The Farmer& #39;s Fable

Today, I’d like to tell you a little story about a farmer named Bill.

If you’re not into farming, it just so happens that Bill discovers one of the most important principles in investing and decision-making in this story, so there’s also that.

Today, I’d like to tell you a little story about a farmer named Bill.

If you’re not into farming, it just so happens that Bill discovers one of the most important principles in investing and decision-making in this story, so there’s also that.

Anyway, back to Bill.

Bill grows crops. In a good season, Bill harvests 150 seeds for every 100 seeds that he plants.

That’s a 50% growth rate!

Bill grows crops. In a good season, Bill harvests 150 seeds for every 100 seeds that he plants.

That’s a 50% growth rate!

If Bill does that every year, his farming business will grow exponentially. 1 kilogram of seeds grows into 1.5kg of seeds in the first year. 1.5kg of seeds grows into 2.25kg of seeds the next year, then into 3.375kg of seeds the next year, and so on.

However, farming is not an easy business. Some times, Bill has bad harvests. In bad years, he only gets 70% of his seeds back, a loss of 30%.

For Bill, good and bad seasons are equally likely and unpredictable.

For Bill, good and bad seasons are equally likely and unpredictable.

On average, half the years will be good and half will be bad.

But, it’s possible to get “lucky” and have a streak of good years or “unlucky” and have a streak of bad years.

But, it’s possible to get “lucky” and have a streak of good years or “unlucky” and have a streak of bad years.

That’s not ideal as a smooth exponential growth curve, but it still seems pretty good, right?

It’s a positive expected value bet: half the time you make 50% and the other half the time, you lose 30%. On “average,” Bill makes 10%.

It’s a positive expected value bet: half the time you make 50% and the other half the time, you lose 30%. On “average,” Bill makes 10%.

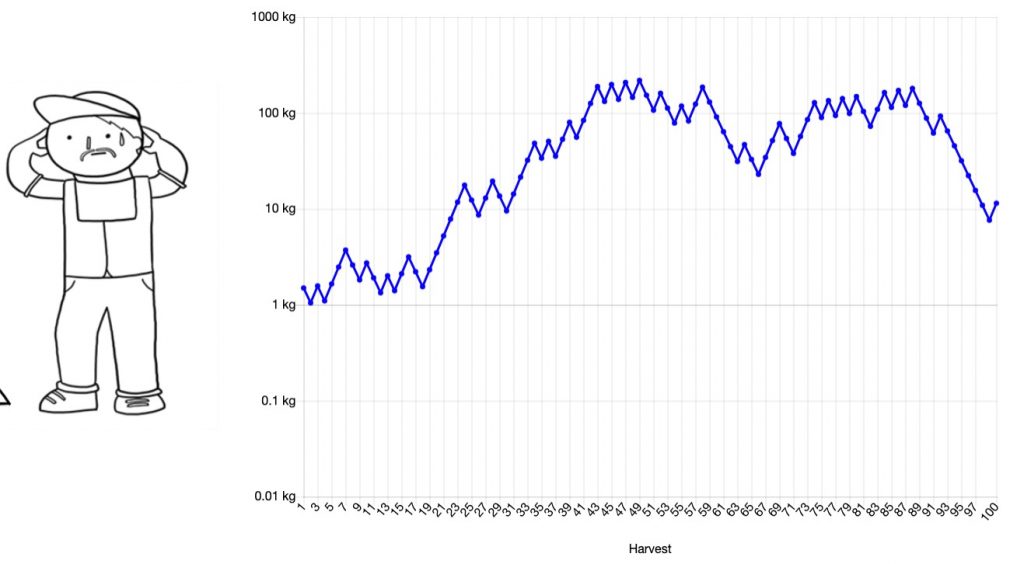

Let’s run the simulation over a hundred years this time and see how Bill does.

The first time I ran the simulation, Bill did pretty well. Things were choppy and he hadn’t made any progress for the first 20 years but then he had a run of good luck and ended up with over 1000kg of seeds.

Not bad!

Not bad!

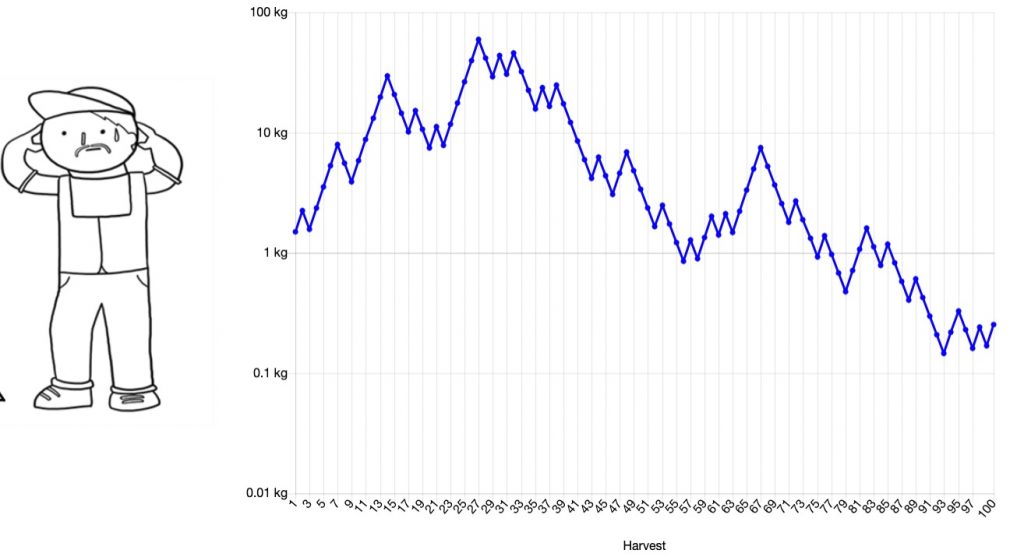

The second time I ran the simulation, Bill started with a run of bad luck.

He had some tough years, losing almost 90% of his seeds before finally bouncing back and ending with a bit over 100kgs in seeds.

He had some tough years, losing almost 90% of his seeds before finally bouncing back and ending with a bit over 100kgs in seeds.

The next time I ran the simulation, Bill had a slow start followed by a lucky steak from years 17 to 45 then went sideways before ending on a tough run of luck with just over 10kg of seeds.

The fourth and final time I ran the simulation, Bill got off to a pretty good start but his luck turned around year 25 and he finished the 100 year period with less than he started with.

That sucks!

That sucks!

There is a lot of luck involved and the possible variety of outcomes is very wide.

In just four simulations, Bill ended up anywhere between +1000x where he’s watching over his farmland from his ski chalet to down 80% where he’s barely able to survive.

In just four simulations, Bill ended up anywhere between +1000x where he’s watching over his farmland from his ski chalet to down 80% where he’s barely able to survive.

So while, “on average,” farming is a good business, Bill doesn’t get “average” returns over the course of his long farming career.

He could do exceptionally well or exceptionally bad, depending on how the chips fall.

He could do exceptionally well or exceptionally bad, depending on how the chips fall.

That doesn’t seem like a very good business, there’s too much luck involved.

Even though it works out “on average,” would you want to start a business or make an investment for your whole lifetime with that much variability?

Even though it works out “on average,” would you want to start a business or make an investment for your whole lifetime with that much variability?

Probably not, it’s like playing Russian Roulette for a million bucks – even though you win “on average,” there’s too much risk of getting “unlucky.”

What can Bill do?

What can Bill do?

Well, there’s another farmer named Ann. Ann’s crop yield follow the same rules as Bill’s yields: half the time she makes 50%, and half the time she loses 30%, for an average return of 10%.

However, Bill and Ann live on opposite ends of the country and so their crop returns are uncorrelated.

Bill having a bad year doesn’t make it any more or less likely for Ann to have a bad year and vice versa.

Let’s run a simulation with both Bill and Ann.

Bill having a bad year doesn’t make it any more or less likely for Ann to have a bad year and vice versa.

Let’s run a simulation with both Bill and Ann.

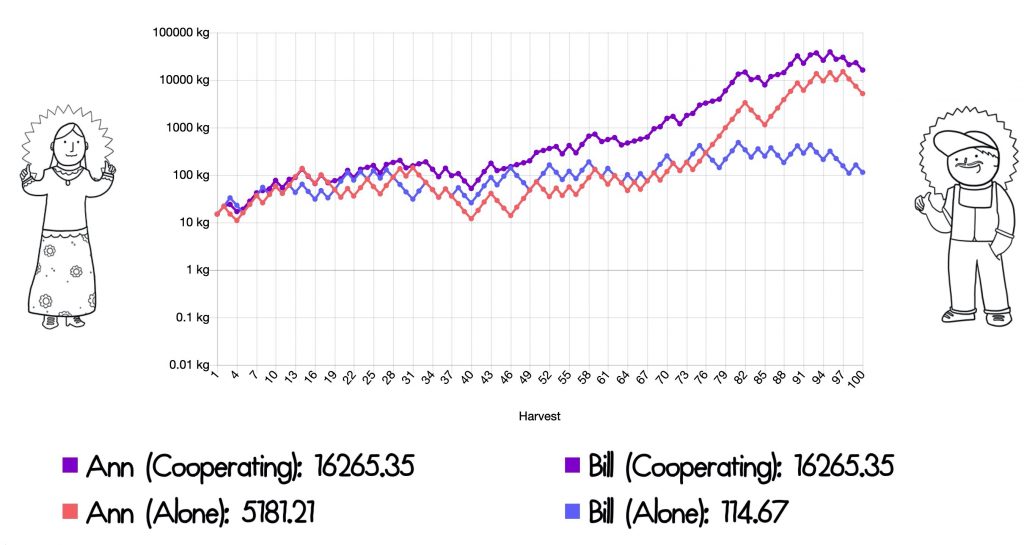

In this simulation, Bill ends up relatively lucky, ending with 1611kg, and Ann is relatively unlucky, ending up with just 16.6kg.

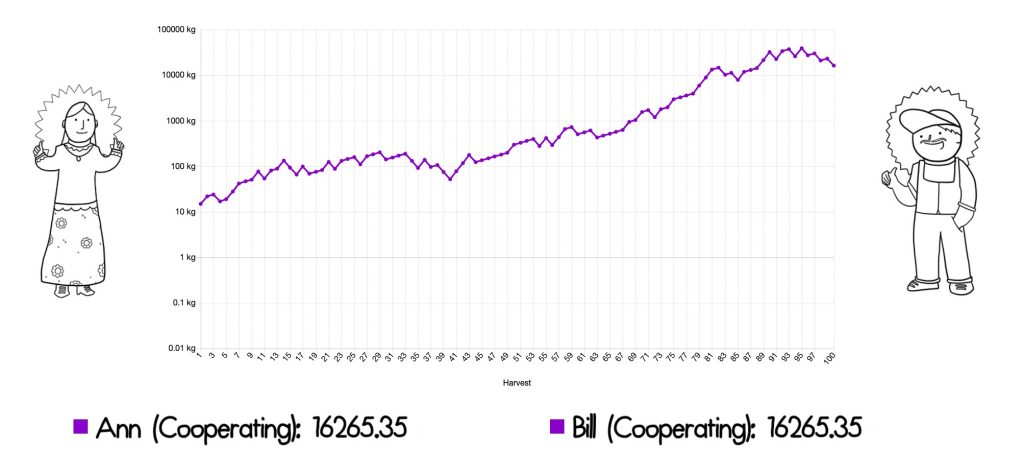

But what if they make a deal? At the end of every season, Ann and Bill agree to share their harvests equally.

In investing terms, they are agreeing to “rebalance” their profits and losses. If Ann does well and Bill does poorly, she’ll share with him and vice versa.

In investing terms, they are agreeing to “rebalance” their profits and losses. If Ann does well and Bill does poorly, she’ll share with him and vice versa.

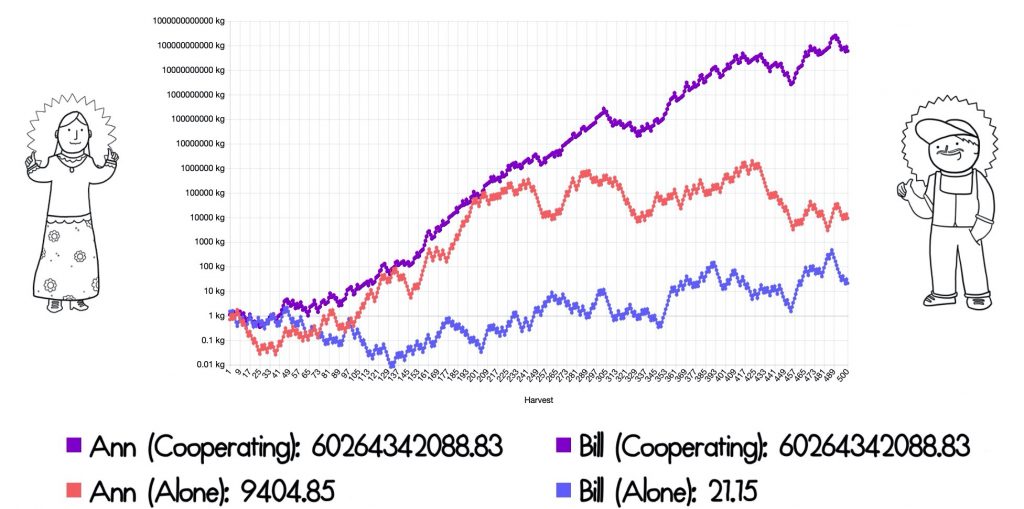

By cooperating, they both do much better. Each ends up with 16,265kg of seeds.

Even though Bill was lucky and did much better than Ann, he did 10X BETTER BY COOPERATING and sharing with Ann then by going it alone.

Even though Bill was lucky and did much better than Ann, he did 10X BETTER BY COOPERATING and sharing with Ann then by going it alone.

Was this just a lucky simulation?

In a sense, there is luck involved because the good and bad years are random.

But, over the long run, luck becomes a certainty.

In a sense, there is luck involved because the good and bad years are random.

But, over the long run, luck becomes a certainty.

When you have two positive expected value bets that are uncorrelated (Ann having a good year doesn’t make it more or less likely for Bill to have a good year – that means they are uncorrelated), then rebalancing them increases the long-term returns and decreases risk.

It’s pretty crazy just how much it improves growth and reduces risk.

In this 500 year simulation, Bill would have finished with just 21kg but by cooperating, he finished with over 60 billion kg – 60,265,342,088kg.

That’s a big difference!

In this 500 year simulation, Bill would have finished with just 21kg but by cooperating, he finished with over 60 billion kg – 60,265,342,088kg.

That’s a big difference!

Anything that grows exponentially, or compounds, grows faster when you rebalance or share resources.

For a delightful playable simulation of this, check out https://www.farmersfable.org/ ">https://www.farmersfable.org/">... to whom all credit is owed!

For a delightful playable simulation of this, check out https://www.farmersfable.org/ ">https://www.farmersfable.org/">... to whom all credit is owed!

Read on Twitter

Read on Twitter