0 - As I delve beyond the ETH ecosystem as local #DeFi token circulating market caps soared (200-500 mm), $LUNA by @terra_money at ~160 mm USD market cap really stood out to me not only as an interesting VC bet, but also as a solid counter-weight to all the native craze.

1 – One can find their shill deck and write-ups pretty easily ( https://docsend.com/view/9mvr5qq ,">https://docsend.com/view/9mvr... https://agora.terra.money/t/analysis-of-luna-staking-rewards/52),">https://agora.terra.money/t/analysi... so I won’t linger on them. This thread is to further lay out my potential case for ~$2-5 USD / token before year-end.

2 – Of the total 1 Bn tokens, only ~400 mm of it is in circulation today, 260 mm of which are sold to VC / institutions, 40 mm genesis liquidity, the rest a combo of founder vest, paid to alliance members, R&D, and community build…

3 – …what I didn’t like is lack of transparency on how the remaining 600 mm will be issued, seems like there’s no schedule and is really at the team’s discretion. Maybe @d0h0k1 can shed some light on this. Most VC already vested & dumped except for last seed tranche @ Oct 2020.

4 – so as of today, ~290 mm staked for clipping fees (we will get into), so it’s really ~50 mm USD worth of $LUNA in circulation today, probably one the tightest held vs. any other DEFI projects out there with small overhang from VCs except from founders + Biz dev.

5 - $LUNA is basically the equity tranche of a payment network like Visa / Mastercard, whereby delegated nodes currently process stablecoin transactions for a ~0.5-0.7% fee. The “Terra” tokens you hear about are basically USDT like stablecoins in USD, KRW, etc flavors.

6 - …so at its core, $LUNA-Terra is in spirit basically Libra / similar to ETH-USDT/DAI, whereby if (a) USDT/DAI users pay USDT/DAI to ETH nodes for every transaction and (b) the stablecoin teams actually have a go-to-market beyond the crypto-native world.

7 – On that thought, $LUNA’s offline push is probably the best in crypto so far (maybe aside from $LINK). Founder team’s last gig created TMON – Groupon equivalent in Korea – and is now leveraging it into likes of 7/11, http://bookings.com"> http://bookings.com , AMC, etc equivalent in Korea.

8 - …most of the volume comes through the payment App “Chai”, which is also pushing out a card this coming Q3 (details on how it accrues value to $LUNA TBD). Team also hired ex-Uber exec for SE Asia push and local president’s daughter for Mongolia.

9 – Rolling it together, the investment logic for $LUNA is much less recursive / ponzinomic than the likes of current suite of #DeFi tokens, but should nonetheless be quite sound – more transaction processed = more fees to LUNA stakers = higher value based on dividend yield.

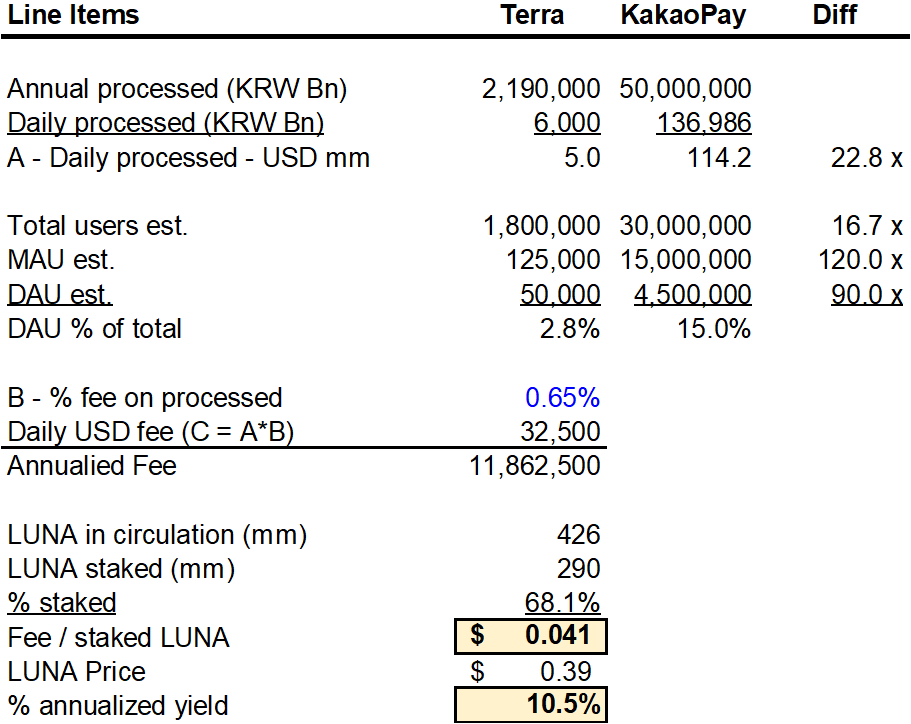

10 – Transparency on that front is actually surprisingly good ( https://station.terra.money/ ,">https://station.terra.money/">... https://www.chaiscan.com/ ).">https://www.chaiscan.com/">... To put it simply, Terra today processes ~5 mm USD of transactions per day on ~50-60k daily active users (1.8mm total), spending ~100 USD each…

11 - …whereby on a fee of ~0.5-0.7%, that’s ~32.5k a day / 12 mm a year to the 290 mm LUNA stakers, or roughly 4 USD cents annualized on a ~0.38 token price, roughly translating to ~10%+ dividend yield. The equivalents like V, MA, PYPL, SQ, etc trade a 3-10x higher valuation.

12 – so let’s say @d0h0k1 manages to 3x DAU to ~150k and keep per user spend the same, we get to almost ~10 USD cents / token. With a ~2-5% yield valuation the token could easily be 2-5 USD, or 5-13x upside. Such trajectory is NOT dependent on how $LUNA token fares itself.

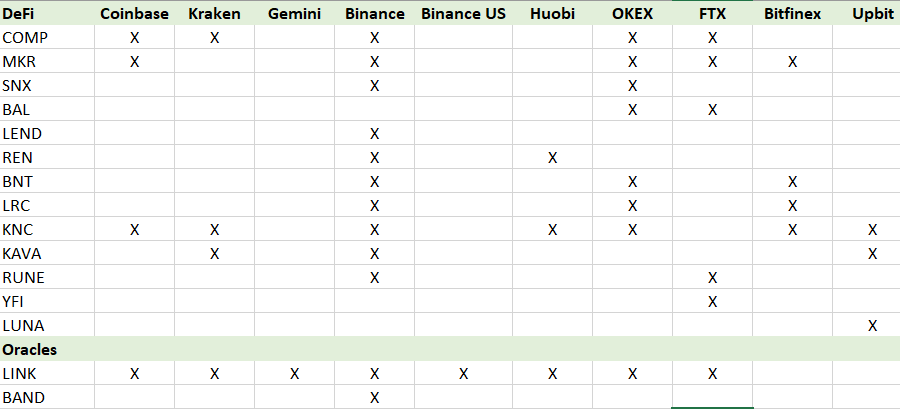

13 – To be fair, 100 USD spend per DAU is high (and DAU vs. registered is v. low), net retention of 20-30% is weak, so my hunch is most users only use Terra for the discount it offers. APAC is also filled with payment giants (Kakao + Naver in Korea, Wechat + AliPay, SEA & Lazada)

14 – …but given Terra’s small size (~1/90 the size of DAU vs. Kakao, 1/20 the daily processed), the rapid pace at which they onboard merchants, and the pending card launch + payment processor integration with BC Card (largest in Korea)…

15 - …that the DAU + $ processed should hockey stick. The seigniorage of Terra when above 1:1 peg (similar to Tether printing USDT when USDT > 1 USD) going partially to merchants that offer discounts & partially burning $LUNA is a clever design.

16 – the optionality to $LUNA of course goes beyond just Terra payments. Recently introduced Anchor (effectively a savings account reaping the yield of various POS chains) and turning on smart-contract capability on Terra means whatever #DeFi happens on ETH can be ported…

17 - …developer outreach and ecosystem building is very slow, yes, hence just optionality, but the fee stream where users pay to interact with these smart contracts (in Terra) will also be paid to $LUNA stakers to process, similar to say you use $Dai to pay for ETH gas.

18 – Anchor + other DeFi applications built on-top of Terra, if well-executed, could mean SIGNIFICANT fee accrual to $LUNA stakers aside from just processing tx payments. Developers should be amped up because it’s real users (not just crypto degen) on the app side.

19 – Airdrop $LUNA to incentivize developers, developers like it because of sizable userbase & real volume, more apps + strong biz dev = more users & GMV = higher yield on staked $LUNA = higher price. This is how you get to $10+ / token and go for top 10.

20 – I do have a few knocks on the team – they don’t market / explain the ecosystem enough, there’s a lack of transparency on token issue schedule, could be more upfront on the risk on DAU & when Terra enters contraction, etc. But I also have to hold them to a higher standard…

21 - …because they chose the trad-fi / non-degen path of offline push (non-native-crypto) + no reflexivity / ponzinomics ($LUNA’s performance doesn’t impact their biz dev). Then again, it’s a good counterweight to all the crypto-native degen projects we love.

22 – Other recommendation is the team should build their own CRV – right now it costs 2% to sell KRT for stakers into LUNA. There’s nothing a non-Korean can do with KRT so they just convert to $LUNA and potentially market-dump. This needs to change.

23 – the other thing is the team already has the likes of Hashed, Polychain, and 3 big China exchanges on their deck that are stronk hands / validators. Should really leverage them more on marketing. Build an ecosystem for both stablecoin use and coders is paramount.

24 - …bottom-line is this, $LUNA was very overvalued back then (lol @ bagholders whoever bought in May 2019 from Arrington) at ~600 mm+ circulating / 2 Bn fully diluted when top ETH defi projects at <100 mm; but @ 160 mm today and express-shipping….

25 - …while 300-500 mm for ETH #DeFi became the norm, $LUNA seems like a no-brainer diversification play not just on valuation alone, but also on geographic region, approach to problem, and perhaps sheerly being overlooked by the entire #DeFi mafia of China & the west alike.

26 - On the crazy and hot scale, $YFI is your 10/10 crazy candy pie that everyone wants a piece of, $SNX and $LEND are the hot twins that you want to ask out. Then $LUNA is this exotic Korean chick that is quiet, does things differently, but is no less interesting.

27 - …none of the “Cool kids” in the west are talking to her yet, she’s quietly taking notes and learning all the tricks. Question is, will @degenSpartan ask for her number? After all, $LUNA stands for moon, and everyone in this space seems to love that planet.

Read on Twitter

Read on Twitter