I& #39;ve gotten back to Capital 3, & reading this passage helped me crystallize an argument I& #39;d be starting to form in the back of my mind earlier this week about trends in the recomposition of landlordism from 2015-2018, as they relate to an alleged corporatization of real estate.

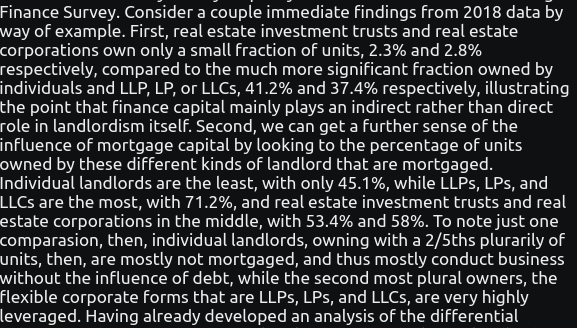

I& #39;m using data from the Rental Housing Finance Survey. The 2018 data is here https://www.census.gov/programs-surveys/rhfs.html">https://www.census.gov/programs-... but the 2015 data is currently down, some I& #39;m working with the partial data I riff& #39;d on a month ago in this thread. https://twitter.com/jfpark3/status/1276750159020322816?s=20">https://twitter.com/jfpark3/s...

The trend identified in the 2012-2015, of fewer units (now less than a majority) owned by individual landlords & more owned by corporations. A major portion of this trend appears to continue to be not concentration of units under larger corporations but by small LLCs & the like.

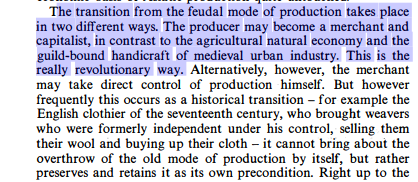

I& #39;ll drop some suggestive numbers in a sec, but that last is the analogy with the Marx passage on the transition to feudalism. Marx calls the producer becoming merchant the really revolutionary form of that transition & the acquisition of production by merchants to be less so.

In contemporary landlordism, it appears that we& #39;re observing is not financialization of landlordism from above, driven by capital investment in larger corporations, but financialization of landlordism from below, driven partly by the low cost of mortgages.

I wrote this brief & partial taxonomy of landlords & their mortgages from 2018, below. I just want to add a little more data, & generalize. 2015-2018 individual landlords lost 6.6% of their units, down to 41.2%, while LLCs etc picked up 4.2% up to 37.4%.

REITs & Real Estate Corps combined netted no change, the former growing .5% to 2.3% & the latter dropping .5% to 2.8%. (No other institutional landlord category made any gains; a greater number of units went unreported in 2018 than 2015).

Now, I don& #39;t have access to the 2015 data on mortgages by type of owner. But let& #39;s assume that the 2018 numbers haven& #39;t changed & that LLCs+ tend to be the highest leveraged & individual landlords the lowest leveraged.

If that& #39;s the case, what we& #39;re seeing is what I speculated above, after Marx & in a completely different domain—the main trend in the composition of landlordism from 2015-2018 is individual landlords leveraging themselves into becoming smaller corporate landlords.

What& #39;s important here, I believe, is that it points toward a major theoretical error on the part of the tenants movement & the left—that our primary target should be the large corporate landlords because they have an outsized effect on the market. The numbers don& #39;t sustain this.

On the contrary, perhaps the opponent that is growing more powerful & having the most significant effect in the aggregate is the smaller corporate landlord of the LLC+ type, landlords who may often fly under the radar as "small" or even "mom & pop landlords."

Consequently, except at the level of spectacle, both media & political, perhaps the tenants movement form that most needs building is not so much the large scale council that takes on the big landlord but the small to medium tenant councils which take on a network of landlords.

Tenant councils of this type, especially right now when every landlord& #39;s cashflow is limited, can perhaps have a disproportionate impact by targeting such landlords, given their far higher than average levels of debt. How to target them is another question entirely....

Read on Twitter

Read on Twitter