Thread

Had a few aha moments thanks to the work of Mike Green @profplum99 & @HorizonKinetics

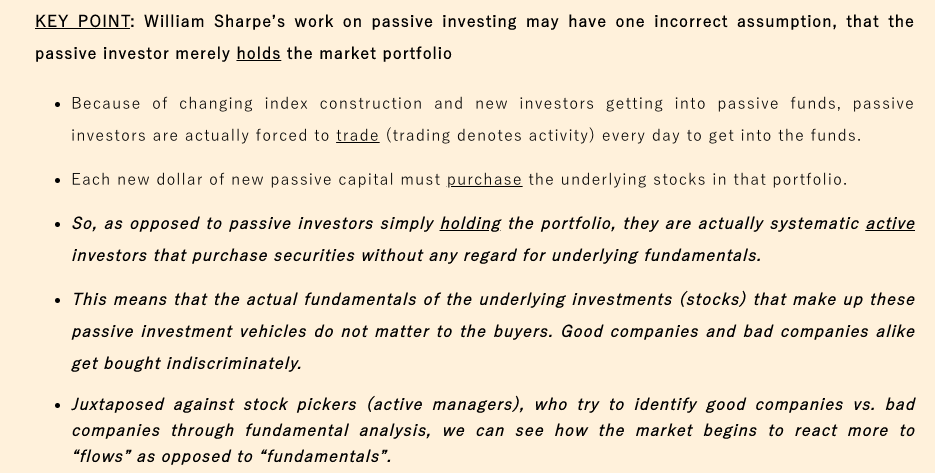

1. Passive being ‘buy and hold’ is misleading as really they are actually systematic active investors at any price

Positive flows = buy at any price

Negative flows = sell at any price

Had a few aha moments thanks to the work of Mike Green @profplum99 & @HorizonKinetics

1. Passive being ‘buy and hold’ is misleading as really they are actually systematic active investors at any price

Positive flows = buy at any price

Negative flows = sell at any price

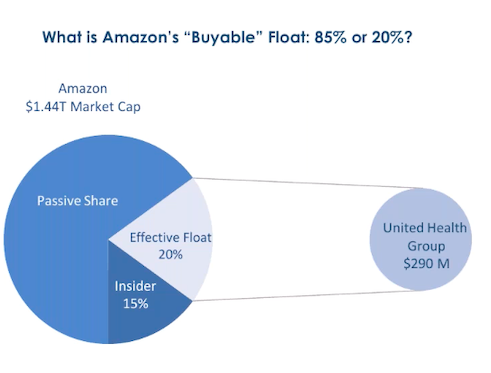

2. Passive is cornering stocks float

Take Amazon

Market cap minus inside ownership (15%) =$1.2T

Passive holds ~$910B which isn& #39;t for sale and is increasing with positive inflows

Which means available float is only ~290B

Index funds are in process of cornering $AMZN stock

Take Amazon

Market cap minus inside ownership (15%) =$1.2T

Passive holds ~$910B which isn& #39;t for sale and is increasing with positive inflows

Which means available float is only ~290B

Index funds are in process of cornering $AMZN stock

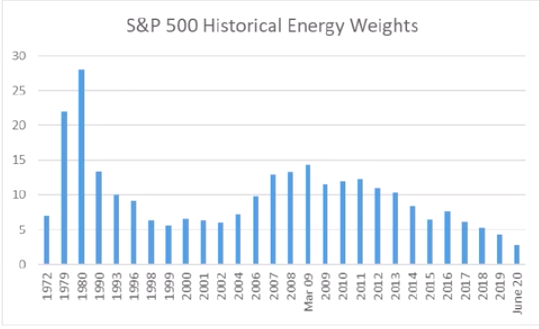

3. Passive being past the point of being able to rebalance

Take Tech =21% of the index

What happens if it wants to rebalance into energy at 3%

There is only $1 active for $2 passive so they can& #39;t buy it and why would they buy it?

Energy is likely outperforming hence rebalance

Take Tech =21% of the index

What happens if it wants to rebalance into energy at 3%

There is only $1 active for $2 passive so they can& #39;t buy it and why would they buy it?

Energy is likely outperforming hence rebalance

4. How the indexes have managed to undiversify and undo the very logic of their creation

The "S&P 495" has largely gone nowhere for the past 5 years

Basic tenet of risk control is diversification yet how diversified are you really when 5 stocks are nearly a quarter of the index

The "S&P 495" has largely gone nowhere for the past 5 years

Basic tenet of risk control is diversification yet how diversified are you really when 5 stocks are nearly a quarter of the index

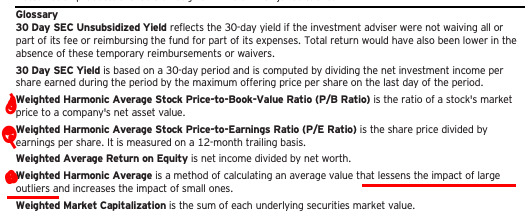

5. Why PE ratio is largely bullshit on the indexes.

PE ratios for $QQQ and $SPY aren& #39;t simply averages of the companies PE ratios as you& #39;d expect.

They are a harmonic average which is a bullshit way of removing "outliers" which would otherwise drag the PE ratio up considerably.

PE ratios for $QQQ and $SPY aren& #39;t simply averages of the companies PE ratios as you& #39;d expect.

They are a harmonic average which is a bullshit way of removing "outliers" which would otherwise drag the PE ratio up considerably.

Highly recommend you take the time to read and listen to Mike Greens blog & podcast

https://thelykeion.com/notes-policy-in-a-world-of-pandemics-social-media-and-passive-investing/?fbclid=IwAR1b6wBOHEWk1dnrn6xVvtVx5f8Q7lYn4rYiOCbuFK6pOuCTrZE42jjMqN4

https://thelykeion.com/notes-pol... href=" https://ttmygh.podbean.com/e/teg_0003/

And">https://ttmygh.podbean.com/e/teg_000... watch this presentation:

https://horizonkinetics.com/market-commentary/2nd-quarter-2020-commentary/

Will">https://horizonkinetics.com/market-co... put you in the top 1% for understanding the implications of passive investing

https://thelykeion.com/notes-policy-in-a-world-of-pandemics-social-media-and-passive-investing/?fbclid=IwAR1b6wBOHEWk1dnrn6xVvtVx5f8Q7lYn4rYiOCbuFK6pOuCTrZE42jjMqN4

And">https://ttmygh.podbean.com/e/teg_000... watch this presentation:

https://horizonkinetics.com/market-commentary/2nd-quarter-2020-commentary/

Will">https://horizonkinetics.com/market-co... put you in the top 1% for understanding the implications of passive investing

Read on Twitter

Read on Twitter