1/DeFi has single-handled sparked more excitement in crypto now than at any point since the 2017 ICO craze

Many are scrambling to figure out what this DeFi craze is all about. Is there substance behind it? Is it all hype? What does DeFi even mean anyway?

A thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Many are scrambling to figure out what this DeFi craze is all about. Is there substance behind it? Is it all hype? What does DeFi even mean anyway?

A thread

2/DeFi is a broad term to describe a variety of blockchain-based financial primitives and protocols.

Some DeFi projects are merely the blockchain version of the traditional finance counterpart while others are novel inventions that evolved with the needs of crypto.

Some DeFi projects are merely the blockchain version of the traditional finance counterpart while others are novel inventions that evolved with the needs of crypto.

3/I like to break up DeFi into several distinct categories:

Permissionless Banking

Permissionless Bootstrapped Liquidity

Permissionless Derivatives

Permissionless Debt

Permissionless can be defined as without the need of a central party

Permissionless Banking

Permissionless Bootstrapped Liquidity

Permissionless Derivatives

Permissionless Debt

Permissionless can be defined as without the need of a central party

4/Permissionless Banking is exactly what it sounds like, protocols where you can lend and borrow the crypto of your choice. Examples of permissionless banking include Compound and Aave. Each of these protocols take different approaches but are the same in principle.

5/In order to encourage activity on their protocols, they will offer incentives in the form of "yield farming" which basically means if you put your tokens here we will reward you in the form of governance tokens such as $COMP and $AAVE.

6/This has given rise to Yield Farmers who are trying to find the best rate. This is comparable to moving cash between bank accounts in order to find the highest interest rate. While traditional banking is slow and time-consuming, yield farming offers an instantaneous solution.

7/When Yield Farmers move their tokens between protocols, it& #39;s referred to as a Crop Rotation. Farmers are always trying to optimize their yield which leads to them swapping tokens using automated market maker DEXs.

8/The most popular AMMs include Uniswap, Curve, and Balancer. Each AMM uses a different ratio to fulfill its needs. Uniswap is a general AMM where you can swap any ERC-20 token while Curve is exclusively used as a stablecoin AMM. This vid has more details https://youtu.be/Ui1TBPdnEJU ">https://youtu.be/Ui1TBPdnE...

9/To give you a sense of the magnitude over Uniswap& #39;s volume, just look at the past 24 hours... it& #39;s up there with major centralized exchanges https://twitter.com/CL207/status/1289121642677850113">https://twitter.com/CL207/sta...

10/In AMMs, Liquidity Providers act as a decentralized intermediary between tokens. So let& #39;s say someone wants to swap $AAVE for $LINK. As a liquidity provider, you can stake $ETH tokens in the $ETH liquidity pool and earn fees for facilitating the trade that goes AAVE->ETH->LINK

11/The risk that comes with being an LP is called impermanent loss which means you would& #39;ve been better off just holding your tokens compared to staking it in a pool. In times of high volume, it& #39;s worth it to be an LP but when volume is low you& #39;ll end up losing $$$

12/I like to think of the @UniswapProtocol as the "Soundcloud of Crypto Exchanges." What& #39;s beautiful about Soundcloud is that any artist can upload a song for the world to hear and gain a following. Soundcloud makes the distribution of music frictionless.

13/Uniswap does the same thing with tokens. ERC-20 tokens are automatically listed and anyone can go trade them. This contrasts greatly with centralized exchanges where users have to sign up and wait for tokens to deposit and projects often pay for listings.

14/All of these elements have played pivotal roles in Uniswap& #39;s exponential growth and has been essential for grassroots community-driven projects ranging from $TEND to $YFI.

15/ $TEND is a meme coin, DeFi& #39;s $DOGE, that is based on the "ultimate" sign of a successful trader, a nice warm crispy bucket of chicken tendies. On it& #39;s first day of trading it had $10 million in volume and was up 400%.

16/ $YFI has become a meme coin in its own right but its backstory has many hailing it as DeFi& #39;s $BTC. It& #39;s founder, @AndreCronjeTech wanted a way to maximize yield for his stablecoins. A few months ago he built yearn (a shortening of "yield earn") to do so.

17/How $YFI works is that its the governance token of http://yearn.finance"> http://yearn.finance that was rewarded to liquidity providers in the yCRV pool on Curve. y tokens such as yCRV and its building blocks like yDAI are permissionless derivatives that auto earn yield. https://www.youtube.com/watch?v=3IkRHymMWLM">https://www.youtube.com/watch...

18/Now what makes $YFI truly 𝑠𝑢𝑖 𝑔𝑒𝑛𝑒𝑟𝑖𝑠 is that:

1) There was no premine

2) There were no investors

3) Andre mined tokens like everyone else

Many have hailed $YFI& #39;s debut as the fairest launch of a token in history, even rivaling that of Bitcoin

1) There was no premine

2) There were no investors

3) Andre mined tokens like everyone else

Many have hailed $YFI& #39;s debut as the fairest launch of a token in history, even rivaling that of Bitcoin

19/ $YFI went from being $31 at its inception to over $4k today and that has been in a span of 10 days.

That& #39;s fucking insane. And Andre just made this tool for himself in order to maximize stablecoin yield. $YFI has been so successful that copies like $YFII have appeared.

That& #39;s fucking insane. And Andre just made this tool for himself in order to maximize stablecoin yield. $YFI has been so successful that copies like $YFII have appeared.

20/A strong factor in $YFI& #39;s success has been the community behind it. The #YFIWaifus have been hard at work discussing and solidifying the future of the protocol. https://gov.yearn.finance/ ">https://gov.yearn.finance/">...

21/Another community that has been around for a few years are the #SNXSpartans rallying behind Synthetix, a synthetic asset protocol. Recently Synthetix dissolved their foundation and development is now governed by three separate DAOs https://decrypt.co/37011/synthetix-is-now-controlled-by-three-daos">https://decrypt.co/37011/syn...

22/ How Synthetix works is that the native $SNX token is staked in order to generate $sUSD. Now sUSD is the permissionless debt that I mentioned earlier, it must be paid back in order to unstake your SNX.

23/A similar comparison to SNX would be $MKR where you can stake ETH as collateral in order to generate DAI. Both DAI and sUSD are stablecoins that can be utilized in several ways by users. For example, sUSD allows traders to trade Synthetic Exchange assets $sBTC, $sDEFI, etc.

24/There are risks involved of course. You could fall below your collateral ratio on $MKR and be liquidated or fall below it on $SNX and be not only unable to unlock for tokens but also unable to claim inflation rewards as well that are baked into the protocol.

25/But let& #39;s say now you want a different type of exposure to risk. Hell, let& #39;s say you want to be the one MAKING the field for that risk and you can sit back relax and watch speculators duke it out. That& #39;s where prediction markets come in.

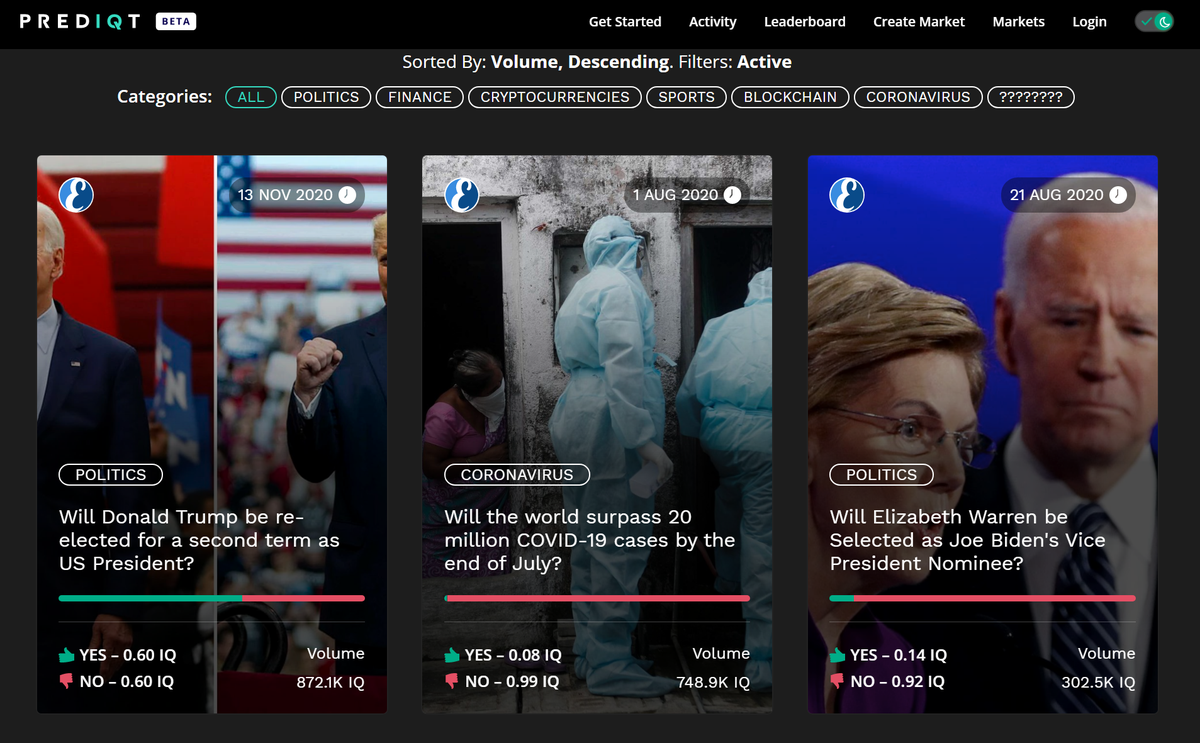

26/Prediction markets such as @PredIQt_Network and @AugurProject allow people to put their knowledge to the test through the speculation of event results. These markets can be about anything ranging from sports to politics to finance.

27/In fact, one of the top markets on PredIQt has to do with COVID-19 numbers. Any user can propose a market with $IQ tokens and when approved can collect both trading and referral fees from the market. Markets can be denominated in either IQ or recently added $USDT

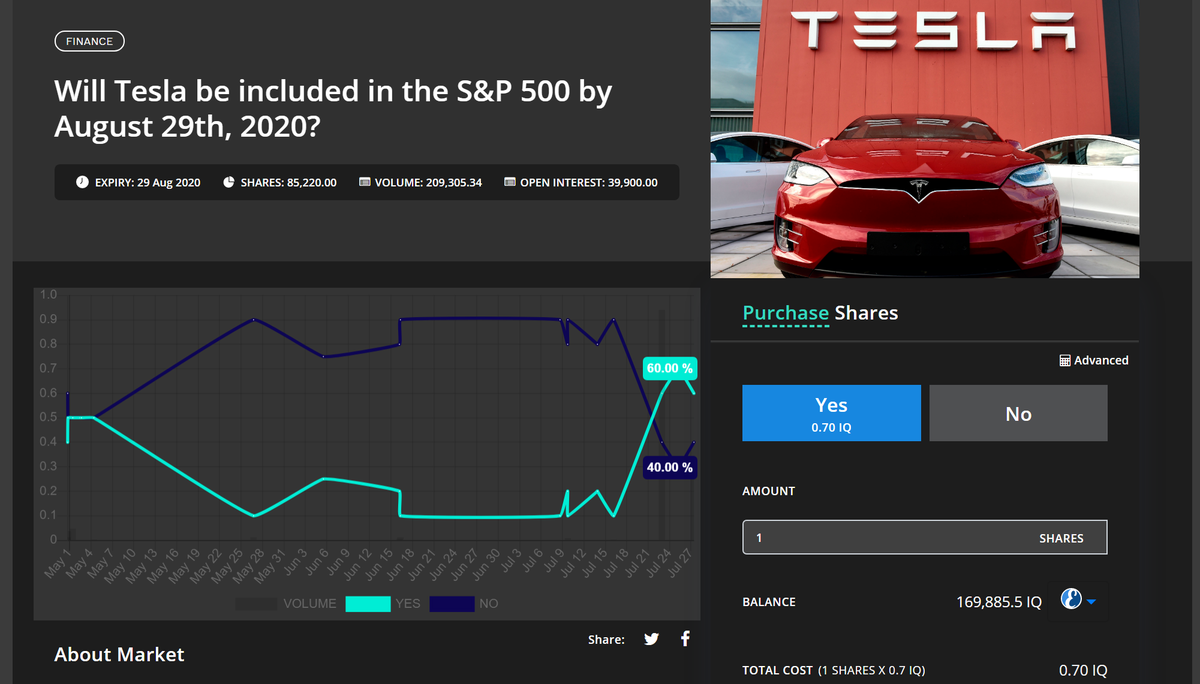

28/Anyone can buy a share in these markets and speculate what percentage of an event is likely to happen. For example, if I wanted to participate in this Tesla market then I can buy "Yes" shares at .7 IQ meaning that I think that there& #39;s a 70% chance TSLA will be in the S&P 500.

29/Once a market expires, it goes through a resolution process where using tokens, IQ holders have a chance to dispute a result in the immediate 72-hour timeframe after the expiration.

30/If there are no disputes on the Tesla market and it resolves as "Yes" then congrats, your .7 IQ shares now become 1 IQ while the "No" shares become zero.

31/Prediction markets like PredIQt are a special type of permissionless derivative where it can be used to measure sentiment and to fight fake news. The fake news aspect is particularly interesting because with $$$ on the line you can& #39;t lie about outcomes.

32/For example, let& #39;s say a report comes out that worldwide COVID infections are +15 million. It carries a lot more weight to cite a prediction market where people have money at stake than a clickbait article pushing a narrative when correcting someone or some organization

33/Right now, crypto is evolving at a breakneck pace and all of these permissionless breakthroughs point to us officially entering the DeFi epoch. If you have the mental fortitude, then there will be a big bucket of tendies waiting for you at the end of this.

Read on Twitter

Read on Twitter