The issue of inheritance and inheritance taxes is highly emotional in Germany and elsewhere - here is a thread with 8 facts GER:

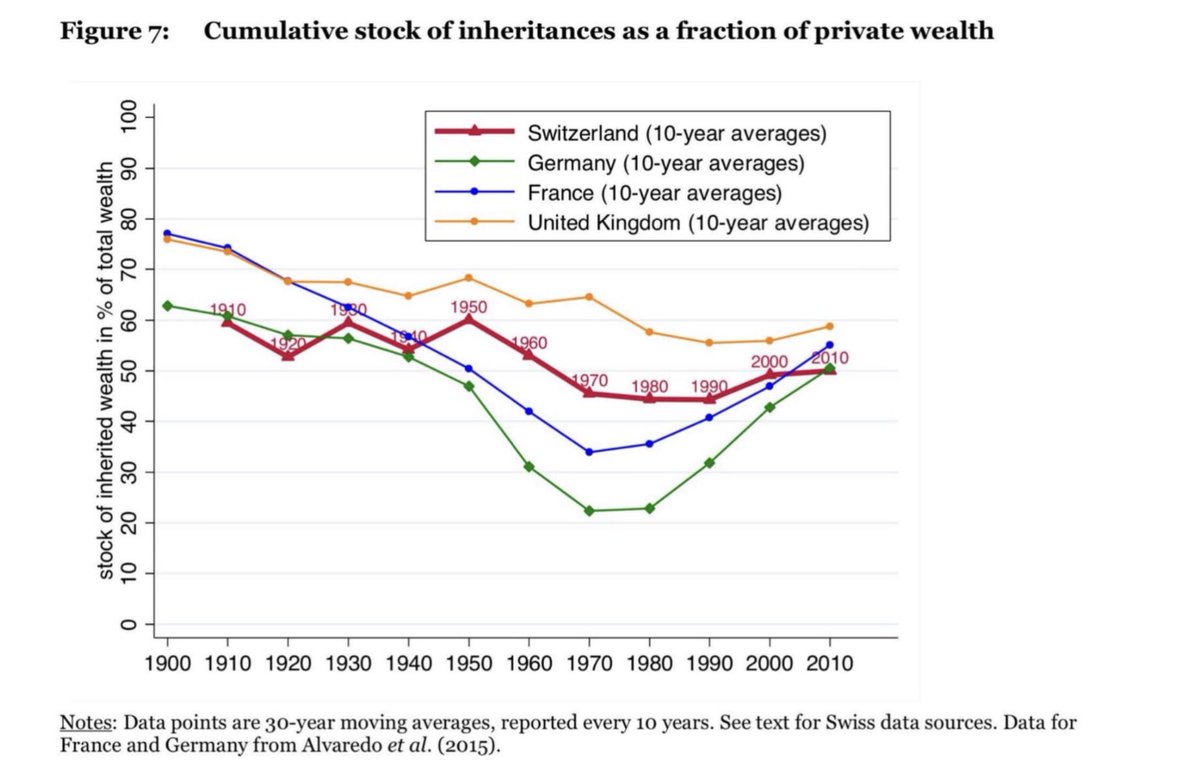

#1: More than half of all private wealth in Germany has been inherited and not be created through one’s own work and efforts.

http://www.hec.unil.ch/mbrulhar/papers/BrulhartDupertuisMoreau.pdf">https://www.hec.unil.ch/mbrulhar/...

#1: More than half of all private wealth in Germany has been inherited and not be created through one’s own work and efforts.

http://www.hec.unil.ch/mbrulhar/papers/BrulhartDupertuisMoreau.pdf">https://www.hec.unil.ch/mbrulhar/...

Facts on inheritances in Germany #2:

38% of Germans have received an inheritance. Most are well educated and have a good income, so that inheritances raise inequality of wealth and income.

Our study @DIW_Berlin_en (in German): https://www.diw.de/de/diw_01.c.608735.de/publikationen/wochenberichte/2018_49_4/die_erbschaftsteuer_ist_die_beste____reichensteuer_____kommentar.html">https://www.diw.de/de/diw_01...

38% of Germans have received an inheritance. Most are well educated and have a good income, so that inheritances raise inequality of wealth and income.

Our study @DIW_Berlin_en (in German): https://www.diw.de/de/diw_01.c.608735.de/publikationen/wochenberichte/2018_49_4/die_erbschaftsteuer_ist_die_beste____reichensteuer_____kommentar.html">https://www.diw.de/de/diw_01...

Facts on inheritances in Germany #3:

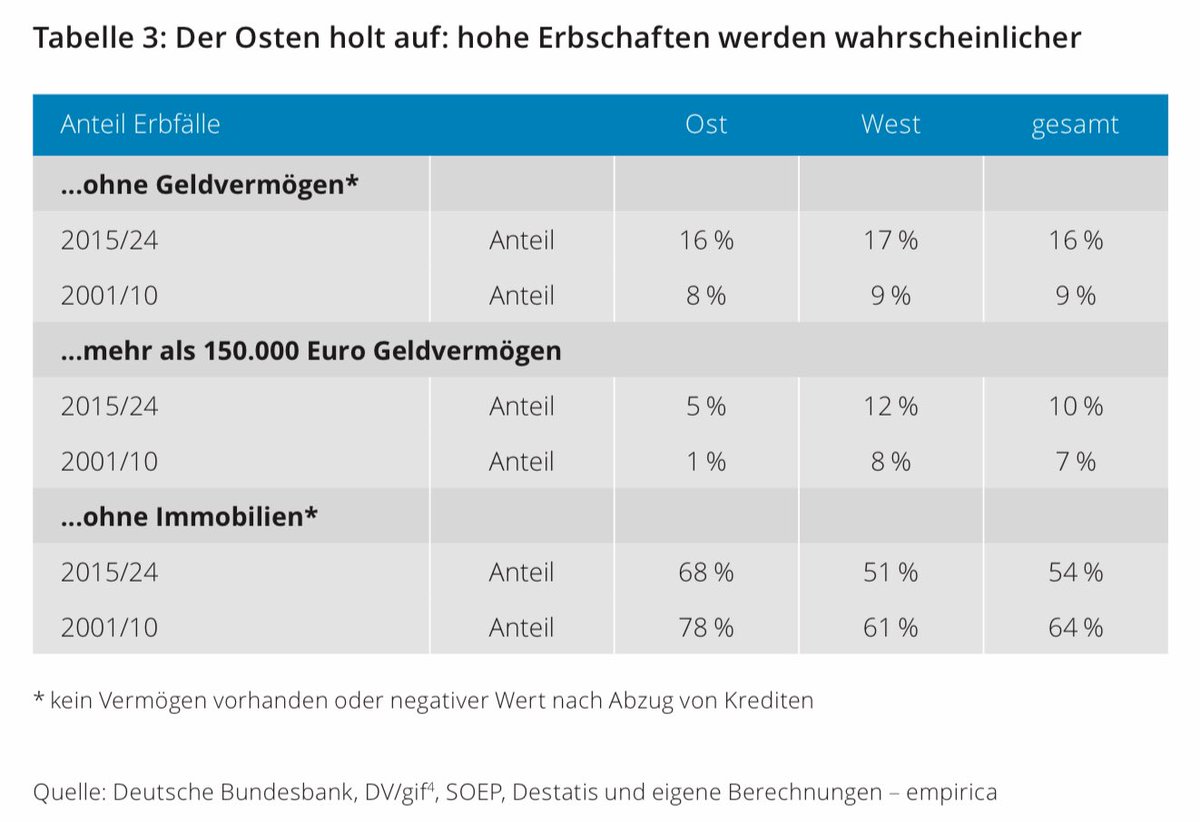

Inheritances are distributed highly unequally across regions in Germany, which are very low in East Germany, also as private ownership was limited before reunification.

https://www.empirica-institut.de/fileadmin/Redaktion/Publikationen_Referenzen/PDFs/DIA_Studie_Erben_in_Deutschland_HighRes.pdf">https://www.empirica-institut.de/fileadmin...

Inheritances are distributed highly unequally across regions in Germany, which are very low in East Germany, also as private ownership was limited before reunification.

https://www.empirica-institut.de/fileadmin/Redaktion/Publikationen_Referenzen/PDFs/DIA_Studie_Erben_in_Deutschland_HighRes.pdf">https://www.empirica-institut.de/fileadmin...

Facts on inheritances in Germany #4:

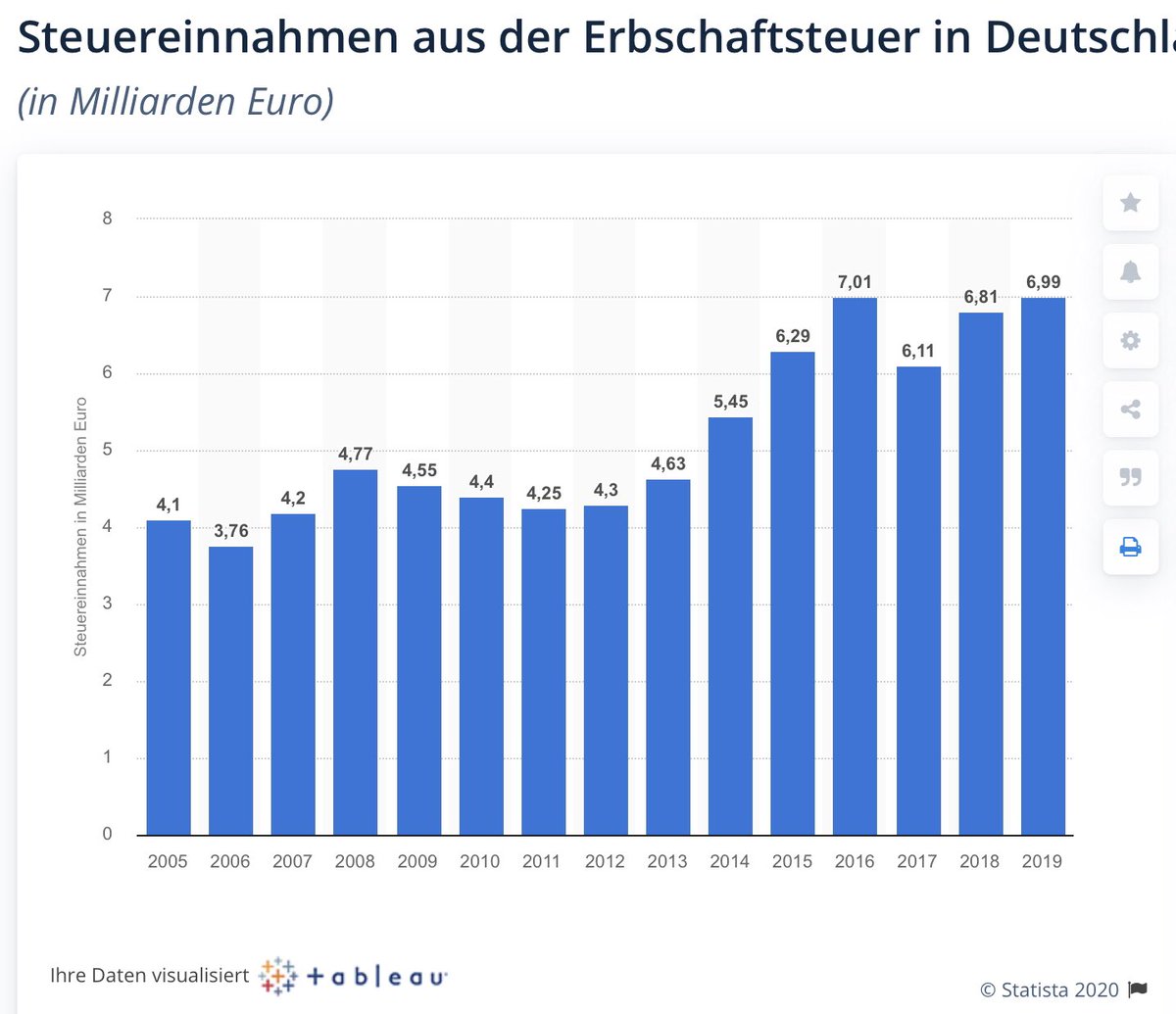

€300 to 400 billion (~10% of GDP) are inherited in Germany every year.

Inheritance tax revenues were €7 billion in 2019 — the low effective tax rate is mainly due to exemptions of the inheritance of companies.

https://www.diw.de/documents/publikationen/73/diw_01.c.560982.de/17-27-3.pdf">https://www.diw.de/documents...

€300 to 400 billion (~10% of GDP) are inherited in Germany every year.

Inheritance tax revenues were €7 billion in 2019 — the low effective tax rate is mainly due to exemptions of the inheritance of companies.

https://www.diw.de/documents/publikationen/73/diw_01.c.560982.de/17-27-3.pdf">https://www.diw.de/documents...

Facts on inheritances in Germany #5:

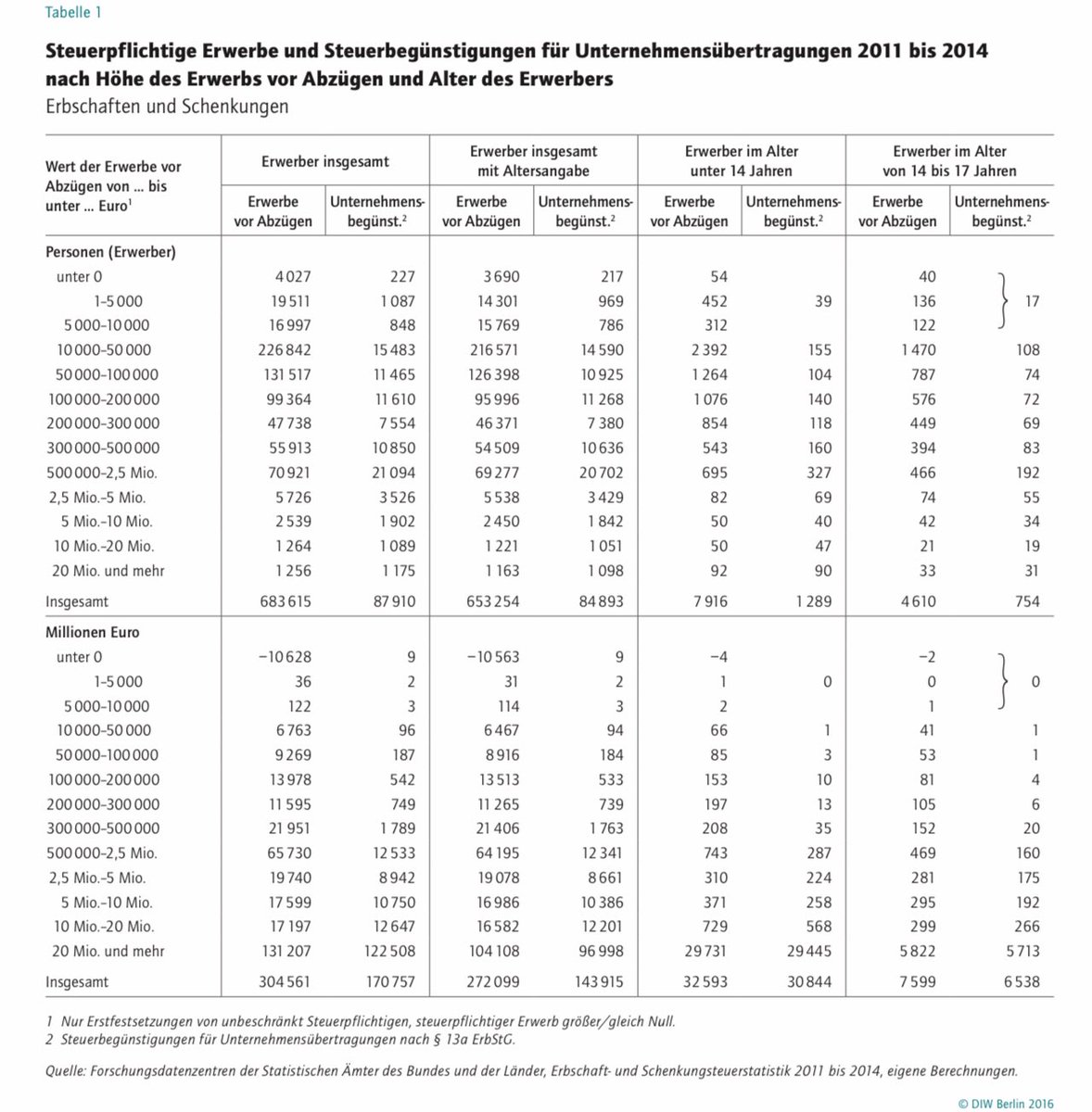

An often heard argument is that passing on company ownership to the children insures its survival.

Yet this is not a credible argument: a big chunk of company inheritances go to underage children, with many being younger than 14 years of age

An often heard argument is that passing on company ownership to the children insures its survival.

Yet this is not a credible argument: a big chunk of company inheritances go to underage children, with many being younger than 14 years of age

Facts on inheritances in Germany #6:

Most heirs in Germany are men: they inherit two thirds of companies. Women generally inherit substantially less when it comes to large inheritances.

https://www.diw.de/documents/publikationen/73/diw_01.c.542137.de/16-36-4.pdf">https://www.diw.de/documents...

Most heirs in Germany are men: they inherit two thirds of companies. Women generally inherit substantially less when it comes to large inheritances.

https://www.diw.de/documents/publikationen/73/diw_01.c.542137.de/16-36-4.pdf">https://www.diw.de/documents...

Facts on inheritances in Germany #7:

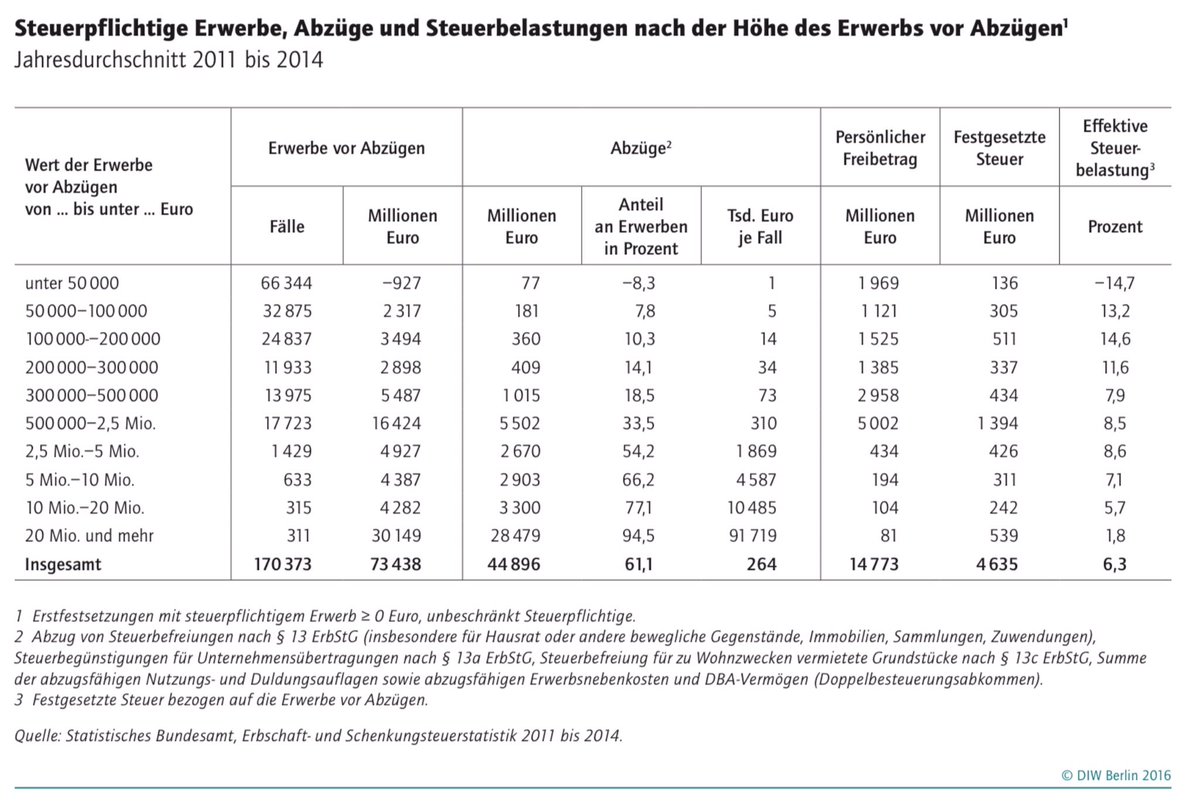

Germans inheriting more than €20 million pay on average 1.8% in inheritance taxes.

Germans inheriting less than €500,000 pay on average 12% in inheritance taxes.

https://www.diw.de/documents/publikationen/73/diw_01.c.524690.de/16-3-1.pdf">https://www.diw.de/documents...

Germans inheriting more than €20 million pay on average 1.8% in inheritance taxes.

Germans inheriting less than €500,000 pay on average 12% in inheritance taxes.

https://www.diw.de/documents/publikationen/73/diw_01.c.524690.de/16-3-1.pdf">https://www.diw.de/documents...

Policy implications on inheritances in Germany -- options:

1. Leave everything as is, i.e. very low and very unequal/regressive inheritance taxes -- this could (yet again) be challenged by the Constitutional Court, requiring changes sooner or later.

1. Leave everything as is, i.e. very low and very unequal/regressive inheritance taxes -- this could (yet again) be challenged by the Constitutional Court, requiring changes sooner or later.

2. Reduce exemptions of inheritance taxes and otherwise keep the current tax regime -- This would generate a lot of additional tax revenues, yet risks creating a problem for the survival of some companies.

3. Introduce a low “flat tax” on inheritances of eg 10%, plus a free amount for small inheritances & the ability to delay payment of inheritance taxes for companies. This could be a good compromise between creating a fair inheritance tax system and avoiding problems for companies

Read on Twitter

Read on Twitter