My thoughts on FIRS& #39;s circular on stamp duty...

• Stamp Duty Update:

FIRS has asked individuals and corporate entities to pay a flat rate of 6% stamp duty on rent agreements via a recently released circular. See here: https://discoverafricanews.com/firs-nigeria-clarifications-on-stamp-duties-administration-in-nigeria/">https://discoverafricanews.com/firs-nige...

• Stamp Duty Update:

FIRS has asked individuals and corporate entities to pay a flat rate of 6% stamp duty on rent agreements via a recently released circular. See here: https://discoverafricanews.com/firs-nigeria-clarifications-on-stamp-duties-administration-in-nigeria/">https://discoverafricanews.com/firs-nige...

• Source of the rates in the circular:

The rates adopted by the FIRS originated from the Joint Tax Board Harmonization of Stamp Duty Rates. Here is the link:

https://stampduty.gov.ng/stamp_duty_charges.">https://stampduty.gov.ng/stamp_dut...

The rates adopted by the FIRS originated from the Joint Tax Board Harmonization of Stamp Duty Rates. Here is the link:

https://stampduty.gov.ng/stamp_duty_charges.">https://stampduty.gov.ng/stamp_dut...

• Is there any legal backing for these rates?

Different rates for different transactions are stated in the Stamp Duty Act and only an act of parliament (Section 116 of the SDA) can increase, diminish or repeal the rates stated in the ACT. JTB rates lack legislative backing.

Different rates for different transactions are stated in the Stamp Duty Act and only an act of parliament (Section 116 of the SDA) can increase, diminish or repeal the rates stated in the ACT. JTB rates lack legislative backing.

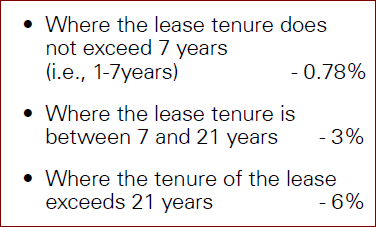

• So what are the applicable rates for lease/rent in the SDA?

KPMG stated in this newsletter ( https://assets.kpmg/content/dam/kpmg/ng/pdf/tax/matters-arising-from-implementation-of-finance-act-2019.pdf)">https://assets.kpmg/content/d... that stamp duty rates on lease are based on the tenure of lease as shown in the picture below.

KPMG stated in this newsletter ( https://assets.kpmg/content/dam/kpmg/ng/pdf/tax/matters-arising-from-implementation-of-finance-act-2019.pdf)">https://assets.kpmg/content/d... that stamp duty rates on lease are based on the tenure of lease as shown in the picture below.

Also, our celebrity tax guru @TaiwoOyedele referenced these rates in this thread: https://twitter.com/taiwoyedele/status/1286676441233530882?s=20">https://twitter.com/taiwoyede...

Although I couldn’t validate these varied rates in the copy of Stamp Duty Act that I have (I don’t have the gazetted version. If you have, kindly share), I am certain these two sources cannot be wrong!

• How often should the stamp duty be paid?

In my view, it will depend on the tenure of individual’s lease contract. It doesn’t seem to me like a one-off payment or that once you are not renting a new place then you don’t have to pay.

In my view, it will depend on the tenure of individual’s lease contract. It doesn’t seem to me like a one-off payment or that once you are not renting a new place then you don’t have to pay.

Every lease contract should have start and end dates. This means that when the agreement is being renewed, you may have to pay stamp duty on it. My rent agreement for instance, is for two years and this means that there will be a renewal at the end of the 2nd year.

• So what should you do when you receive a letter from your landlord (I know mine is already drafting one) regarding this 6% stamp duty?

6% stamp duty for a lease below 21 years is against the law and no one should pay this.

6% stamp duty for a lease below 21 years is against the law and no one should pay this.

Once I receive this letter from my landlord, I will respond quoting the law (hopefully, I will have the right sections of the SDA by then)

• Which internal revenue service should your stamp duty be paid to?

When a corporate entity is a party to the agreement, the stamp duty should be remitted to FIRS. If the agreement is btw 2 individuals, the duty should be remitted to the State IRS (LIRS for Lagos)

When a corporate entity is a party to the agreement, the stamp duty should be remitted to FIRS. If the agreement is btw 2 individuals, the duty should be remitted to the State IRS (LIRS for Lagos)

• Why can’t I even deduct 10% WHT from my rent since rent is WHT deductible?

As an individual, you are not a collecting agent for WHT, you should pay in full. Only companies, businesses and government parastatals can withhold tax from payments.

As an individual, you are not a collecting agent for WHT, you should pay in full. Only companies, businesses and government parastatals can withhold tax from payments.

• FIRS, why now?

The law has been in existence since 1939 and it has been amended several times so it is not a new law really. However, I think this is a wrong time to implement a law like this. Both tenants and landlords are struggling now,

The law has been in existence since 1939 and it has been amended several times so it is not a new law really. However, I think this is a wrong time to implement a law like this. Both tenants and landlords are struggling now,

and this is not in the interest of anybody. Many have lost their jobs, scores have had pay cuts in their salaries, vacancy rate is quite high now and so you are forced to ask, who exactly will pay this stamp duty on rent?

It would even have been a bit better if the rates were restricted to what the SDA stipulates but dangling a very high rate at this time seems inconsiderate.

• What should our next steps be?

On this same stamp duty, I wrote FIRS (through our company lawyers) when I saw FIRS was asking for a flat rate of 1% stamp duty on every signed contract. This like the rent case is not in the law.

On this same stamp duty, I wrote FIRS (through our company lawyers) when I saw FIRS was asking for a flat rate of 1% stamp duty on every signed contract. This like the rent case is not in the law.

Different types of contracts attract different stamp duty rates and some contracts are even exempted by law. I have not received their response, but I am certain they will respond.

In the same vein, let me encourage tax consultants, lawyers, accountants to inundate FIRS with letters and state clearly that they won’t be paying any rate that is not stated in the SDA Act.

Twitter rants may not really help us.

my 2 kobo

Twitter rants may not really help us.

my 2 kobo

Read on Twitter

Read on Twitter