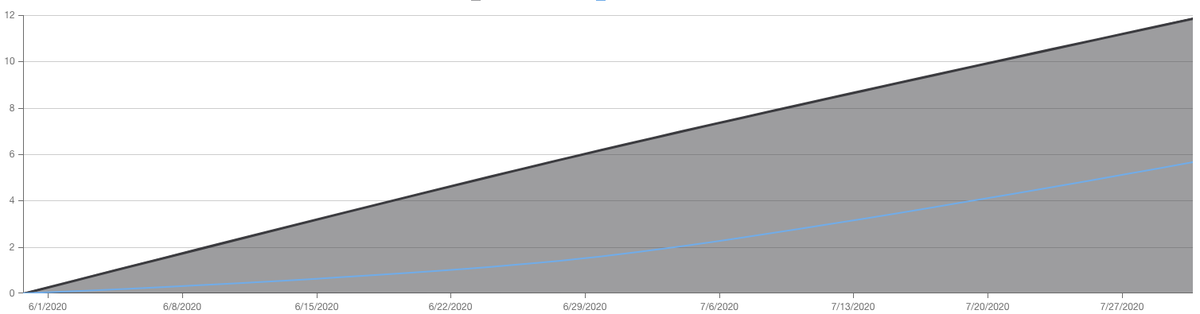

I shifted my mindset into a Portfolio approach and I knew that I could swing my trades and achieve a higher R multiple.I could get anywhere from 5-6R on 1R. (5 times return on my risk). Huge.

When markets would not trend, I not only would take more stops, lose money, and more importantly lose the emotional capital needed to act on your edge over, and over again.

This showed me where my system would thrive and where my system would perform bad and result in sizable drawdowns. I knew then, to act on my system during the Portfolio approach with confidence and not trade when the market is not trending.

However, since I like a good challenge, I did some analysis on the individual signals that my system generated during non-trending markets. Specifically, those that actually performed well and resulted in a 2-3R.

Through time, I learned what conditions these stocks had to meet in order for me to take the trades even during a non-trending period. This is how I created the Active approach.

During a Portfolio Approach, I press hard on my system and get amazing results. During an Active Approach, my trades get cut by 75% and I only take those who have met pertinent requirements. If they don’t, then I don’t trade at all during these times.

You guys may have noticed that I brought up 5x more “boxes” last month. This is because I was in Portfolio approach and some of my trades were in the 30-40% returns. Insane. Last week and half, what I have shared has gone down and I have been mostly in cash.

During that period I made 12% while $SPX went up 5.7%. As I sit at all time highs, $SPX has pulled back a bit and at risk of going down further. In the meantime, I take a select few trades (like $FSLY yesterday) and wait until market conditions are met for my system again.

Spend some time learning how the market trends, how price behaves, what indicators may help you identify the changes, etc. Think outside the BOX. If you are a discretionary trader, must become proficient enough at following your system that you become your edge.

I share insights into what has worked for me in hopes of helping you guys in your journey. Do you know how your system works in different cycles? Have you done the work? Do you know what your quarter or yearly numbers are supposed to look like?

Let me know what you guys think

Let me know what you guys think

Read on Twitter

Read on Twitter